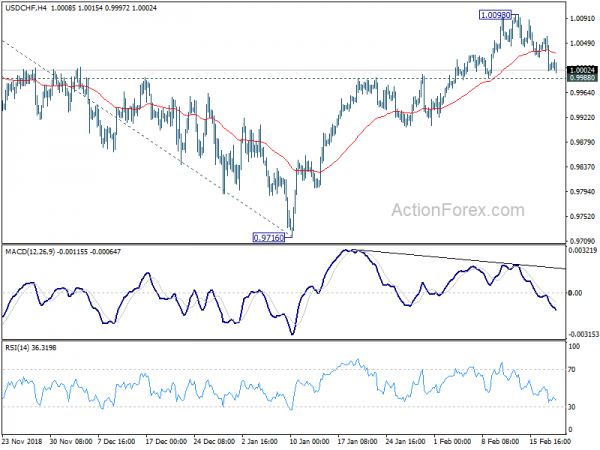

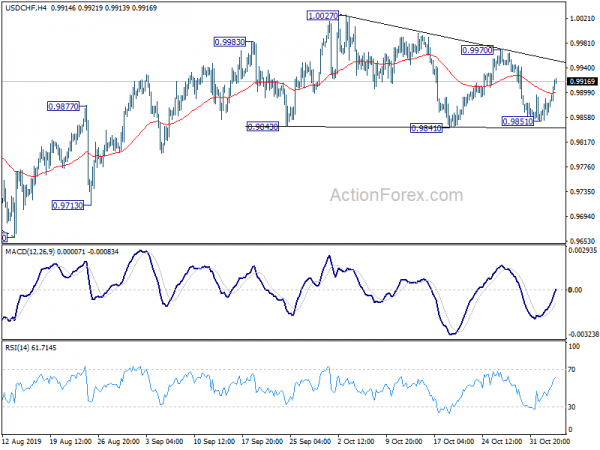

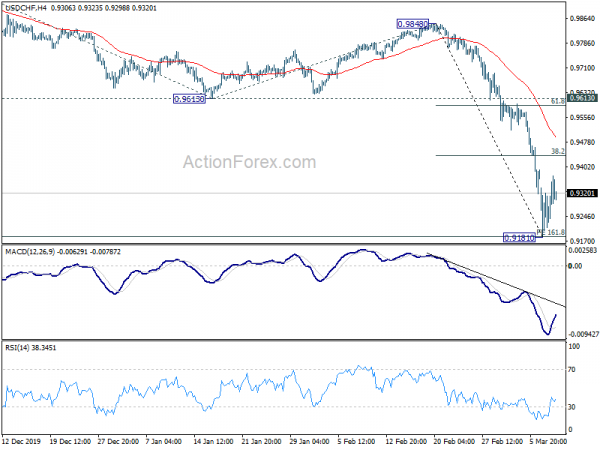

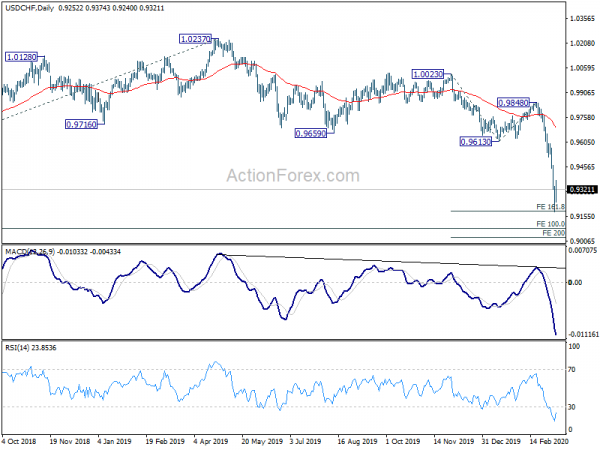

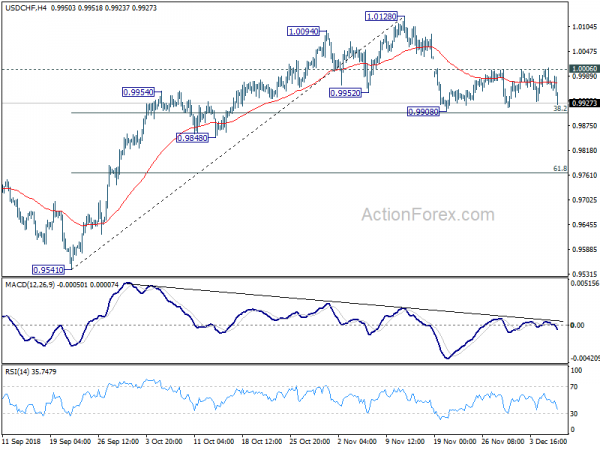

Daily Pivots: (S1) 0.9989; (P) 1.0025; (R1) 1.0049; More….

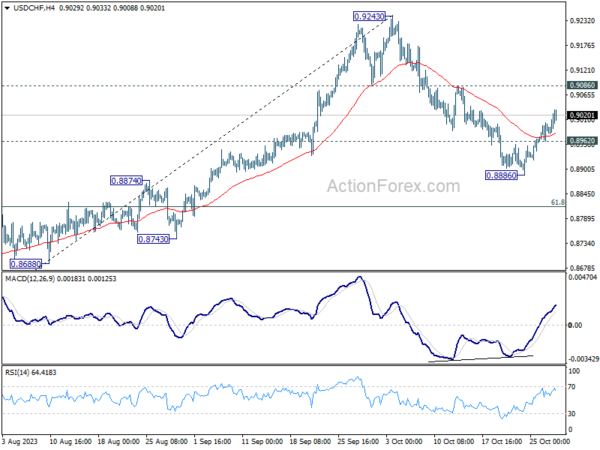

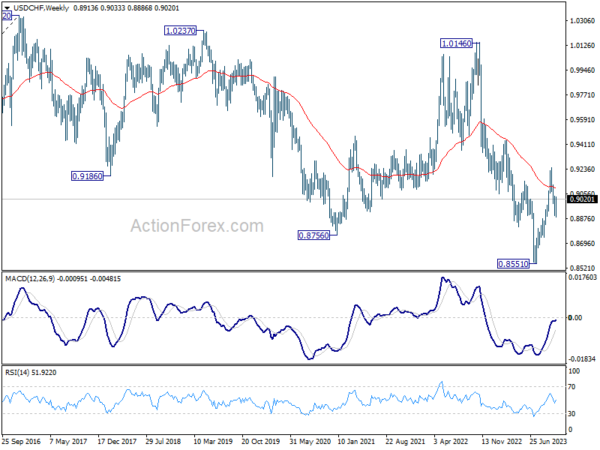

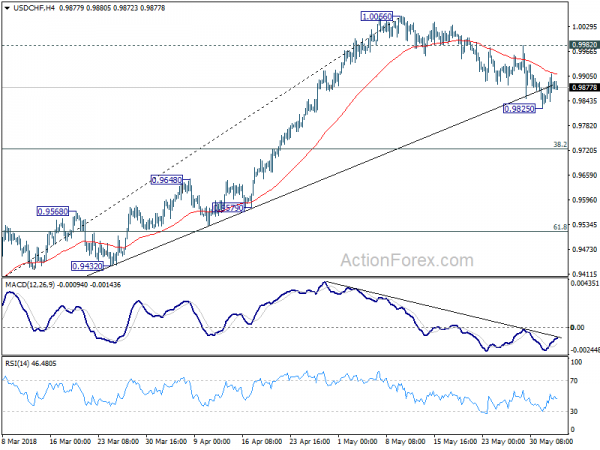

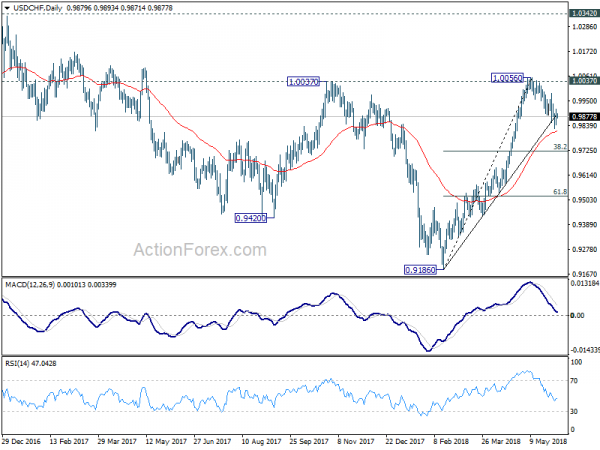

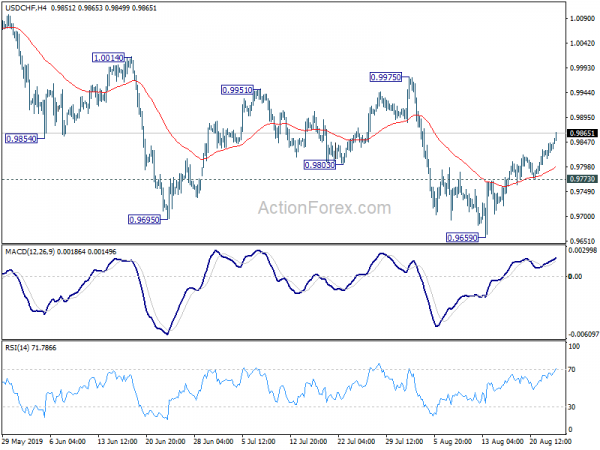

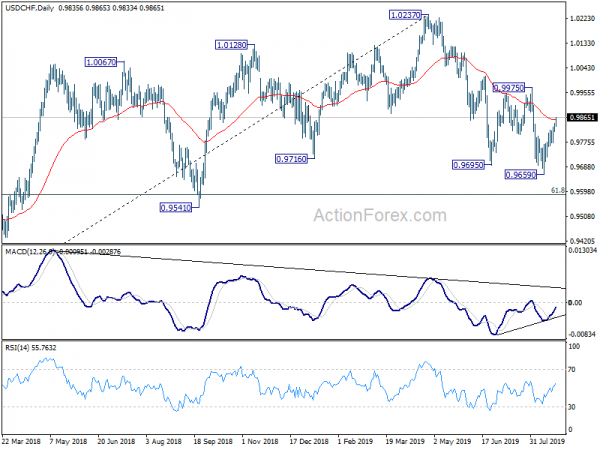

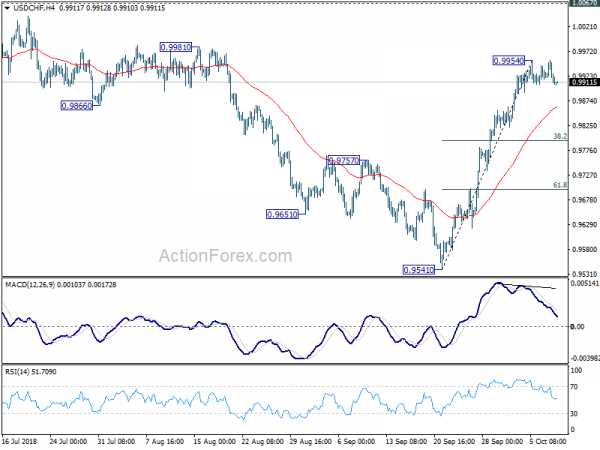

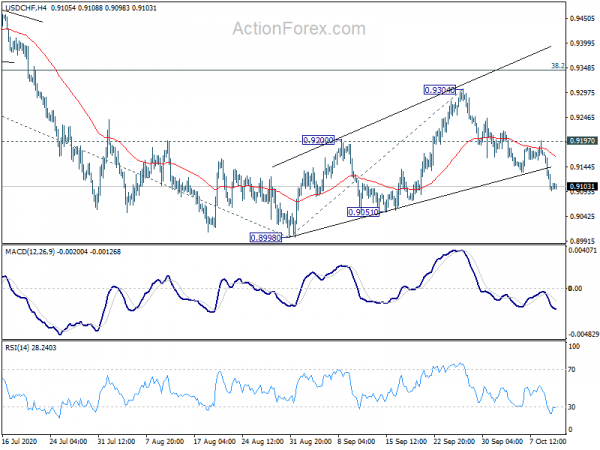

Intraday bias in USD/CHF remains neutral at this point. With 0.9988 support intact, further rise is still mildly in favor. On the upside, above 1.0098 will target 1.0128 first. Break will confirm resumption of up trend from 0.9186. Next target will be 100% projection of 0.9541 to 1.0128 from 0.9716 at 1.0303. However, break of 0.9988 will indicate rejection by 1.0128 and turn intraday bias to the downside for 0.9716 support again.

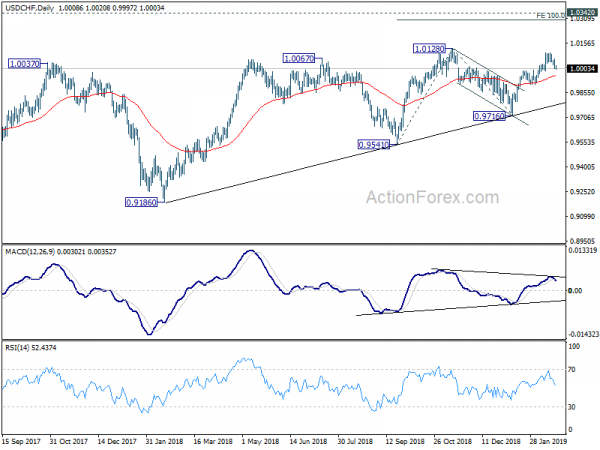

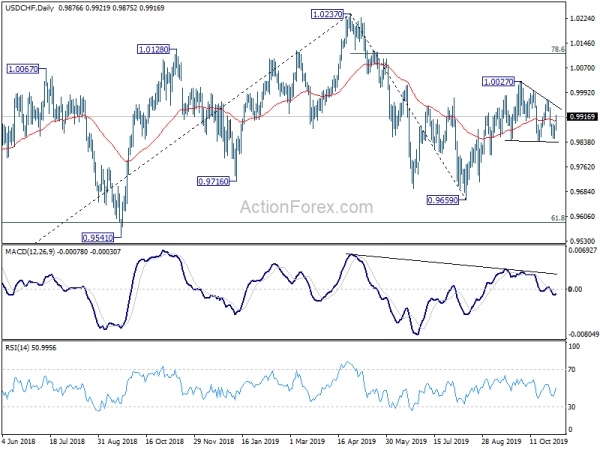

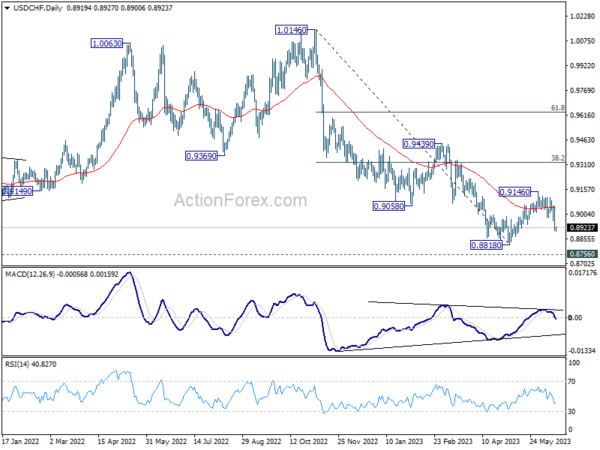

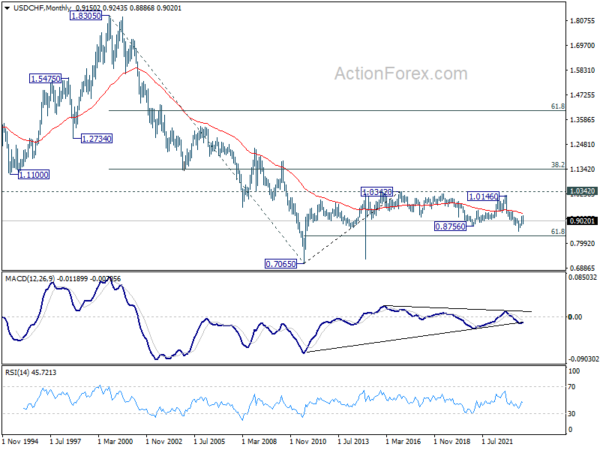

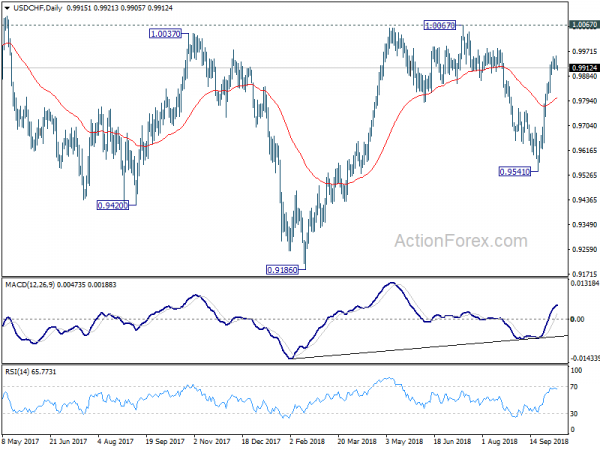

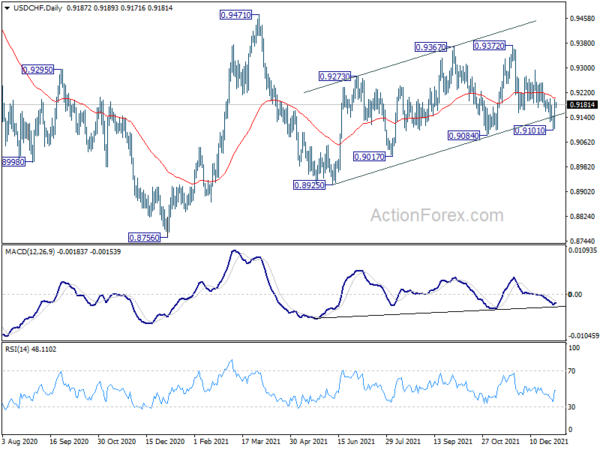

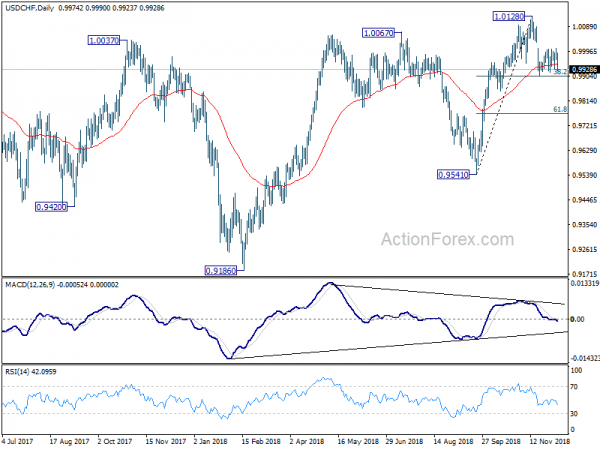

In the bigger picture, USD/CHF drew strong support from medium term trend line and rebounded. That suggests rise from 0.9186 is still in progress. Further break of 1.0128 will confirm up trend resumption and target 1.0342 key resistance. Nevertheless, break of 0.9716 will dampen this bullish view and at least bring deeper fall to 0.9541 key support.