ommodity currencies trade broadly lower today as risk appetite lost momentum. Major US indices reversed earlier gains to close mildly lower. Asian stocks generally follow with the exception of Singapore. Aussie is also weighed down by deteriorating consumer sentiment. Swiss Franc and Yen gearing up some momentum but for now, Euro and Dollar are not too far behind. Activity could be subdued with a very light European session. ECB President Mario Draghi is scheduled to speak but he isn’t expected to say anything different from his press conference less than a week ago.

Technically, EUR/AUD’s rally continues today and is on track to 1.6410 projection level. AUD/USD’s downside momentum is not too convincing. But it should still be heading back towards 0.6864 low. USD/CHF, USD/JPY and USD/CAD are staying in near term consolidations. But all three pairs remain bearish for now. US CPI could be the trigger for downside breakout later in the day. At the same time, gold is back at 1332 after drawing support from 1320 handle. It’s probably heading back to 1347 resistance.

In Asia, currently, Nikkei is down -0.09%. Hong Kong HSI is down -1.59%. China Shanghai SSE is down -0.57%. Singapore Strait Times is up 0.18%. Japan 10-year yield is up 0.0052 at -0.105. Overnight, DOW reached as high as 26248.67 but closed down -0.05% at 26048.51. S&P 500 dropped -0.03%. NASDAQ dropped -0.01%. 10-yer yield dropped -0.003 to -2.140.

Trump tells China: Go back to that deal or I have no interest

Trump said he’s now holding up the deal with China and he’s only interested if China goes back to “that deal” before negotiations collapsed. He said, “it’s me right now that’s holding up the deal… We had a deal with China and unless they go back to that deal I have no interest.”

While Trump might meet Chinese President Xi at G20 in Osaka later this month, expectations are generally low. White House Acting Chief of Staff Mick Mulvaney it’s an opportunity to get talks “hard-wired again.” However, he added, “I do not see the president’s meeting as a deal closer.”

US Commerce Secretary Wilbur Ross also said “At the G20, at most it will be … some sort of agreement on a path forward, but certainly it’s not going to be a definite agreement. Though he added, “Eventually, this will end in negotiation. Even shooting wars end in negotiations.”

RBA rate cuts failed to lift consumer sentiments

Australia Westpac Consumer Confidence dropped -0.6 to 100.7 in June. Westpac noted that it’s a “disappointing result” given the RBA’s rate cut on June 4. Also, the results suggests “deepening concerns about the economy have outweighed the initial boost from lower rates. ” Looking at some details, economic expectations for the next 12 months dropped -4.7 to slightly pessimistic territory at 99.3. Though, House Price Expectations Index rose notably by 22.7 to 109.7, in clear response to the rate cut.

Westpac also said “initial sentiment reaction to the June rate cut will be somewhat disappointing for the Bank”. After disappointing Q1 GDP, RBA will need to “make a further downgrade to its growth forecasts”. And “the case for further policy easing remains clear”. Westpac expects another 25bps cut in August.

Elsewhere

China CPI accelerated to 2.7% yoy in May, up from 2.5% yoy. PPI slowed to 0.6% yoy, down from 0.9% yoy. Both matched expectations. Japan domestic CGPI rose 0.7% yoy in May, matched expectations. Machine orders rose 5.2% mom in April, much better than expectation of -0.8% mom contraction.

Looking ahead, US CPI will be the major focus. Headline CPI is expected to slow from 2.0% yoy to 1.9% yoy in May. CPI core is expected to be unchanged at 2.1% yoy.

AUD/USD Daily Outlook

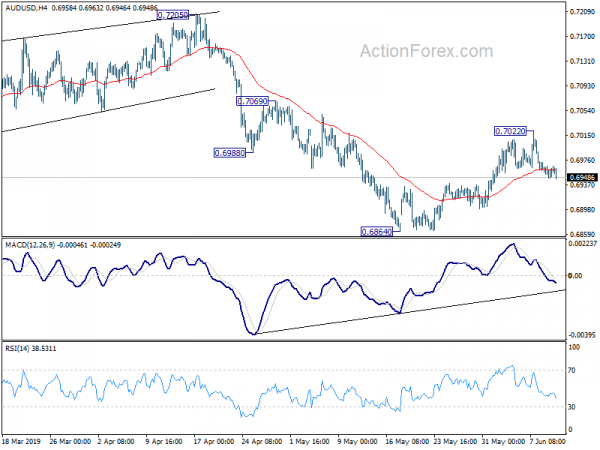

Daily Pivots: (S1) 0.6949; (P) 0.6958; (R1) 0.6969; More…

Intraday bias in AUD/USD remains mildly on the downside at this point. Corrective recovery from 0.6864 could have completed at 0.7022 already. Deeper fall would be seen back to retest 0.6864 low. Decisive break there will resume whole fall from 0.7295. On the upside, break of 0.7022 will resume the rebound to 0.7069 resistance instead.

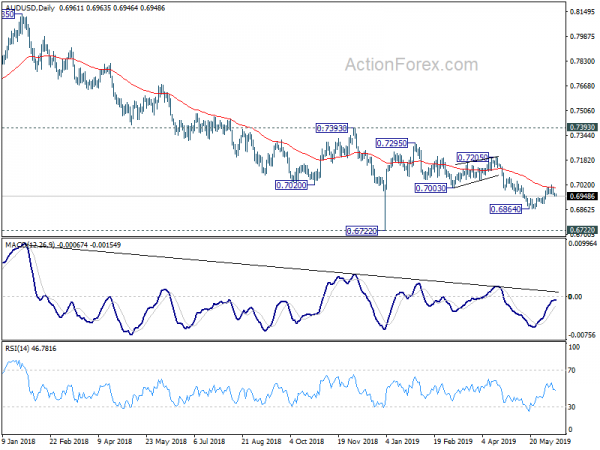

In the bigger picture, with 0.7393 key resistance intact, medium term outlook remains bearish. The decline from 0.8135 (2018 high) is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y May | 0.70% | 0.70% | 1.20% | 1.30% |

| 23:50 | JPY | Machine Orders M/M Apr | 5.20% | -0.80% | 3.80% | |

| 0:30 | AUD | Westpac Consumer Confidence Jun | -0.60% | 0.60% | ||

| 1:30 | CNY | CPI Y/Y May | 2.70% | 2.70% | 2.50% | |

| 1:30 | CNY | PPI Y/Y May | 0.60% | 0.60% | 0.90% | |

| 12:30 | USD | CPI M/M May | 0.10% | 0.30% | ||

| 12:30 | USD | CPI Y/Y May | 1.90% | 2.00% | ||

| 12:30 | USD | CPI Core M/M May | 0.20% | 0.10% | ||

| 12:30 | USD | CPI Core Y/Y May | 2.10% | 2.10% | ||

| 14:30 | USD | Crude Oil Inventories | 6.8M |