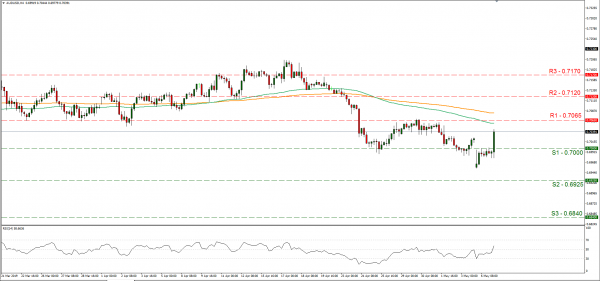

The AUD strengthened against the USD as RBA released its interest rate decision to remain on hold at +1.50%. In its accompanying statement the bank stated that it sees the risks for global trade to be tilted to the downside while domestically uncertainty remains. The bank also expects the economy at +2.75% in 2019 and underlying inflation at +1.75%, while it commented that the AUD is at the lower end of its narrow range. Finally it should be noted that the bank still sees further space capacity in the economy. We expect the AUD to maintain the momentum it has gained especially should there be favorable data from China the next days. AUD/USD rose upon the release of RBA’s interest rate decision and broke above the 0.7000 (S1) resistance line (now turned to support). We could see the Aussie maintaining momentum and the pair could have some bullish tendencies today. Should the bulls dictate the pair’s direction, we could see the pair breaking the 0.7065 (R1) resistance line and aim for the 0.7120 (R2) resistance level. Should the bears take over, we could see the pair breaking the 0.7000 (S1) support line and aim for the 0.6925 (S2) support barrier.

RBNZ Interest rate decision

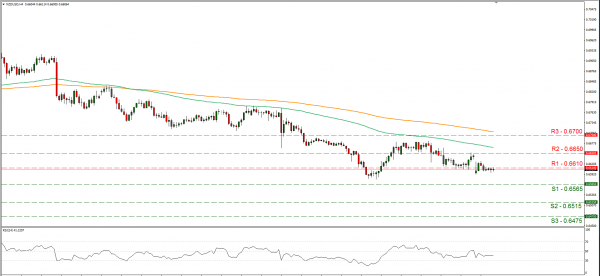

Tomorrow during the Asians session (02:00, GMT) New Zealand’s RBNZ is expected to announce its interest rate decision. The bank is expected to cut rates by 25 basis points reaching +1.50% and currently NZD OIS imply a probability of 57.10% for such a scenario. On the one hand the slowing CPI and GDP growth rates along with the employment change figure dropping into the negatives suggest caution. Also not that the previous interest rate decision showed a clear dovish bias, paving the way for a rate cut. On the other hand analysts point out that indicators show the economy cooling off, but that it has not tanked yet and that remaining on hold may be more appropriate. Also the bank will be releasing its quarterly monetary statement policy which along with the accompanying statement could shed more light in the bank’s future intentions. Should the bank lower its rates, we could see the NZD weakening, should it remain on hold we could see it getting some support. NZD/USD maintained a sideways movement yesterday near the 0.6610 (R1) resistance line. We could see the pair showing little volatility in the today and expect Kiwi traders to expect RBNZ’s interest rate decision for direction. Should the pair come under the selling interest of the market, we could see the pair breaking the 0.6565 (S1) support line and aim for lower grounds. Should the market favor the Kiwi’s long positions, we could see the pair clearly breaking the 0.6610 (R1) and aiming if not breaking the 0.6650 (R2) resistance hurdle.

Other economic highlights, today and early tomorrow

In the European morning, we get from Germany’s industrial orders growth rate for March and UK’s Halifax House Prices for April. In the American session we get Canada’s Ivey PMI for April and the API weekly crude oil inventories figure. In tomorrow’s Asian session, besides RBNZ’s interest rate decision, we get China’s trade balance figure for April. Please bear in mind that in the American session Fed’s Quarles and Dallas Fed president Kaplan are scheduled to speak, while in tomorrow’s Asian session, the BoJ is to release the minutes of its meeting in March.

Support: 0.6565 (S1), 0.6515 (S2), 0.6475 (S3)

Resistance: 0.6610 (R1), 0.6650 (R2), 0.6700 (R3)

Support: 0.7000 (S1), 0.6925 (S2), 0.6840 (S3)

Resistance: 0.7065 (R1), 0.7120 (R2), 0.7170 (R3)