British Pound sees a broad rally today, fueled by robust wage growth, indicating that secondary inflationary pressure remains persistent, which will likely force BoE to continue tightening. In contrast, Euro fell sharply due to plunging economic sentiment, leading to a downside breakout in EUR/GBP, resuming its recent downward trend.

As it stands, Yen remains the top performer, slightly edging out the Pound. Swiss Franc is not far behind, benefitting from an influx of buyers from Euro. Australian and New Zealand Dollar are underperforming, even falling behind the weakened Euro. Dollar presents a mixed picture, with a recovery against Euro, range trading against commodity currencies, but weak against Sterling, Swiss Franc, and Yen.

Technically, with breach of 0.8818 support, USD/CHF is now having 0.8756 (2021 low). Ideally, strong support should be seen from 0.8756 to bring bullish trend reversal, to extend the long term sideway pattern. However, decisive break of 0.8756 will be a strong sign persistent long term bullishness in the France. If realized, that would likely be accompanied by extended fall in EUR/CHF too.

In Europe, at the time of writing, FTSE is down -0.10%. DAX is up 0.75%. CAC is up 1.27%. Germany 10-year yield is down -0.015 at 2.627. Earlier in Asia, Nikkei rose 0.04%. Hong Kong HSI is up 0.97%. China Shanghai SSE rose 0.55%. Singapore Strait Times rose 0.46%. Japan 10-year JGB yield dropped -0.0168 to 0.456.

Germany ZEW plunged on higher interest and weak export markets

Germany’s ZEW Economic Sentiment for July plunged significantly, from -8.5 to -14.7, far underperforming the expected -9.5. Additionally, Current Situation Index dropped from -56.5 to -59.5, a decline which was marginally better than anticipated -60.0.

Similarly, Eurozone’s ZEW Economic Sentiment also fell from -10 to -12.2 in July, coming in under the anticipated -10.2. Current Situation Index also took a dip, decreasing by -2.5 points to -44.4.

ZEW President Achim Wambach expressed concern over the economic outlook, stating: “The ZEW Indicator of Economic Sentiment is shifting even more noticeably into negative territory. Financial market experts predict a further deterioration in the economic situation by year-end.”

According to Wambach, key drivers for this economic pessimism include the anticipated rise in short-term interest rates in Eurozone and US, as well as a perceived weakness in important export markets like China.

He noted: “The industrial sectors are likely to bear the brunt of the anticipated economic downturn, with profit expectations for these export-oriented industries experiencing a substantial decline once again.”

UK payrolled employment down -9k in Jun, median pay accelerated to 9.7% yoy

In June, UK payrolled employment decreased by -9k, comparing with May. But payrolled employment was still up 439k comparing with the same month last year. Median monthly pay was up 9.7% yoy, accelerated from May’s 8.4% yoy. Claimant count rose 25.7k, above expectation of 20.5k.

In the three months to May, unemployment rate rose 0.2% to 4.0% compared with the previous three month period. Employment rate rose 0.2% to 76.0%. Economic inactivity rate was down -0.4% to 20.8%. Total weekly hours rose 4.5%. Average earnings including bonus rose 6.9, up from April’s 6.7%. Average earnings excluding bonus rose 7.3%, same as the prior period.

Australia’s Westpac consumer sentiment up 2.7% mom, but pessimism still prevails

Westpac-MI Consumer Sentiment Index in Australia witnessed a modest 2.7% mom increase in July, rising to 81.3. However, the index remains entrenched the deeply pessimistic territory, a condition that has prevailed for over a year now.

According to Westpac, the main driving force behind this month’s uplift is easing in monthly inflation, which dipped from 6.8% in April to 5.6% in May.

RBA decision to pause in July, however, failed to instill confidence. In fact, the sentiment was considerably more buoyant before the decision, with an index reading of 88, marking an 11.2% rise from June. Post-RBA responses, on the other hand, presented a combined index reading of 77.9, a dip of -11.6% from the pre-RBA sample and a -1.6% fall from June’s reading.

Westpac’s key message is clear: “Sentiment is probably not going to stage a sustained lift from current deeply pessimistic levels until inflation is much lower and interest rates are firmly on hold.”

Looking ahead to the RBA’s next meeting on August 1, Westpac expects that if annual underlying inflation prints around 6.1% for the June quarter, and if the unemployment rate continues to hold well below full employment, the case for higher rates will be clear.

As such, Westpac anticipates that RBA Board will raise cash rate by 0.25% at both August and September Board meetings, followed by a prolonged pause. The first rate cut in the subsequent easing cycle is expected next May.

EUR/GBP Mid-Day Outlook

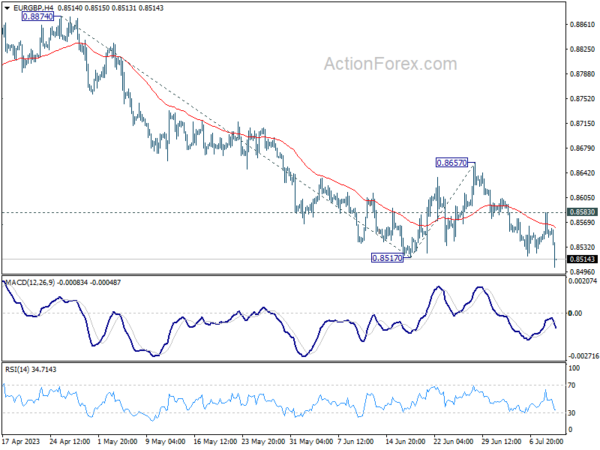

Daily Pivots: (S1) 0.8535; (P) 0.8559; (R1) 0.8579; More…

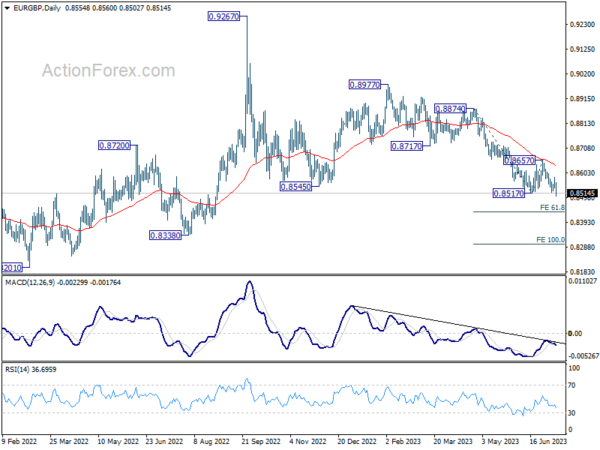

Break of 0.8517 in EUR/GBP indicates resumption of recent down trend. Intraday bias is back on the downside for 61.8% projection of 0.8874 to 0.8517 from 0.8650 at 0.8436. On the upside, above 0.8583 minor resistance will turn intraday bias neutral first. But near term outlook will remain bearish as long as 0.8657 resistance holds, in case of recovery.

In the bigger picture, the down trend from 0.9267 (2022 high) is still in progress. It’s seen as part of the long term range pattern from 0.9499 (2020 high). Deeper fall could be seen towards 0.8201 (2022 low). But strong support should be seen from there to bring reversal. This will now remain the favored case as long as 0.8657 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Jun | 4.20% | 3.70% | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Jun | 2.60% | 2.70% | 2.70% | |

| 00:30 | AUD | Westpac Consumer Confidence Jul | 2.70% | 0.20% | ||

| 01:30 | AUD | NAB Business Conditions Jun | 9 | 8 | ||

| 01:30 | AUD | NAB Business Confidence Jun | 0 | -4 | ||

| 06:00 | GBP | Claimant Count Change Jun | 25.7K | 20.5K | -13.6K | -22.5K |

| 06:00 | GBP | ILO Unemployment Rate (3M) May | 4.00% | 3.80% | 3.80% | |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y May | 6.90% | 6.80% | 6.50% | 6.70% |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y May | 7.30% | 7.10% | 7.20% | 7.30% |

| 06:00 | EUR | Germany CPI M/M Jun F | 0.30% | 0.30% | 0.30% | |

| 06:00 | EUR | Germany CPI Y/Y Jun F | 6.40% | 6.40% | 6.40% | |

| 08:00 | EUR | Italy Industrial Output M/M May | 1.60% | 0.90% | -1.90% | -2.00% |

| 09:00 | EUR | Germany ZEW Economic Sentiment Jul | -14.7 | -9.5 | -8.5 | |

| 09:00 | EUR | Germany ZEW Current Situation Jul | -59.5 | -60 | -56.5 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Jul | -12.2 | -10.2 | -10 | |

| 10:00 | USD | NFIB Business Optimism Index Jun | 91 | 89.9 | 89.4 |