Australia’s employment report for February is expected to attract investors’ attention on Thursday at 00:30 GMT. Preliminary retail sales will also come under the spotlight on Friday at the same time. The labour market sentiment is anticipated to show strength in the month, reporting one of its best readings in nearly a decade.

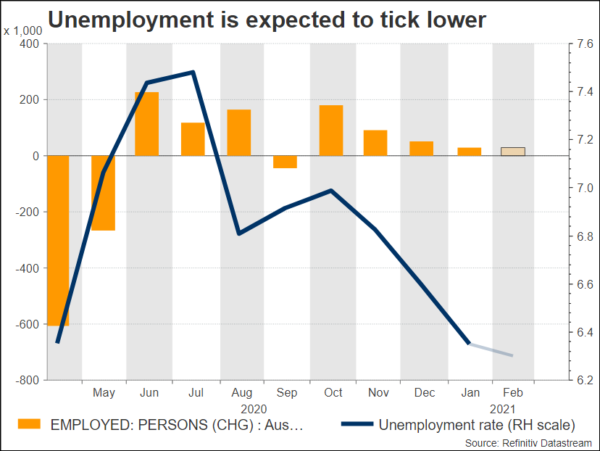

Unemployment rate projected to fall to its lowest since last March

The Australian measures reveal the impact of further lockdowns and re-openings, with employment surging in Victoria, which is still running behind the recovery seen in other states. The unemployment rate is predicted to fall even lower to 6.3% from 6.4% before. This was the lowest jobless rate since April, as the economy recovers gradually from the coronavirus pandemic. In February, the economy is predicted to have added 30k from 29.1k in the previous month.

Preliminary retail sales may display some decline

Retail sales rose by 0.5% m/m in January, revised slightly down from a preliminary estimate of 0.6%. February’s preliminary reading is predicted to report a small drop of 0.4%. It should be noted that retail is likely to show some softening in sales as the economy is reopening and consumers shift more of their spending back towards areas previously affected by restrictions.

RBA predicts unemployment to fall further till the end of the year

During March’s monetary policy meeting, Reserve Bank of Australia (RBA) left its cash rate unchanged at a record low of 0.1% as forecast. The central bank mentioned that it was prepared to make further adjustments to bond purchases in response to market situations; and reiterated that it will not increase the cash rate until inflation is sustainably within the 2 to 3% target, which is not expected to be met until 2024. The jobless rate is anticipated to slip further, with this scenario predicting that it will be around 6% at the end of 2021 and 5.5% at the end of 2022.

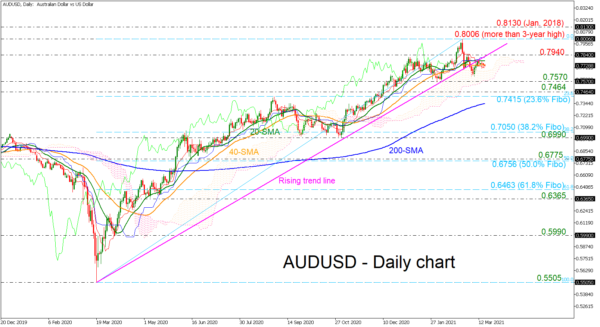

Aussie eases below uptrend line

From the technical viewpoint, aussie/dollar is heading south, holding slightly below the long-term ascending trend line. If the unemployment rate falls further as expected, the bulls may take the market higher towards the immediate resistance of 0.7940 ahead of the more-than-three-year high of 0.8006. Steeper increases may see the 0.8130 barrier, registered in January 2018.

On the other hand, the price could be at risk of further bearish movement if the employment report disappoints. Price action is likely to challenge the 0.7570 support before slipping to 0.7464. A leg lower could open the way for the 23.6% Fibonacci retracement level of the up leg from 0.5505 to 0.8006 at 0.7415.

In conclusion, combined with the global vaccine rollouts and the growing expectation of a swift, full recovery, Australia’s domestic strength has left the consumer in a very optimistic mood.