Copper’s collapse this week has triggered renewed weakness across metals, with Silver and Gold also on the back foot. However, underlying, it’s Dollar’s unrelenting strength that’s proving most punishing for precious metals. The next catalyst? The July US non-farm payroll report due today.

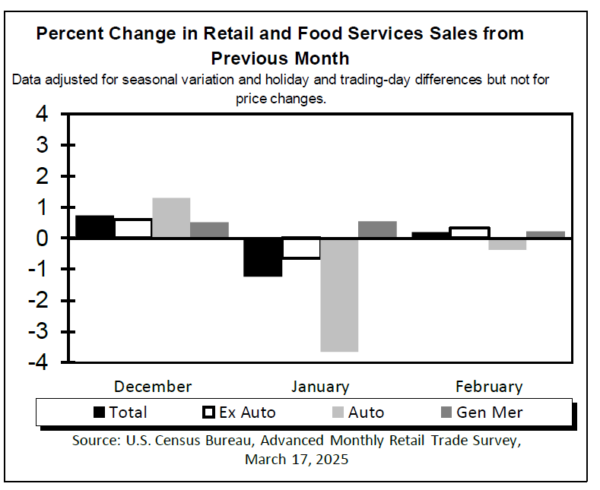

NFP is expected to show 102k job growth, a slight rise in the unemployment rate from 4.1% to 4.2%, and solid wage gains of 0.3% mom.

This month, only two of the usual four leading indicators are available to help guide expectations. The ADP report posted a 104k rise in private jobs, a bounce from last month’s downward surprise. Meanwhile, the 4-week moving average of initial jobless claims fell to 221k.

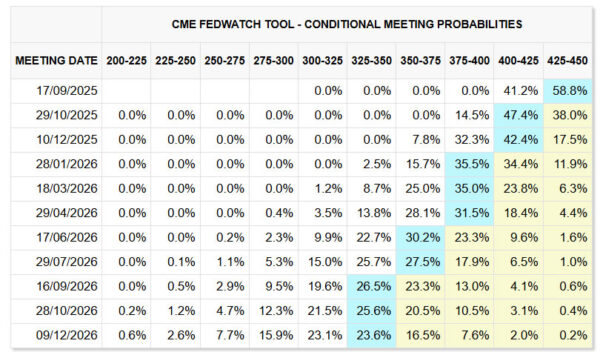

Taken together, these suggest a decent chance of an upside surprise in today’s payrolls release. That would likely trigger further hawkish adjustment in Fed expectations. After this week’s solid GDP and Powell’s cautious tone, markets have already dialed back bets on aggressive easing.

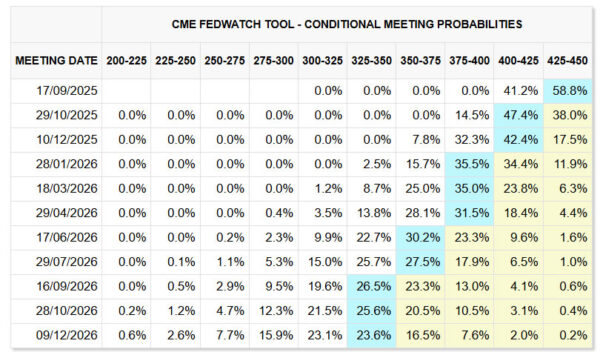

Fed fund futures are pricing just a .2% chance of a September rate cut, and only 40.1% chance of two cuts this year. A robust NFP report could shift expectations further toward a single cut in 2025, providing fresh tailwinds for the Dollar and keeping downward pressure on Gold and Silver.

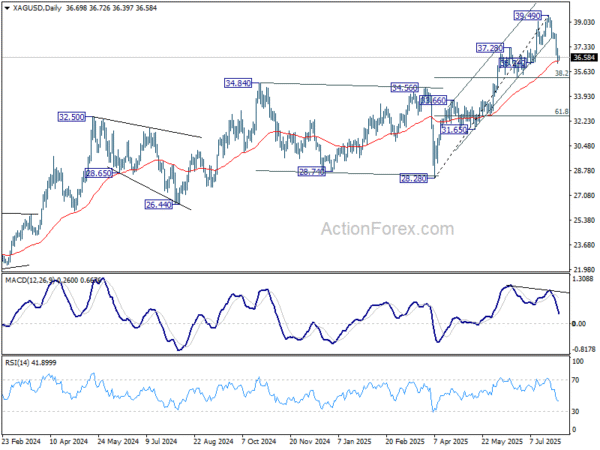

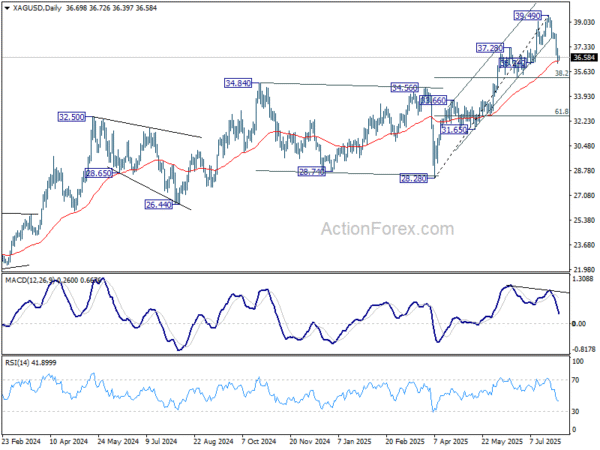

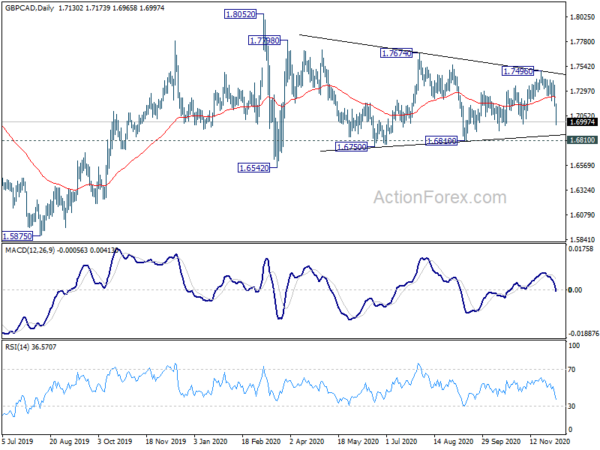

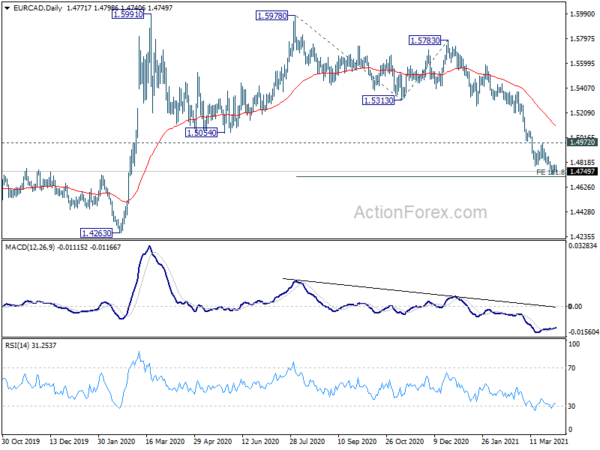

Technically, Silver’s extended fall this week should confirm completion of the five-wave rally from 28.28, on bearish divergence condition in D MACD. While 55 D EMA (now at 36.33) might provide interim support, the correction from 39.49 should at least extend to 38.2% retracement of 28.28 to 39.49 at 35.20 before completion.

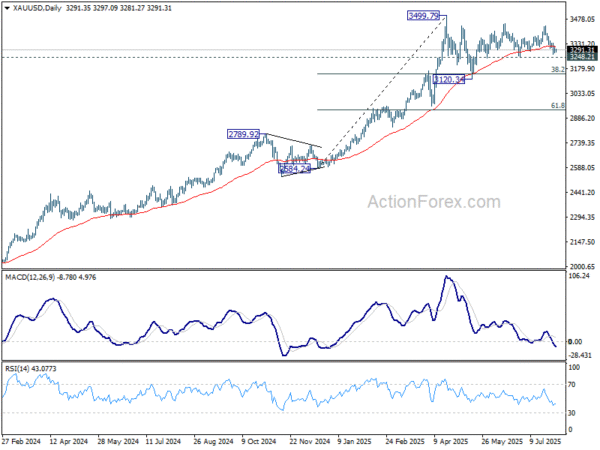

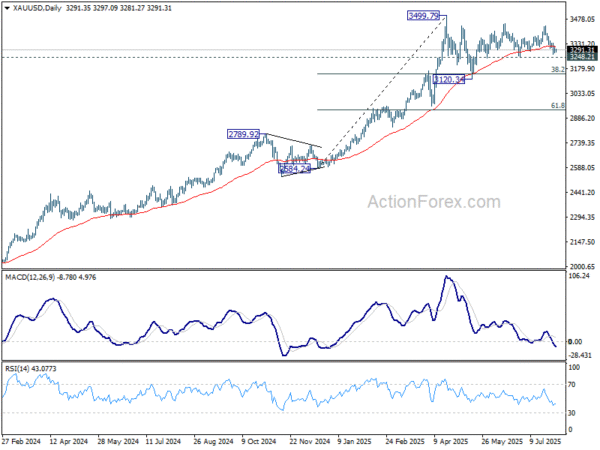

Gold is extending the medium term corrective pattern from 3499.79 high. Immediate focus is on 3248.21 support. Firm break there will open up deeper fall to test 38.2% retracement of 2584.24 to 3499.79 at 3150.04 again.

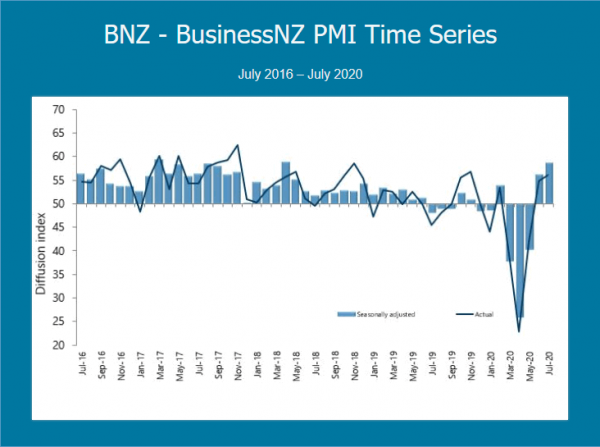

NZ ANZ business confidence dropped slightly, inflation expectation lowest since Mar 2022

New Zealand ANZ Business Confidence index decrease slightly in April, dipping from -43.4 to -43.8. On the other hand, Own Activity Outlook improved from -8.5 to -7.6. A closer look at the details reveals that export intentions jumped from -8.9 to -1.5, while investment intentions remained unchanged at -6.8. Employment intentions rose from -4.6 to -2.4, and pricing intentions fell from 56.8 to 53.7. Cost expectations dropped from 86.4 to 84.2, and profit expectations declined from -33.9 to -37.7.

Inflation expectations decreased from 5.82 to 5.70, reaching the lowest level since March 2022. ANZ observed that the overall decline in inflation signals is consistent with RBNZ gradually gaining traction. However, the situation is far from resolved, as the proportion of firms experiencing high costs and intending to raise prices remains “problematically high”.

ANZ added: “The RBNZ will be encouraged to see the ongoing fall in the inflation indicators in the survey. While there’s still a way to go, inflation is set to continue easing over the year ahead, as they and we are forecasting.

“It’s important to note that the data does not represent a ‘surprise’ for the RBNZ; rather, it’s what they will be expecting to see if their forecasts are to come to fruition, with the OCR able to top out shortly.

“There are risks on both sides: inflation could get “stuck” north of the target band, or global markets could deliver a side-swipe, for example. But the overall message from this month’s survey is “on track.”

Full ANZ Business Confidence release here.