- Dollar cannot sustain Fed-fueled advance, will ISM data help?

- Reserve Bank of Australia could abandon its tightening bias

- Crucial data releases also from China, Canada, and New Zealand

Fed warns against early rate cuts

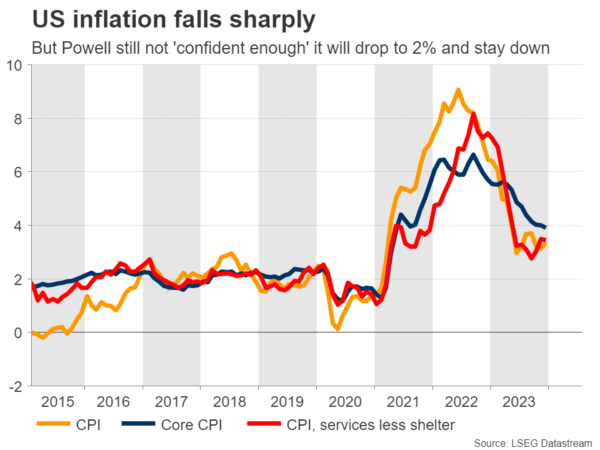

It was an eventful week in global markets. The spotlight fell on the Federal Reserve, which shot down expectations it would cut interest rates in March, with Chairman Powell stressing that this is not the “base case” scenario.

Even though inflation has declined substantially, Powell downplayed speculation that rate cuts are just around the corner, arguing that the Fed is still not fully confident it has won the war. He pointed to solid economic growth, resilient consumer spending, and a tight labor market as factors that could keep inflation above 2% for some time.

Reading between the lines, his broader message was that rates will eventually come down, but not quite as quickly as markets had hoped. As a result, traders scaled back bets on a March rate cut, slashing the probability to around 35% from 60% ahead of the Fed decision.

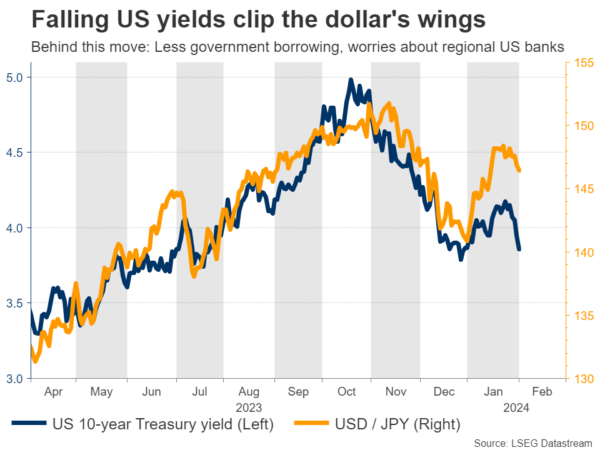

This translated into a boost for the US dollar. However, the dollar could not sustain those gains, mostly because the market didn’t change its view on the total amount of rate cuts that will be delivered this year – it simply pushed back the timing. Nearly six rate cuts are still priced in for the year.

A sharp decline in US bond yields was another element behind the dollar’s inability to rally, as lower yields diminish the dollar’s interest rate advantage. This slide was fueled by the government’s announcement that it will borrow less this quarter than previously estimated, as well as renewed concerns about the health of US regional banks after some poor earnings.

Looking ahead, the main event next week will be the ISM non-manufacturing survey, due on Monday. This is one of the most important leading economic indicators of the US economy, and forecasts point to a meaningful increase in January. If that is the case, the market could continue to unwind some of its Fed rate cut bets, helping the dollar regain some momentum.

RBA meets, will it abandon its tightening bias?

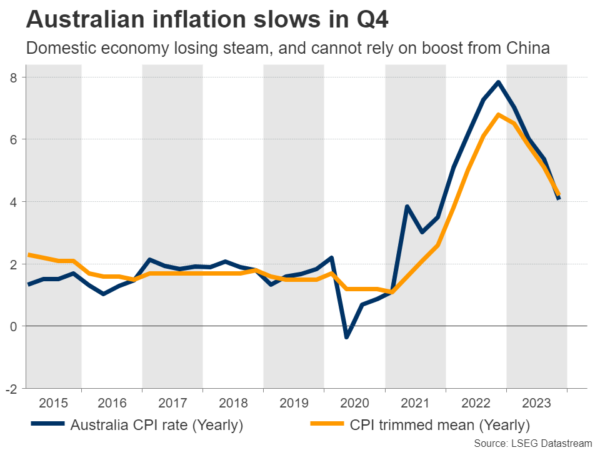

Over in Australia, the Reserve Bank will meet on Tuesday. Market pricing suggests interest rates will be kept unchanged, so the focus will fall mostly on whether the central bank will keep further rate increases on the table.

The minutes of the December meeting showed that policymakers discussed another rate increase, but decided against it. Since then, incoming data has been on the weaker side with inflation slowing sharply in Q4, the labor market losing jobs, and consumer spending disappointing during the holiday season.

Even though policymakers may keep the option of raising rates again on the table, it is becoming clear that this is unlikely to happen. The domestic economy is losing steam and Australia’s largest trading partner – China – is in bad shape as it deals with the implosion of its property market.

Therefore, even if the Australian dollar spikes higher in the case the RBA maintains a tightening bias, the general outlook for the currency seems gloomy. It would probably take a meaningful recovery in China and commodity prices, before the currency can stage a sustainable rally.

Speaking of China, the latest inflation stats will be released on Thursday. Forecasts suggest the world’s second largest economy sunk deeper into deflation in January, which could reignite concerns around the future outlook, keeping local stock markets and the China-linked Australian dollar on the defensive overall.

New Zealand and Canada release job numbers

Staying in the sphere of commodity currencies, employment data out of New Zealand and Canada will also be in focus on Tuesday and Friday, respectively.

In New Zealand, forecasts point to a looser labor market in Q4, with the unemployment rate projected to rise to 4.3% from 3.9% in the previous quarter and wage growth set to cool off. Most of this loosening reflects increasing labor supply amid record migration inflows, which will be welcome news for the Reserve Bank as it will help cool inflation.

That said, the New Zealand dollar might react negatively to this dataset, as a softer labor market strengthens the case for cutting interest rates.

Over in Canada, the show will begin on Wednesday with the summary of deliberations from the latest Bank of Canada meeting. This is similar to the meeting minutes, and will give investors a detailed account of what was discussed. Then on Friday, the employment report for January will reveal whether the trend of a rising unemployment rate continues.