U.S. Review

Policy Moves Are More Important than the Data

- The Federal Reserve greatly expanded the collateral that it is willing to buy, further easing pressures in financial markets.

- While hiccups in implementing the Payroll Protection Program have been frustrating, the plan offers significant relief to small businesses that will lessen the severity of the downturn and contribute to a speedier recovery.

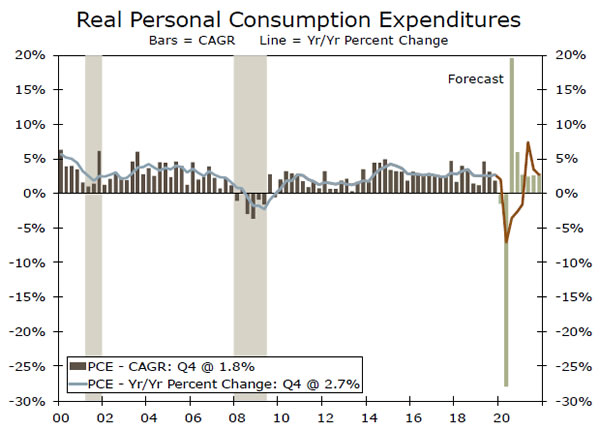

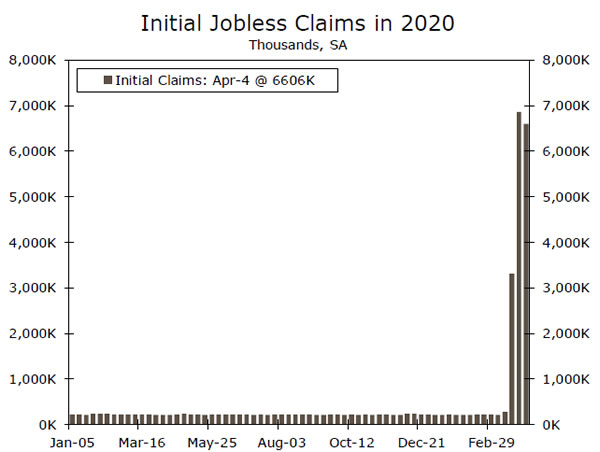

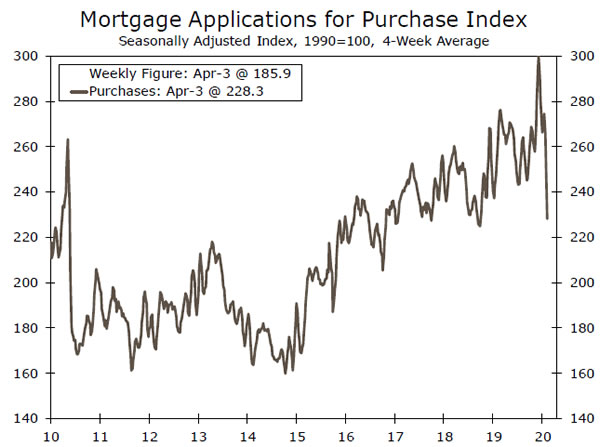

- High frequency data, such as jobless claims, consumer confidence and mortgage applications, continue to show an economy under intense pressure. Inflation data are largely old news given the sharp plunge in demand in recent weeks.

The Curve Is Flattening, What Comes Next?

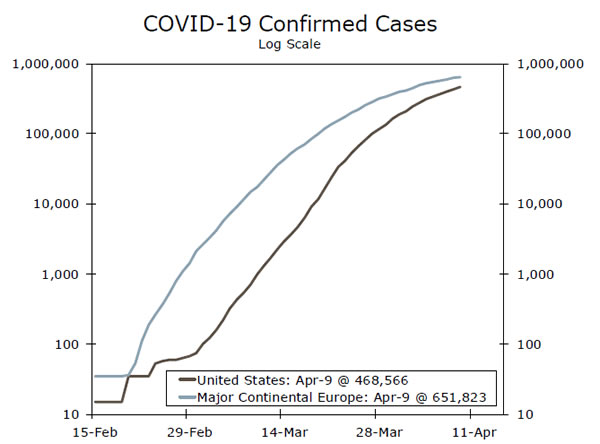

Progress at containing the spread of COVID-19 and policy moves to alleviate damage wrought by the pandemic are more important in determining what lies ahead for the U.S. economy than most current economic data. The growth rate of confirmed COVID-19 cases appears to be flattening. As we noted previously, the outbreak began to accelerate about two weeks later in the U.S. than it did in Europe and their experience offers some sense of a road map for the United States. The 12 major nation’s comprising western Continental Europe combined have roughly the same population as the U.S. (334 million vs 330 million). Collectively, the curve has flattened there, although various nations are at different points in the process, as are various states in the U.S. A few nations, most notably Austria, have already announced plans to reopen parts of their economy. We may see the same thing happen in parts of the U.S. later this month. A more widespread and comprehensive reopening of the economy, however, appears to be a long ways off.

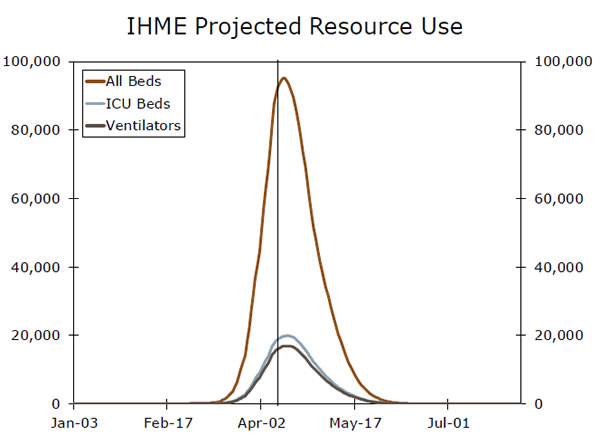

Vice President Pence outlined some of the necessary conditions that need to be in place in order to reopen the economy. First and foremost, most major metropolitan areas would need to be at the end of their outbreaks. We would take this to mean that we are at the tail end of the growth curve on confirmed cases and at the end of the IHME resource curve. Widespread testing should also be available–both to tell who has the disease and who has antibodies in their system. In addition, therapeutics would need to be available to treat those who contract the disease, as well as some effective way tracing who infected persons have come in contact with. The CDC would also have to develop a consistent set of guidelines on how businesses could operate safely, which local government would then have to sign off on. While some areas of the country may get there sooner, for most of the country, meeting these criteria will likely not be accomplished until the end of May.

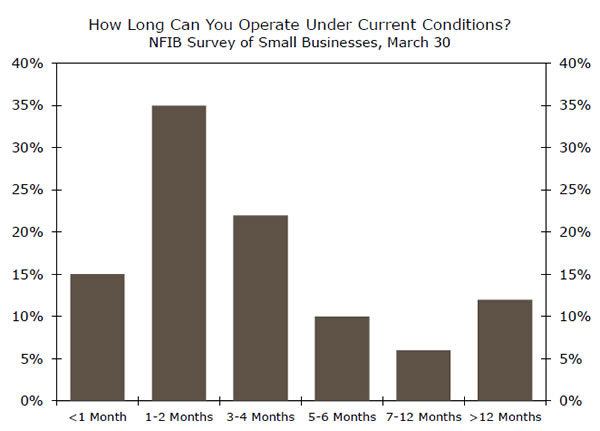

The economic toll from efforts to contain COVID-19 are evident in this week’s economic reports. The NFIB Small Business Optimism Index tumbled 8.1 points in March, which was the largest one-month drop in the index’s history. Even that drop, however, did not capture the full extent of the deterioration in business conditions that took place later that month. A special survey conducted by the NFIB found that most businesses only had resources to hold on for one-to-two months. After that, restarting their business would become much more difficult or impossible, which is one reason why the success of the Payroll Protection Program and Fed’s Main Street Lending Program are so essential in order for the economy to recover. While both programs will take time to ramp up, they should be in place by the time the economy is ready to reopen.

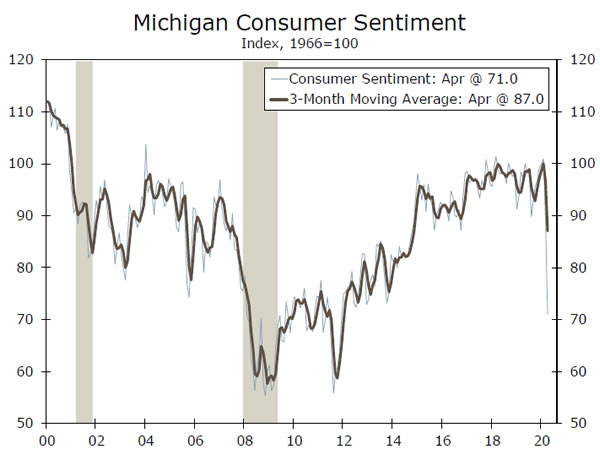

The University of Michigan’s Consumer Sentiment Survey offers another near-term look on the state of the consumer. The index plunged 18.1 points in early April, providing the first real insight into how much consumer attitudes have been dented. A big part of the reason consumer confidence has fallen so much is that layoffs continue to skyrocket. The latest weekly initial unemployment claims data surged 6.6 million, bringing the cumulative rise in layoffs over the past three weeks to an astonishing 17 million.

U.S. Outlook

Retail Sales • Wednesday

The March retail sales report will be wild. We expect overall sales to plunge 6%, the largest decline on record, but we will also likely see historic increases at grocery stores, warehouse clubs and online vendors. Never before have the shopping habits of U.S. consumers changed so suddenly. Expect volatile numbers, as well as substantial revisions, as the Department of Commerce attempts to accurately track the decline in consumption, as well as its compositional shift.

A few notable categories: bars and restaurants typically comprise 12% of retail sales, but are now limited to take-out and delivery across the vast majority of the county. Grocery stores, which usually see very steady sales, are around 12% of sales and saw unprecedented demand in March. Gas stations are 8%, and were hit by simultaneous plunges in both volume, as automobile traffic fell 50% or more, and price, as COVID-19 and OPEC+ maneuverings brought crude oil prices to the lowest levels in nearly 20 years.

Previous: -0.5% Wells Fargo: -6.0% Consensus: -8.0% (Month-over-Month)

Jobless Claims • Thursday

The U.S. labor market is in meltdown. Almost 17 million people have filed for unemployment benefits in just the past three weeks (3.3M, 6.9M and 6.6M), which implies the unemployment rate is already in the double-digits. States are still working through capacity constraints and backlogs, meaning that the true number of layoffs is likely even higher than what has been reported so far. And although the number of new claims in a single week has probably peaked, we still expect millions more people to lose their job. The claims data do not track perfectly with nonfarm employment, but after the dust hopefully settles, we look for the economy to have shed more than 20 million net jobs in the second quarter, which implies that by June the level of nonfarm payrolls will stand 14% below the February 2020 peak. The pertinent question then shifts to the duration of unemployment. We expect many of the lost jobs to return, but the unemployment rate will likely remain elevated for years.

Previous: 6,606K

Housing Starts • Thursday

The housing market had strong momentum to start the year, but that is old news. COVID-19 has made shopping for a new home nearly unthinkable, and mortgage demand has subsequently plunged. However, at least at first construction of new homes was probably less affected than sales—social distancing and other hygienic practices and residential construction are not wholly incompatible, and for the most part construction has been deemed ‘essential.’ That said, construction cancellations have mounted because of government-mandated halts, difficulty procuring needed materials, labor shortages or simply preemptive developer caution. Mortgage market dysfunction is another major risk to the single-family market, if payment delays squeeze servicers and cause credit to contract. Moreover, the millions of layoffs—and the associated loss of income—will destroy purchasing power and hold back single- and multifamily demand for months to come.

Previous: 1,559K Wells Fargo: 1,357K Consensus: 1,320K

Global Review

Bad Economic News Keeps on Coming

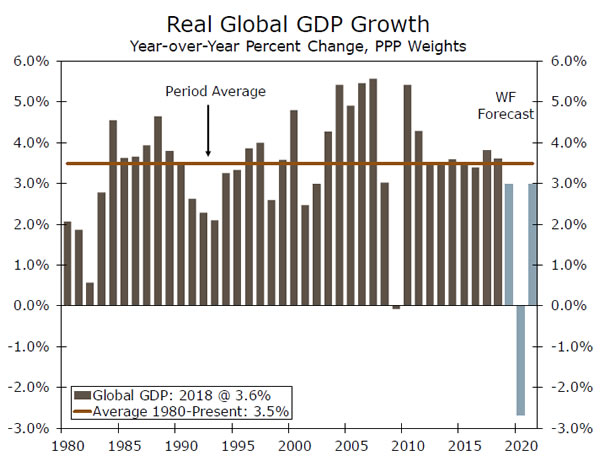

- 2020 is going to be a very tough year for the global economy. In our latest forecast update published earlier this week, we highlighted that every major economy we monitor will suffer a recession, and we revised our GDP forecast down further to project a 2.7% global contraction this year.

- This week’s data gave further clarity on how bad global activity might be. Canada’s March employment fell by one million, and given a large drop in hours worked a sizeable Q1 decline looks assured. The U.K. economy was slowing even before the virus hit and the U.K. should also see Q1 GDP fall, while next week’s data focus will be an expected slump in China’s Q1 GDP.

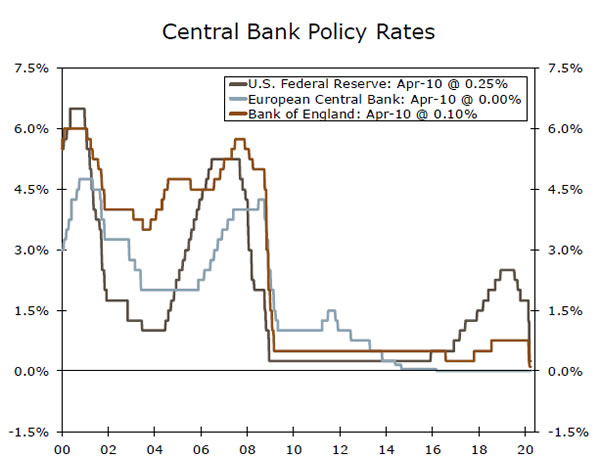

Some Central Banks Still Active

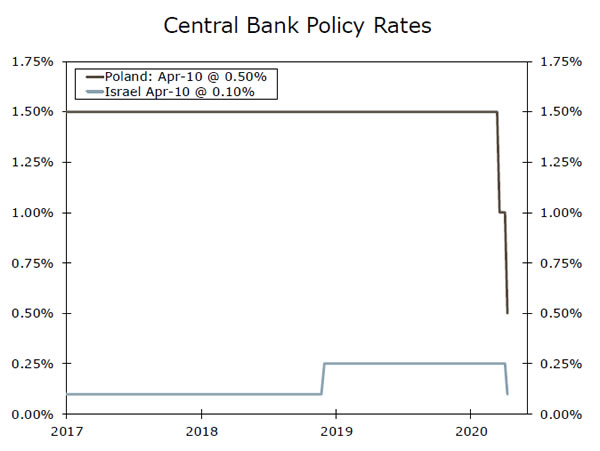

The past several weeks have been a particularly active time for global central banks, and that continued this week with a couple of policy changes. Poland’s central bank followed up its mid-March rate cut with another 50 basis point cut this week, lowering its base rate to 0.50%. The central bank also said it would continue with its measures to support bond market liquidity. The monetary easing comes despite elevated inflation, and is aimed at cushioning the economy against the negative effects of the COVID-19 virus.

Israel’s central bank also lowered interest rates by 15 basis points to just 0.10%. The central bank also expanded its repo operations to include corporate bonds and announced three-year loans to banks at just a 0.10% rate. This policy easing comes after the central bank had previously announced a government bond purchase program, while the central bank also revised its economic outlook to forecast a 5.3% contraction in 2020 GDP.

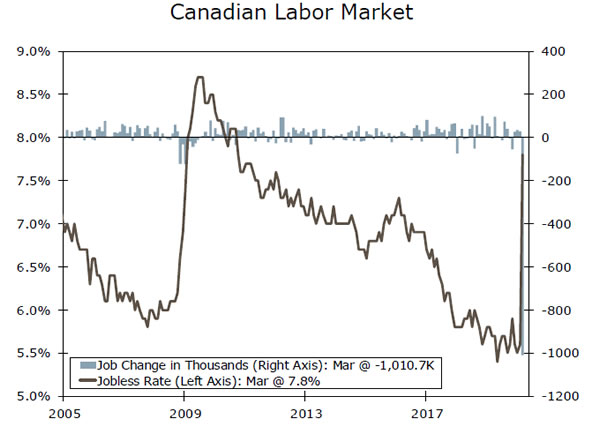

Canada’s Economy Feeling the Effect of the Coronavirus

Canada’s March labor market report highlighted the devastating economic effect of measures taken to contain the COVID-19 virus. March employment plunged by 1,011,000, by far the largest monthly decline on record, while the unemployment rate spiked to 7.8% (from 5.6%). The job losses were concentrated in the private sector with a drop of 830,200, and were relatively evenly split between full-time job losses (474,000) and part-time job losses (536,700). One other staggering figure from the employment report was the decline in total hours worked across all industries which slumped some 15.1% month-over-month, again by far the largest monthly drop on record. With Canada also faced with the challenge of low oil prices the outlook for the economy is bleak, even with the Bank of Canada’s monetary stimulus and the government’s fiscal stimulus so far. Currently we forecast Canada’s economy to contract 4.2% for full year 2020, through clearly the risk is that the decline is much greater than that.

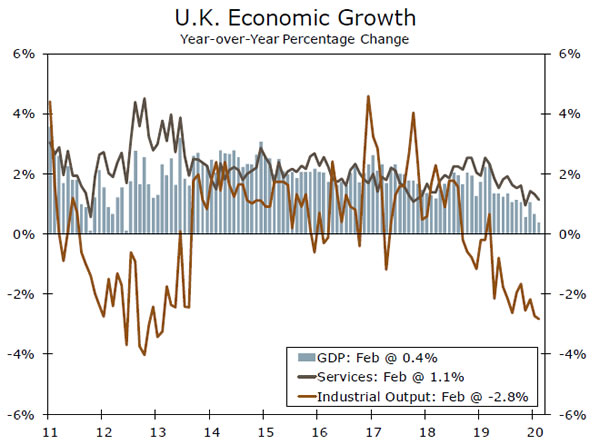

U.K. Economy Stuttering Ahead of COVID-19

U.K. February GDP data showed activity stuttering even ahead of the most significant impacts of the COVID-19 virus on the economy, as February GDP fell 0.1% month-over-month. To be sure much of the weakness was concentrated in construction activity, which fell 1.7%. Industrial output rose 0.1% and for the service sector—which accounts for some 80% of the overall economy—activity was flat for the month. Compared to February last year, U.K. GDP rose just 0.4%, the smallest annual increase since mid-2012.

Given the sluggish February outcome, it will take only a moderate decline in March monthly GDP for the economy to contract on a sequential basis in Q1. We estimate that March GDP would need to fall just 0.4% month-over-month for Q1 GDP to decline on a quarter-over-quarter basis. Considering the sharp drop in the U.K. March services PMI to 34.5, such an outcome appears quite likely. While our forecast is that Q1 GDP fell 0.5% quarter-over-quarter, we think the risks are tilted towards a larger decline.

Global Outlook

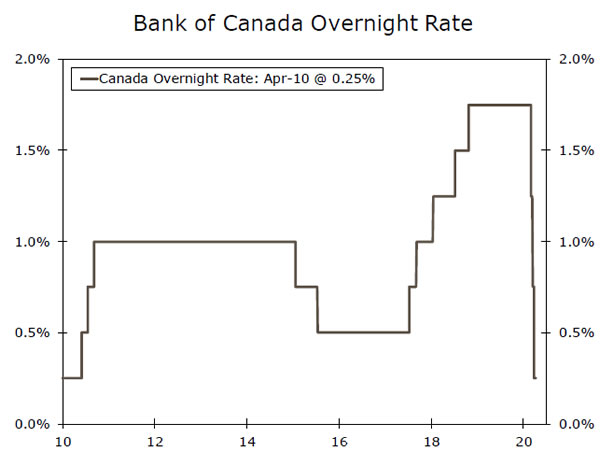

Central Bank of Canada• Wednesday

March was a particularly active month for the Bank of Canada (BoC). The central bank cut its policy interest rates a cumulative 150 bps to just 0.25%, while also introducing a raft of other measures. These measures included, among other things, purchases of mortgage bonds and provincial money market paper, a Bankers Acceptance purchase facility, a commercial paper purchase program, and also C$5 billion purchases per week of Canadian government securities. The BoC also launched the Standing Term Liquidity Facility to provide liquidity to the financial system.

After such a busy March we expect the BoC to pause in April, and do not expect any changes to the policy rate or other policy measures. The announcement will not be without interest however as the central bank will provide updated economic forecasts in its Monetary Policy Report, which will provide the BoC’s clearest indication yet of the negative impact of the COVID-19 virus on Canada’s economy.

Previous: 0.25% Wells Fargo: 0.25% Consensus: 0.25%

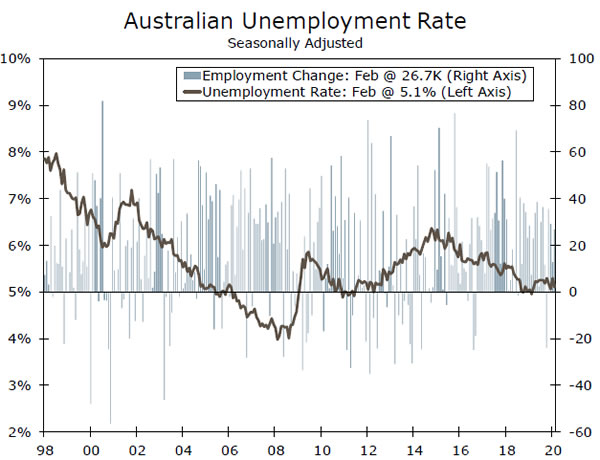

Australian Employment • Thursday

Australia’s March jobs report could offer an early indication of negative effects of the COVID-19 virus, and associated lockdown, on the economy. February employment rose by a solid 26,700, but leading indicators suggest a sizeable decline in March. For example March job advertisements fell 10.3% month-over-month, the steepest monthly decline since early 2009. For March, the consensus forecast is for employment to fall by 30,000, perhaps because the survey period was early in the month while the strictest virus lockdown measures came later in March. That said, we believe the risk is for a larger decline than the consensus forecast. Economists will also watch for the composition of the job decline, in terms of the change in full-time jobs versus part-time jobs. Meanwhile the jobless rate is expected rise to 5.4%.

March business conditions and business confidence are also due next week, and will be closely watched for signs of a weaker economy.

Previous: 26,700 Consensus: -30,000 (Monthly Employment Change)

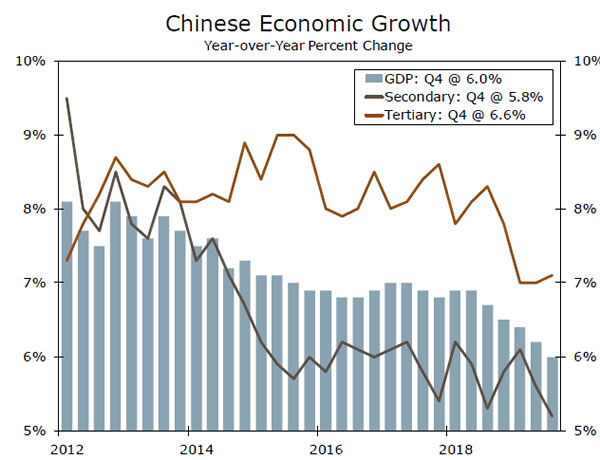

Chinese GDP • Friday

The most significant Chinese data so far this year is released next week in the form of Q1 GDP. China was the epicenter of the COVID- 19 outbreak, and given signals from extremely soft PMI surveys, as well as retail sales and industrial output, economic activity looks certain to have plunged in the first quarter. We expect Q1 GDP decline some 10.0% quarter-over-quarter (close to the consensus), which would see Q1 GDP down 5.9% year-over-year.

China’s economy improved a bit in March as the outbreak eased, with the manufacturing and services PMI both jumping higher. That said a complete recovery in activity is unlikely, with the consensus forecast for March retail sales to fall 10% and industrial output to fall 7.0%, both year-over-year. Similarly, while we expect GDP growth to resume in Q2, we do not expect the first quarter losses to be fully recouped, and we forecast China’s GDP to fall 1.2% for full year 2020.

Previous: 1.5% Wells Fargo: -10.0% Consensus: -9.8% (Quarter-over-Quarter)

Point of View

Interest Rate Watch

FOMC Minute Clinic

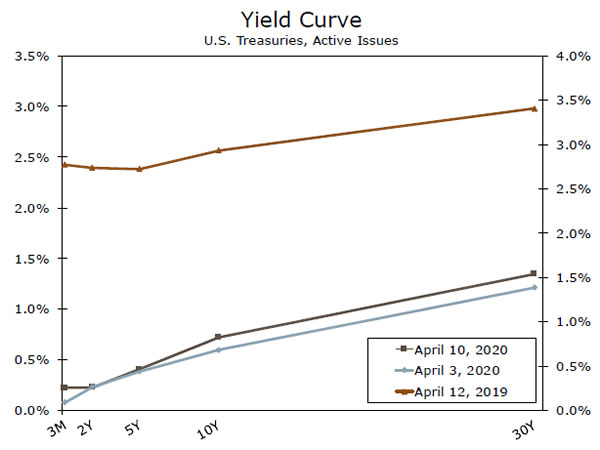

Additional evidence that the Fed is willing to do all within its power to support the economy through an unprecedented time was confirmed this week. Since the beginning of March, the Fed has brought the federal funds rate to effectively zero and committed to a massive new quantitative easing program. Recently released minutes for the FOMC emergency meeting on March 15 reveal the thinking behind these historic monetary policy moves.

At this point, March 15 seems like an eternity ago, but there are still some useful takeaways from the FOMC meeting. Most importantly, officials appeared ready to reach deep into the Fed’s arsenal to combat the economic damage likely to occur as a result of shut-downs and social distancing guidelines. Given the ongoing rollout of lending facilities designed expressly for the purposes of supporting households, small businesses and state & local governments, few would argue the Fed has failed to follow through with these intentions. Furthermore, Fed officials voiced a willingness to continue these operations “until the economy had weathered recent events and was on track to achieve the Committee’s maximum employment and price stability goals.”

With regards to the outlook, Fed officials acknowledged the growth trajectory of the economy was largely dependent on “the evolution of the virus outbreak and the efforts undertaken to contain it.” Acknowledging the inherent uncertainty of it all and that the economy had already very likely entered into a recession, one optimistic scenario was presented where the economy fully rebounds in the second half of the year. Another more pessimistic scenario was laid out where the recovery is not fully underway until 2021. In both scenarios, inflation pressures were expected to weaken. At the time of the meeting, oil prices had also just collapsed as OPEC+ failed to come to an agreement, meaning consumer energy prices would likely decline on top of the deflationary pressures brought on by the coronavirus crisis. Given all this, we expect the Fed will continue to keep rates at effectively zero for the remainder of the year and through 2021.

Credit Market Insights

Argentina’s Default Plan

On Sunday, Argentina’s government announced it would default on its debt obligations, opting to delay repayments on dollar-denominated debt issued under local law until the end of the year.

The decree noted that the government’s response was in part due to the coronavirus outbreak in addition to the general deterioration in the domestic economy following last year’s election and collapse in the Argentine peso.

Authorities suggested that the debt payment deferral could end earlier, if the Economy Ministry determines that suitable progress under the debt sustainability plan has been made. Following the announcement, Argentina’s foreign currency and local currency debt was downgraded by Moody’s, S&P and Fitch to reflect default status.

As we previously noted, we felt a sovereign debt default in Argentina was imminent given the state of the economy and less than ideal sovereign debt profile. In our view, the default will create some additional challenges for the Argentine economy as costs of financing will likely increase, while it could also be difficult for the government to get investors to purchase any new debt issuances. The Argentine economy is currently in recession, and as of now, we expect the effects of the coronavirus outbreak as well as a debt default should extend the recession for the foreseeable future.

Topic of the Week

Phase 4, or CARES Act 2.0?

Momentum has begun to build for another fiscal support package in Congress. What might such a plan look like?

First, more money seems likely for the Payroll Protection Program (PPP), the small business loan/grant portion of the “Phase 3” package. The White House has signaled it would like to see another $250 billion for the program. This would be a sizable boost from the original $350 billion allocated to the PPP, but it would not surprise us if this number eventually ends up even bigger.

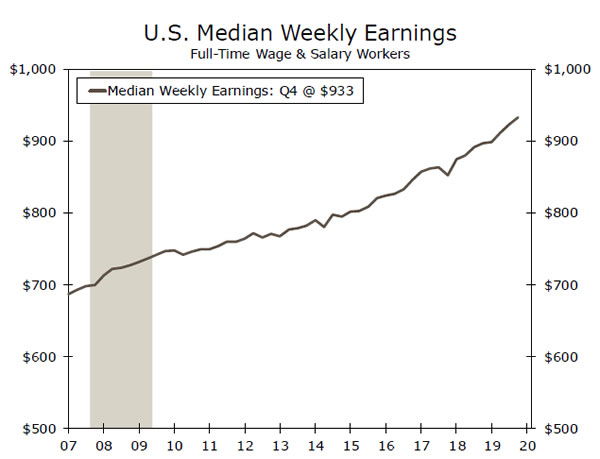

More money for households also seems likely, with another round of direct checks a natural starting point. The last bill also expanded unemployment benefits by adding a $600 per week boost to regular state level benefits, which vary by state and income but generally average about $400 per week. This $600 boost is set to expire on July 31 and could be extended a couple months in the next plan. Given that median weekly earnings for a full-time worker in the United States were $933 in Q4- 2019 (top chart), this significant expansion of benefits should go a long way towards keeping many unemployed workers afloat until the shutdown parts of the economy are allowed to operate once again.

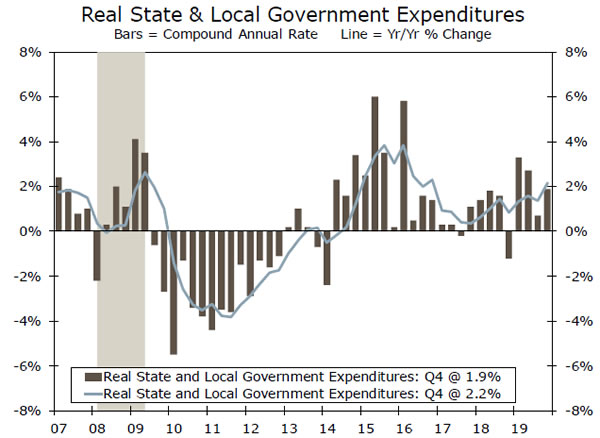

Additional money for state & local governments will likely be another point of focus. Unlike the federal government, most state & local governments must balance their budgets. The severe economic downturn we expect will likely cause a sharp contraction in income and sales tax receipts for state & local governments. Absent federal help, these governments may be forced to cut employment and capital expenditures going forward. A similar dynamic occurred in the wake of the Great Recession, weighing on the recovery (bottom chart). In the aggregate, a package in the ballpark of $1 trillion is starting to look increasingly likely in our view. Should one be adopted, this would likely push our federal budget deficit forecast for FY 2020 north of $3 trillion.

For further reading, see our special report “What Might a ‘Phase 4’ Fiscal Package Include?”