Initial selloff in the US stock markets overnight shot up Japanese Yen. DOW initially dipped to as low as 23531.31, suffering near 400 pt loss, but reversed and closed up 0.02% at 23930.15. Nonetheless, S&P 500 and NASDAQ closed in red, down -0.23% and -0.18% respectively. Yen pared back some gains on stocks rebound but remains one of the strongest for the week. The torch is then passed to Australian Dollar today. The Aussie responds well to RBA monetary statement and surges broadly. But going forward, Dollar will surely take back the stage with non-farm payroll featured.

NFP expected to grow 194k, wage growth the maker mover

US non-farm payrolls report will be the main feature today. Markets expect 194k job growth in April. Unemployment rate is expected to drop from 4.1% to 4.0%. Average hourly earnings are expected to rise 0.2% mom. Pre-NFP job data saw ADP job grew solid 204k. Employment component of ISM manufacturing and services dropped to 53.6 and 54.2 respectively, both showing slowdown but still well in expansion territory. Weekly jobless claims have been exceptionally low in the prior weeks.

There isn’t much concern on the headline number as the most other data pointed to healthy employment market. Instead, there could be a pleasant surprise of upward revision in March’s dismal figure of 103K. Wage growth will likely continue to be the market mover.

Mnuchin: There were “very good conversations” with China

US Treasury Secretary Steven Mnuchin, now in Beijing on the second day of trade talk with China, said there were “very good conversations”. But he didn’t made any further comments. Meanwhile, Mark Calabria, chief economist to U.S. Vice President Mike Pence, commented on the US-China trade negotiations in Washington. He said that the “full day of negotiations” has been “fairly positive”. There were “pretty positive things” from China. But “the question question is whether they will actually do them”.

The official China Daily newspaper said in an editorial that “acceptable agreements can be reached if both sides have realistic expectations of their give and take.” The usually hawkish Global Times said that “since both sides have their bottom lines to keep, it may be hard to reach a deal, but it is good to start somewhere.”

RBA to stay patient despite slightly more positive than expected forecasts

In RBA’s latest Statement on Monetary Policy, economic projections were largely unchanged. Overall, the projections are slightly more positive than expected. But there wouldn’t be any change to the expectation that RBA will stand pat throughout 2018, at least. There was no downward revision in GDP forecast. Underlying inflation forecasts were revised slightly up. On the negative side, unemployment rate will take longer to drop again.

And as noted in the statement, RBA said “the forecasts reflect the expected decline in spare capacity in the economy as GDP growth picks up and as the labour market moves towards full employment.” And, “a key area of uncertainty for the inflation outlook is around how quickly wages growth picks up in response to improving labour market conditions.”

Year-average GDP growth is forecast to be at 3.00% in 2018 and 3.25% in 2019. CPI inflation is forecast to rise to 2.25% at 2018 year end and stay there till June 2020.

The first change is that unemployment rate forecast was raised to 5.50% in June 2018 and December 2018, revised up from 5.25%. Onwards, unemployment rate is projected to drop to 5.25% in June 2019 and stay there till June 2020.

The second change is that underlying inflation is expected to be higher at 2.00% in June 2018 and December 2018, revised up from 1.75%. Then underlying inflation is projected to stay a 2.00% till picking up again to 2.25% in June 2020.

Below are the most updated forecasts.

Here are February projections.

Here are February projections.

Elsewwhere

China Caixin PMI services rose to 52.9 in April, up from 52.4. Eurozone will release PMI services revision today, as well as retail sales. Canada will release Ivey PMIs later in US session.

AUD/USD Daily Outlook

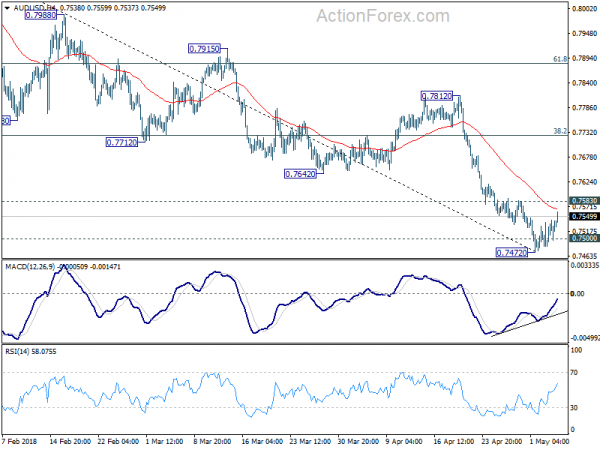

Daily Pivots: (S1) 0.7495; (P) 0.7519; (R1) 0.7554; More…

AUD/USD’s recovery from 0.7472 extends today but it’s staying below 0.7583 minor resistance. Intraday bias remains neutral at this point and further decline is expected. As noted before, sustained break of of 0.7500 key support level will indicate medium term reversal and target next support at 0.7328. However, break of 0.7583 will indicate short term bottoming, on bullish convergence condition in 4 hour MACD. And stronger rebound could be seen back to 38.2% retracement of 0.8135 to 0.7472 at 0.7725 and possibly above.

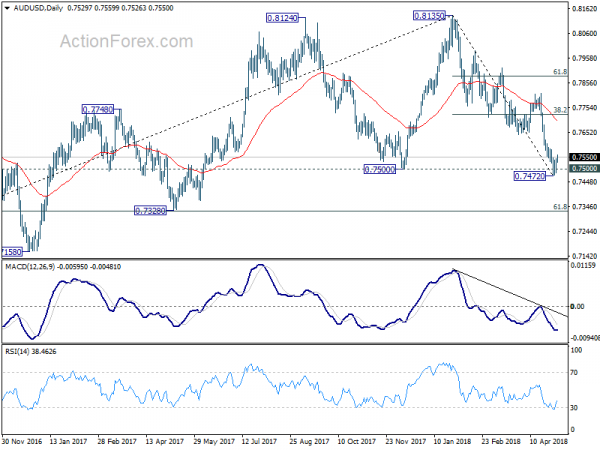

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. Decisive break of 0.7500 key support will suggest that such correction is completed. In that case, deeper decline would be seen back to retest 0.6826 low. In case of another rise, we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption eventually.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Monetary Policy Statement | ||||

| 01:45 | CNY | Caixin PMI Services Apr | 52.9 | 52.3 | 52.3 | |

| 07:45 | EUR | Italy Services PMI Apr | 53 | 52.6 | ||

| 07:50 | EUR | France Services PMI Apr F | 57.4 | 57.4 | ||

| 07:55 | EUR | Germany Services PMI Apr F | 54.1 | 54.1 | ||

| 08:00 | EUR | Eurozone Services PMI Apr F | 55 | 55 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Mar | 0.50% | 0.10% | ||

| 12:30 | USD | Change in Non-farm Payrolls Apr | 194K | 103K | ||

| 12:30 | USD | Unemployment Rate Apr | 4.00% | 4.10% | ||

| 12:30 | USD | Average Hourly Earnings M/M Apr | 0.20% | 0.30% | ||

| 14:00 | CAD | Ivey PMIs Index Apr | 60.2 | 59.8 |