Amid ongoing jitters about the fallout from the banking sector, inflation will fall back into the limelight next week. The flash CPI readings for the euro area as well as the PCE inflation figures out of the United States will grab most of the headlines, in an otherwise quiet week. Australia will also get inflation data, and in Japan, Tokyo prices will be watched. Hot CPI numbers could roil markets as central banks have indicated that they are not about to take their eye off the ball during these turbulent times.

Will PCE inflation further complicate the Fed’s rate path?

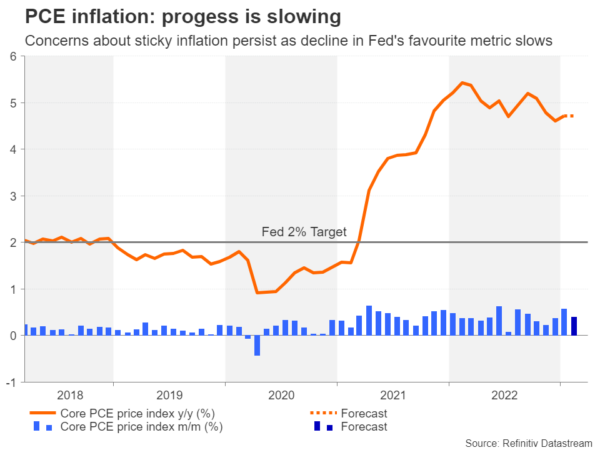

Hot on the heels of the FOMC meeting and the banking crisis, investors will have to digest another dose of inflation data out of America. The PCE inflation report comes out on Friday along with personal income and spending numbers. Whilst there’s been good progress in overall price pressures easing in recent months, the Fed is focusing its efforts these days on services inflation, and on that, Chair Jerome Powell’s latest assessment is that there has not been any progress when excluding housing components.

Policymakers will get the chance to take another look at February prices, this time in the form of the core PCE price index. The Fed pays a lot more attention to this particular measure of inflation so any upside surprises could boost bets of a follow-up 25-basis-point rate hike in May, which at the moment, the odds are constantly swinging above and below 50%.

The strength of the consumer will be in focus too, with the Conference Board’s closely watched consumer confidence gauge out on Tuesday and the personal consumption print due Friday. The former is more forward looking so any deterioration in the March figure might be associated with the blow up of regional banks.

In other data, housing indicators from S&P Corelogic Case-Shiller Index (Tuesday) and pending home sales (Wednesday) will be important amid signs that the sector is rebounding after falling off a cliff last year when the Fed’s tightening campaign went into overdrive. The final estimate of Q4 GDP is due Thursday, and finally, the Chicago PMI will round up Friday’s releases.

With market sentiment still quite fragile in the aftermath of the bank collapses, investors are more likely to react negatively to strong data as they would give the Fed less reason to be cautious. However, this may not necessarily lift the US dollar much, as even in the most bullish scenario, the Fed’s terminal rate has permanently shifted lower.

Eurozone inflation expected to edge down again

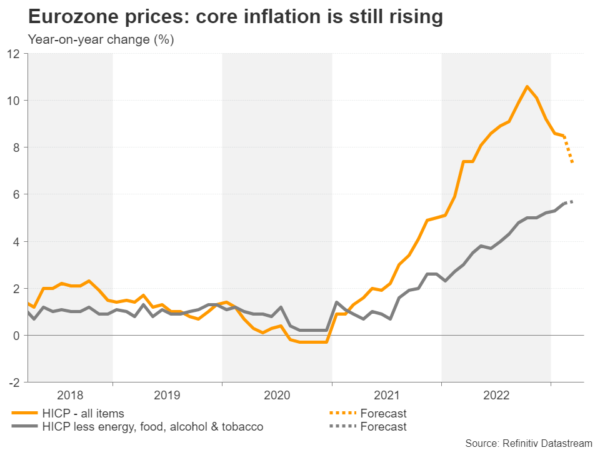

The European Central Bank may have dropped its forward guidance in March, but since that meeting, policymakers have been eager to signal that further rate increases are nevertheless likely in the coming months as inflation remains far above their 2% target. Headline inflation could ease below 8% when the flash estimates for March are published on Friday. However, the bigger headache for the ECB is the continued climb in the underlying measures of inflation.

When excluding food, energy, alcohol and energy, the consumer price index is forecast to creep up to 5.8% in March from 5.6% in February.

The longer this trend continues, the greater the odds that the ECB will remain on a tightening path and the possibility of that happening whilst the Fed goes on pause is buoying the euro. Having consolidated over the last couple of months, the euro has a good chance of surpassing its February 2 peak of $1.1033 as long as the impact from the banking crisis on the Eurozone economy remains contained.

It’s a different matter in the US, however, where there is a heightened risk of a credit squeeze even if there aren’t any fresh casualties from the fallout of Silicon Valley Bank’s collapse. Powell himself has highlighted the danger that credit conditions are likely to tighten regardless of whether there are further rate increases, as banks turn more cautious and hand out fewer risky loans.

That’s not to say, though, that the European economies won’t feel any aftershocks and investors will be on alert for any dip in business confidence. The March surveys will kick off on Monday with Germany’s Ifo business climate index, followed by the Eurozone economic sentiment indicator on Thursday.

Aussie eyes CPI data as RBA pause hangs in the balance

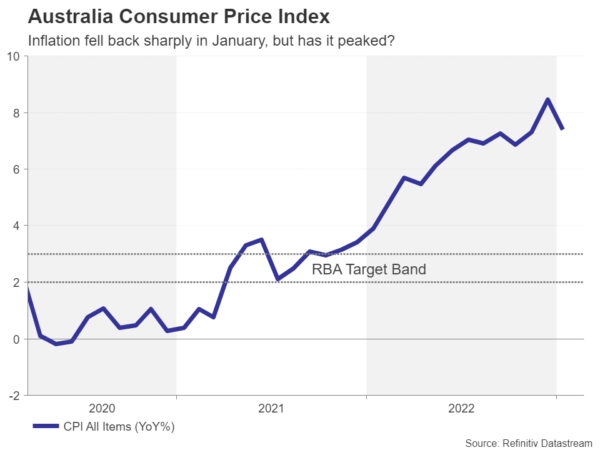

The Reserve Bank of Australia started its debate about pausing long before the banking turmoil and will probably be even more inclined to do so at its April meeting. Markets have currently priced in about 90% probability of a pause and inflation figures due on Wednesday could push those bets closer to 100% if they unexpectedly decline further.

The RBA is hoping that inflation peaked in December when it hit 8.4% before sharply dropping to 7.4% in February. Another fall in March would be seen as sealing the deal for an April pause, although such an outcome would not bode well for the Australian dollar.

Alternatively, stronger-than-expected CPI readings would be positive for the aussie, and there could be some upside too from manufacturing PMIs out of China on Friday should they point to a further rebound in the economy in March.

Japan’s inflation picture still unclear

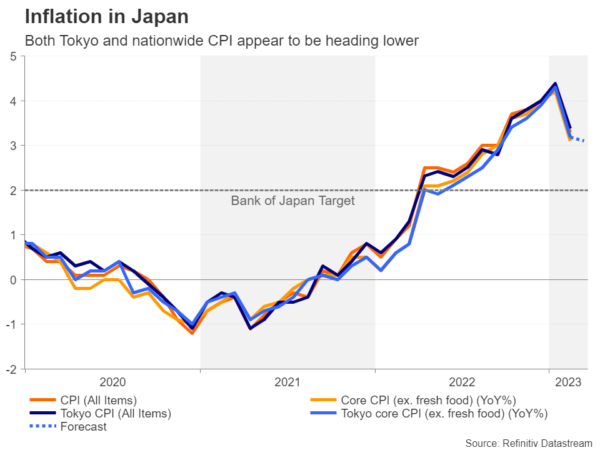

Sticking to the Asia-pacific region, it’s a data heavy week in Japan, with the flurry primarily taking place on Friday. Preliminary industrial production stats, retail sales and the jobless rate, all for February, are on the agenda. But of most interest to investors will likely be the March CPI prints for the Tokyo region, which are seen as a precursor for the nationwide numbers published much later.

Japan’s inflation rate eased back sharply in February, taking the pressure off the Bank of Japan to further scale back its stimulus policies. The March forecast is that core CPI in Tokyo continued to moderate slightly. The yen, which has been on a roll lately against its US counterpart, might struggle to extend its gains if the forecasts are met.

However, in the event that inflation reverses higher again, this could intensify speculation of some sort of policy action by the BoJ at its April meeting, as it would come on the back of the Spring wage negotiations where labour unions agreed to an inflationary pay deal that averages at 3.8% y/y.