The forex markets turned mixed today, together with major Asian indices. Dollar and Yen are trying to recover but there isn’t any conviction in buying. Both remain the worst performing ones for the week so far. News regarding lockdown exits and coronavirus vaccines were generally welcomed. But investors are turning a bit more cautious, awaiting further development in the US-China-Hong Kong tensions. US President Donald Trump indicated something “very powerful” is underway regarding their response to China’s push for national security laws in Hong Kong. We’ll what those response would be, before the end of the week.

Technically, the greenback’s development against commodity currencies would be a major focus for now. AUD/USD is pressing 0.6670 key resistance level and sustained break there could raise the chance of medium term reversal. At least, 0.7031 resistance will be the next target. USD/CAD is also pressing 1.3762 fibonacci support and break will also raise the chance of medium term bearish reversal and put 1.3664 key resistance turned support into focus.

In Asia, Nikkei closed up 0.70%. Hong Kong HSI is down -0.90%. China Shanghai SSE is down -0.36%. Singapore Strait Times is down -0.55%. Japan 10-year JGB yield is down -0.0021 at 0.001. Overnight, DOW rose 2.17%. S&P 500 rose 1.23%. NASDAQ rose 0.17%. 10-year yield rose 0.041 to 0.698.

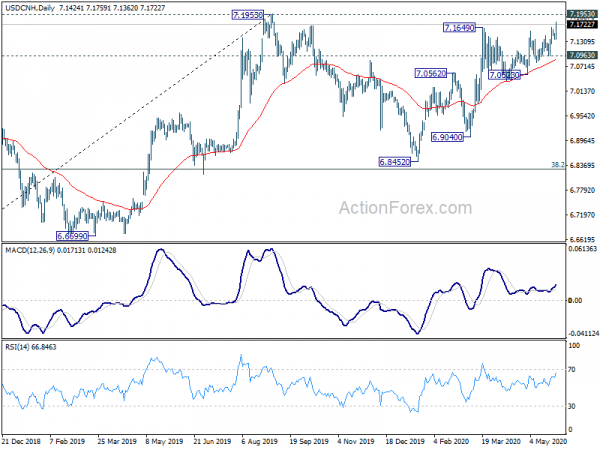

Yuan falling towards key support with eyes on China-Hong Kong-US relations

Chinese Yuan weakens further against the Dollar today and tensions heighten over the situations in Hong Kong. The new national security law on Hong Kong is expected to be passed on May 28, by passing the city’s own legislature, by the rubber-stamp Congress of China. It’s widely seen as a move that violates the “one country, two systems” principle that jeopardize the city’s global status.

Ahead of that, US President Donald Trump indicated some “very powerful” measures in response to China’s move regarding Hong Kong. He told reporters yesterday, “we’re doing something now. I think you’ll find it very interesting. But I won’t be talking about it today… It’s something you’re going to be hearing about over the next — before the end of the week.. Very powerfully, I think.”

The measures by the Trump could involve triggering the Hong Kong Human Rights and Democracy Act, passed last year, to sanction some Chinese and Hong Kong officials, as well as businesses. More important, the US could suspending Hong Kong’s special trade status.

At the same time, protests are going on in Hong Kong today against the new national anthem bill. The Hong Kong Bar Association warned that parts of the bill “deviate from the good traditions” of Hong Kong’s common law system”. It’s seen by some legal experts that the laws looked like they’re written in Beijing, for implementing Chinese styles rules.

USD/CNH’s breaks 7.1649 resistance today and hits as high as 7.1759 so far. While further rise cannot be ruled out, technically, we’d still expect strong resistance from 7.1953 high to limit upside. Break of 7.0963 support should indicate short term topping, and bring deeper fall to extend the consolidation pattern from 7.1953. However, sustained break of 7.1953 would firstly resume medium term up trend. More importantly, that would be a strong signal of further deterioration in US-China tensions.

ECB Schnabel ready to expand any tools if further stimulus is needed

Markets are expecting ECB to expand its Pandemic Emergency Purchase Program next week. ECB Executive Board member Isabel Schnabel said, “one number . . . of particular interest is the evolution of the medium-term inflation outlook. If we see that the situation has deteriorated, and if we judge that further stimulus is needed then the ECB will be ready to expand any of its tools in order to achieve its price stability objective.”

In the same interview by Financial Times, she added the board is “not adjusting our monetary policy in any way in response” German constitutional court’s ruling against its QE program. “We have to avoid a situation in which one national central bank cannot participate in our asset purchase programmes,” she added. “I’m sure there is going to be communication between the Bundesbank and the German parliament and the German government, and one will have to find a solution”.

“Germany is one of the countries that has benefited a lot from the euro and therefore it shouldn’t be the country that is most critical about it,” she criticized. “Many of the narratives that are very popular in Germany cannot be maintained because they simply do not match the facts.”

Poloz: BoC has tools to deliver further monetary stimulus if needed

Outgoing BoC Governor Stephen Poloz said that to bring inflation back to target, “it is necessary to stabilize the economy and then return economic output and employment to their potential”. He also told the Senate’s finance committee, “If further monetary stimulus is required to meet our inflation targets, the bank has tools available to deliver that stimulus”. But negative rates would only be needed in extreme conditions.

It’s Poloz’s last public appearance as Governor before retiring next week. Former Senior Deputy Governor and Dean of the Rotman School of Management Tiff Macklem will take up the job then.

RBNZ Orr: Banking system has significant capital and liquidity buffers

RBNZ Governor Adrian Orr said that the “significant capital and liquidity buffers” built up in the banking system before the coronavirus pandemic “buffers can now be used to support their customers’ long-term economic future”. Stress tests suggest that banks “banks can continue to lend and prosper through a broad range of adverse scenarios.”

Deputy Governor Geoff Bascand also said the Bank and the Government have been working with in number of initiatives to support the flow of lending and functioning of the financial system. “Our actions have included making bank funding plentiful and cheap, facilitating the deferral of loan payments, and ensuring cash was readily accessible nationwide,” he added.

On the data front

Australia construction work done dropped -1.0% in Q1, matched expectations. Swiss will release ZEW expectations. Fed will release Beige Book economic report. Otherwise, the calendar is pretty empty.

USD/CHF Daily Outlook

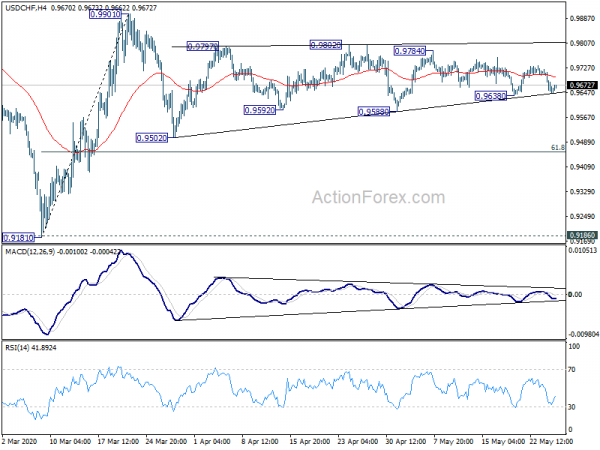

Daily Pivots: (S1) 0.9628; (P) 0.9674; (R1) 0.9702; More…

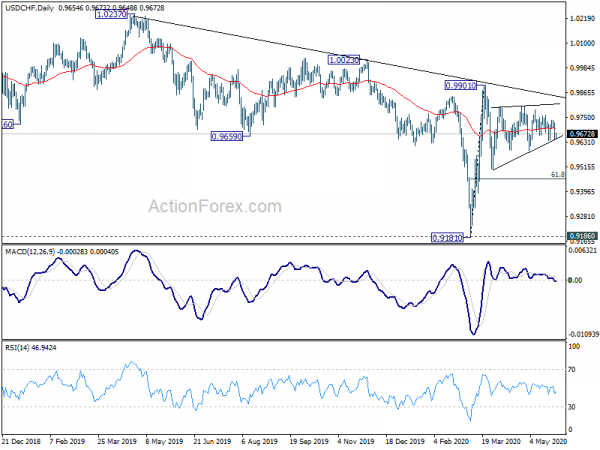

USD/CHF recovers ahead of 0.9638 support and intraday bias remains neutral first. On the downside, break of 0.9638 will extend the corrective pattern from 0.9901 with another fall, to 0.9588 support and below. But downside should be contained by 61.8% retracement of 0.9181 to 0.9901 at 0.9456 to rebound. On the upside, break of 0.9784 resistance will target a test on 0.9901 high.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). It could have completed at 0.9181 after hitting 0.9186 key support (2018 low). Break of 0.9901 will extend the rebound form 0.9181 through 1.0023 resistance. After all, medium term range trading will likely continue between 0.9181/1.0237 for some more time.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | RBNZ Financial Stability Report | ||||

| 01:30 | AUD | Construction Work Done Q1 | -1.00% | -1.00% | -3.00% | -2.90% |

| 08:00 | CHF | ZEW Expectations May | 12.7 | |||

| 18:00 | USD | Fed’s Beige Book |