Fed’s decisively hawkish stance overnight propelled both Dollar and yields upwards, albeit dampening the stock market. Majority of FOMC members maintained projections of another interest rate hike within the year, with a tempered pace of rate cuts anticipated for the forthcoming year.

Fed’s message resounded in the markets as we witnessed a significant leap in two-year yield to levels unseen since 2006 and ten-year yield reaching its highest since 2007. Conversely, equity markets displayed vulnerability, with major US stock indices shutting shop in the red, a sentiment echoing into Asian.

Despite Dollar’s vigorous performance, it is only standing as the week’s third strongest currency, trailing behind Canadian and New Zealand Dollars, the latter buoyed by impressive GDP results from New

In contrast, Sterling grapples with uncertainty, with looming BoE rate decision casting a shadow on its performance. The fate of the Pound hangs in balance, with potential downward pressure irrespective of whether BoE adopts a hawkish hold or dovish hike.

Meanwhile, risk-averse sentiments have doused Australian Dollar, relegating it to the second-last position. Both Euro and Swiss Franc oscillate with mixed sentiments, with eyes keenly set on the impending SNB rate decision.

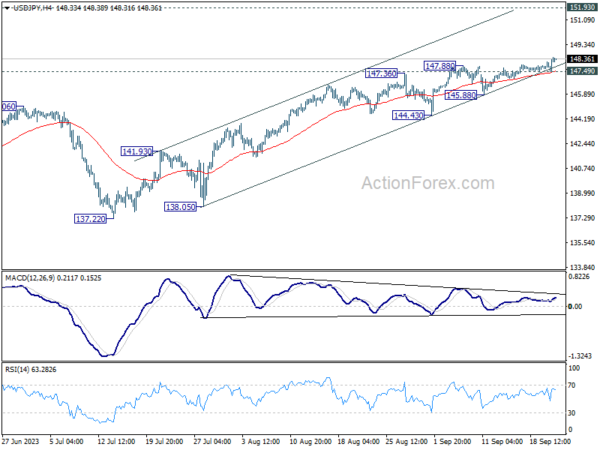

The market’s gaze is also fixed on USD/JPY, heightened by Japan’s Chief Cabinet Secretary Hirokazu Matsuno’s forewarning of a government-led response to necessary forex movements, fostering speculation on intervention — either verbal or actionable — or a policy shift to be unveiled in BoJ’s decision tomorrow.

Technically, USD/JPY has clearly been losing upside momentum as seen in 4H MACD. But for now, there is not sign of topping as long as 147.49 minor support holds. Current rally is still in progress for retesting 151.93 high.

In Asia, at the time of writing, Nikkei is down -1.34%. Hong Kong HSI is down -1.24%. China Shanghai SSE is down -0.60%. Singapore Strait Times is down -1.16%. Japan 10-year JGB yield is up 0.021 at 0.746. Overnight, DOW fell -0.22%. S&P 500 fell -0.94%. NASDAQ fell -1.53%. 10-year yield dropped -0.016 to 4.349.

S&P 500 dips on Fed’s definitive hawkish stance

US equities ended their trading session in the red, following a definitive hawkish stance from Fed, even though interest rate was kept unchanged as expected. Fed sent a clear signal that another rate hike is still on the cards this year, and interest rate is going to stay higher for longer. Fed Chair Jerome Powell confirmed in the post meeting press conference, “We’re in a position to proceed carefully in determining the extent of additional policy firming.”

The new batch of economic projections divulged a prevailing sentiment among 12 of 19 Fed officials in favor of one more rate hike within this year. Investors were taken by surprise not by the rate hike anticipation but by the foreseeing of lesser rate cuts in 2024, a strategic shift attributed largely to the resilient labor market.

Furthermore, the projections hinted at a steeper path for interest rates in the years ahead. Median outlook for federal funds rate was adjusted upwards, settling at 5.1% for 2024, from a prior 4.6%, and 3.9% for 2025, up from 3.4%. This suggests that monetary policy will lean on the tighter side stretching into 2026. A 2.9% funds rate is projected for 2026, marking a divergence from the long-run neutral rate, which remains pegged at 2.5%.

More on Fed:

- Fed Review: Upbeat on Growth

- Message from FOMC Meeting: Higher for Longer

- Fed React: Dollar Pares Earlier Losses after Fed’s Attempt of a Hawkish Skip

- Fed stands part, 12 members see one more hike

Reflecting these developments, S&P 500 took a dip, shedding -0.94% or -41.75 points to conclude at 4402.20. In a technical context, S&P 500’s movements stemming from 4607.07 are perceived a correction pattern. D deeper slide is on the cards to 4335.31 or even lower.

However, robust support levels are anticipated around the 38.2% retracement of 3491.58 to 4607.07 at 4180.95. This is expected to limit further losses, at least at first attempt. Meanwhile, a close above 55 D EMA (now at 4438.25) will neutralize the bearish outlook.

New Zealand’s Q2 GDP outperforms expectations with 0.9% qoq growth

New Zealand’s GDP surged by 0.90% qoq in Q2, doubling the expected growth rate of 0.4%. This notable growth is significantly attributed to substantial boost in the business services sector, specifically within the realm of computer system design.

Despite a setback in the primary industries, which contracted by 1.9%, goods-producing industries and service sectors pulled their weight, recording a growth of 0.7% and 1.0% respectively. The service sector emerged as a strong pillar of economic advancement.

The quarter also saw manufacturing sector shake off its lethargy, reversing a trend of decline sustained over five consecutive quarters to contribute positively to the economic pie.

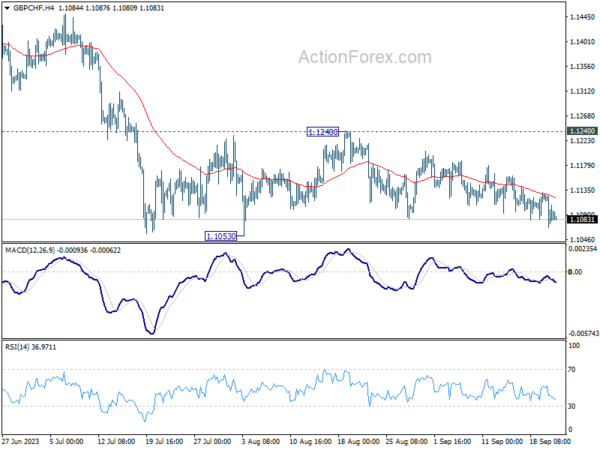

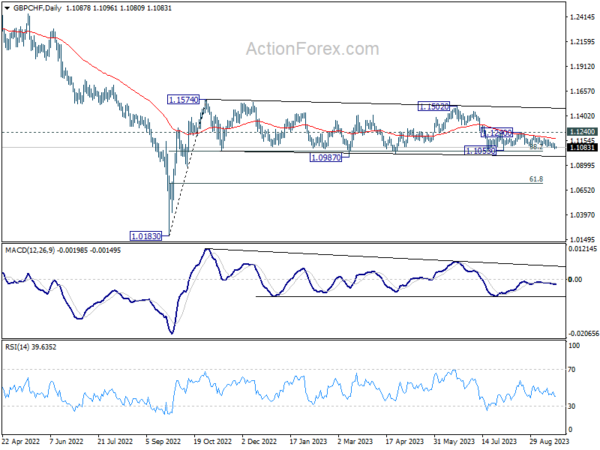

BoE and SNB looms as GBP/CHF awaits Clarity

Today, all eyes are firmly fixed on BoE and SNB rate decisions, which are poised to offer directional cues for the GBP/CHF, hopefully. The pair has been bounded in a constrained range for some time, hungry for a catalyst to redefine its movement.

On one hand, BoE is grappling with the aftermath of lackluster UK inflation data, leaving its imminent rate decision hanging in a delicate balance. The central bank faces two potential paths: embracing a hawkish hold akin to Fed, hence deferring a rate hike while keeping it in the future playbook, or mirroring ECB’s strategy with a dovish hike, signaling a peak in the tightening cycle. This undetermined stance has metamorphosed the rate decision into somewhat of a coin toss.

Meanwhile, the consensus among analysts is leaning towards a 25bps hike by SNB, setting the interest rate at a neat 2.00%, thereby drawing the current cycle to a close. This perspective, held by a substantial majority of economists surveyed by Bloomberg, finds reinforcement in the upward revision of the 2024 inflation forecasts tabled by SECO yesterday.

Casting an eye on GBP/CHF, it is currently oscillating within a short-term range between 1.1053 and 1.1240. Presently, its trajectory is hard to pin down. The bearish sentiment is palpable with the pair capped below by 55 D EMA at 1.1709. However, this is offset by the steadfast support at 38.2% retracement of 1.0183 to 1.1574 at 1.1043.

For a clear bearish momentum to materialize, the cross would need to break the 1.1053 support, and then ensuring it sustainably trades below 1.1043 – a weekly close below this fibonacci level would solidify this stance. Yet, a spike lower, followed a substantial rebound could indicate a bullish reversal, hinting at a potential rise past 1.1240 resistance later, to extend the medium term range trading from 1.1574.

Elsewhere

Canada will release new housing price index. US will release jobless claims, Philly Fed survey and existing home sales.

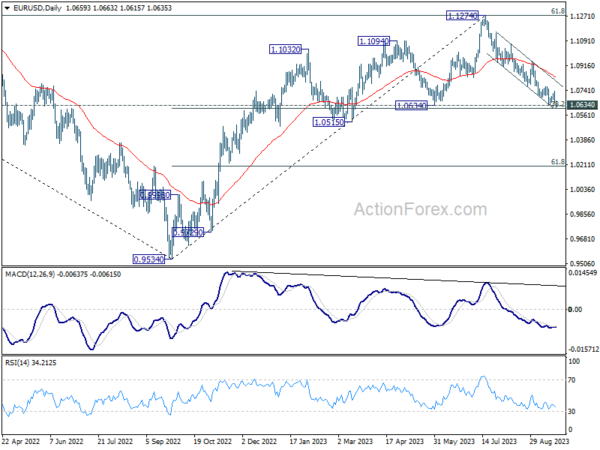

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0628; (P) 1.0683; (R1) 1.0715; More…

EUR/USD’s decline resumes and intraday bias is back on the downside. Sustained break of 1.0609/34 support zone will carry larger bearish implication. Fall from 1.1274 should then target target 1.0515 support next. Nevertheless, strong strong rebound from current level, followed by break of 1.0767 resistance, should confirm short term bottoming. Intraday bias will be back on the upside for 1.0944 resistance.

In the bigger picture, fall from 1.1274 medium term top is seen as a correction to up trend from 0.9534 (2022 low). Strong support could be seen from 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609) to bring rebound, at least on first attempt. However, sustained break of 1.0609/0634 will raise the chance of bearish trend reversal, and target 61.8% retracement at 1.0199.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | GDP Q/Q Q2 | 0.90% | 0.40% | -0.10% | 0.00% |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Aug | 9.8B | 3.5B | ||

| 07:30 | CHF | SNB Interest Rate Decision | 2.00% | 1.75% | ||

| 11:00 | GBP | BoE Interest Rate Decision | 5.50% | 5.25% | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 8–0–1 | 8–0–1 | ||

| 12:30 | CAD | New Housing Price Index M/M Aug | 0.00% | -0.10% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 15) | 222K | 220K | ||

| 12:30 | USD | Philadelphia Fed Survey Sep | -0.7 | 12 | ||

| 12:30 | USD | Current Account (USD) Q2 | -220B | -219B | ||

| 14:00 | USD | Existing Home Sales Aug | 4.10M | 4.07M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Sep P | -16.5 | -16 | ||

| 14:30 | USD | Natural Gas Storage | 65B | 57B |