Risk-off the flavour of NY trading

Markets reversed early Monday gains as US ISM Mfg PMI disappointed overnight printing 48.1 vs 49.2 expected, bucking the trend of recent European and China PMI beats. The print showed demand had contracted across not only the headline number but many of its sub-components – new orders, employment and backlog of orders – with global trade remaining the most pressing cross-industry issue. ASX Futures dropped from near all-time highs, similar to major benchmarks, closing NY session down ~1.3%. This suggests ASX Cash is primed for a heavy fall at the open to the tune of 92pts. The US Dollar Index also cratered 0.4% as reverse-carry trades saw capital flows exit the US and into safe-haven JPY. USDJPY is back under 109.

RBA decision secondary to forward outlook

The RBA is widely expected to stay on hold for its December meeting with market pricing suggesting a ~92% likelihood that the cash target rates remains the same, or alternatively, an ~8% chance the RBA do indeed undertake a 25bps cut. RBA Gov. Lowe noted in his most recent speech on unconventional monetary policy that “at the moment, [Australia] is expected to progress towards its [growth and inflation] goals over the next couple of years”. A gradual return to trend growth and inflation, in addition to, November’s upbeat housing data should limit any surprises at 2.30pm AEDT, when a decision is released. However, with Nov. employment figures and the labour market slack still a concern – AUD traders will be intently watching for any dovish clues. While AUDUSD trekked back above 0.68 following an overnight USD sell-off, client positioning remains neutral.

Trade tensions far from over

Global trade risks are also weighing on risk sentiment with developments overnight doing little to quell fears that the world is becoming less fragmented. Not surprisingly, this was driven by Twitter comments in which Trump said he would “restore tariffs on all steel & aluminium that is shipped to the US [from Brazil and Argentina]” as mean of deterring currency devaluation. On Europe, USTR noted that “strong action is needed to convince the EU to end market-distorting subsidies”. And to further add fuel to the fire, US-China progress remains lacklustre with the recently signed HK decree complicating negotiations. Gold has edged back up to US$1,462. We think a bear case sustains but would be open to reassessment should fundamentals materially deteriorate before the close of the year.

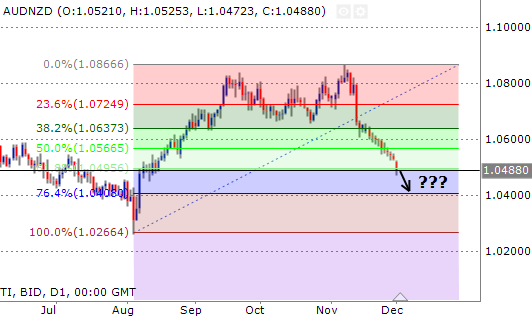

Look out for AUDNZD

Building on RBA vs RBNZ relative central bank expectations, I think the facts for the time being very much favour stronger NZD in the near-term over AUD. This is off the back of the RBNZ’s surprise hold in November in addition to yesterday’s comments from NZ Finance Minster Robertson which underpinned the closeness of fiscal stimulus. A dovish RBA at today’s meeting could see AUDNZD continue to push into 1.04 which represents 76.4% Fib on a multi-month move.