- Central bank decisions in Eurozone, Canada, and New Zealand

- Highlight will be the ECB – likely to signal a rate cut in June

- In US, the dollar will be driven by inflation stats and Fed minutes

ECB meeting – Nearly time to cut

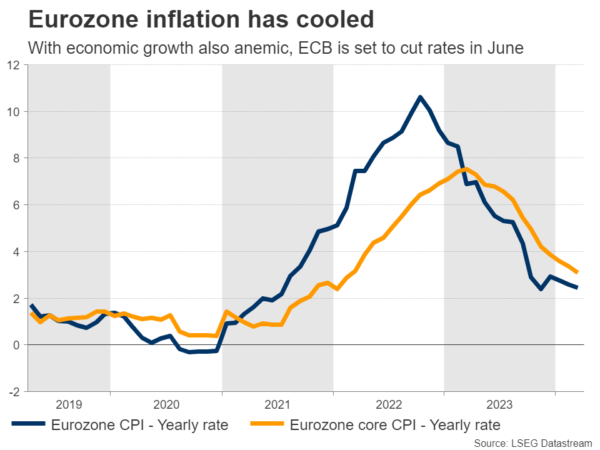

The Eurozone economy has gone through a rough patch over the last year. Growth has been almost stagnant, held back by Germany, which fell into contraction as a slowdown in global trade suppressed demand for exports and crippled the nation’s manufacturing sector.

On the bright side, the economic stagnation has helped dampen inflationary pressures. Inflation fell to 2.4% in March, pushing the European Central Bank one step closer to cutting interest rates. Most ECB officials have pointed to a cut in June as the most likely scenario.

Investors share this view. A June rate cut is already fully priced into money markets, reflecting the slower growth pulse and the cooldown in inflation. The unemployment rate has also risen a touch this year, reinforcing hopes that inflation is headed lower.

Therefore, the ECB will likely use the meeting on Thursday as a stepping stone, setting the stage for summer rate cuts. President Lagarde could highlight the progress on inflation and argue that lowering rates soon would help minimize the risk of a recession.

As for the euro, its gloomy economic fundamentals paint a negative picture. One reason the single currency has been so resilient over the past year has been the collapse in natural gas prices, which benefited the euro through the trade channel. The euphoric tone in stock markets also helped, by pinning down the safe-haven US dollar.

So the euro has been kept afloat not by economic performance, but rather by developments in other financial markets. This is a double-edged sword, because it implies that any change in these trends could remove a big pillar of support for the currency.

In other words, the euro needs low gas prices and rising stock markets to remain above water. Otherwise, traders might start focusing on the anemic growth outlook and rate cuts.

US inflation and Fed minutes in focus

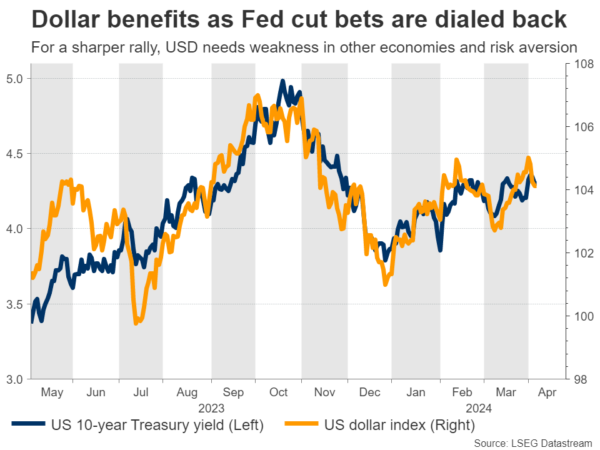

Over in the United States, the spotlight will fall on CPI inflation data and the minutes of the latest Fed meeting, both on Wednesday. These will help investors decide whether the Fed will cut rates in June, which markets currently assign a 70% probability to.

Forecasts suggest inflation reaccelerated, with the CPI rate seen at 3.4% in March from 3.2% previously. However, the core rate is anticipated to tick down to 3.7%. The difference most likely reflects the rally in oil during the month, as the core figure excludes the effects of energy prices.

This would translate into a mixed report for the Fed. A decline in the core rate would suggest the broader trend of disinflation continues, even if rising energy prices are keeping headline inflation elevated.

Meanwhile, the minutes will cover the March meeting, where FOMC officials upgraded their growth and inflation forecasts but still projected three rate cuts for this year. It will be interesting to see the discussions behind the scenes. That said, this release is unlikely to contain any groundbreaking revelations, as most officials have spoken several times since this meeting.

As for the dollar, it went for a wild ride this week, losing ground after a disappointing ISM services survey but then recovering with some help from risk aversion amid fears of an Iranian attack against Israel.

Overall, US economic fundamentals seem stronger than most regions. For instance, GDP growth is on track to hit 2.5% this quarter according to the Atlanta Fed. Therefore, the broader outlook seems positive, although for the reserve currency to stage a lasting rally, it might need more signs of weakness in foreign economies or a risk-off atmosphere that fuels demand for haven assets.

Rate decisions in Canada and New Zealand

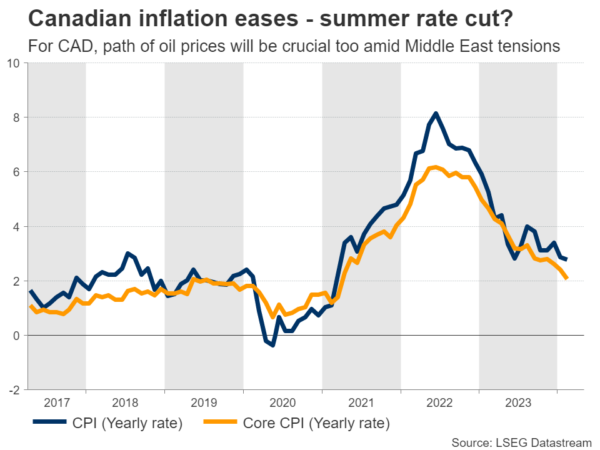

In Canada, the central bank meets on Wednesday and markets assign a 15% chance for an immediate rate cut, as core inflation has declined steadily. Massive population growth has helped to loosen labor market conditions, dampening concerns about wage-fueled inflation. The negative side of that is housing shortages, which are keeping shelter inflation hot.

As such, the Bank of Canada is unlikely to slash rates at this meeting, although it might provide clearer signals that cuts are coming this summer. The Canadian dollar will also be driven by oil prices, with any escalation in the Middle East likely to benefit the oil-exporting currency.

Crossing into New Zealand, the local currency has been on the ropes this year, losing more than 4% against the US dollar. The economy fell into a minor technical recession late last year, which has weighed on consumer and business confidence. But inflation remains elevated, so markets don’t expect any move from the Reserve Bank when it meets on Wednesday.

For the New Zealand dollar to mount a sustainable comeback, it will probably need a meaningful recovery in China that boosts demand for the nation’s commodity exports.

In this sense, China’s trade data for March will be closely watched on Friday for any signs of a rebound. Other notable releases on Friday include monthly GDP stats from the United Kingdom.