New Zealand Dollar rises broadly after RBNZ surprised the market with a 50bps interest rate hike. In contrast, Australian Dollar is suffering from cross-selling, extending the post-RBA selloff. Canadian Dollar is taking a breather as oil prices plateau following an earlier surge this week, with WTI still struggling around 80 handle. This divergence in commodity currencies is noteworthy as they respond to different market factors.

European majors are showing more unity in their movements, with Euro and Swiss Franc following Sterling’s lead in extending recent rallies against Dollar. But they are sluggish against Yen for now. The early advantage that Sterling held against other European currencies has reversed, and it remains unclear whether they will establish a clear direction against each other. The greenback is currently the weakest performer for the week, along with the Aussie.

Technically, Gold resumed its recent uptrend, breaking through 2,009.59 resistance level. As long as 1,976.80 support holds, near-term outlook remains bullish, with the next target at 2,070.06 resistance and 2,074.84 record high. A decisive break above these levels could indicate a resumption of the long-term uptrend and potentially signal an intensified selloff in Dollar. Market participants will be closely watching to see if this scenario unfolds.

In Asia, at the time of writing, Nikkei is down -1.67%. Japan 10-year JGB yield is up 0.590 at 0.475, heading back to BoJ’s 0.5% cap. Singapore Strait Times is up 0.47%. Hong Kong and China are both on holiday. Overnight, DOW dropped -0.59%. S&P 500 dropped -0.58%. NASDAQ dropped -0.52%. 10-year yield dropped -0.093 to 3.337.

RBNZ hikes 50bps after considering a 25bps move too

In an unexpected move, RBNZ raised the Official Cash Rate by 50bps to 5.25%, doubling the anticipated 25bps hike. This bold step reflects the central bank’s concerns about persistently high inflation and employment levels.

The RBNZ statement highlighted that “inflation is still too high and persistent, and employment is beyond its maximum sustainable level.” Despite lower-than-expected economic activity in the December quarter, demand continues to outstrip supply, exerting further pressure on annual inflation.

The statement also noted that severe weather events in the North Island have contributed to higher prices for some goods and services. This increased near-term CPI inflation poses a risk of inflation expectations remaining above the target range.

In the meeting minutes, the Committee emphasized the need to continue raising the OCR to bring inflation back to the 1-3% target and fulfill their remit. They discussed both 25 and 50 basis point increases, ultimately opting for the more aggressive 50 basis point hike. This decision aims to maintain current lending rates for businesses and households while supporting an increase in retail deposit rates, countering the downward pressure on lending rates caused by falling wholesale interest rates since the February Statement.

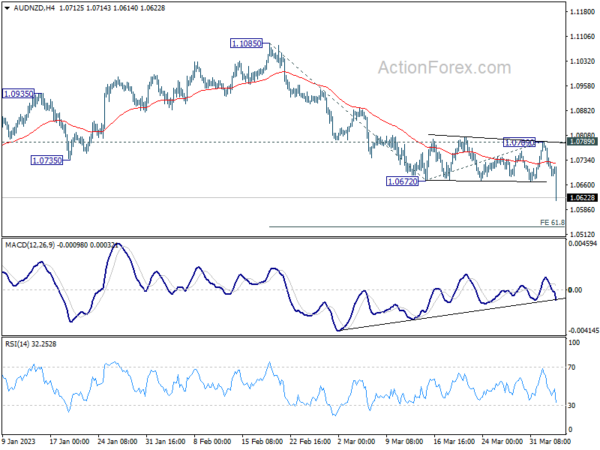

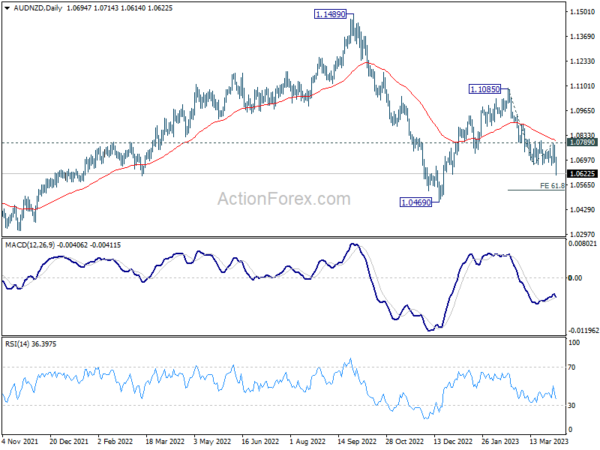

Powerful downside breakout in AUD/NZD, 1.0534 next

AUD/NZD powered through 1.0672 support to resume the decline from 1.1085 after larger than expected rate hike by RBNZ. Tightening is not finished with RBNZ yet, another 25bps hike could be delivered to bring the OCR from today’s 5.25% to 5.50 within first half of the year. Any movements in the OCR beyond that point will be data-dependent. Meanwhile, RBA has started the pause yesterday by holding cash rate target unchanged at 3.60%. There are talks that this level could be RBA’s peak rate in the current cycle.

From technical point of view, near term outlook will now stay bearish as long as 1.0789 resistance holds in AUD/.NZD. Next target is 61.8% projection of 1.1085 to 1.0672 from 1.0789 at 1.0534. In the larger picture, the down trend from 1.1489 (2022 high) could be ready to extend through 1.0469 if monetary policies diverge further.

RBA Lowe: To hold doesn’t imply tightening is over

RBA Governor Philip Lowe, in a speech today, clarified that the decision to keep interest rates unchanged yesterday does not mark the end of tightening measures.

“The decision to hold rates steady this month does not imply that interest rate increases are over. Indeed, the Board expects that some further tightening of monetary policy may well be needed to return inflation to target within a reasonable timeframe,” he said.

Acknowledging that monetary policy is now in restrictive territory, Lowe said it was time to hold interest rates steady and gather more information. He also mentioned that RBA will review its monetary policy stance at the next meeting, taking into account updated forecasts and scenarios.

Fed Mester sees monetary policy turning more restrictive this year

In a speech yesterday, Cleveland Federal Reserve President Loretta Mester highlighted her expectation that monetary policy will move “somewhat further into restrictive territory this year,” with the fed funds rate surpassing 5% and the real fed funds rate remaining in positive territory for an extended period.

Mester explained that the precise extent and duration of the federal funds rate hike will depend on how inflation and inflation expectations are affected by demand slowing, supply challenges being resolved, and price pressures easing. She noted that her forecast aligns with the modal forecasts of FOMC participants released two weeks ago, although she sees “somewhat more persistent inflation pressures than the median forecast among participants.”

According to Mester, inflation will show a substantial improvement, as price pressures are expected to decline from their current 5% yoy increase to 3.75% by the end of 2023 and 2% by 2025. She also anticipates a slowdown in economic growth this year, followed by a rebound in 2023. In terms of unemployment, Mester projects a rise from the current 3.6% to a range of 4.5% to 4.75% by the conclusion of 2023.

Looking ahead

Germany factory orders, France industrial output, Eurozone PMI services final and UK PMI services final will be released in European session. Later in the day, Canada will release trade balance. US will release ADP employment, trade balance and ISM services.

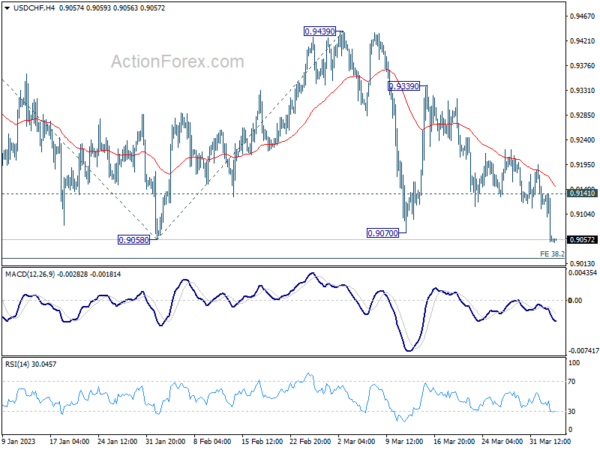

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9031; (P) 0.9087; (R1) 0.9118; More…

USD/CHF’s break of 0.9058 support suggests that the down trend from 1.0146 is finally resuming. Intraday bias is now back on the downside. Sustained break of 38.2% projection of 1.0146 to 0.9058 from 0.9439 at 0.9023 will pave the way to 61.8% projection at 0.8767.On the upside, above 0.9141 minor resistance will delay the bearish case and turn intraday bias neutral again.

In the bigger picture, outlook will stay bearish as long as 0.9439 resistance holds, and fall from 1.1046 (2022 high) is still in progress. Prior rejection by 55 week EMA was a medium term bearish sign. Sustained of 0.9058 will resume such decline towards 0.8756 support (2021 low). But overall, this fall is still as a leg in the long term range pattern from 1.0342 (2016 high). So, downside should be contained by 0.8756 to bring reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | NZD | RBNZ Interest Rate Decision | 5.25% | 5.00% | 4.75% | |

| 06:00 | EUR | Germany Factory Orders M/M Feb | 0.40% | 1.00% | ||

| 06:45 | EUR | France Industrial Output M/M Feb | 0.60% | -1.90% | ||

| 07:45 | EUR | Italy Services PMI Mar | 53 | 51.6 | ||

| 07:50 | EUR | France Services PMI Mar F | 55.5 | 55.5 | ||

| 07:55 | EUR | Germany Services PMI Mar F | 53.9 | 53.9 | ||

| 08:00 | EUR | Eurozone Services PMI Mar F | 55.6 | 55.6 | ||

| 08:30 | GBP | Services PMI Mar F | 52.8 | 52.8 | ||

| 09:00 | EUR | Italy Retail Sales M/M Feb | 0.50% | 1.70% | ||

| 12:15 | USD | ADP Employment Change Mar | 200K | 242K | ||

| 12:30 | CAD | Trade Balance (CAD) Feb | 2.2B | 1.9B | ||

| 12:30 | USD | Trade Balance (USD) Feb | -68.5B | -68.3B | ||

| 13:45 | USD | Services PMI Mar F | 53.8 | 53.8 | ||

| 14:00 | USD | ISM Services PMI Mar | 54.5 | 55.1 | ||

| 14:30 | USD | Crude Oil Inventories | -1.6M | -7.5M |