Today’s trading session saw broad selling pressure on commodity currencies, partially due to risk-off sentiment prevalent in the market and partly due to the dovish rate hike from RBNZ. As it stands, Euro seems to be the major benefactor, in part due to its rebound against Swiss Franc. However, despite a slight recovery, the common currency is still considered bearish against Dollar in the near term. The uplift in Sterling following the Consumer Price Index (CPI) data proved to be short-lived. Yen, for its part, is consolidating its recent losses and appears still poised for a near-term decline.

From a technical perspective, EUR/CHF could be a focal point for the remainder of the day. Break of 0.9760 resistance level will confirm short-term bottoming at 0.9675, with a bullish convergence condition in 4H MACD. This could lead to a stronger rebound towards 0.9878 resistance level. If this occurs, stronger bounce in EUR/CHF could potentially aid Euro in rebounding further against both the Dollar and Sterling.

In Europe, at the time of writing, FTSE is down -1.77%. DAX is down -1.68%. CAC is down -1.76%. Germany 10-year yield is down -0.0206 at 2.451. Earlier in Asia, Nikkei dropped -0.89%. Hong Kong HSI dropped -1.62%. China Shanghai SSE dropped -1.28%. Singapore Strait Times dropped -0.12%. Japan 10-year JGB yield rose 0.0045 to 0.409.

Bundesbank: German economy expected to have slight uptick in Q2

In their most recent monthly report, the experts at Bundesbank forecast that Germany’s economic output will experience a modest increase in the second quarter of 2023. A confluence of factors, including easing supply bottlenecks, a substantial backlog of orders, and a decrease in energy prices, are all expected to bolster the ongoing recovery of the industrial sector.

Despite the continuing high inflation, the sharp rise in wages should prevent further declines in the real net income of private households. As a result, private consumption is predicted to remain steady, rather than falling.

Bundesbank stated, “The German economy stagnated in the first quarter of 2023 after shrinking in the previous quarter”. The bank’s experts maintain an overall slightly positive outlook for the labor market, although they note that its prospects have not brightened further in recent months.

In light of the robust labor market, high inflation, and the anticipated economic improvement, the Bundesbank predicts, “high wage agreements can also be expected in the coming months”.

Germany Ifo dropped to 91.7, businesses skeptical about upcoming summer

Germany Ifo Business Climate dropped from 93.4 to 91.7 in may, below expectation of 93.4. This also marked the first decline in the index after six increases in a row. Current Assessment Index dropped from 95.1 to 94.8, worse than expectation of 95.2. Expectations Index, also dropped from 91.7 to 88.6, below expectation of 91.7.

By sector, manufacturing dropped sharply from 6.3 to -0.3. That’s the largest decrease since March 2022, after the start of the war in Ukraine. Services ticked down from 6.9 to 6.8. Trade tumbled from -10.7 to -19.1. Construction also dropped from -16.6 to -18.2.

Ifo said: “Sentiment in the German economy has suffered a setback….. Driving this development are the significantly more pessimistic expectations. Managers are somewhat less satisfied with their current situation. German companies are skeptical about the upcoming summer.”

UK CPI slowed to 8.7%, CPI core rose to highest since 1992

UK CPI slowed from 10.1% yoy to 8.7% yoy in April, above expectation of 8.2% yoy. On a monthly basis, CPI rose by 1.2% mom, above expectation of 0.8% mom.

CPI core (excluding energy, food, alcohol and tobacco) rose from 6.2% yoy to 6.8% yoy, above expectation of 6.2% yoy. That’s the highest level since March 1992.

CPI goods annual rate eased from 12.8% yoy to 10.0% yoy, while the CPI services annual rate rose from 6.6% yoy to 6.9% yoy.

RBNZ delivered dovish rate hike

RBNZ raised OCR by 25bps to 5.50% today, reaching the projected peak interest rate. The decision was made by a 5-2 vote, with two committee members voted for no change. The central bank noted that “The OCR will need to remain at a restrictive level for the foreseeable future, to ensure that consumer price inflation returns to the 1% to 3% annual target range, while supporting maximum sustainable employment.”

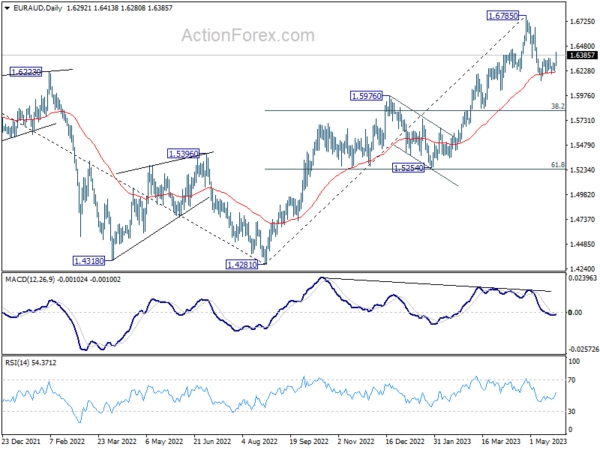

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6224; (P) 1.6268; (R1) 1.6299; More…

Range trading continues in EUR/AUD and intraday bias remains neutral. Fall from 1.6785 might be a correction to whole up trend from 1.4281. Break of 1.6134 will target 38.2 retracement of 1.4281 to 1.6785 at 1.5828, which is inside 1.5254/5976 support zone. Nevertheless, sustained break of 1.6354 minor resistance will turn bias back to the upside for retesting 1.6785 high instead.

In the bigger picture, whole down trend from 1.9799 (2020 high) should have completed at 1.4281 (2022 low). Further rise should be seen to 61.8% retracement of 1.9799 to 1.4281 at 1.7691 next. For now, outlook will stay bullish as long as 1.5976 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q1 | -1.40% | 0.20% | -0.60% | -1.00% |

| 22:45 | NZD | Retail Sales ex Autos Q/Q Q1 | -1.10% | -1.00% | -1.30% | -1.60% |

| 00:30 | AUD | Westpac Leading Index M/M Apr | 0.00% | 0.00% | ||

| 02:00 | NZD | RBNZ Rate Decision | 5.50% | 5.50% | 5.25% | |

| 03:00 | NZD | RBNZ Press Conference | ||||

| 06:00 | GBP | CPI M/M Apr | 1.20% | 0.80% | 0.80% | |

| 06:00 | GBP | CPI Y/Y Apr | 8.70% | 8.20% | 10.10% | |

| 06:00 | GBP | Core CPI Y/Y Apr | 6.80% | 6.20% | 6.20% | |

| 06:00 | GBP | RPI M/M Apr | 1.50% | 1.70% | 0.70% | |

| 06:00 | GBP | RPI Y/Y Apr | 11.40% | 11.20% | 13.50% | |

| 06:00 | GBP | PPI Input M/M Apr | -0.30% | -0.50% | 0.20% | |

| 06:00 | GBP | PPI Input Y/Y Apr | 3.90% | 3.80% | 7.60% | 7.30% |

| 06:00 | GBP | PPI Output M/M Apr | 0.00% | -0.10% | 0.10% | 0.00% |

| 06:00 | GBP | PPI Output Y/Y Apr | 5.40% | 7.40% | 8.70% | 8.50% |

| 06:00 | GBP | PPI Core Output M/M Apr | 0.00% | 0.10% | 0.30% | |

| 06:00 | GBP | PPI Core Output Y/Y Apr | 6.00% | 7.30% | 8.50% | 8.30% |

| 08:00 | EUR | Germany IFO Business Climate May | 91.7 | 93.4 | 93.6 | 93.4 |

| 08:00 | EUR | Germany IFO Current Assessment May | 94.8 | 95.2 | 95 | 93.1 |

| 08:00 | EUR | Germany IFO Expectations May | 88.6 | 91.7 | 92.2 | 91.7 |

| 14:30 | USD | Crude Oil Inventories | 1.5M | 5.0M | ||

| 18:00 | USD | FOMC Minutes |