It’s a huge week ahead, with the Reserve Bank of Australia and the Bank of England both announcing their rate decisions ahead of the all-important US employment data. For markets, the burning question is whether a decent payrolls report will be enough to halt the dollar’s relentless slide. The other variable that will impact most charts through the risk sentiment channel is whether Congress will reach a compromise on the new rescue package, and if so, how much will they deliver. Too early for US payrolls to reflect slowing recovery

‘King dollar’ has fallen from grace lately as a combination of concerns around the US recovery, expectations for more action by the Fed, evaporating safe-haven demand amid calmer markets, and a resurgent euro all came together to sink the reserve currency. The upcoming events will therefore be crucial in deciding whether this weakness will continue.

The week kicks off with the ISM manufacturing index on Monday, which is expected to inch higher in expansionary territory. The non-manufacturing index will follow on Wednesday, alongside the ADP employment report, which will give us a taste of what to expect from Friday’s official jobs data.

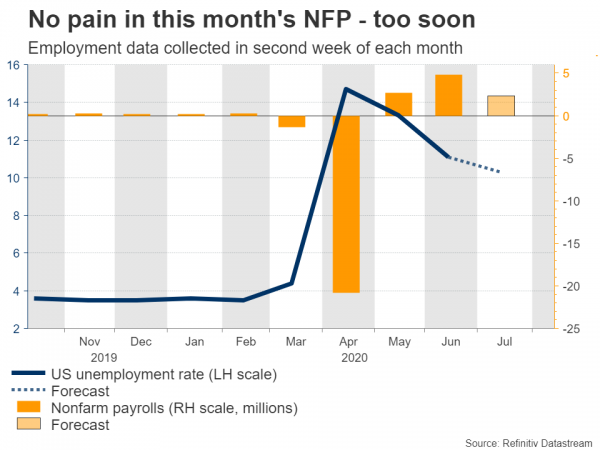

Nonfarm payrolls are forecast to have risen by another 2.3 million in July, pushing the unemployment rate down to 10.3%, from 11.1% previously. How could the labor market have staged such a powerful rebound even though infections are spiking, and many states were forced to roll back their re-opening plans?

The answer lies with the period that the data were collected. The Bureau of Labor Statistics conducts its payrolls survey in the second week of each month, and in the second week of July, the recovery was still more or less on track. Infections were soaring, but many of the re-closures hadn’t happened yet, so the current setback in the economy probably won’t be reflected in this data set.

Beyond the data, the real test for both the dollar and stocks might be what Congress does. Crucial benefits such as the extra $600/week in unemployment aid expire on July 31, and lawmakers have made little progress on a new relief package. This generates the risk of a major negative income shock for millions of Americans, which could kneecap consumption.

Admittedly, some deal will probably be hashed out before Congress goes on recess at the end of the week. The stakes are too high, and no politician wants to be blamed for shattering the recovery, especially ahead of an election. That said, the longer we go without clear signals that a deal is within reach, the more nervous markets might become.

RBA: With a dose of caution

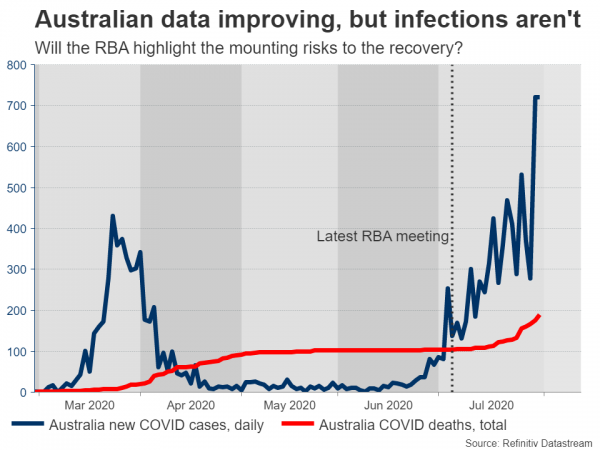

In Australia, the Reserve Bank concludes its meeting on Tuesday, and recent signals from policymakers suggest more stimulus is not on the cards. Incoming data have been as encouraging as possible, with both the labor market and retail sales recovering decently.

This was perfectly captured in the latest RBA minutes, where policymakers noted that ‘the downturn had been less severe than feared a few months earlier’. Indeed, the latest PMIs confirm the recovery continued in July.

So will the RBA strike an optimistic tone? Maybe not. Infections and deaths in Australia are sadly surging again, hitting new daily records this week. While most of those are concentrated in the state of Victoria, the healthcare crisis is nonetheless moving in the wrong direction, and that’s a major threat to the recovery.

As such, the risks seem tilted towards a slightly more cautious message, despite the improving data. If so, that could spark a minor correction in the high-flying aussie, though the currency’s broader direction will depend mostly on global risk appetite. A few hours ahead of the RBA decision, we’ll also get the nation’s retail sales numbers for June.

Bank of England: A round of profit-taking?

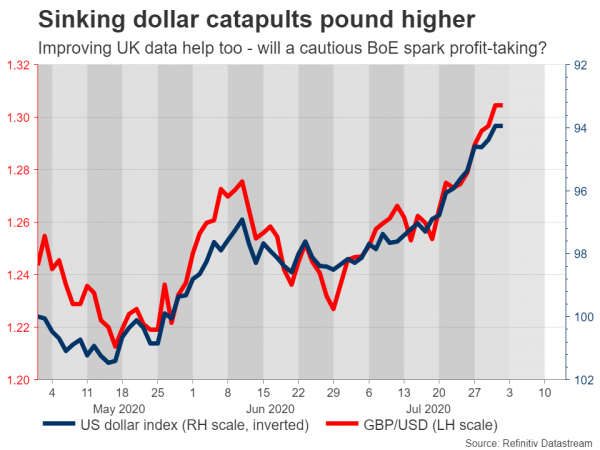

The British pound has enjoyed a remarkable run higher lately, with Cable crossing back above $1.31, boosted by a sinking dollar and signs that the domestic recovery is picking up. The nation’s composite PMI soared to 57.1 in July and retail sales continued to climb in June, though the labor market unfortunately remained weak.

Overall, there’s a growing sense that the UK won’t lag the rest of Europe in this recovery, despite the questionable handling of the health crisis. There may also be some optimism that a powerful comeback in the euro area could spill over into Britain too, judging by the fact that euro/sterling hasn’t moved higher lately even though the euro has soared.

All this implies that the Bank won’t take any further action at its meeting on Thursday. But that doesn’t mean policymakers will be happy. Many officials have expressed doubts about the recovery lately, indicating that while it looks like a ‘V’ so far, it may not stay that way as lower incomes and voluntary social distancing keep consumption under pressure. Additionally, there are concerns that unemployment might surge again in the Autumn, when the government’s furlough scheme ends.

As such, the BoE might maintain a dovish tone, highlighting its readiness to do more to ensure inflation returns to its target. Typically, such a signal might not have impacted sterling much, but considering the currency’s meteoric rise lately, it may be enough to trigger a round of profit-taking.

New Zealand and Canada also unveil jobs data

The rest of the commodity-linked currencies will also be under the limelight next week, as New Zealand and Canada release their own jobs data on Wednesday and Friday, respectively.

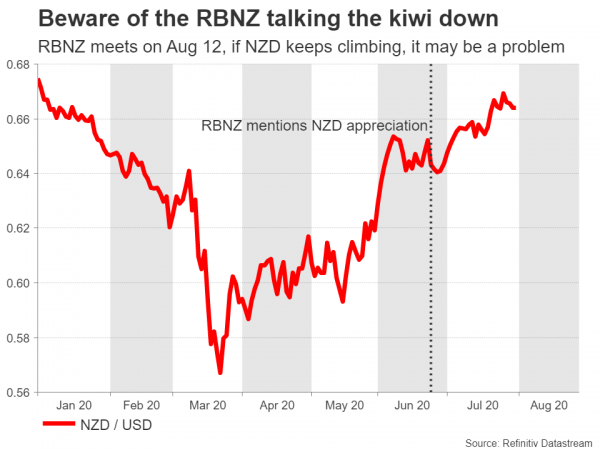

In New Zealand, the unemployment rate is expected to have risen to 5.7% in Q2, from 4.2% earlier. While such a minor increase seems promising, it likely masks the true pain in the jobs market as several workers were unable to look for work during the lockdown, resulting in them being counted as outside the labor force.

The kiwi may cheer the seemingly decent numbers, but it faces a steep uphill battle from current levels considering that the RBNZ – which meets the following week – might talk down the currency more forcefully.

Over in Canada, things are not looking too bright for the loonie, which has failed to capitalize on the substantial drop in the dollar amid a fall in oil prices and a softer outlook for the US economy, which Canada is highly exposed to. The jobs data may therefore add some volatility, but the broader trend in the loonie will hinge on these two factors.

Finally, notable names releasing their earnings results include Berkshire Hathaway, Activision Blizzard, and Walt Disney.