Dollar and Yen recover some ground in Asian session but it’s unsure if this week’s pull back is completed yet. There were little reactions to the President debate of Donald Trump and Joe Biden. Asian markets are mixed despite some solid data out of China. DOW future is currently down around -200 pts but it’s still long a way to open. Focus will, for now, turn back to economic data, starting with ADP employment today, ISM manufacturing tomorrow, and then the big event of non-farm payrolls on Friday.

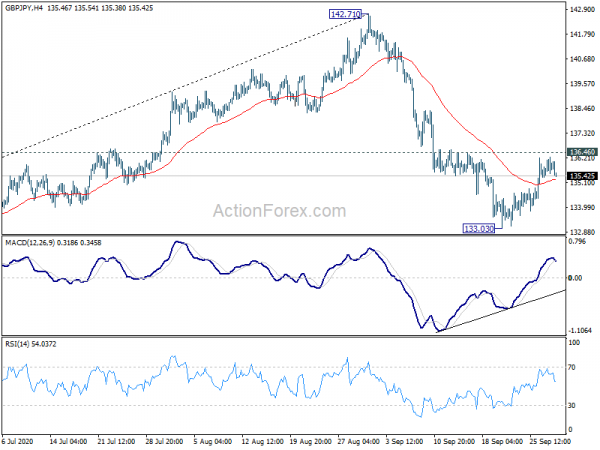

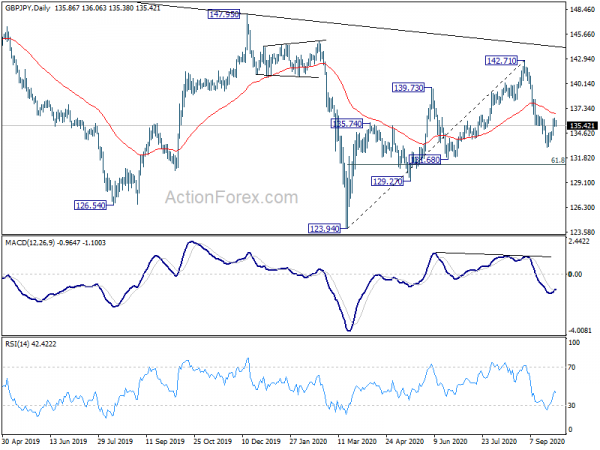

Technically, EUR/USD breached 1.1752 resistance while USD/CHF breached 0.9200 support. But there was no follow through selling in Dollar yet. Meanwhile, EUR/JPY retreats just ahead of 124.31 resistance, same for GBP/JPY on 136.46 resistance. There is no confirmation that this week’s pullbacks in Dollar and Yen are turning into near term reversal. These levels will be the focuses for the rest of the week.

In Asia, currently, Nikkei is down -1.18%. Hong Kong HSI is up 1.10%. China Shanghai SSE is up 0.18%. Singapore Strait Times is down -0.16%. Japan 10-year yield is up 0.0009 at 0.021. Overnight, DOW dropped -0.48%. S&P 500 dropped -0.48%. NASDAQ dropped -0.29%. 10-year yield dropped -0.018 to 0.645.

China PMI manufacturing rose slightly to 51.5, Caixin PMI edged down to 53.0

China’s NBS PMI Manufacturing rose slightly to 51.5 in September, up from 51.0, above expectation of 51.2. NBS PMI Non-Manufacturing rose to 55.9, up from 55.2, above expectation of 54.6. “Although overall manufacturing demand has improved, the industry has recovered unevenly,” said Zhao Qinghe, an NBS official. “In addition, the global epidemic has not yet been fully and effectively controlled, and there are still uncertain factors in China’s imports and exports.”

Caixin PMI Manufacturing dropped slightly by -0.1 pts to 53.0, missed expectation of 53.1. Output growth eases but remains marked. There is sharper increase in total new work as export sales rebound. Staffing levels stabilize, ending at eight-month period decline.

Wang Zhe, Senior Economist at Caixin Insight Group said: “The sharp rise in overseas demand has complemented the domestic market… The strength of the manufacturing sector will take some of the pressure off policymakers going forward. However, the job market remains worrisome, as the improvement in employment relies on a longer-term economic recovery and a more stable external environment.”

Japan industrial production rose 1.7% mom, retail sales dropped -1.9% yoy

Japan industrial production rose 1.7% mom in August, above expectation of 1.5% mom. That’s also the third straight month of growth, as boosted by automobiles and car parts, as well ass iron, steel and non-ferrous metals. Shipments rose 2.1% mom. Inventories dropped -1.4%. Inventory ratio dropped -2.5%. Over the year, production was down -13.3% yoy.

On the other hand, retail sales dropped -1.9% yoy in August, better than expectation of -3.5% yoy. But that’s still the sixth consecutive month of decline, highlighting the weak recovery in consumer demand.

New Zealand ANZ business confidence rose to -28.5, but activity remain very subdued

New Zealand ANZ Business Confidence rose to -28.5 in September, up from August’s -41.8, but revised down from preliminary reading of -26.0. All sectors stayed negative with Agriculture at -72.2 and services at -31.7. Own Activity Outlook improved to -5.4, up from August’s -17.5, revised up from preliminary reading of -9.9. Agriculture activity was positive at 13.6 and contraction at 10.8. Services activity was worse at -12.1.

ANZ said business “appear relatively optimism”. But “as a reality check, though, the levels of most activity indicators remain very subdued relative to pre-COVID days, and are still at levels regrettably reminiscent of 2009.”

Also released from down under, New Zealand building permits rose 0.3% mom in August, versus expectation of -1.4% mom. Australia building permits dropped -1.6% mom, versus expectation of 0.1% mom in August. Australia private sector credit rose 0.0% mom in August, versus expectation of 0.2% mom.

Fed Williams: It’s a matter of fiscal policy that tilts the economic trajectory

New York Fed President John Williams said the economy is on a “pretty good trajectory”. And, “it’s really a matter of if there’s more or less fiscal policy that maybe tilts that trajectory”. He expects the economy to be back close to full employment in “about three years time”, but “there’s clearly a lot of unknowns”.

On Fed’s average inflation targeting, “we’re purposely overshooting that moderately for some time to get that balance,” he said. “To me, success is not some arithmetic or some formula but it’s really this notion of inflation expectations, how people think about what’s inflation going to be in the future.”

Dallas Fed President Robert Kaplan said in an essay that 2020 GDP is expected to show a contraction of approximately -3.0%. The economy would then growth by roughly 3.5% in 2021. But he emphasized the need of “additional” fiscal measures. “Lack of additional fiscal relief would create a key downside risk to my economic forecast for 2020 and 2021.”

BoE Bailey: No judgement on whether to use negative interest rates yet

BoE Governor Andrew Bailey said in a speech to Queen’s University Belfast that the economy has performed a bit stronger than expected. However, there are signs that recovery might not be as strong going forward. In Q3, economic activity was around -7% to -10% lower than pre-pandemic levels. Risks include COVID, Brexit talks, US-China relationship.

On monetary policy he emphasized it’s “critically important that the BoE’s can use all its tools to support the economy.” The central bank is “not out of ammunition on QE”, and it can also use “forward guidance”.

“Negative interest rates are in the BoE’s toolbox, have not reached judgement on whether or when to use them,” he added. “We do not rule out using negative interest rates but are realistic about challenges from banking retail deposits.”

Looking ahead

Germany import price, retail sales and unemployment will be released in European session. France will release CPI. Swiss will release KOF economic barometer and Credit Suisse economic expectations. UK will release Q2 GDP final. Later in the day, Canada will release GDP. US will release ADP employment, Q2 GDP final, Chicago PMI and pending home sales.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 135.43; (P) 135.85; (R1) 136.27; More…

GBP/JPY’s rebound from 133.03 is still in progress but fails to take out 136.46 resistance so far. Intraday bias remains neutral and further decline is in favor. On the downside, break of 133.03 will resume the fall from 142.71 and target 61.8% retracement of 123.94 to 142.71 at 131.11 next. However, firm break of 136.46 will indicate short term bottoming and turn bias back to the upside for stronger rebound.

In the bigger picture, rise from 123.94 is seen only as a rising leg of the sideway consolidation pattern from 122.75 (2016 low). As long as 147.95 resistance holds, an eventual downside breakout remains in favor. However, firm break of 147.95 will raise the chance of long term bullish reversal. Focus will then be turned to 156.59 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Aug | 0.30% | -1.40% | -4.50% | -4.60% |

| 23:01 | GBP | BRC Shop Price Index Y/Y Aug | -1.60% | -1.60% | ||

| 23:50 | JPY | Industrial Production M/M Aug P | 1.70% | 1.50% | 8.70% | |

| 23:50 | JPY | Retail Trade Y/Y Aug | -1.90% | -3.50% | -2.90% | |

| 0:00 | NZD | ANZ Business Confidence Sep | -28.5 | -26 | ||

| 1:00 | CNY | Manufacturing PMI Sep | 51.5 | 51.2 | 51 | |

| 1:00 | CNY | Non-Manufacturing PMI Sep | 55.9 | 54.6 | 55.2 | |

| 1:30 | AUD | Private Sector Credit M/M Aug | 0.00% | 0.20% | -0.10% | |

| 1:30 | AUD | Building Permits M/M Aug | -1.60% | 0.10% | 12.00% | 12.20% |

| 1:45 | CNY | Caixin Manufacturing PMI Sep | 53 | 53.1 | 53.1 | |

| 5:00 | JPY | Housing Starts Y/Y Aug | -10.90% | -11.40% | ||

| 6:00 | EUR | Germany Import Price Index M/M Aug | 0.00% | 0.30% | ||

| 6:00 | EUR | Germany Retail Sales M/M Aug | 0.40% | -0.90% | ||

| 6:00 | GBP | GDP Q/Q Q2 F | -20.40% | -20.40% | ||

| 6:00 | GBP | Current Account (GBP) Q2 | -1.4B | -21.1B | ||

| 6:45 | EUR | France CPI M/M Sep P | -0.10% | -0.10% | ||

| 6:45 | EUR | France CPI Y/Y Sep P | 0.30% | 0.20% | ||

| 6:45 | EUR | France Consumer Spending M/M Aug | -0.10% | 0.50% | ||

| 7:00 | CHF | KOF Economic Barometer Sep | 106 | 110.2 | ||

| 8:00 | CHF | Credit Suisse Economic Expectations Sep | 45.6 | |||

| 8:55 | EUR | Germany Unemployment Change Sep | -9K | -9K | ||

| 8:55 | EUR | Germany Unemployment Rate Sep | 6.40% | 6.40% | ||

| 12:15 | USD | ADP Employment Change Sep | 650K | 428K | ||

| 12:30 | USD | GDP Annualized Q2 F | -31.70% | -31.70% | ||

| 12:30 | USD | GDP Price Index Q2 F | -2.00% | -2.00% | ||

| 12:30 | CAD | GDP M/M Jul | 2.90% | 6.50% | ||

| 13:45 | USD | Chicago PMI Sep | 52 | 51.2 | ||

| 14:00 | USD | Pending Home Sales M/M Aug | 3.10% | 5.90% | ||

| 14:30 | USD | Crude Oil Inventories | -1.6M |