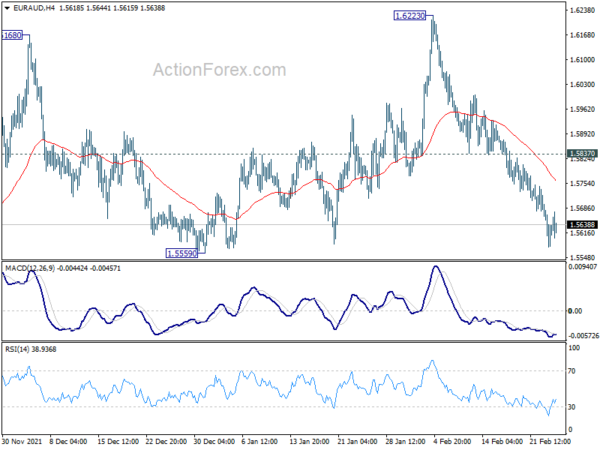

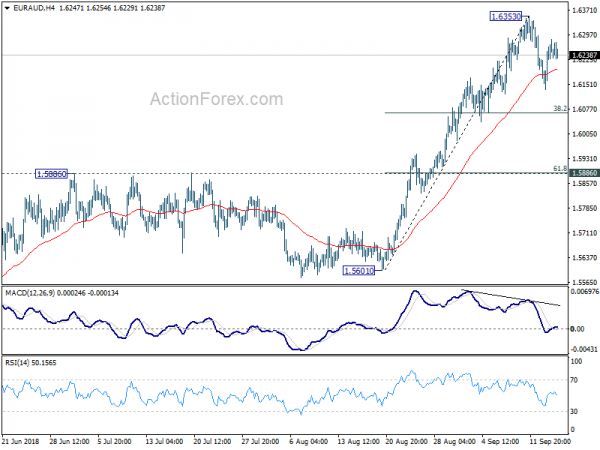

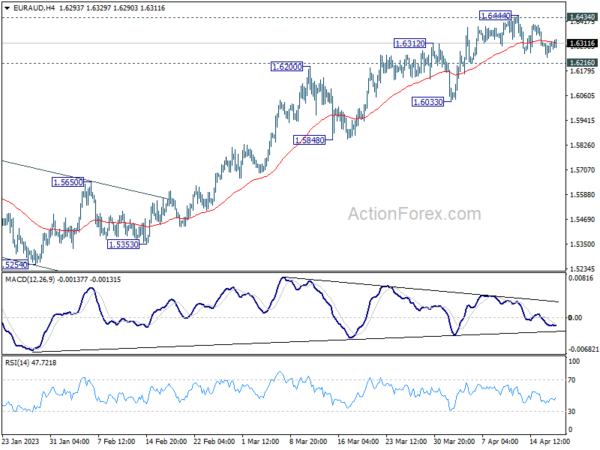

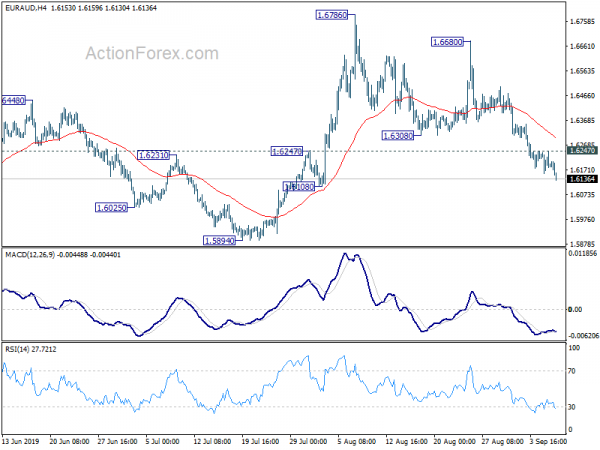

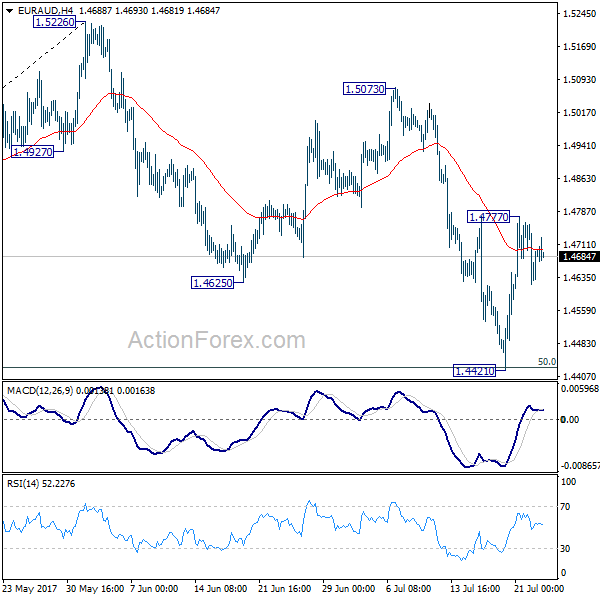

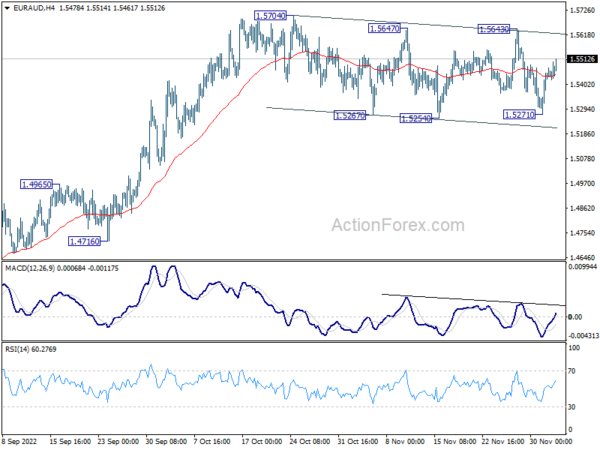

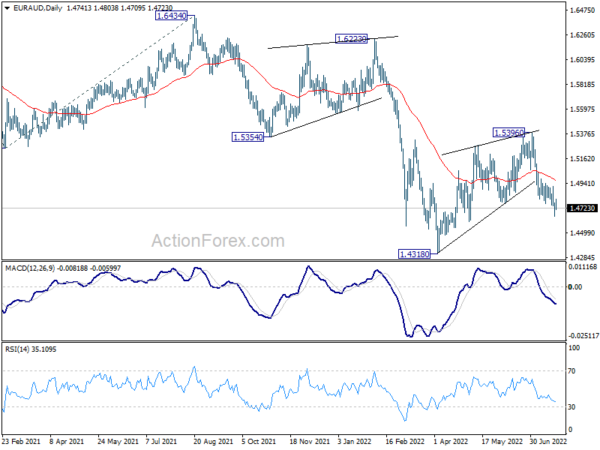

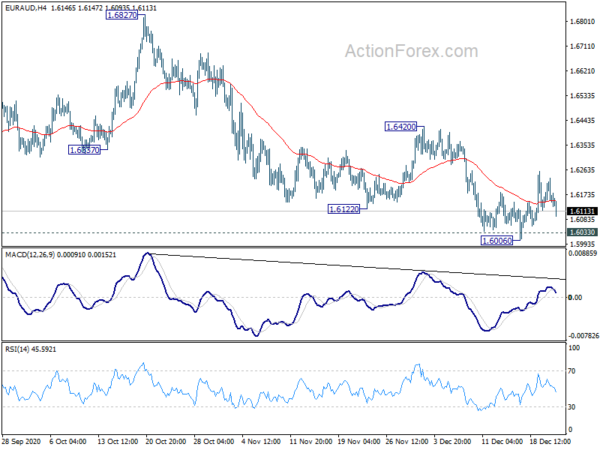

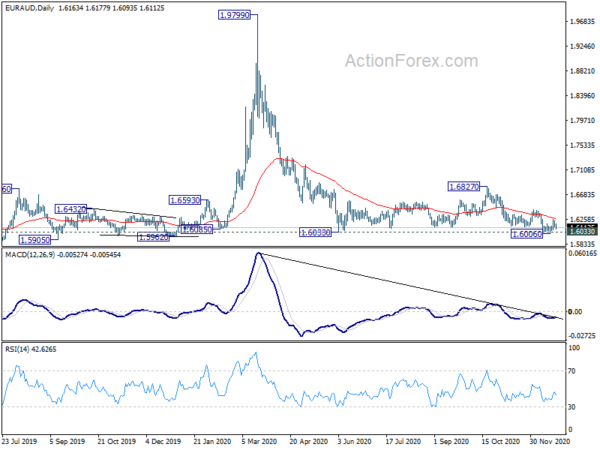

Daily Pivots: (S1) 1.5574; (P) 1.5636; (R1) 1.5691; More…

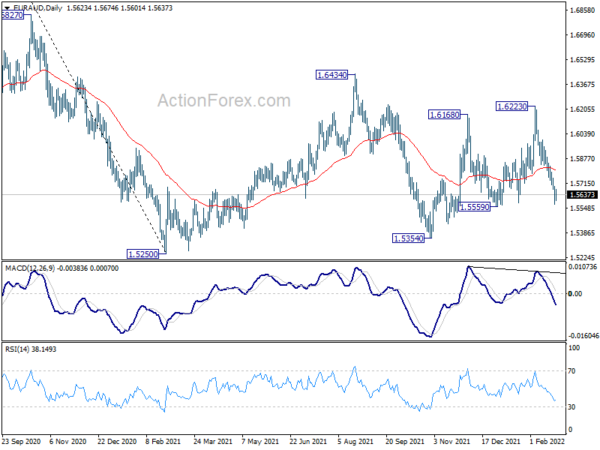

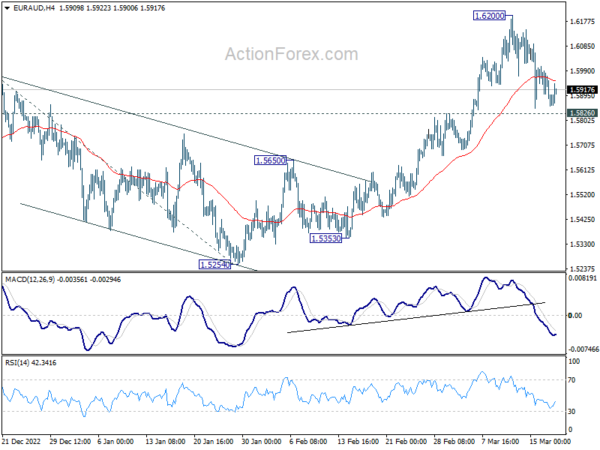

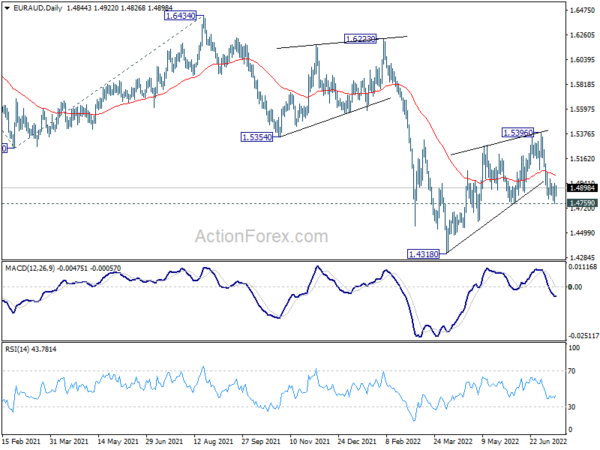

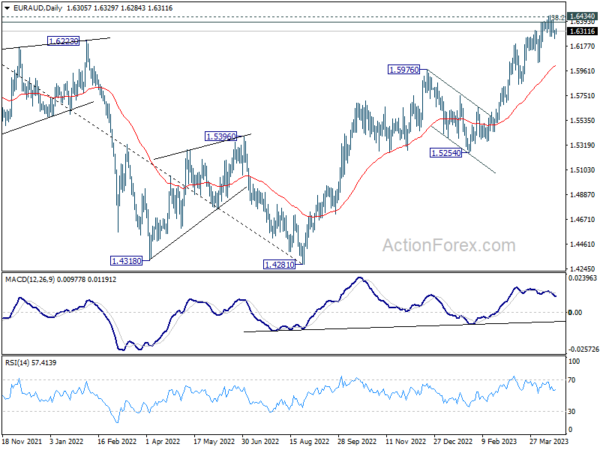

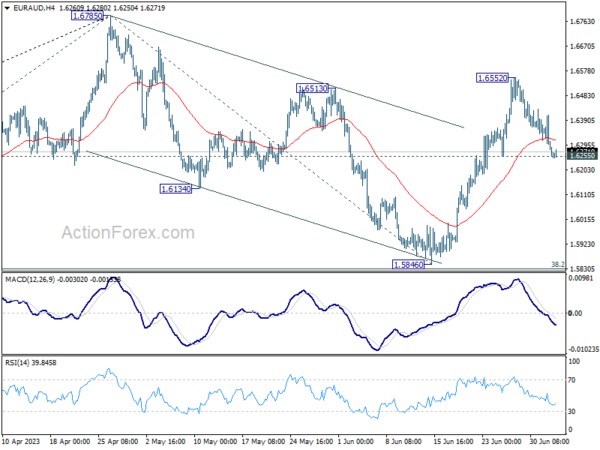

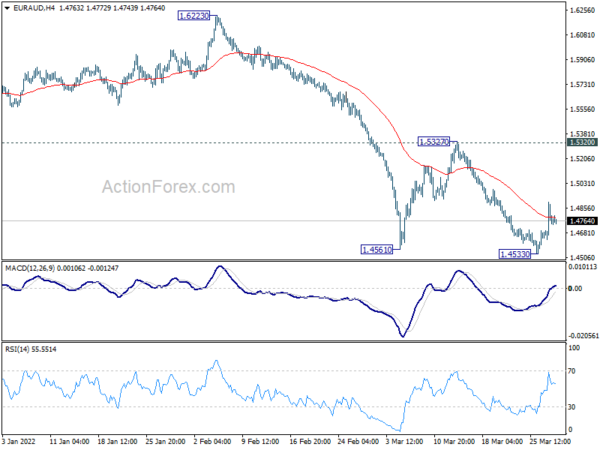

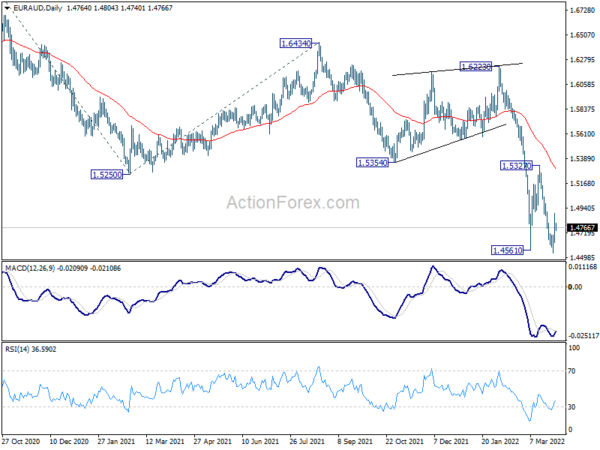

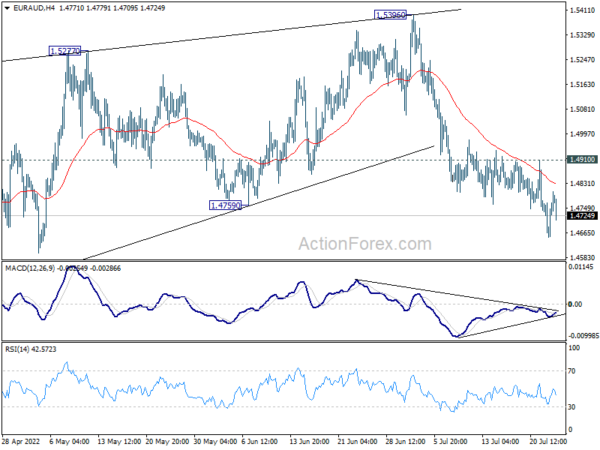

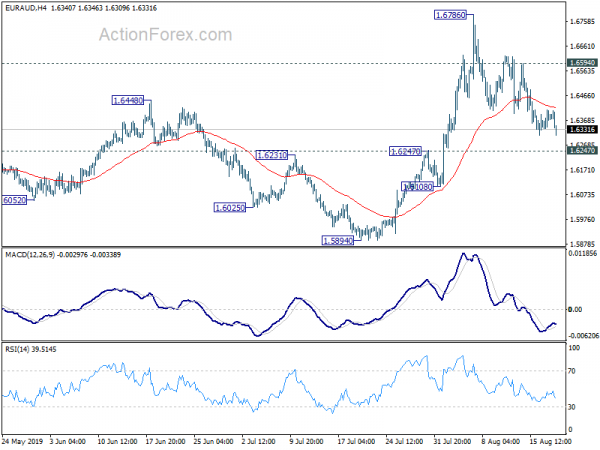

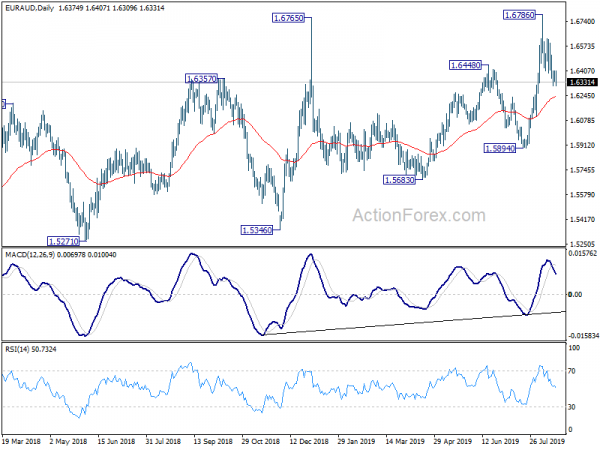

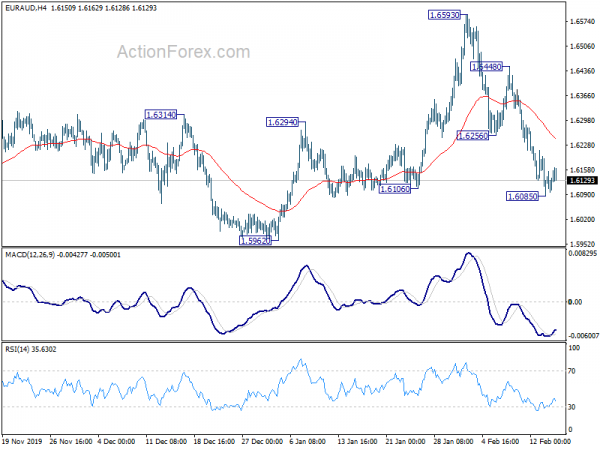

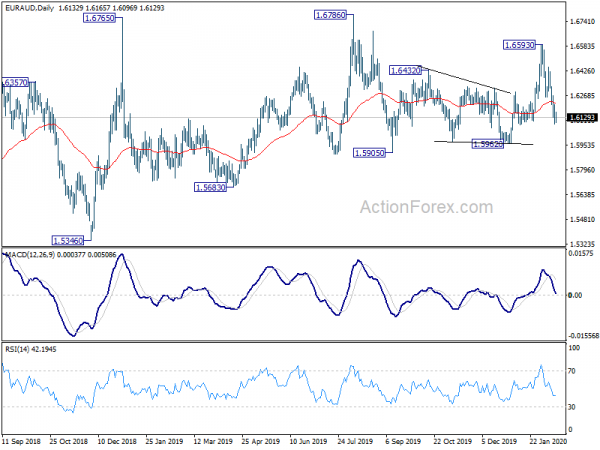

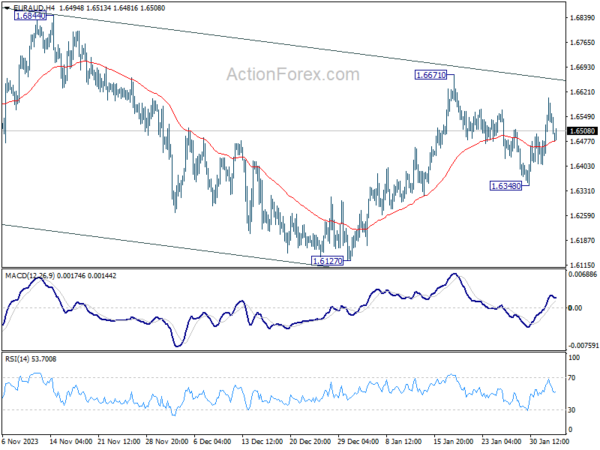

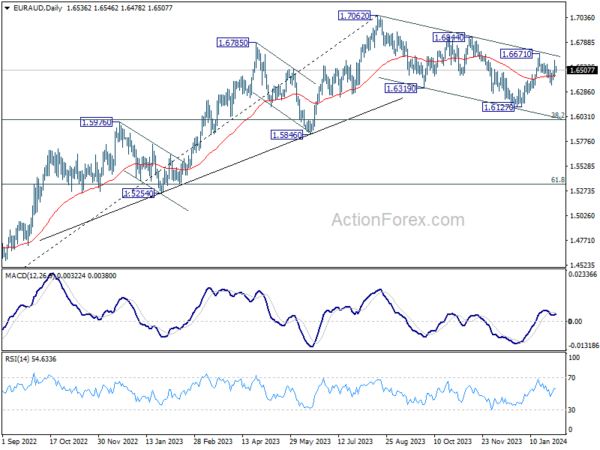

EUR/AUD’s fall from 1.6223 is still in progress and intraday bias stays on the downside. Break of 1.5559 support should indicate that corrective rise from 1.5354 has completed in form of a three wave pattern. Further decline would then be seen back to 1.5250/5354 support zone. On the upside, above 1.5837 minor resistance will turn intraday bias neutral first.

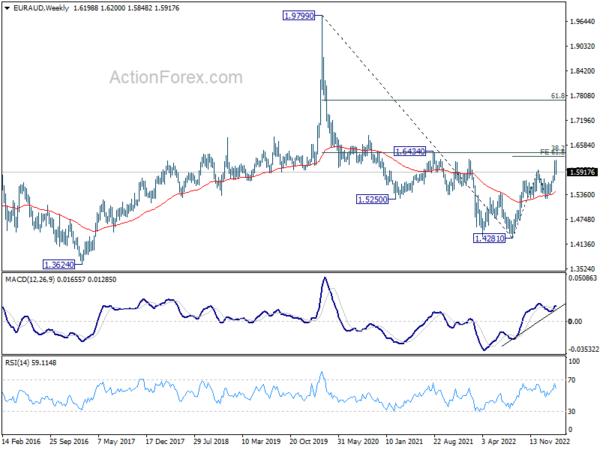

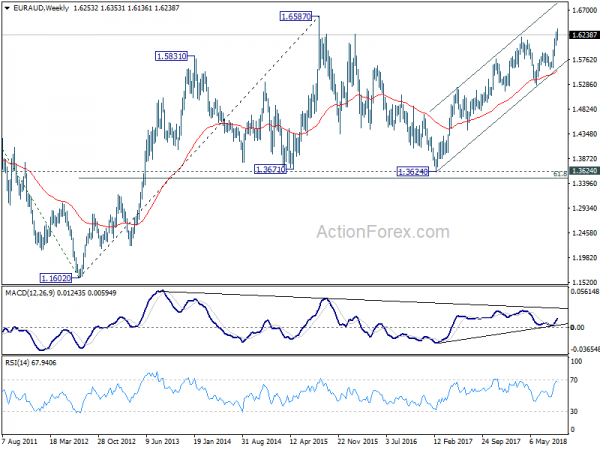

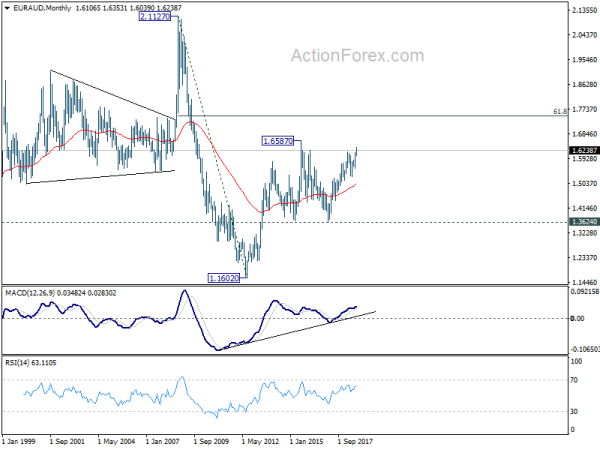

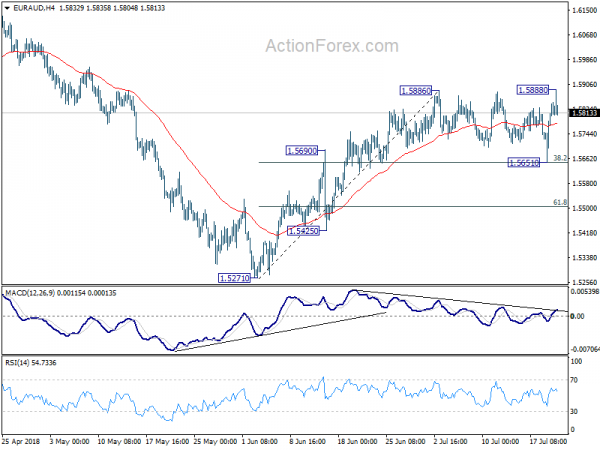

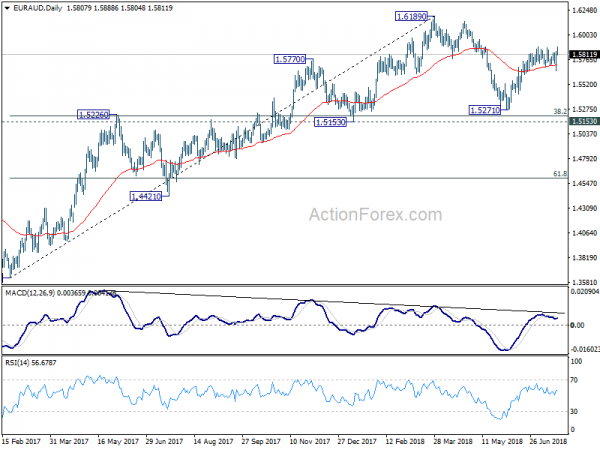

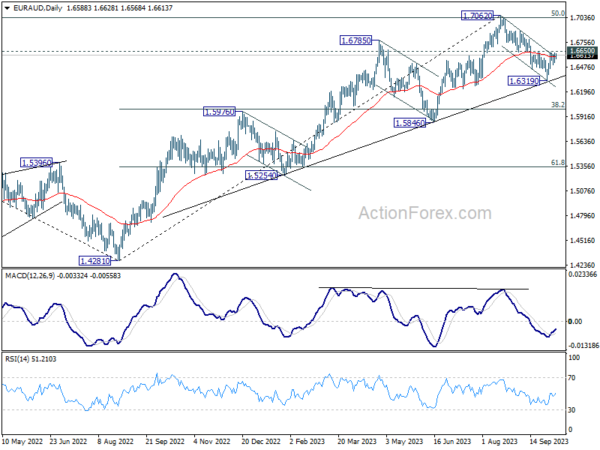

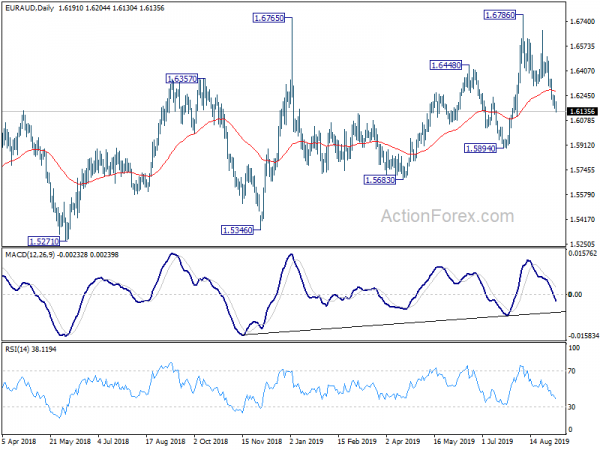

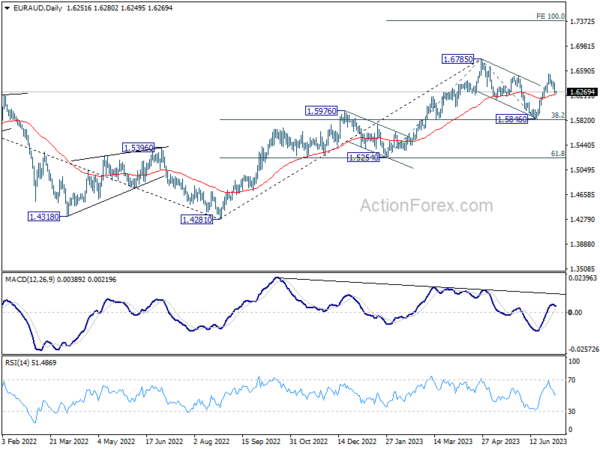

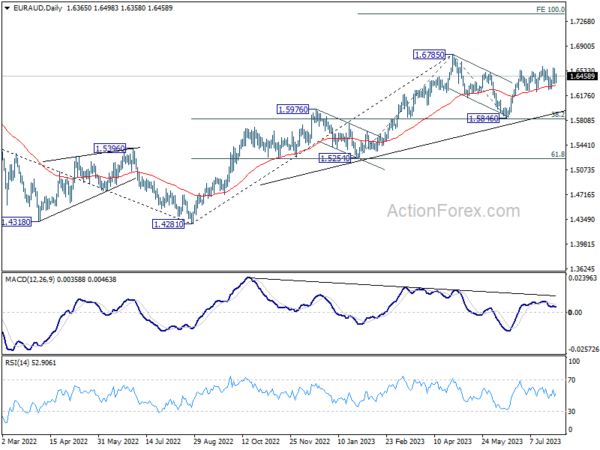

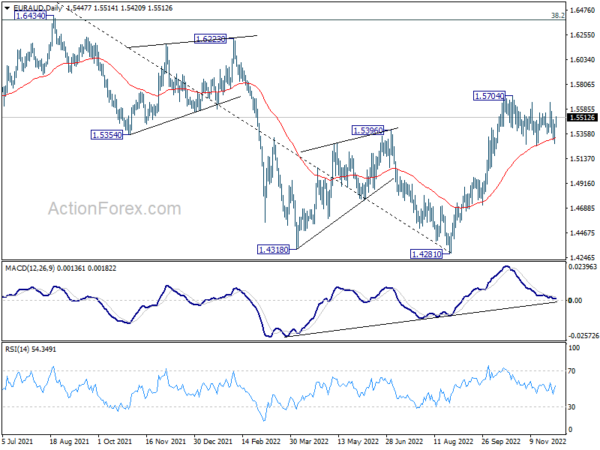

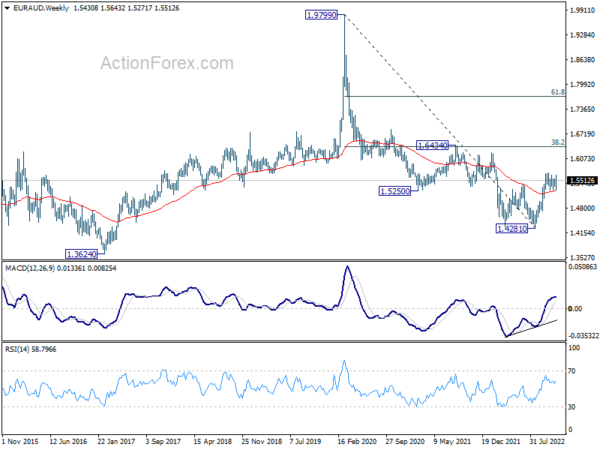

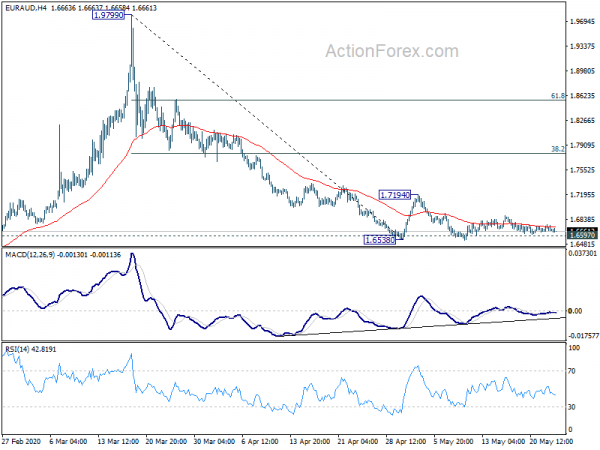

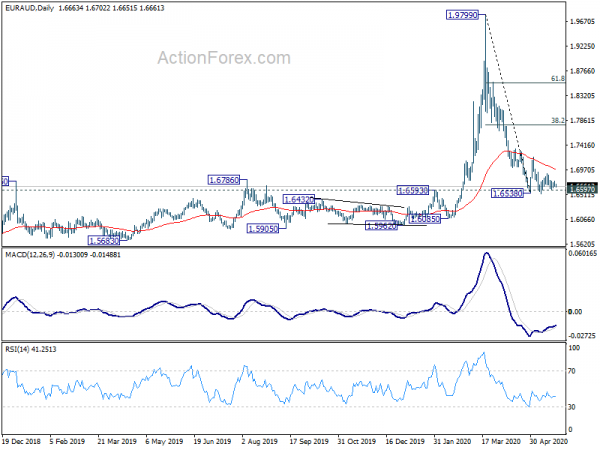

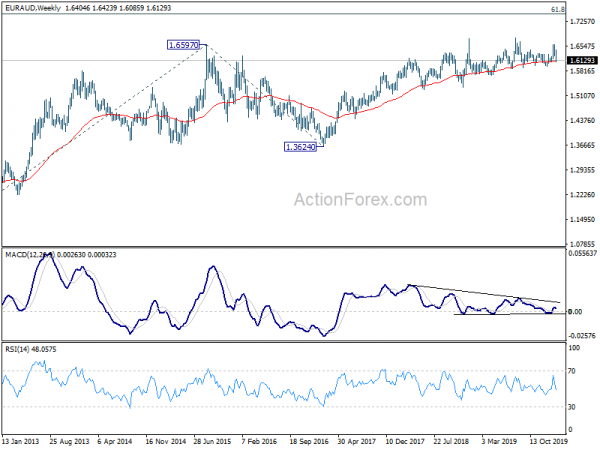

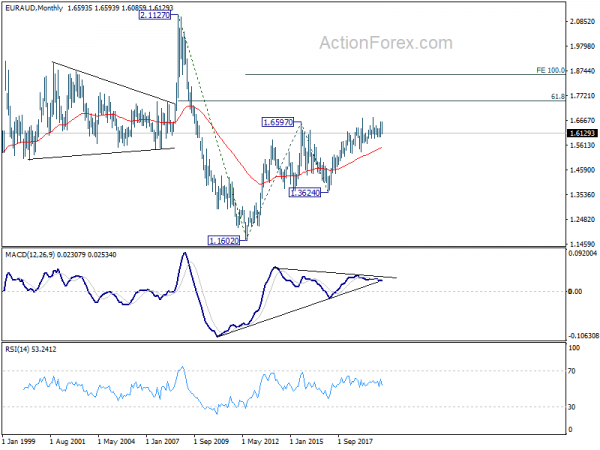

In the bigger picture, price actions from 1.5250 low are seen as a corrective pattern. Further extension could be seen and another rise cannot be ruled out. But strong resistance should be seen at 38.2% retracement of 1.9799 to 1.5250 at 1.6988. Larger down trend from 1.9799 is in favor to extend through 1.5250 at a later stage.