Week in review – Geopolitical Turmoil on the Menu

Traders have returned to their desks, and volumes are finally normalizing after a holiday period that was anything but boring.

Connecting back to the end-December trading, metals rode a rollercoaster that took many to fresh record highs, setting a bar of high expectations for the new year.

The weekly open did not disappoint. The capture of Venezuelan President Nicolas Maduro by the Trump Administration over the weekend sent shockwaves through the headlines and ignited a wave of excitement across markets.

This reaction is rooted in a clear shift: The revival of the Monroe Doctrine—now dubbed the “Donroe Doctrine”—sets a precedent unseen in decades.

When viewing this alongside recent administration moves, such as renaming the Department of Defense to the Department of War and shifting military assets to the Caribbean, the market’s angst transforms into a realization of a new reality.

As the operation unfolded, markets opened a renewed hype: The Freedom Trade.

Newfound excitement surged through the US Stock Market, powering the Dow Jones and traditional sectors beyond year-end records.

Investors are betting that “America First” is no longer just an isolationist slogan, but a policy that places US strategic interests above all else—including international norms.

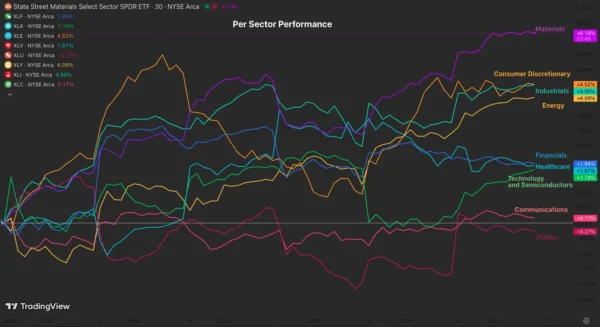

Stock Market per Sector Performance since beginning 2026 – Source: TradingView

The Market Consequence? Gigantic rallies in Industrials, Materials, Energy, and Consumer Discretionary sectors.

The translation is simple: if US External Policy returns to its past century way of operating—global military dominance and strategic shows of strength—traditional sectors stand to benefit the most. The administration is making it clear: the US is not to be reckoned with.

The Venezuela capture also extended elsewhere.

With threats of intervention now extending to Mexico, Cuba, Colombia, and even Greenland, global heads of state are waking up to defend their interests. The most significant tail risk for sentiment remains the standoff regarding Greenland, which directly challenges the NATO framework.

Amidst the geopolitical noise, markets also received crucial economic clues: the US labor picture is not worsening, and the global economy remains resilient, with Global PMIs staying firmly in expansion territory.

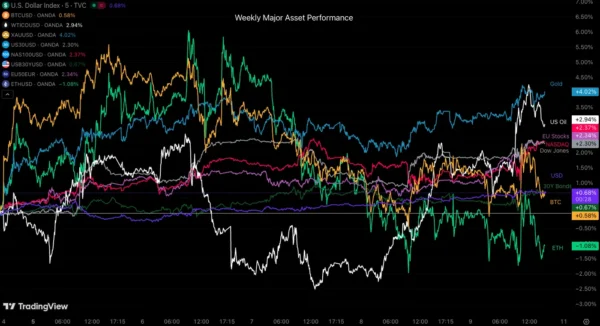

Weekly Performance across Asset Classes

Weekly Asset Performance – January 9, 2026 – Source: TradingView

Metals are once again standing on top of the latest geopolitical developments. Gold is up a sneaky 4% on the week, while Silver and Palladium are up above 11%.

The Week Ahead – CPI and Elevated Tensions

Asia Pacific Markets – Chinese Trade Data and Australian Employment

This week wasn’t only interesting for North America.

Japan saw renewed strength in wage growth data, which, combined with hawkish speeches from Bank of Japan members and strong approval ratings, led PM Takaichi to announce snap elections for mid-February. Her aim is to consolidate power; a victory would make her the first officially elected female Prime Minister in Japanese history.

China also released an improved inflation picture. Recent stimulus and a shift toward more business-friendly regulations have sparked a decent rebound from the preceding deflation. As a result, the CNY (Chinese Yuan) is strengthening aggressively and maintaining a higher path.

Looking ahead to next week, markets expect a slew of Chinese data. This includes Trade Reports on Tuesday—which will put hard numbers on the state of a fragmented global trade regime—followed by Retail Sales on Wednesday and GDP data on Thursday. Strong Chinese data tends to have a boosting effect on Antipodean currencies (AUD and NZD).

Speaking of the Antipodeans, traders will also welcome Australian Employment numbers. Following last week’s better-looking but still very hot CPI data (3.4% y/y), expectations for this report are high.

A beat here would likely cement the case for a rate hike at the next RBA meeting on February 3.

Europe and UK Markets – UK Employment & GDP mixed with European CPIs

The UK moves to the forefront for the upcoming week.

Following last month’s improved inflation data, traders will look to confirm a smoother rate cut cycle for the Bank of England in 2026, provided UK employment figures don’t show unexpected strength. The release is scheduled for the Monday-Tuesday overnight session at 2:00 A.M.

Amidst appearances by several BoE members, market participants should also expect the UK monthly GDP numbers on Thursday.

For the Eurozone, ECB Vice President Luis de Guindos—one of the favorites to replace Christine Lagarde—is expected to speak twice. His comments should be tracked closely by EU traders as he looks to cement his standing.

On the data front, attention will turn to inflation, with the French and German CPI releases scheduled for Thursday and Friday, respectively.

North American Markets – US CPI and A LOT of Fed Speakers

The US will finally receive on-time Inflation data, with the CPI (Tuesday) and PPI (Wednesday) releases forming a critical wombo-combo which will be tracked closely by global traders.

Scrutiny is particularly high after the last report raised doubts regarding its accuracy; that print came in at 2.7% (vs. 3.4% expected), with the BLS reportedly taking some liberties to fill data gaps caused by the Shutdown.

The CPI is expected to land at 0.3% Month-over-Month, a sticky read that would almost certainly dash any hopes for a January rate cut (currently priced at just 10%).

Of course, don’t forget the US Retail Sales at 8:30, also on Wednesday.

Elsewhere, a parade of Fed officials is scheduled to speak. NY Fed President Williams will headline the slate with appearances on Monday and Wednesday. We will also hear from the new 2026 rotation of regional voters, including Minneapolis Fed President Neel Kashkari, who is also set to speak on Wednesday.

To learn more about the 2026 voting rotation, check out our recent publication:

Who Are the Fed Speakers to Watch in 2026? A New Front-Runner for the Fed Chair

Finally, keep your notifications on for the geopolitical scene: The developing revolution in Iran could have profound implications for Oil markets and the broader global regime.

Next Week’s High Tier Economic Events

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (High-tier data only)

Safe Trades and enjoy your weekend!