Global markets are dragged down by the steep decline in the Chinese Yuan today. Major European indices are all in deep red today, following the selloffs in Asia. DOW future is currently down over -1.4% or -370 pts. Treasury yields also suffer with German 10-year yield breaking -0.5 handle again. US 10-year yield is also sent below 1.8 handle. In the currency markets, Swiss Franc and Yen are among the strongest for today so far. Euro is a surprise as second strongest, probably as markets are expecting currency war between US and China. Meanwhile, Australian Dollar is the weakest one, followed by New Zealand and then Canadian.

Technically, EUR/USD”s break of 1.1162 resistance suggests short term bottoming at 1.1026. Stronger rebound could be seen to 1.1282 resistance or above. EUR/GBP’s break of 0.9190 resistance suggests rally resumption for 0.9305 key resistance. EUR/AUD also took out 1.6448 key resistance to resume recent rise for 1.6765. Though, EUR/CHF’s decline is still in progress, without clear loss of momentum.

In Europe, currently, FTSE is down -2.12%. DAX is down -1.59%. CAC is down -1.93%. German 10-year yield is down -0.0171 at -0.511. Earlier in Asia, Nikkei dropped -1.74%. Hong Kong HSI dropped -2.85%. China Shanghai SSE dropped -1.62%. Singapore Strait Times dropped -2.04%. Japan 10-year JGB yield dropped -0.0299 at -0.195.

Trump accuses China of currency manipulation

Chinese Yuan dropped sharply in Asian session, with USD/CNH hitting as high as 7.1111, staying comfortably above psychologically important 7 handle. The decline firstly argues that the Chinese government is seeing no need to keep Yuan exchange rate stable. Further, it’s a sign that Beijing is weaponizing the Yuan as a tool to offset the impact of tariffs in trade war.

Trump accused China for currency manipulation today, and with the same tweet, he also urged Fed to “listen” He said “China dropped the price of their currency to an almost a historic low. It’s called ‘currency manipulation.’ Are you listening Federal Reserve? This is a major violation which will greatly weaken China over time!” But it’s unsure what “historic low” he referred to.

On the other hand, China dismissed Trump’s claim that the country didn’t buy US agricultural products. A National Development and Reform Commission (NDRC) was reported saying that such accusation was “groundless”. The official noted China bought 130,000 tonnes of soybeans, 120,000 tonnes of sorghum, 60,000 tonnes of wheat, 40,000 tonnes of pork and products, and 25,000 tonnes of cotton from the United States between July 19 and August 2.

Also, the NDRC official also said China purchased 75,000 tonnes of hay, 5,700 tonnes of dairy products, 4,500 tonnes of processed fruits, and 400 tonnes of fresh fruits from the United States during the same period.

Eurozone Sentix dropped to -13.7, spectre of recession is going around

Eurozone Sentix Investor Confidence dropped to -13.7 in August, down from -5.8 and missed expectation of -7.0. That’s also the lowest level since October 2015. Current Situation Index dropped from 1.8 to -7.3, lowest sine January 2015. Expectations Index de August 2012.

Sentix warned that “the spectre of recession is going around.” It also said number of economists merely dismissed the deterioration as a “mood correction”. The current “manufacturing deterioration” is referred to as a “recession in the manufacturing sector” only, with “service sectors excluded. And it’s a “big mistake” from Sentix’s view.

For Germany, Overall Index dropped from -4.8 to -13.7, lowest since August 2009. Current Situation Index dropped from 7.0 to -5.5, lowest since March 2010. Expectations Index dropped from -16.0 to -21.5, lowest since July 2012.

Sentix said, “the former world champion exporter is feeling the effects of the backward roll of globalisation.” It also complained that the “entire political spectrum in Germany is discusses climate issues but “completely overlooks the fact that the economic climate is fading”.

Eurozone PMI Composite finalized at 51.5, scale of manufacturing downturn starting to overwhelm

Eurozone PMI Services was finalized at 53.2, down from 53.3, and June’s 53.6. PMI Composite was finalized at 51.5, down from 52.2. Looking at the member states, Germany PMI Composite dropped to 50.9, 73-month low. Italy hit 51.0, 4 -month high. Spain dropped to 51.7, 68-month low. France hit 51.9, 2-month low.

Chris Williamson, Chief Business Economist at IHS Markit said: “Trade war worries, slower economic growth, falling demand for business equipment, slumping auto sales and geopolitical concerns such as Brexit led the list of business woes, dragging manufacturing production lower at its fastest rate for over six years. While the service sector has helped offset the manufacturing downturn, growth also edged lower among service providers in July, meaning the overall pace of expansion of GDP signalled by the PMI has slipped closer to 0.1%.”

UK PMI services rose to 51.4, 9-month high, economy stagnating at start of Q3

UK PMI Services recovered to 51.4 in July, up from 50.2 and beat expectation of 50.4. That’s already the highest level since October 2018 even though rate of expansion remained subdued overall. Markit noted there was modest increase in service sector output. There was rebound in new work, helped by export sales. But business expectations eased to a four-month low.

Chris Williamson, Chief Business Economist at IHS Markit: “The latest PMI numbers are indicative of the economy stagnating at the start of the third quarter after indicating a 0.1% decline in the second quarter. Even growth in the service sector remains worryingly subdued, constrained by a marked fall in business services activity, where the rate of decline in July has been exceeded only once in the past ten years. The best performing sector was consumer services, highlighting how the economy remains dependent on consumer spending to avoid contraction.”

China Caixin PMI services dropped to 51.8, economic slowdown under control

China Caixin PMI Services dropped to 51.8 in July, down from 52.0 and missed expectation of 52.0. PMI Composite rose slightly from 50.6 to 50.9. Markit noted that manufacturing sector stabilized but service sector growth weakened further. Total new work expanded at a slightly faster pace. Also, optimism regarding future output improved to three- month high.

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said: “In general, China’s economy showed signs of recovery in July, thanks to large-scale tax and fee cuts, as well as ongoing support from monetary policy and government-driven infrastructure investment. It remains to be seen if the economic recovery can continue amid trade fictions with the U.S. and rigid regulations on the financial sector and debt levels. The recovery in July suggests that China’s economic slowdown is under control.”

Australia AiG Performance of Services dropped sharply to 43.9, largest monthly decline since 2018

Australia AiG Performance of Services dropped sharply to 43.9 in July, down from 52.2. The -8.3 pts fall is the largest monthly decline since July 2018. Reading below 50 signaled a return to contraction, as trading conditions for many businesses dived again.

Looking at some details, among the business-oriented sectors, only wholesale trade reported positive results. Among the consumer-oriented segments, the large ‘health, education & community services’ sector was strongest. The retail trade sector continued to perform very weakly.

Also from Australian, TD securities inflation gauge rose 0.3% mom in July.

RBA to stand pat tomorrow

Following two consecutive rate cuts, RBA is widely expected to leave the cash rate unchanged at 1.00% tomorrow. Incoming economic data since the last meeting have also supported the pause. Yet, given the aggressive target in the longer-term unemployment rate, downside risks to growth and ongoing uncertainty in the US- China trade war, another rate cut is still likely in 4Q19. We expect the members to open the door for further monetary easing at the meeting. More in RBA Preview – Pausing (Not Ending) after Two Consecutive Rate Cuts.

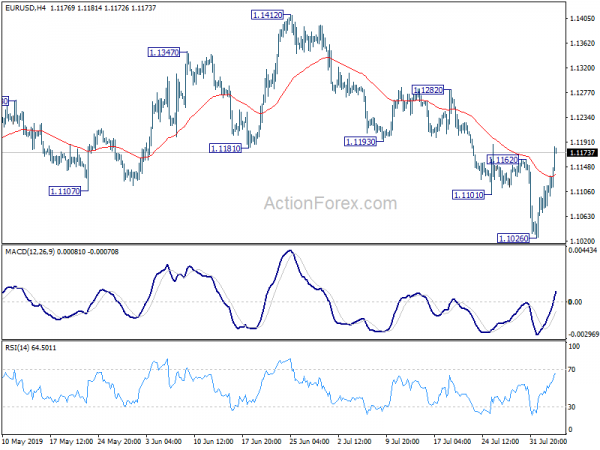

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1079; (P) 1.1098; (R1) 1.1125; More…..

EUR/USD’s rebound from 1.0126 extends higher today. Break of 1.1162 resistance suggests short term bottoming. Intraday bias is back on the upside for 55 day EMA (now at 1.1216) and above. But upside should be limited by 1.1282 resistance to bring fall resumption. On the downside, break of 1.1026 will extend the downtrend from 1.2555.

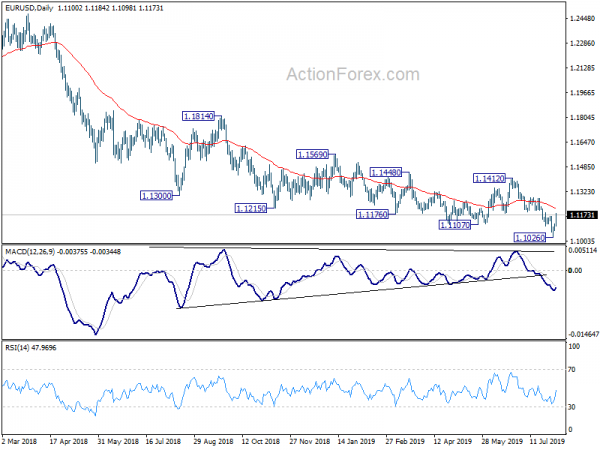

In the bigger picture, current development suggests that down trend from 1.2555 (2018) is in progress and extending. Prior rejection of 55 week EMA also maintained bearishness. Further fall should be seen to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Decisive break there will target 1.0339 (2017 low). On the upside, break of 1.1412 resistance is needed to indicate medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Service Index Jul | 43.9 | 52.2 | ||

| 1:00 | AUD | TD Securities Inflation M/M Jul | 0.30% | 0.00% | ||

| 1:45 | CNY | Caixin PMI Services Jul | 51.8 | 52 | 52 | |

| 5:45 | CHF | SECO Consumer Confidence Jul | -8 | -8 | -6 | |

| 6:30 | CHF | Retail Sales Real Y/Y Jun | 0.70% | -0.60% | -1.70% | -1.10% |

| 7:45 | EUR | Italy Services PMI Jul | 51.7 | 50.6 | 50.5 | |

| 7:50 | EUR | France Services PMI Jul F | 52.6 | 52.2 | 52.2 | |

| 7:55 | EUR | Germany Services PMI Jul F | 54.5 | 55.4 | 55.4 | |

| 8:00 | EUR | Eurozone Services PMI Jul F | 53.2 | 53.3 | 53.3 | |

| 8:30 | EUR | Eurozone Sentix Investor Confidence Aug | -13.7 | -7 | -5.8 | |

| 8:30 | GBP | Services PMI Jul | 51.4 | 50.4 | 50.2 | |

| 13:45 | USD | US Services PMI Jul F | 52.2 | |||

| 14:00 | USD | ISM Non-Manufacturing/Services Composite Jul | 55.5 | 55.1 |