The Australian dollar declined slightly after the RBA released its minutes for the meeting held on July 2nd. In the meeting, the RBA slashed interest rates by 25 basis points for the second consecutive month. In the minutes, the members said that they were prepared to slash rates again with the goal of supporting the economy. Officials argued that low interest rates would provide more jobs to Australians and assist with achieving more assured progress towards the inflation target. Yesterday, the Australian dollar rose shortly after China released its GDP data, which implied that the country could be forced to increase its stimulus.

The New Zealand dollar rose after the country released its inflation data. In the second quarter, consumer prices increased to an annualized rate of 1.7% from 1.5% in the previous month. This was in line with expectations. On a QoQ basis, the CPI increased from 0.1% to 0.6%. The New Zealand economy mostly depends on the amount of goods it exports. In recent data, the country’s economy expanded by 2.5%, while the unemployment rate declined to 4.2% from the previous 4.3%.

Today, investors will receive the employment numbers from the UK, where the unemployment rate is expected to remain unchanged at 3.8%. The claimant count is expected to decline from 23.2k to 18.9k while the average earnings index plus bonus is expected to remain unchanged at 3.1%. In Germany, ZEW will release its current conditions and economic sentiment data. From the US, investors will receive the retail sales, export and import price data and statements from Fed officials like Bostic, Browman, and Powell. Further, there will be important earnings releases today such as those from Goldman Sachs, Morgan Stanley, and Johnson & Johnson.

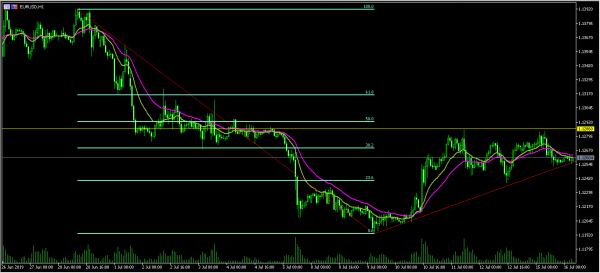

EUR/USD

The EUR/USD pair declined in the US session yesterday. In the Asian session, the pair remained unchanged and is currently trading at 1.1260. On the hourly chart, this is slightly below the 38.2% Fibonacci Retracement level and along the 21 and 14-day moving averages. The pair has formed an ascending triangle pattern as shown below. With major news expected from Europe and the Fed, the pair will likely experience a major upward or downward trend today.

AUD/USD

The AUD/USD pair moved slightly lower and is trading at 0.7035, which is lower than yesterday’s high of 0.7043. On the hourly chart below, this price is along the shorter-term 21-day EMA and slightly above the longer-term 42-day EMA. The RSI has moved slightly lower from the overbought level of 70 to the current 55. The pair will likely retest the 61.8% Fibonacci Retracement level of 0.7000.

NZD/USD

The NZD/USD pair rose after New Zealand released its inflation numbers. The pair is now trading at 0.6735, which is the highest level since April 18. On the daily chart below, the price is slightly above the 21-day and 42-day moving averages while the RSI has climbed to the current level of 42. It’s likely that the pair will continue moving higher, to test the important resistance level of 0.6940.