While risk market retreats mildly, the developments in currency markets are unchanged. New Zealand and Australian Dollar remain the strongest one for now. In particular, Kiwi is lifted a bit further by RBNZ governor’s comment that it doesn’t want to go to negative rates for now. Aussie somewhat shrugs off expectedly poor April retail sales data. On the other hand, Yen and Dollar remain the weakest one and stays generally pressured. The next move will remain heavily dependent on overall risk sentiments.

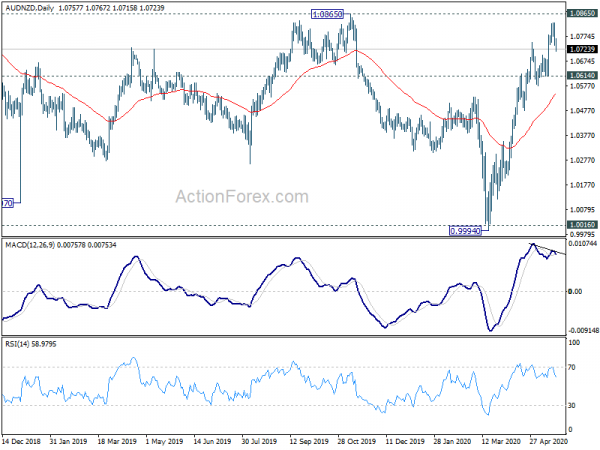

Technically, AUD/NZD is a pair to watch for the near term. It’s apparently losing upside momentum ahead of 1.0865 resistance, with bearish divergence condition in daily MACD. Focus is back on 1.0614 support and break will indicate short term topping and bring deeper pull back. In that case, we’d see Aussie underperform Kiwi for the near term. EUR/CHF turned sideway after spiking higher to 1.0662 earlier this week. As long as 1.0578 minor support holds, further rise should be seen to 1.0710 key cluster resistance. Firm break there will be a important sign of medium reversal. but a break of 1.0578 will dampen the bullish case and turn focus back to 1.0503 low.

In Asia, currently, Nikkei is up 0.97%. Hong Kong HSI is down -0.10%. China Shanghai SSE is down -0.45%. Singapore Strait Times is down -0.93%. Japan 10-year JGB yield is up 0.0001 at 0.001. Overnight, DOW dropped -1.59%. S&P 500 dropped -1.05%. NASDAQ dropped -0.54%. 10-year yield dropped -0.033 to 0.711.

US CBO: Labor market to materially improve after Q3

US Congressional Budget Office said in a report yesterday the economy is expected to “begin recovery during the second half of 2020”. Labor market is projected to “materially improve after the third quarter”. Though, “the persistence of social distancing will keep economic activity and labor market conditions suppressed for some time.”

In the new projections, GDP would contract by an annualized rate of -37.7% in Q2. Though, the economy is expected to pick up during H2 and rebound by averaged annualized rate of 15.8%. For 2020 as a whole, GDP could contract by -5.6% in 2020, followed by 4.2% growth in 2021.

Unemployment rate is projected to peak at an average of 15.8% in Q3. At the mean time, participation rate, has already dropped by -3.2% to 60.2% in April. It’s expected to recovery slightly to 61.1% in Q3 only, and edge further higher to 61.5% in 2021.

Fed Rosengren: Unemployment will remain at double-digit by year end

Boston Fed President Eric Rosengren said yesterday that unemployment will likely “peak at close to 20%” in the US. “Unfortunately, even by the end of the year, I expect the unemployment rate to remain at double-digit levels.” He emphasized that “public health solutions are paramount”. Without them, it will be “virtually impossible to return to full employment”.

He added that the Main Street Lending Program, which is expected to open in the coming weeks, is an “important program”. “It will not be able to assist everyone, but we expect that it will provide an important bridge for many businesses that employ much of the American workforce,” he added.

BCC: Only 37% UK firms can fully restart with workplace safety guidance

According to the coronavirus business impact tracker of the British Chambers of Commerce, only 37% of firms said they can “fully restart” operations while implementing the government’s coronavirus workplace safety guidance. 45% said they can “partially restart”.

BCC Director General Adam Marshall said: “Companies at all levels of readiness to restart, of all sizes, and in every part of the UK will need sustained government support as they navigate the ‘new normal’ with reduced demand and restrictions still in place. Many support schemes will need to be adapted and updated, but must not be withdrawn prematurely.”

Australia retail sales dropped record -17.9 in April, falls in every industry

According to preliminary data, Australia retail sales dropped -17.9% mom in April. That’s the biggest seasonally adjusted fall on record, and came after the biggest jump in March. Comparing to a year ago, retail turnover dropped -9.4% yoy. Falls were seen in every industry, with particularly strong falls in food retailing, cafes, restaurants and takeaways, and clothing, footwear and personal accessories.

Westpac-Melbourne Institute Leading Index dropped form -2.34 to -5.16 in April. The indicator points to a “broad-based economic contraction”. This is “easily the weakest reading since the GFC and is comparable to readings seen prior to Australia’s recessions in the 1990–91, 1982–83, 1974–75 and 1960–61.”

Westpac also said, ‘we do not expect the economy to return to pre-Coronavirus levels of activity before 2022.” But for now, RBA has already indicated that it’s “committed to maintaining its significant support for the economy for the foreseeable future.”

RBNZ Orr prepared to go to negative rate but a lot later

RBNZ Governor Adrian Orr said in a Bloomberg interview today that he’s currently “targeting a low and flat yield curve through the purchases bonds.” The central bank “does not want to go to negative rate at this point”. It’s “prepared to go to negative rate but a lot later” And it remains one option for RBNZ.

Also, he reiterated the view that “the operational challenge still remains with some banks still working on being able to actually operate with negative official cash rate and negative wholesale rates”.

Looking ahead

Inflation data will be a major focus today. UK Will release April CPI, RPI and PPI. Eurozone will release April CPI final and March current account. Canada will release April CPI too. Fed will release FOMC minutes.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6503; (P) 0.6544; (R1) 0.6578; More…

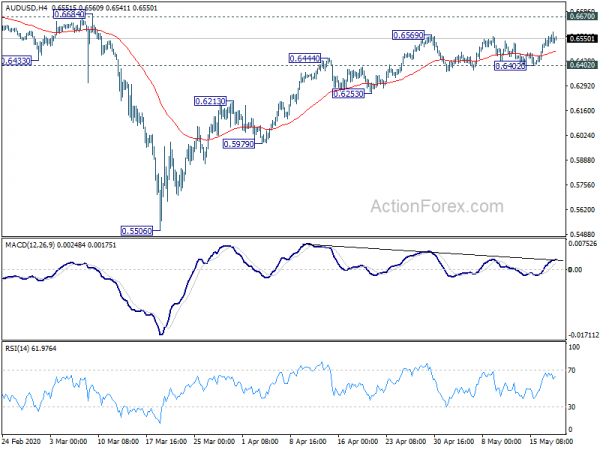

AUD/USD’s breach of 0.6569 suggests resumption of whole rebound from 0.5506. Intraday bias is back on the upside for 0.6670 key resistance. Considering bearish divergence in 4 hour MACD, we’d expect upside to be limited there, at least on first attempt, to bring pull back. On the downside, break of 0.6402 support will indicate short term topping and turn bias to the downside for 0.6253 support.

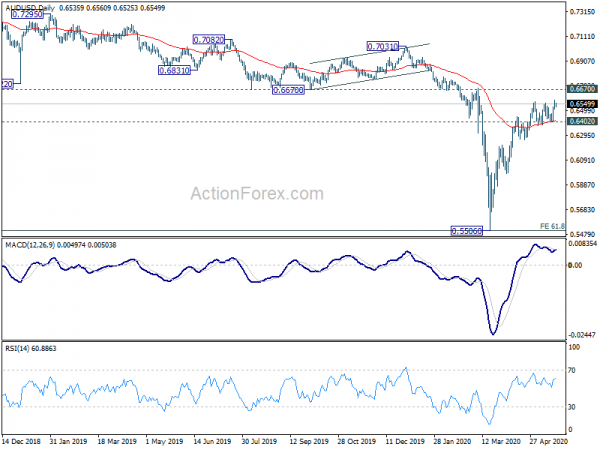

In the bigger picture, there is no clear sign of trend reversal yet. The larger down trend from 1.1079 (2011 high) is still in favor to extend. 61.8% projection of 1.1079 to 0.6826 from 0.8135 at 0.5507 is already met. Sustained break there will pave the way to 0.4773 (2001 low). On the upside, however, sustained break of 0.6607 will suggest medium term bottoming and turn focus to 0.7031 resistance next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machinery Orders M/M Mar | -0.40% | -7.10% | 2.30% | |

| 00:30 | AUD | Westpac Leading Index M/M Apr | -1.50% | -0.80% | -0.70% | |

| 06:00 | GBP | CPI M/M Apr | -0.10% | 0.00% | ||

| 06:00 | GBP | CPI Y/Y Apr | 0.90% | 1.50% | ||

| 06:00 | GBP | Core CPI Y/Y Apr | 1.40% | 1.60% | ||

| 06:00 | GBP | RPI M/M Apr | 0.10% | 0.20% | ||

| 06:00 | GBP | RPI Y/Y Apr | 1.60% | 2.60% | ||

| 06:00 | GBP | PPI Input M/M Apr | -3.70% | -3.60% | ||

| 06:00 | GBP | PPI Input Y/Y Apr | -8.40% | -2.90% | ||

| 06:00 | GBP | PPI Output M/M Apr | -0.40% | -0.20% | ||

| 06:00 | GBP | PPI Output Y/Y Apr | -0.40% | 0.30% | ||

| 06:00 | GBP | PPI Output Core M/M Apr | -0.10% | 0.30% | ||

| 06:00 | GBP | PPI Output Core Y/Y Apr | 0.60% | 0.90% | ||

| 08:00 | EUR | Eurozone Current Account (EUR) Mar | 40.2B | |||

| 09:00 | EUR | Eurozone CPI M/M Apr F | 0.30% | 0.50% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Apr F | 0.90% | 0.90% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Apr F | 0.40% | 0.40% | ||

| 12:30 | CAD | Wholesale Sales M/M Mar | -4.50% | 0.70% | ||

| 12:30 | CAD | CPI M/M Apr | -0.40% | -0.60% | ||

| 12:30 | CAD | CPI Y/Y Apr | -0.10% | 0.90% | ||

| 12:30 | CAD | CPI Common Y/Y Apr | 1.70% | 1.70% | ||

| 12:30 | CAD | CPI Median Y/Y Apr | 1.90% | 2.00% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Apr | 1.80% | 1.80% | ||

| 14:00 | EUR | Eurozone Consumer Confidence May P | -23 | -23 | ||

| 14:30 | USD | Crude Oil Inventories | 1.7M | -0.7M | ||

| 18:00 | USD | FOMC Minutes |