Markets are generally steady so far today. The panic selloff overnight in the US wasn’t carried through to Asia. DOW had another worst day since Black Monday, getting practically no support from Fed’s all-in easing. In the currency markets, major pairs and crosses are staying inside yesterday’s range for now. Yen, Euro and Swiss Franc remain the strongest while Australian Dollar is leading commodity currencies lower.

Technically, gold is attempting a recovery after hitting as low as 1451.16, but struggling to stand above 1500 handle. Corrective fall from 1703.28 is still in progress. Gold could target key cluster level at 1365.26, 61.8% retracement of 1160.17 to 1703.28 at 1367.63, before bottoming. EUR/USD’s recovery appears to be limited below 1.1250 minor resistance. Further fall is mildly in favor through 1.1055 temporary low. Both development could revive strength in Dollar.

In Asia, Nikkei closed up 0.06%. Hong Kong HSI is up 0.38%. China Shanghai SSE is down -0.34%. Singapore Strait Times is down -0.47%. Japan 10-year JGB is down -0.0016 at 0.009. Overnight, DOW dropped 2997.10 pts or -12.93%. S&P 500 dropped -11.98%. NASDAQ dropped -12.32%. 10-year yield dropped -0.223 to 0.728.

RBA: Significant coronavirus effect on economy the more realistic scenario

Minutes of March 3 RBA meeting noted that “it was becoming increasingly clear that COVID-19 would cause major disruption to economic activity around the world”. The recent outbreak outside of China ” raised the prospect of a broader and more extended disruption to the global economy”.

The global development “was having a significant effect on the Australian economy, particularly in the education, transport and tourism sectors”. Uncertainty was also likely to “affect household spending and business investment in coming months.” Q1 GDP was likely to be “noticeably weaker than previously expected”.

Board members have considered a “number of scenarios” regarding monetary policy response to coronavirus outbreak. If the outbreak would be contained in the very near future, “maximum effect” of further stimulus would be felt in the “recovery phase”. However, this scenarios was considered “very unlikely, with the more realistic scenario being that the outbreak would have a significant effect on the Australian economy.”

RBA cut interest rate by 25bps to 0.50% at that meeting. Earlier on Monday, it indicated that there will be additional measures to be announced this coming Thursday. Markets generally expect another rate cut to bring the benchmark rate down to 0.25%.

New Zealand launches NZD 12.1B fiscal stimulus to cushion coronavirus impacts

New Zealand government announced a massive NZD 12.1B stimulus program to support the economy at the time of disruptions by coronavirus pandemic. That’s equivalent to 4% of the country’s GDP. The package includes NZD 2.8B in income support, NZD 5.1B in wage subsidy support, NZD 2.8B in business tax changes, NZD 500m support for aviation sector and NZD 600m boost for health services.

Finance Minister Grant Robertson said the economy is expected to fall -1% by Q1 if 2021 if the package is implemented, better than -3% without the support. He also told the parliament that recession was “almost certain” in New Zealand”. “We will have an extended period of deficits and our debt as a country will have to substantially increase,” he added.

BCC downgrades UK 2020 growth forecast to 0.8% on coronavirus impacts

The British Chambers of Commerce downgraded UK 2020 growth forecast due to disruption caused by the impact of coronavirus. GDP is now projected to growth 0.8% in 2020, lowered from prior forecast of 1.0%. That would be the weakest full growth growth since 1992, outside of 2008/09 financial crisis. Growth is than projected to pick up to 1.4% in 2021 and 1.6% in 2022.

Suren Thiru, Head of Economics at BCC, said: “Early evidence of disruption to supply chains and weakening in consumer demand and business activity could mean that even in the case of a temporary shock to the economy, there may be some long-term impact on economic output – particularly if significant action is needed to combat its spread.”

Adam Marshall, Director General, added: “Coronavirus could further weaken an already stagnant UK economy, as many businesses are starting to report an impact on their cashflow and growth prospects. The Chancellor and the Bank of England have responded to the immediate challenge with measures to help firms hit by Coronavirus, and they must now ensure this support gets to businesses as quickly as possible.

On the data front

Australia house price index rose 3.9% qoq in Q4, matched expectations. Japan industrial production was finalized at 1.0% mom in January. UK February job data are featured in European session. But the bigger surprise could come from March German ZEW economic sentiment. Later in the day, Canada will release manufacturing sales and foreign securities purchases. US will release retail sales, industrial production, business inventories and NAHB market index.

EUR/USD Daily Outlook

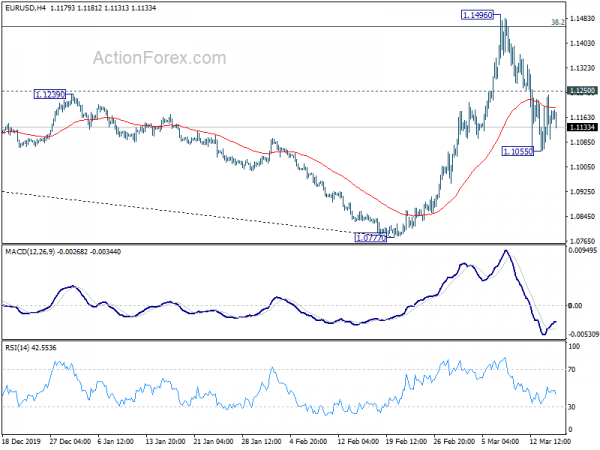

Daily Pivots: (S1) 1.1084; (P) 1.1160; (R1) 1.1247; More…

Intraday bias in EUR/USD remains neutral for the moment. Further fall is mildly in favor with 1.1250 minor resistance intact. On the downside, below 1.1055 will reaffirm the case that rebound from 1.0777 has completed at 1.1496. Intraday bias will be back to the downside for retesting 1.0777. On the upside, however, above 1.1250 minor resistance will turn bias to the upside for 1.1496 resistance again.

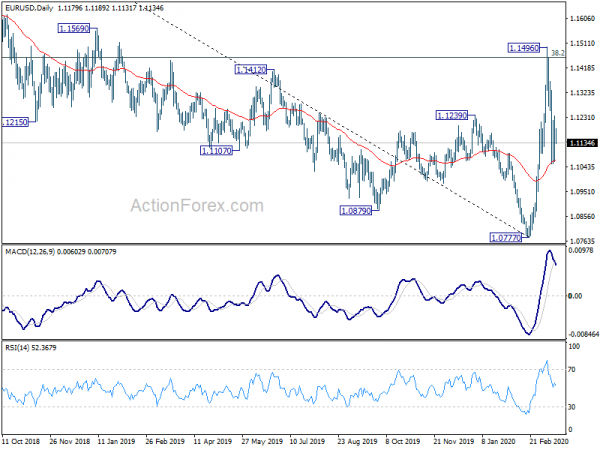

In the bigger picture, rebound from 1.0777 low faced heavy rejection from 38.2% retracement of 1.2555 to 1.0777 at 1.1456, as well as 55 month EMA. The development argues that price actions from 1.0777 medium term pattern are just corrective the down trend from 1.2555 (2018 high). Further decline is in favor to retest 1.0339 (2017 low). Nevertheless, sustained break of 1.1456 will raise the chance of medium term bullish reversal and target 61.8% retracement at 1.1876.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | House Price Index Q/Q Q4 | 3.90% | 3.90% | 2.40% | |

| 0:30 | AUD | RBA Minutes | ||||

| 4:30 | JPY | Industrial Production M/M Jan F | 1.00% | 0.80% | 0.80% | |

| 6:45 | CHF | SECO Economic Forecasts | ||||

| 9:30 | GBP | Claimant Count Change Feb | 6.2K | 5.5K | ||

| 9:30 | GBP | Claimant Count Rate Feb | 3.40% | |||

| 9:30 | GBP | ILO Unemployment Rate (3M) Jan | 3.80% | 3.80% | ||

| 9:30 | GBP | Average Earnings Excluding Bonus 3M/Y Jan | 3.30% | 3.20% | ||

| 9:30 | GBP | Average Earnings Including Bonus 3M/Y Jan | 3.00% | 2.90% | ||

| 10:00 | EUR | Germany ZEW Economic Sentiment Mar | -23.4 | 8.7 | ||

| 10:00 | EUR | Germany ZEW Current Situation Mar | -25 | -15.7 | ||

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Mar | 35.4 | 10.4 | ||

| 12:30 | CAD | Manufacturing Sales M/M Jan | -0.70% | |||

| 12:30 | CAD | Foreign Securities Purchases (CAD) Jan | -9.57B | |||

| 12:30 | USD | Retail Sales M/M Feb | 0.20% | 0.30% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Feb | 0.30% | 0.30% | ||

| 13:15 | USD | Industrial Production M/M Feb | 0.40% | -0.30% | ||

| 13:15 | USD | Capacity Utilization Feb | 77.00% | 76.80% | ||

| 14:00 | USD | Business Inventories Jan | 0.00% | 0.10% | ||

| 14:00 | USD | NAHB Housing Market Index Mar | 74 | 74 |