Dollar and Yen trade generally higher today as Asian markets turned mixed. The strong rally in Asian stocks yesterday was based on optimism on US-China trade negotiation. But such optimism has quickly turn into cautiousness. Another round of negotiation will start in Washington today, followed by high-level meeting later in the week. It remains to be seen what kinds of progress were made and investors would be eager to see then in writing in a to-be-delivered MOU.

Staying in the currency markets, Australian and New Zealand Dollars are the weakest one so far. Aussie is pressured as RBA minutes revealed much concerns over housing market slump. Economists are predicting that RBA could stand pat through 2021. And some even expected a cut as next move. Sterling follows as next weakest ahead of employment data. Euro is mixed, awaiting German economic sentiment.

Technically, there is no breakthrough in the markets so far. EUR/USD and GBP/USD remains held below 1.1341 and 1.2958 resistance. USD/CHF is holding above 0.9988 support, USD/JPY above 110.00, USD/CAD above 1.3196. The greenback is in favor to rally in general. AUD/USD’s dip today could also be an early of weakness ahead. Similarly, EUR/JPY is held well below 125.95 resistance, GBP/JPY well below 144.84 resistance. CAD/JPY is staying below 83.98 resistance. Outlook in Yen is neutral for now but upside risks are building. 0.8728 minor support in EUR/GBP could be a level to watch given the data release schedule in UK and EU.

In other markets, Nikkei closed up 0.17%. Hong Kong HSI is down -0.24%. China Shanghai SSE is down -0.35%. Singapore Strait Times is up 0.05%. Japan 10-year JGB yield is down -0.004 at -0.024.

US-China trade talks to resume today, high level meeting starts Thursday

The White House confirmed in a statement that US-China trade negotiations will resume on Tuesday, today, in Washington. High-level talks will start on Thursday as led by US Trade Representative Robert Lighthizer. Treasury Secretary Steven Mnuchin, Commerce Secretary Wilbur Ross, economic adviser Larry Kudlow and trade adviser Peter Navarro would also take part in the talks. Chinese Vice Premier Liu He is expected to join the meeting on Thursday and Friday too.

White House said the talks are aimed at “achieving needed structural changes in China that affect trade between the United States and China”. And, “the two sides will also discuss China’s pledge to purchase a substantial amount of goods and services from the United States.”

A memorandum of understanding of some sort is expected at the conclusion of the meeting, acting as the framework for the trade agreements to be detailed. If the teams are able to deliver the MOU, it should then be known what kind of structural reforms China has agreed to take. For now, no detail is leaked on the core issues regarding IP theft, forced technology transfer, subsidies on State-Owned Enterprises, and enforcement of the agreement.

EU Juncker believes Trump will keep his words and no US auto tariffs for now

European Commission President Jean-Claude Juncker believed that US will refrain from imposing auto tariffs on EU cars for now. He told Stuttgarter Zeitung newspaper that “Trump has given me his word that there will be no car tariffs for the time being. I believe him.” But Juncker warned that “should he renege on that commitment, we will no longer feel bound by our commitments to buy more US soya and liquid gas. However, I would very much regret that”.

The US Commerce Department submitted the Section 232 national security report on auto imports to the White House on Sunday. Trump Trump has 90 days to make a decision on whether to act up the recommendations, which could include tariffs. The Commerce Department refused to disclose any details of the report to the public nor the industry.

Germany’s BDI industry association urged the US to release information on the report. BDI President Dieter Kempf said “the U.S. Department of Commerce should now publish its report on automobile imports quickly, so as not to further increase business uncertainty for companies.” He also reiterated that “The import of automobiles is not a threat to U.S. national security, and U.S. President Donald Trump must abide by applicable trade law, and he should refrain from imposing any tariffs or quotas.”

UK Cox to set out proposed legal changes in Irish backstop, and return to Brussels mid-week

UK Brexit Minister Stephen Barclay said he had a “positive meeting” with EU chief Brexit negotiator Michel Barnier and UK Attorney General Geoffrey Cox. In the meeting, the proposed Malthouse Compromise regarding Irish backstop was discussed.

And, Cox shared his thinking in terms of the legal way forward and the ways to address the central issue. That is, according to Barclay, “the legal underpinning that is temporary and his advice to parliament in terms of the indefinite nature of the backstop”.

Fox is now expected to set out the changes on Irish backstop on Tuesday. He and Barclay will return to Brussels at mid-week to present the proposals to Barnier.

BoJ Kuroda: We’ll consider easing if currency moves derails path to inflation target

BoJ Governor Haruhiko Kuroda told the parliament today that “currency moves could have an impact on the economy and prices, so it’s crucial we take into account these factors when guiding monetary policy.”

And, if the currency moves are “having an impact on the economy and prices, and if consider it necessary to achieve our price target, we’ll consider easing policy.”

Yen dips mildly after the comments. But there is no follow through selling as what Kuroda said are pretty much known.

RBA minutes: Further decline in house prices could result in lower GDP, higher unemployment and lower inflation

RBA reiterated its rate views in the February meeting minutes but sounded more cautious regarding the downturn in housing markets. The central bank maintained that “given that further progress in reducing unemployment and lifting inflation was a reasonable expectation, members agreed that there was not a strong case for a near-term adjustment in monetary policy.”

And, the minutes echoed Governor Philip Lowe’s comments too. That is, “there were significant uncertainties around the forecasts, with scenarios where an increase in the cash rate would be appropriate at some point and other scenarios where a decrease in the cash rate would be appropriate.” Most importantly, “the probabilities around these scenarios were now more evenly balanced than they had been over the preceding year, when an eventual increase in the cash rate had appeared more likely.”

RBA tied the subdued consumption growth in Q4 to the possibility of being influenced by “lower housing prices and reduced housing market activity”. On housing, RBA admitted that “dwelling investment was also expected to decline more sharply than previously expected, consistent with the decline in residential building approvals and the fall in housing prices”. And, “members observed that if prices were to fall much further, consumption could be weaker than forecast, which would result in lower GDP growth, higher unemployment and lower inflation than forecast.”

According to a Reuters poll, all of the 41 economists expected RBA to keep interest rate unchanged at 1.50% through 2019. 28 expected RBA to stand pat at least until Q1 of 2021. 10 expected at least one cut by the end of 2020. NAB economist David de Garis was quoted saying “For the rates outlook, the course of the economy will drive whether the RBA manages to hold rates steady for a while, or, as the risk has grown in recent months, the RBA cuts again. If there is a move this year, it’s more likely to be an easing in policy.”

On the data front

Swiss will release trade balance in European session while Eurozone will release current account. But main focuses will firstly be on UK job data, and then German ZEW economic sentiment. Later in the day, US will release NAHB housing market index.

AUD/USD Daily Outlook

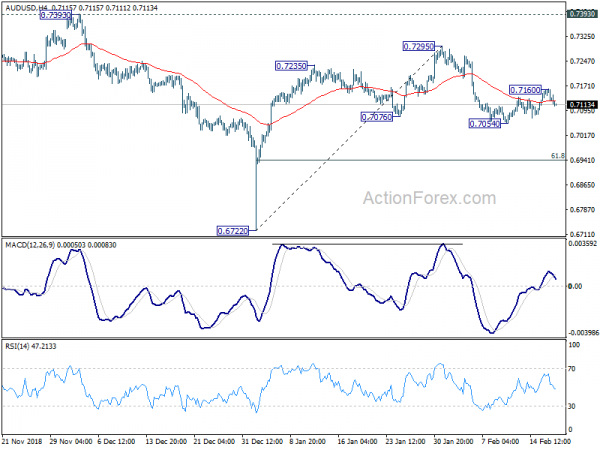

Daily Pivots: (S1) 0.7116; (P) 0.7138; (R1) 0.7153; More…

AUD/USD’s corrective recovery extended to 0.7160 but dropped sharply since then. For now, it’s still staying above 0.7054 temporary low and intraday bias remains neutral first. More consolidation could be seen. In case of another rise, upside should be limited below 0.7295 resistance. We’re favoring the case that rebound from 0.6722 has completed at 0.7295 already. On the downside break of 0.7054 support will affirm this case and target 61.8% retracement of 0.6722 to 0.7295 at 0.6941 next.

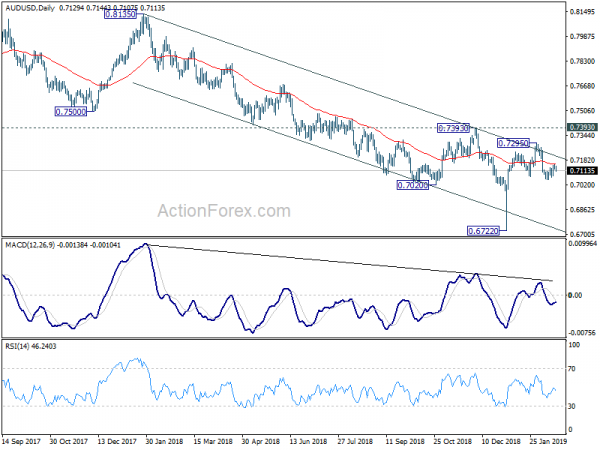

In the bigger picture, as long as 0.7393 resistance holds, we’d treat fall from 0.8135 as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | RBA Minutes Feb | ||||

| 07:00 | CHF | Trade Balance (CHF) Jan | 2.24B | 1.90B | ||

| 09:00 | EUR | Eurozone Current Account (EUR) Dec | 30.9B | 20.3B | ||

| 09:30 | GBP | Jobless Claims Change Jan | 12.3K | 20.8K | ||

| 09:30 | GBP | Claimant Count Rate Jan | 2.80% | |||

| 09:30 | GBP | ILO Unemployment Rate 3Mths Dec | 4.00% | 4.00% | ||

| 09:30 | GBP | Average Weekly Earnings 3M/Y Dec | 3.50% | 3.40% | ||

| 09:30 | GBP | Weekly Earnings ex Bonus 3M/Y Dec | 3.40% | 3.30% | ||

| 10:00 | EUR | German ZEW Economic Sentiment Feb | -13.7 | -15 | ||

| 10:00 | EUR | German ZEW Current Situation Feb | 21 | 27.6 | ||

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Feb | -20.9 | |||

| 15:00 | USD | NAHB Housing Market Index Feb | 59 | 58 |