Australian dollar experienced a broad decline today following a subtle dovish shift in the statement, raising speculation of a potential earlier pause in the tightening cycle. While the general expectation of another hike in April remains unchanged, May is getting slightly more uncertain. So far, New Zealand dollar is the strongest performer today, followed by the European majors. Yen and dollar are the weakest next to Aussie. The greenback is likely to be impacted by the upcoming semi-annual testimony by Fed Chair Jerome Powell, with traders closely monitoring any hints of a 50bps hike this month and his outlook on the terminal rate.

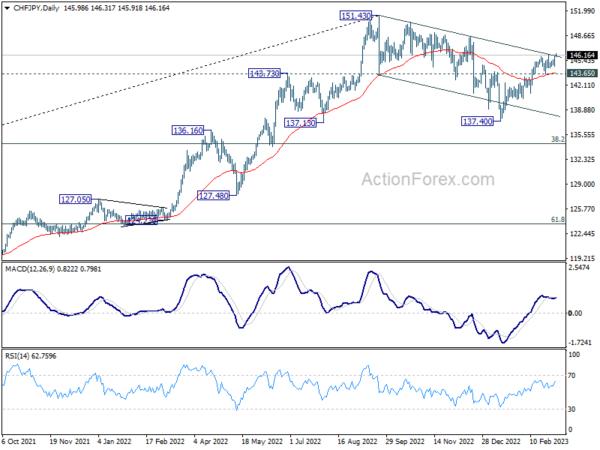

Traders should keep an eye on CHF/JPY, as the franc experienced a sharp jump yesterday following stronger-than-expected Swiss CPI data, ahead of the SNB rate decision later in the month. As a result, today’s remarks from SNB Chair Thomas Jordan will be particularly important, and may trigger volatility. From a technical perspective, the rise from 137.40 is still ongoing, with sustained trading above channel resistance confirming the completion of the entire correction from 151.43, and potentially leading to a retest of that level.

In Asia, Nikkei closed up 0.34%. Hong Kong HSI is down -0.21%. China Shanghai SSE is down -0.45%. Singapore Strait Times is up 0.28%. Japan 10-year JGB yield is down -0.0041 at 0.500. Overnight, DOW rose 0.12%. S&P 500 rose 0.07%. NASDAQ dropped -0.11%. 10-year yield rose 0.019 to 3.983.

RBA hikes 25bps, notes lower risk of prices-wages spiral

RBA raised the cash rate target by 25bps to 3.60%, which was widely anticipated. The bank also signaled the need for further tightening of monetary policy. Nevertheless, there was a notable dovish twist in the the statement about a lower risk of prices-wages spiral.

The central bank said monthly CPI indicator suggested that “inflation has peaked in Australia”. The central forecasts is for inflation to decline this year and next to around 3% in mid-2025. Medium-term inflation expectations remain “well anchored”.

Growth over the next couple of years is expected to be “below trend”. Labor markets remains “very tight, although conditions have eased a little”. Wage growth is “still consistent with the inflation target” and “recent data suggest a lower risk of a cycle in which prices and wages chase one another”.

It indicated that “further tightening of monetary policy will be needed”. The timing and extent of further interest rate hikes will depend on “developments in the global economy, trends in household spending and the outlook for inflation and the labour market”.

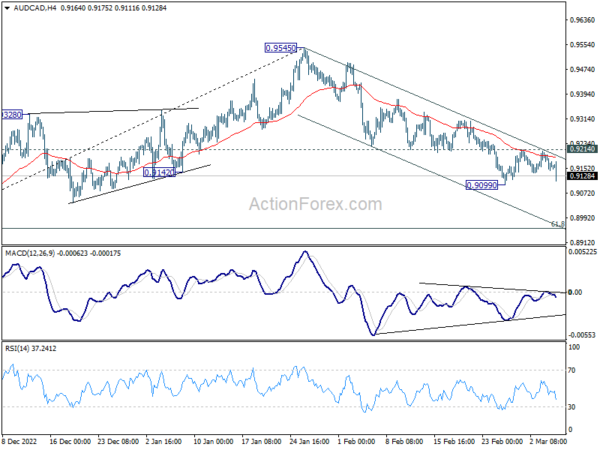

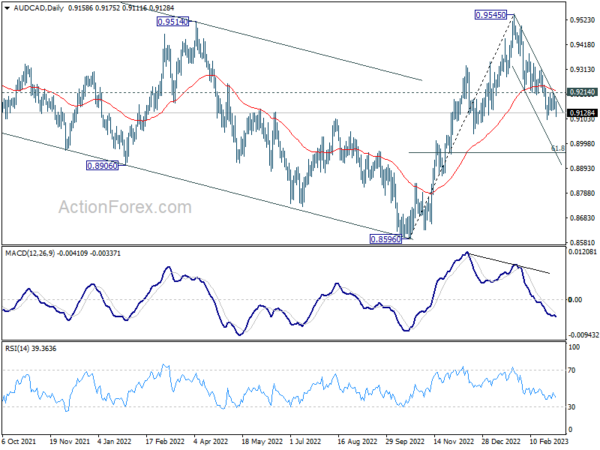

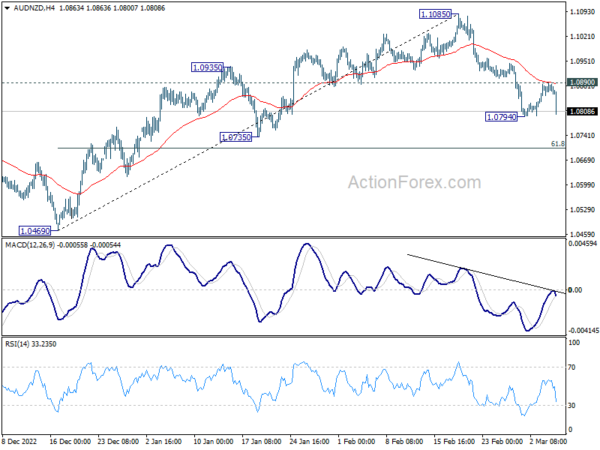

AUD/CAD and AUD/NZD near downside breakout after RBA

Australian Dollar weakened broadly despite RBA’s rate hike. This is attributed to the less hawkish statement by RBA indicating a “lower risk of a cycle in which prices and wages chase one another”.

As AUD/CAD nears a breakthrough of 0.9099 temporary low, a deeper decline is expected as long as 0.9214 resistance holds. The next target for the fall from 0.9545 is 61.8% retracement of 0.8596 to 0.9545 at 0.8959. Bullish convergence conditions in 4 hour MACD suggest that stronger support may be seen there to bring a rebound.

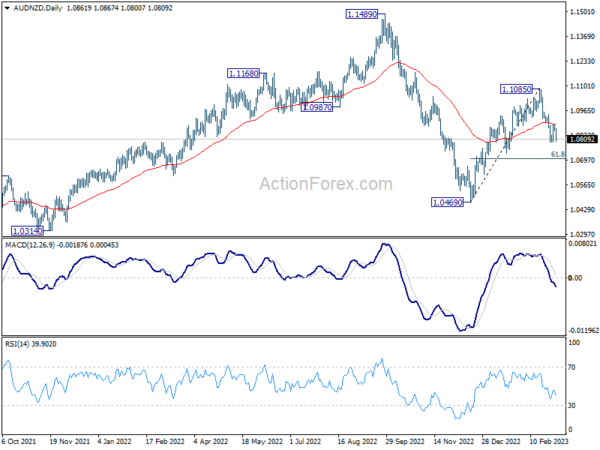

Likewise, AUD/NZD is poised to break through 1.0794, with the decline from 1.1085 targeting the 1.0735 support or further to the 61.8% retracement of 1.0469 to 1.1085 at 1.0704. Sustained break there could pave the way to retest 1.0469 low. The near-term outlook will remain bearish as long as the 1.0890 resistance holds.

Japan’s Wage Growth Disappoints in January, Real Earnings Fall the Most Since 2014

Japan’s nominal labor cash earnings rose by 0.8% yoy in January, below expectations of 1.9% yoy. The strong growth rate of 4.1% yoy in December was an anomaly due to lump-sum payments, rather than regular wage rises. The level of wage growth is far below the required level needed to maintain a 2% inflation rate, as indicated by outgoing BoJ Governor Haruhiko Kuroda.

Moreover, real cash earnings of workers have declined by -4.1% yoy, indicating that their real wages have fallen the most since 2014. The continuous decline in real wages for ten consecutive months shows that inflation has surpassed earnings.

Later in the week, BoJ is expected to keep its ultra-loose monetary policy unchanged, including the negative short-term interest rate of -0.10% and the 10-year yield cap at 0.50% at Kuroda’s final meeting before handing over the reins to Kazuo Ueda. The declining real wages poses a challenge for the incoming governor to achieve the inflation target set by the central bank.

Looking ahead

Swiss unemployment rate and foreign currency reserves, Germany factor orders will be released in European session. But the major focus will be on Fed Chair Jerome Powell’s semi-annual testimony.

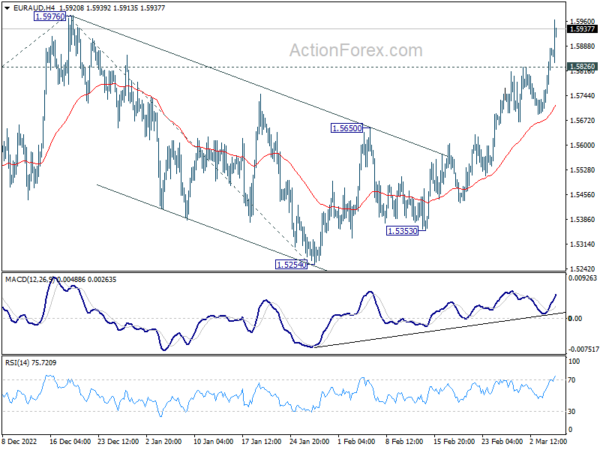

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5763; (P) 1.5824; (R1) 1.5932; More…

EUR/AUD accelerates to as high as 1.5963 so far. Intraday bias stays on the upside for retesting 1.5976 high. Decisive break there will resume whole rally from 1.4281. Next target will be 61.8% projection of 1.4281 to 1.5976 from 1.5254 at 1.6302. On the downside, below 1.5826 minor support will turn intraday bias neutral and bring consolidations first, before staging another rise.

In the bigger picture, the strong support from 55 week EMA (now at 1.5396) is raising the chance of bullish trend reversal. On break of 1.5976, focus will be on 1.6434 cluster resistance (38.2% retracement of 1.9799 to 1.4281 at 1.6389). Sustained break there should confirm that whole down trend form 1.9799 (2020 high) has completed. However, rejection by this cluster resistance will make medium term outlook neutral at best.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Jan | 0.80% | 1.90% | 4.80% | 4.10% |

| 00:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Feb | 4.90% | 3.90% | ||

| 00:30 | AUD | Trade Balance (AUD) Jan | 11.69B | 12.25B | 12.24B | 12.99B |

| 03:30 | AUD | RBA Interest Rate Decision | 3.60% | 3.60% | 3.35% | |

| 06:45 | CHF | Unemployment Rate Feb | 1.90% | 1.90% | ||

| 07:00 | EUR | Germany Factory Orders M/M Jan | -0.90% | 3.20% | ||

| 08:00 | CHF | Foreign Currency Reserves (CHF) Feb | 784B | |||

| 15:00 | USD | Fed Chair Powell Testifies | ||||

| 15:00 | USD | Wholesale Inventories Jan F | -0.40% | -0.40% |