On Tuesday, the market will have the opportunity to see the true pace of the much-talked Chinese reopening as we get a plethora of key Chinese economic data. While a stronger set of data releases will be positive for the global growth outlook, are central banks ready for news that could potentially mean that the acute inflationary pressures might be resurfacing?

Is the world ready for a rapidly expanding China?

It has been an interesting period over the past two years as developed economies have been trying to recover from the Covid pandemic impact with China being hamstrung. The much-talked and eagerly expected Chinese reopening has been more gradual than most have anticipated, with its full impact yet to be seen. However, there is a troubling dichotomy regarding China’s growth outlook. A rebound in the Chinese economy is clearly beneficial for the entire world.

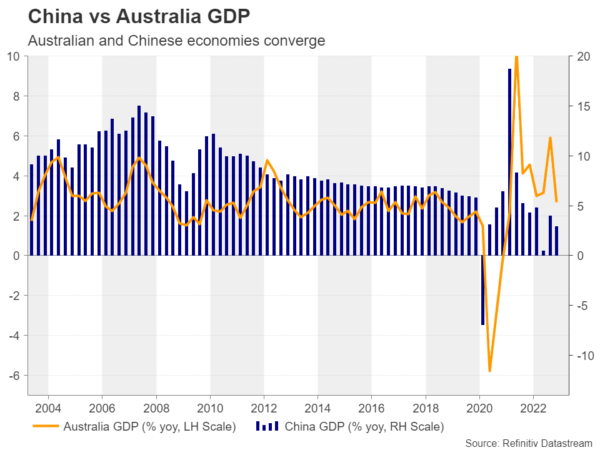

The recent IMF forecasts show global growth slowing considerably in 2023, with the situation likely to have been much worse if China was not expected to almost double its growth rate from 2022. Certain commodity-exporting nations like Australia would likely be the first ones to enjoy the increased demand for resources from China, boosting the slowing local economies. This will potentially give time to the local central banks to evaluate the impact of their aggressive recent rate hiking cycles and map out their rate cutting strategies.

Over the past two months we have noticed an interesting phenomenon. On the back of lower oil prices, headline inflation has been aggressively dropping in most major economies, with the latest example being Wednesday’s CPI release in the US. However, core inflation, which includes the less volatile components, has proved more stubborn and it is currently hovering at unsustainably high levels. This situation is complicating the monetary policy outlook.

Now, add to this mixture a rapidly growing China with its commodity-hungry economy. An increase in oil prices will probably lead to a jump in the headline CPI that will most likely drag core inflation even higher. And then central banks would be faced with a massive dilemma: whether to opt for even higher rates risking a proper recession as demand crashes under the higher price of money or allow their economies to be ravaged by another inflation wave that is bound to have second and third round effects on wages and the public perception of inflation.

Data galore on Tuesday

IMF economists have penciled in a 5.2% year-on-year GDP increase for 2023 in their latest projections. This is slightly higher than the 5% economic growth target set by the Chinese government in early March. This is one of its lowest targets in decades, thus leaving substantial room for an upside surprise this year. On Tuesday, we will get the growth figures for the first quarter of 2023. While the initial market forecasts point to a slower quarter, on the back of the recent disappointing manufacturing business surveys, most acknowledge that there is sizeable risk of a stronger-than-expected print considering the latest trade balance data.

If the forecasts for a weaker quarter are confirmed, the market would quickly assume that further interventions by the central government and the PBoC could be on the cards, in order to help the economy pick up pace. Another reserve requirement ratio cut could be an easy option as inflation remains very low compared to the West and the PPI YoY% change remains in negative territory for the past six months.

What also needs some boosting is the struggling retail sector. The great transformation of China to a consumer-driven economy appears to have stalled during the Covid years and hence renewed effort from government officials is required. Retail sales rebounded in February, but it has been a very weak 18-month period with the dataset showing unprecedented weakness. Another weak point on Tuesday is bound to increase the pressure on the PBoC to act more forcefully.

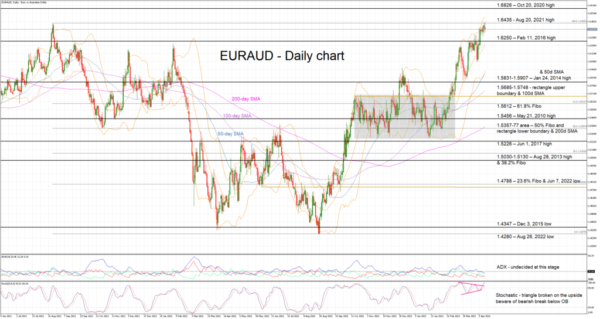

Euro/aussie at 20-month high

The euro/aussie pair has completed a 20-month round trip from the August 20, 2021 high of 1.6435 to the August 26, 2022 low of 1.4280 and back again to the highs. This movement is partly reflecting the divergent economic outlook over the past two years with the euro area economy shooting down the recession expectations and the Australian economic growth moving down a notch.

Euro bulls would enjoy another rally, but the overall picture appears to be toppy, particularly when examining the RSI and the stochastic oscillator indicators. On the other hand, aussie bulls would love a strong show from Tuesday’s Chinese data, despite the possible complications for the RBA down the line. A break below 1.6250 and a push towards the busy 1.5831 area would allow the aussie bulls to declare a short-term victory, but they must be fully aware that it will not be the end of the war.