Dollar suffers another round off selloff after terribly poor ADP job data, which showed only 27k growth in May. 10-year yield also takes a steep dive breaching Monday’s low at 2.081. Gold breaks 1344 and is on track to take on 1346.71 resistance. The poor data adds to speculation that Fed would be forced to at least an “insurance cut” later this year, if job markets worsen.

However, we’d like to point out again that Fed Chair Jerome Powell just promised to “act as appropriate” to economic developments. A rebound in unemployment rate of 3.60% isn’t a disaster. Meanwhile, tariffs on Chinese imports might not have brought any surge in inflation, but how about Mexican goods? The developments ahead remain fluid. And judging from today’s reaction, falling yields and stocks paring gains, a Fed cut shouldn’t be something to cheer for neither.

For today, Dollar is now the clear loser, followed by Australian Dollar and then Canadian. New Zealand Dollar is the strongest one, followed by Swiss Franc and then Euro. Both the Franc and Yen are picking up momentum again on falling treasury yields. For the week, Dollar is the weakest followed by Yen. Kiwi is the strongest followed by Swiss.

Technically, Dollar bears are finally showing some aligned commitment. GBP/USD is set to take on 1.2747 minor resistance and break will at least confirm short term bottoming. EUR/USD has finally overcome 1.1263 resistance will conviction. 1.1448 could be the next destination to determine medium term reversal USD/CHF’s break of 0.9879 support already takes the lead in indicating medium term reversal. Next is 0.9716 support.

In Europe, FTSE is currently up 0.17%. DAX is down -0.07%. CAC is up 0.24%. German 10-year yield is continuing to make record low, down -0.014 at -0.220. Earlier in Asia, Nikkei rose 1.80%. Hong Kong HSI rose 0.50%. China Shanghai SSE dropped -0.03%. Singapore Strait Times rose 0.61%. Japan 10-year JGB yield dropped -0.0249 to -0.126

US ADP employment rose 27k only, small businesses lost jobs

US ADP report shows only 27k private sector job growth in May, way below expectation of 185k. Looking at the details, small businesses lose -52k job, offsetting 11k growth in medium business and 68k in large businesses. Goods producing sectors lost -43k jobs, while service-providing sector gained 71k.

“Following an overly strong April, May marked the smallest gain since the expansion began,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Large companies continue to remain strong as they are better equipped to compete for labor in a tight labor market.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth is moderating. Labor shortages are impeding job growth, particularly at small companies, and layoffs at brick-and-mortar retailers are hurting.”

EU Dombrovskis: EDP on Italy is not just about procedure

European Commission Vice President Valdis Dombrovskis said the Commission concluded that Italy’s debt criterion is not complied with and there fore a “debt-based excessive deficit procedure (EDP) is warranted”. EDP is not opened today yet. And EU member states will give their views on the report on Italy first. Then, economic and financial committee has two weeks to form its opinion. He added “it’s much more than just about the procedure, when we look at the Italian economy we see the damage that recent policy choices are doing.”

The Commission estimated that Italy used EUR 2.2B more than expected to service its debt in 2018. And it’s paying as much toward its debt servicing as it does toward its entire education system. Dombrovskis added “growth has come to almost a halt … and we now expect the Italian debt (to GDP) ratio to rise in 2019 and 2020 to over 135%.”

Earlier today, coalition League’s economic chief Claudio Borghi rejects fiscal tightening measures and warned that Economy Minister Giovanni Tria must take a “hard line on EU budget talks”.

Eurozone retail sales dropped -0.4% mom, PPI slowed to 2.6% yoy

Eurozone retail sales dropped -0.4% mom in April, slightly better than expectation of -0.5% mom. Volume of retail trade decreased by 0.4% for food, drinks and tobacco and for non-food products, while automotive fuel increased by 0.1%. EU28 retail sales dropped -0.3% mom. In EU, volume decreased by 0.4% for non-food products and by 0.2% for food, drinks and tobacco and for automotive fuel.

Among Member States for which data are available, the largest decreases in the total retail trade volume were registered in Germany (-2.0%), Portugal (-1.0%) and Croatia (-0.9%). The highest increases were observed in Sweden (+2.4%), Slovenia (+2.0%) and Malta (+1.7%).

Eurozone PPI came in at -0.3% mom, 2.6% yoy in April, below expectation of 0.2% mom, 3.1% yoy. EU 28 PPI was at -0.1% mom, 2.9% yoy. The largest monthly decreases in industrial producer prices were recorded in Belgium (-1.7%), Italy (-1.5%) and Sweden (-0.8%), while the highest increases were observed in Denmark and Greece (both +1.2%), and Hungary (+0.9%). Annually, the highest increases in industrial producer prices were recorded in Romania (+6.7%), Hungary (+6.5%) and Latvia (+5.6%), while there were no decreases observed.

Eurozone PMI Composite finalized at 51.8, suggests 0.2% Q2 GDP growth only

Eurozone PMI services was finalized at 52.9, up from flash reading at 52.5 and April’s final at 52.9. PMI Composite was revised up to 51.8, up from flash reading of 51.6 and April’s final at 51.5. Among the countries, Italy PMI Composite improved to 49.9, 2-month high. France PMI Composite rose to 51.2, 6-month high. German PMI Composite rose to 52.6, 3-month high. But Spain PMI Composite dropped to 52.1, 66-month low.

Chris Williamson, Chief Business Economist at IHS Markit said: “Despite output at goods and service providers collectively rising at a slightly faster rate in May, the survey data are merely indicating a modest 0.2% rise in GDP in the second quarter… Furthermore, there seems little prospect of any immediate improvement: new orders barely rose in May, painting one of the gloomiest pictures of demand seen over the past six years, and companies’ expectations of growth over the coming year likewise fell to one of the lowest in six years.”

UK PMI services rose to 51.0, but pace of expansion remained disappointingly muted

UK PMI services rose to 51.0 in May, up from 50.4 and beat expectation of 50.6. Markit noted there was modest increase in business activity. New work rises for the first time since December 2018. But there was slowest rise in input costs for 12 months. All Sector PMI Index dropped to 0.7, down from 50.9. A sharp slowdown in manufacturing production growth and lower construction output more than offset an improvement in service sector business activity.

Chris Williamson, Chief Business Economist at IHS Markit, said: “PMI surveys collectively indicated that the UK economy remained close to stagnation midway through the second quarter as a result, registering one of the weakest performances since 2012… On a brighter note, optimism about the year ahead picked up to an eight-month high, in part reflecting an easing of near-term concerns due to the extension of the Brexit deadline to 31st October. However, it is clear that many businesses remain cautious in relation to spending and investing in the uncertain political environment, which is exacerbating the impact of a wider global economic slowdown on the UK.”

IMF lowered China growth forecast on trade tensions, but no additional policy stimulus needed yet

IMF lowered growth forecast for China in 2019 to 6.2% (down from 6.3%). For 2020, growth forecast was cut to 6.0% (down from 6.1%). The IMF’s First Deputy Managing Director, David Lipton, noted that the economy stabilized in early 2019 reflecting a wide range of policy support. However, “renewed trade tensions” is a “significant course of uncertainty” that weighs on sentiment.

However, IMF noted that “policy stimulus announced so far is sufficient to stabilize growth in 2019/20 despite the recent US tariff hike. ” And “no additional policy easing is needed” for the moment, provided there are no further increases in tariffs or a significant slowdown in growth. However, if trade tensions escalate further, “some additional policy easing would be warranted.

China Caixin PMI Services dropped to 52.7, subdued expectations linked to ongoing China-US trade dispute

China Caixin PMI Services dropped to 52.7 in May, down from 54.5 and missed expectation of 54.2. PMI Composite dropped to 5.15, down from 52.7. Markit noted that “overall confidence towards the year ahead weakened to the lowest on record, which was primarily driven by weaker sentiment at manufacturers”. Also, “expectations at goods producers were the least upbeat since the series began in April 2012″, ” services firms registered the lowest degree of confidence since July 2018″.

And, “subdued expectations were often linked to the ongoing China-US trade dispute and relatively subdued global demand conditions.”

Australia GDP grew 0.4% in Q1, driven mainly by government spending

Australian GDP grew 0.4% qoq in Q1, matched expectations. Annually, growth slowed to 1.8% yoy, down from 2.3% yoy and matched expectations too. But the details are rather weak. Government spending was the main contributor to growth, while rose 0.8%. Household spending slowed to 0.3% and contributed a modest 0.1%. And, dwelling investment contracted by -2.5% while slowing housing market has resulted in significant falls in ownership transfer costs. Non-mining investment rose 2.0% while mining investment dropped -1.8%.

Separately, RBA Head of Economic Analysis Alexandra Heath said in a report that “mining investment is probably around its trough and is likely to pick-up gradually over the next year or so”. And, “resource exports are also expected to contribute to GDP growth before plateauing at a new, higher level.”

Also from Australia, AiG Performance of Services Index rose to 52.5 in May, up fro 46.5.

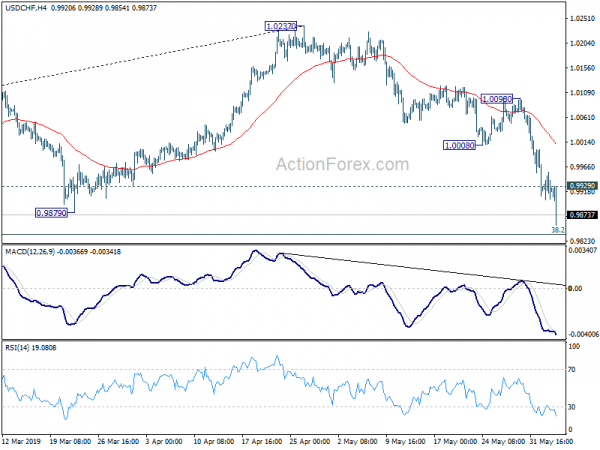

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9898; (P) 0.9927; (R1) 0.9953; More…

USD/CHF drops further to as low as 0.9854 so far and intraday bias remains on the downside. Break of 0.9879 support, now suggests that whole up trend from 0.9186 has completed at 1.0237. Further fall should be seen to 0.9716 cluster support (50% retracement of 0.9186 to 1.0237 at 0.9712). On the upside, break of 0.9929 minor resistance will turn intraday bias neutral first. But recovery should be limited by 1.0008 support turned resistance to bring fall resumption.

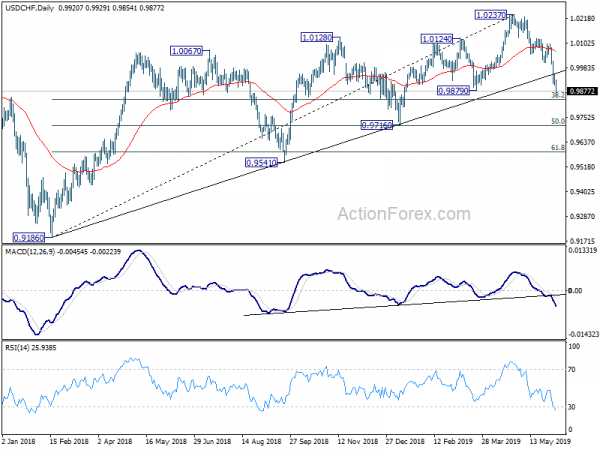

In the bigger picture, USD/CHF’s break of long term trend line support is the first indication of medium term reversal. Focus is now back on 0.9879 support. Sustained break should confirm that medium term up trend from 0.9186 has completed at 1.0237 already. Further fall should be seen to 0.9716 cluster support (50% retracement of 0.9186 to 1.0237 at 0.9712) next. Break will target 61.8% retracement at 0.9587.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Service Index May | 52.5 | 46.5 | ||

| 01:30 | AUD | GDP Q/Q Q1 | 0.40% | 0.40% | 0.20% | |

| 01:30 | AUD | GDP Y/Y Q1 | 1.80% | 1.80% | 2.30% | |

| 01:45 | CNY | Caixin PMI Services May | 52.7 | 54.2 | 54.5 | |

| 07:45 | EUR | Italy Services PMI May | 50 | 49.8 | 50.4 | |

| 07:50 | EUR | France Services PMI May F | 51.5 | 51.7 | 51.7 | |

| 07:55 | EUR | Germany Services PMI May F | 55.4 | 55 | 55 | |

| 08:00 | EUR | Eurozone Services PMI May F | 52.9 | 52.5 | 52.5 | |

| 08:30 | GBP | Services PMI May | 51 | 50.6 | 50.4 | |

| 09:00 | EUR | Eurozone PPI M/M Apr | -0.30% | 0.20% | -0.10% | |

| 09:00 | EUR | Eurozone PPI Y/Y Apr | 2.60% | 3.10% | 2.90% | |

| 09:00 | EUR | Eurozone Retail Sales M/M Apr | -0.40% | -0.50% | 0.00% | |

| 12:15 | USD | ADP Employment Change May | 27K | 185K | 275K | |

| 12:30 | CAD | Labor Productivity Q/Q Q1 | 0.30% | 0.40% | -0.40% | |

| 13:45 | USD | Services PMI May F | 50.9 | 50.9 | ||

| 14:00 | USD | ISM Non-Manufacturing/Services Composite May | 55.5 | 55.5 | ||

| 14:30 | USD | Crude Oil Inventories | -0.3M | |||

| 18:00 | USD | Federal Reserve Beige Book |