US stocks surged to new record overnight, shrugging off FOMC minutes. But Asian markets are walking another path, as led by the free fall in Hong Kong stocks. Yen surges broadly on risk aversion, followed by Swiss Franc. Commodity currencies are generally pressured, with Aussie weighed down by dovish RBA comments too. Euro, Sterling and Dollar are mixed for the moment, awaiting ECB minutes for more guidance.

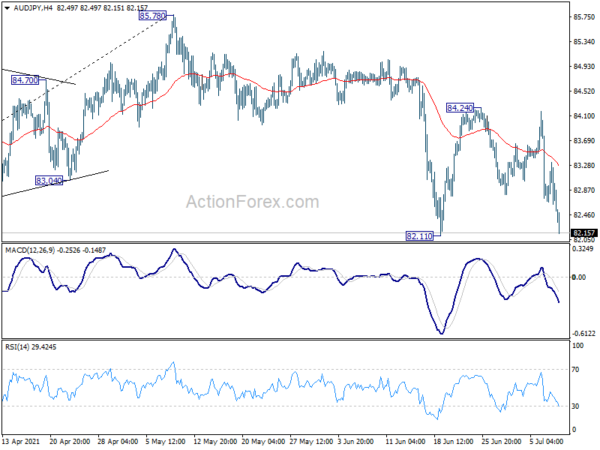

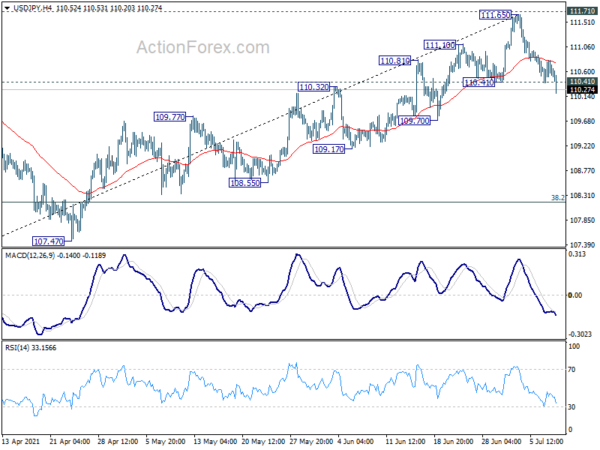

Technically, USD/JPY’s break of 110.41 support suggest rejection by 111.71 key medium term resistance. It’s also a very early sign of larger bearish reversal. Immediate focus will be on 130.02 support in EUR/JPY to double confirm near term bearishness in Yen crosses. Similarly, AUD/JPY is now eyeing 82.11 support and break will resume the whole fall from 85.78.

In Asia, Nikkei closed down -0.68%. Hong Kong HSI is down -2.40%. China Shanghai SSE is down -0.78%. Singapore Strait Times is down -0.55%. Japan 10-year JGB yield is down-0.0060 at 0.031. Overnight, DOW rose 0.30%. S&P 500 rose 0.34%> NASDAQ rose 0.01%. 10-year yield dropped to as low as 1.296, before closing down -0.049 at 1.321.

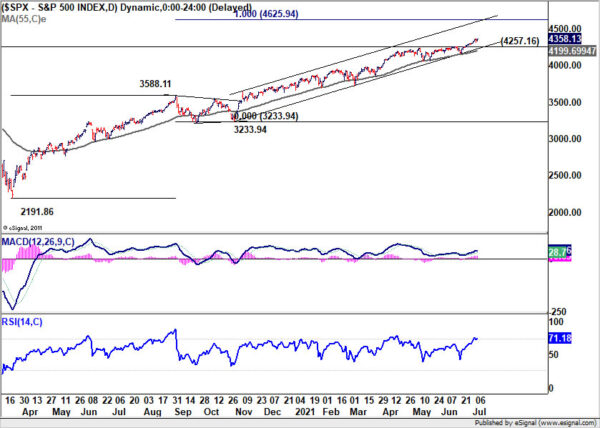

S&P 500 hit new records, shrugs off FOMC minutes

US stocks regained bullishness overnight, with S&P 500 and NASDAQ closing at new record highs. FOMC minutes noted that tapering of asset purchases would happen “somewhat earlier” than expected, after seeing more data over the “coming months”. Meanwhile, rate hike could also come “somewhat earlier” than expected. The overall messages were largely consistent with the prior statement and projections.

Suggested readings on FOMC minutes:

- FOMC Minutes Reveals that QE Tapering to Begin Later this Year

- FOMC Minutes: More Details From The Fed, But No More Clarity

- (FED) Minutes of the Federal Open Market Committee

S&P 500 rose 0.34% or 14.59 pts to close at 4358.13. The current medium term up trend is still on track to 100% projection of 2191.86 to 3588.11 from 3233.94 at 4625.94. In any case, near term outlook will stays bullish as long as 4257.16 support holds, in case of retreat.

Hong Kong stocks in free fall on fear of more regulatory crackdown

While US stocks were strong, Asian markets are trading notably lower today, as led by the free fall in Hong Kong. Selloff in Chinese tech stocks intensified after the Chinese government announced a step up in oversight on Chinese stocks listing in the US. The announcement came just after the surprised crackdown on ride-hailing giant Didi, days after it’s mega IPO last week.

At the time of writing, HSI is down -2.5%. Considering the downside momentum, the break of 38.2.% retracement of 21139.26 to 31183.35 at 27346.50 is starting to make outlook bearish. Focus is now on 26782.61 resistance turned support. Sustained break there will suggest that whole rise from 21139.26 has completed at 31183.35 in a corrective three-wave structure. That would at least open up a bearish case for 61.8% retracement at 24976.10 and below.

RBA Lowe wants to see results, not forecast, for rate hikes

In a speech, RBA Governor Philip Lowe said, it is “not enough” for inflation to be “forecast” in the rate of 2-3% target for the central bank to lift interest rates. He emphasized, “We want to see results before we change interest rates”. Also, “the bond purchases will end prior to any increase in the cash rate”.

He added that for inflation be sustainably in target rate, it’s like that “wage growth will need to exceed 3 per cent”. It will take “until 2024” for inflation to be sustainably within the target range.

Lowe also emphasized that “the condition for an increase in the cash rate depends upon the data, not the date; it is based on inflation outcomes, not the calendar.” Also, the tapering to AUD 4B purchase in bonds a week “does not represent a withdrawal of support”.

On the data front

Japan bank lending rose 1.4% yoy in June, below expectation of 3.0% yoy. Eco Watcher sentiment rose to 47.6 in June, up form 38.1, above expectation of 41.9. Current account surplus widened to JPY 1.87T in May, above expectation of JPY 1.59T.

UK RICS house price balance rose to 83 in June, above expectation of 78. Swiss unemployment rate rose to 3.1% in June, up from 3.0%, above expectation of 3.0%. Germany trade surplus narrowed to EUR 12.6B in May, below expectation of EUR 15.8B.

USD/JPY Daily Outlook

Daily Pivots: (S1) 110.41; (P) 110.61; (R1) 110.83; More…

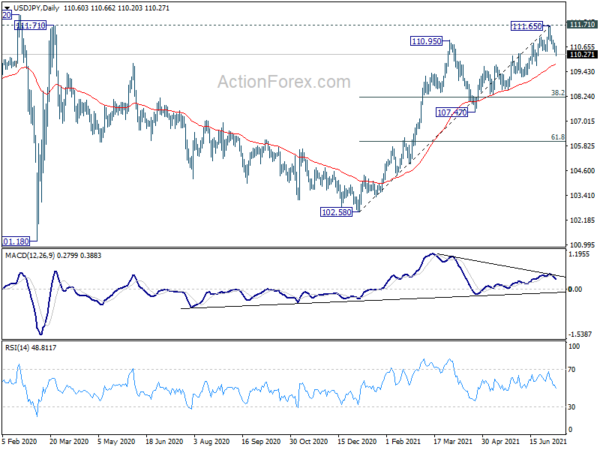

USD/JPY’s break of 110.41 support argues that rise from 107.47 has completed at 111.65, after rejection by 111.71 key resistance. Intraday bias is turned back to the downside for 55 day EMA (now at 109.79) first. Sustained break there will suggest that it’s at least correcting the whole rise from 102.58, and targets 38.2% retracement of 102.58 to 111.65 at 108.18. For now, risk will be mildly on the downside as long as 111.65 resistance holds, in case of recovery.

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. Though, as notable support was seen from 55 day EMA, rise from 102.58 is mildly in favor to extend higher. Decisive break of 111.71/112.22 resistance will suggest long term bullish reversal. Rise from 101.18 could then target 118.65 resistance (Dec 2016) and above. However, sustained break of 55 day EMA would revive some medium term bearishness, and open up deep fall back towards 102.58 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Jun | 83% | 78% | 83% | 82% |

| 23:50 | JPY | Bank Lending Y/Y Jun | 1.40% | 3.00% | 2.90% | 2.80% |

| 23:50 | JPY | Current Account (JPY) May | 1.87T | 1.59T | 1.55T | |

| 5:00 | JPY | Eco Watchers Survey: Current Jun | 47.6 | 41.9 | 38.1 | |

| 5:45 | CHF | Unemployment Rate Jun | 3.10% | 3.00% | 3.00% | |

| 6:00 | EUR | Germany Trade Balance (EUR) May | 12.6B | 15.8B | 15.9B | |

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | USD | Initial Jobless Claims (Jul 2) | 355K | 364K | ||

| 13:00 | RU | Central Bank Reserves $ | $592.4B | |||

| 14:30 | USD | Natural Gas Storage | 76B | |||

| 15:00 | USD | Crude Oil Inventories | -6.7M |