In today’s Asian trading, Australian Dollar took a brief dip following release of consumer inflation data that indicated more rapid deceleration than predicted. This dampened expectations for an additional rate hike by RBA in early August. Nonetheless, Aussie managed to regain stability promptly, reversing some of the selloff. As Fed’s rate decision looms, market participants remain hesitant to adjust their current positions significantly.

Currently, Dollar finds itself in a somewhat precarious position, ranking as the second weakest performer of the week, only outdone by Euro. The latter experienced a steep drop due to a string of disappointing economic data released this week. There’s a perceivable tilt in risk towards the downside for the greenback. Despite expectations for a hawkish stance from Fed today, markets might easily dismiss such a posture. On the other hand, any dovish leaning could potentially incite a significant reaction. Yet, the more likely outcome is that FOMC rate decision and press conference would be a non-event.

Staying in the currency markets, Swiss Franc is currently the week’s third weakest performer, trailing behind Euro and Dollar, with British Sterling tailing closely behind. New Zealand Dollar leads the pack as the strongest performer, followed by Japanese Yen, and then Aussie, while Canadian Dollar is mixed in the middle.

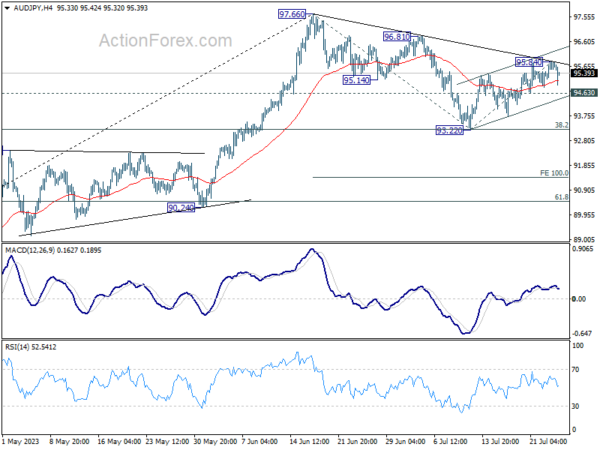

On a technical note, AUD/JPY deserves some attention, given the potential strong response to upcoming risk market developments. The cross’s corrective recovery from 93.22 has been losing steam, evident from 4H MACD. It has also struggled to break through near term falling trend line resistance. Firm break of 94.63 support will argue that larger fall from 97.66 is ready to resume. Deeper decline should then be seen to retest 93.22 support first in this case.

In Asia, at the time of writing, Nikkei is down -0.07%. Hong Kong HSI is down -0.88%. China Shanghai SSE is down -0.54%. Singapore Strait Times is up 0.76%. Japan 10-year JGB yield is down -0.013 at 0.454, moving further away from BoJ’s 0.5% yield cap. Overnight, DOW rose 0.08%. S&P 500 rose 0.28%. NASDAQ rose 0.61%. 10-year yield jumped 0.055 to 3.912.

Australian Q2 CPI records slowest quarterly rate since Q3 2021, annual inflation eases again

In Q2, Australia’s CPI decelerated from 1.4% qoq to 0.8% qoq, coming in below the expected 1.0% qoq. This marked the lowest quarterly rate since Q3 2021. Year-on-year, CPI eased from 7.0% to 6.0%, falling short of anticipated 6.2% yoy. Annual inflation rate has been on a downtrend for two consecutive quarters since peaking at 7.8% in Q4 2022.

RBA’s trimmed mean CPI registered at 0.9% qoq and 5.9% yoy, which were below forecast of 1.1% qoq and 6.0% yoy respectively. While CPI for goods slowed from 7.6% yoy to 5.8% yoy, CPI for services rose from 6.1% yoy to 6.3% yoy, hitting its highest level since 2001.

Michelle Marquardt, ABS head of prices statistics, noted the shift in inflationary drivers, stating, “This is the first time since September 2021 that services inflation has been higher than goods, highlighting the change from 12 months ago when goods like new dwellings and automotive fuel were driving inflation. Now price increases for a range of services like rents, restaurant meals, child-care and insurance are keeping inflation high.”

In June, monthly CPI slipped from 5.5% yoy to 5.4% yoy, in line with expectations. CPI excluding volatile items and holiday travel eased from 6.4% yoy to 6.1% yoy, and trimmed mean CPI fell from 6.1% yoy to 6.0% yoy.

IMF urges Japan to start preparing for rate hikes

IMF Chief Economist Pierre-Olivier Gourinchas shared his views on Japan’s economy highlighting that the risks related to inflationary pressures likely lean towards the upside. He urged BoJ to start preparing for increasing interest rates.

Addressing Japan’s monetary stance, Gourinchas stated, “Our advice for Japanese authorities there is that right now, monetary policy can remain accommodative, but it needs to prepare itself for the need to maybe start hiking.” Furthermore, he suggested that Japan should consider flexibility in its monetary policy, “maybe move away from the yield-curve control that it has now.”

In its updated World Economic Outlook report, IMF projected a 1.4% expansion for Japan’s economy in 2023, up from a 1.0% rise last year, primarily driven by boost in consumption as pandemic restrictions are lifted. However, growth is anticipated to slow to 1.0% in 2024 as the impact of past stimulus measures wanes.

Fed to hike 25bps, too soon to confirm it’s last

FOMC is widely anticipated to increase interest rates by 25bps to between 5.25-5.50% today, following a brief pause in June. Recent chatter among financial circles suggests that this could mark the last hike in Fed’s current tightening cycle, as inflation has shown promising signs of deceleration.

However, it’s worth noting that the next FOMC meeting is not scheduled until September 20-21, a significant interval that will witness multiple key data releases. These encompass two sets of PCE inflation, CPI, and non-farm payroll figures. Furthermore, the September meeting will bring updated economic projections from Fed.

Given this context, it is highly improbable that today’s accompanying statement will slacken the tightening bias. Fed Chair Jerome Powell is expected to maintain a cautious approach, underscoring the commitment to curb inflation and even reiterating that Fed policymakers had projected at least one more rate hike this year, in their last projections. However, any departure from these expected messages could precipitate a bearish turn for Dollar and a bullish surge for stocks.

Presently, market expectations for another rate hike stand at only around 20% for September, 40% for November, and 36% for December. Meanwhile, market pricing suggests the first cut could be on the horizon as early as May next year, with an estimated probability of about 81%.

Here are some suggested readings on Fed:

- Will July Rate Hike Be One and Done for Fed?

- Fed Preview: July Marks the End of the Hiking Cycle

- July Flashlight for the FOMC Blackout Period

Looking ahead

Swiss Credit Suisse economic expectations and Eurozone M3 money supply will be featured in European session. US will release new home sales. BoC will also publish summary of deliberations.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1022; (P) 1.1054; (R1) 1.1088; More…

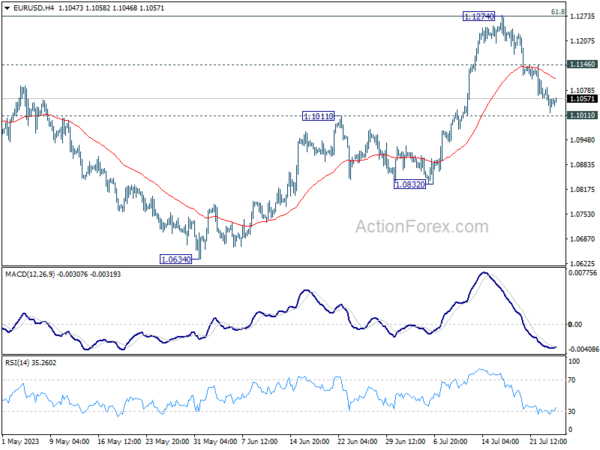

Intraday bias in EUR/USD is turned neutral with 4H MACD crossed above signal line. Near term outlook will stay bullish as long as 1.1011 resistance turned support holds. Above 1.1146 minor resistance will turn bias back to the upside for retesting 1.1274 high first. However, firm break of 1.1011 will argue that larger correction is underway. Deeper fall would then be seen to 1.0832 support next.

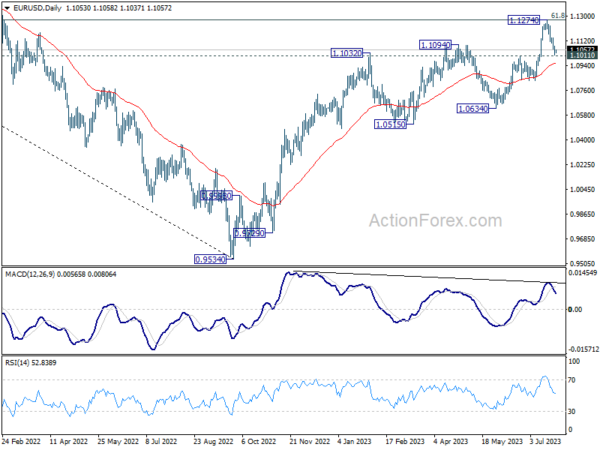

In the bigger picture, rise from 0.9534 is still expected to continue as long as 1.1011 resistance turned support holds. Decisive break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next. However, firm break of 1.1011 will indicate rejection by 1.1273 and raise the chance of reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Jun | 1.20% | 1.50% | 1.60% | 1.70% |

| 01:30 | AUD | Monthly CPI Y/Y Jun | 5.40% | 5.40% | 5.60% | 5.50% |

| 01:30 | AUD | CPI Q/Q Q2 | 0.80% | 1.00% | 1.40% | |

| 01:30 | AUD | CPI Y/Y Q2 | 6.00% | 6.20% | 7.00% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Q/Q Q2 | 0.90% | 1.10% | 1.20% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Y/Y Q2 | 5.90% | 6.00% | 6.60% | |

| 08:00 | CHF | Credit Suisse Economic Expectations Jul | -30.8 | |||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jun | 1.00% | 1.40% | ||

| 14:00 | USD | New Home Sales Jun | 720K | 763K | ||

| 14:30 | USD | Crude Oil Inventories | -2.2M | -0.7M | ||

| 17:30 | CAD | BOC Summary of Deliberations | 6.70% | 7.10% | ||

| 18:00 | USD | Fed Interest Rate Decision | 5.50% | 5.25% | ||

| 18:30 | USD | FOMC Press Conference |