Euro remains the worst performer for the day so far, as weighed down by the news that Russia’s state-controlled Gazprom would stop gas delivery via the Nord Stream 1 due to a fault. Yet, the common currency is not giving up yet, as losses are relatively limited. Dollar is the strongest one, followed by Swiss Franc and Canadian, But there is no clear follow through buying too. Australian Dollar is mixed, awaiting tomorrow’s RBA rate hike.

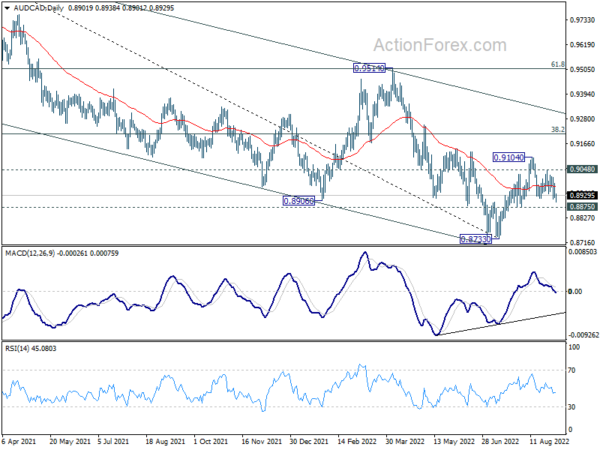

Technically, AUD/CAD is an interesting one to watch with RBA and BoC scheduled for the next two days. Break of 0.8875 support will argue that rebound from 0.8733 has completed, and larger down trend is ready to resume. On the other hand, break of 0.9048 will extend the rebound through 0.9104 and resume the down trend at a later stage.

In Europe, at the time of writing, FTSE is down -0.23%. DAX is down -2.44%. CAC is down -1.53%. Germany 10-year yield is up 0.0479 at 1.571. Earlier in Asia, Nikkei dropped -0.11%. Hong Kong HSI dropped -1.16%. China Shanghai SSE rose 0.42%. Singapore Strait Times rose 0.31%. Japan 10-year JGB yield dropped -0.0075 to 0.235.

Eurozone Sentix investor confidence dropped further to -31.8, a significant recessionary trend already set in

Eurozone Sentix Investor Confidence dropped further from -25.2 to -31.8 in September, below expectation of -27.5. That’s also the lowest level since May 2020. Current Situation Index dropped from -16.3 to -26.5, lowest since February 2021. Expectations index dropped from -33.8 to -37.0, lowest since December 2008.

Sentix said: “It is very likely that a significant recessionary trend has already set in… In historical retrospect, it is clear that the extent of the current economic dislocation exceeds the collapse of tech stocks (2003), the euro crisis (2012) and even the collapse in the course of the Corona lockdowns (2020).”

“Although the collapse in 2020 was even sharper, the monetary policy response in the form of trillion-dollar money-printing programmes by central banks quickly led to a turnaround in economic expectations. There are no signs of this at present. Worse still, a look at the sentix thematic indices shows that investors cannot expect any help from either inflation or the central banks.”

Eurozone retail sales volume rose 0.3% mom in Jul, EU up 0.3% mom

Eurozone retail sales volume rose 0.3% mom in in July, below expectation of 0.6% mom. volume of retail trade increased by 0.4% for automotive fuels and by 0.1% for food, drinks and tobacco, while it decreased by -0.4% for non-food products.

EUR retail sales volume rose 0.3% mom. Among Member States for which data are available, the highest monthly increases in the total retail trade volume were registered in Germany (+1.9%), the Netherlands (+1.7%), Luxembourg and Poland (both +1.5%). The largest decreases were observed in Austria (-1.8%), Finland (-1.7%) and Spain (-1.0%).

Eurozone PMI composite finalized at 49.8, economy undergoing its weakest spell for nine years

Eurozone PMI Services was finalized at 49.8 in August, down from July’s 51.2, a 17-month low. PMI Composite was finalized at 48.9, down from prior month’s 49.9, a 18-month low.

Looking at some member states, Ireland PMI Composite dropped to 51.0 (18-month low). Spain dropped to 50.5 (7-month low). France dropped to 50.4 (17-month low). Italy recovered to 49.6, (2-month high). Germany dropped to 46.9 (27-month low).

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“A second month of deteriorating business conditions in the euro area adds to the likelihood of GDP contracting in the third quarter…. The deterioration is also becoming more broad-based, with services now joining manufacturing in reporting falling output..”

“Although the overall rate of decline remains only modest, commensurate with GDP falling at a quarterly rate of just 0.1%, the latest data point to the economy undergoing its weakest spell for nine years, excluding the downturns seen during the height of the pandemic.”

UK PMI services finalized at 50.9 in Aug, composite at 49.6

UK PMI Services was finalized at 50.9 in August, down from July’s 52.6. PMI Composite was finalized at 49.6, down from prior month’s 51.2, the first contraction reading in 18 months.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“UK private sector business activity fell for the first time in a year-and-a-half in August as an increasingly severe downturn in manufacturing was accompanied by a near-stalling of the vast services sector…

“Although the survey data are currently consistent with the economy contracting at a modest quarterly rate of 0.1%, deteriorating trends in order books suggest the incoming prime minister will be dealing with an economy that is facing a heightened risk of recession, a deteriorating labour market and persistent elevated price pressures linked to the soaring cost of energy.”

Swiss GDP grew 0.3% qoq in Q2, strong private consumption

Swiss GDP grew 0.3% qoq in Q2, below expectation of 0.4% qoq. Looking at some details, manufacturing contracted -0.5%. Construction contracted -1.7%. Trade dropped -2.1%. However, accommodation and food grew strongly by 12.4%.

By expenditure approach, private consumption rose 1.4%. Government consumption was flat. Equipment and software investment rose 2.5%. Exports of goods dropped sharply by -11.5%. Import of goods dropped -0.6% too.

Australia AiG construction rose to 47.9, pull back continued

Australia AiG Performance of Construction Index rose 2.6 pts to 47.9 in August. Activity rose 3.5 to 46.2. Employment dropped -5.3 to 47.7. New orders rose 7.9 to 51.0. Supplier deliveries rose 3.4 to 45.6. Input prices dropped -1.2 to 92.6. Selling prices dropped sharply by -18.6 to 68.5. Average wages rose 1.2 to 77.6.

Peter Burn, Chief Policy Advisor at Ai Group said: “The pull back of the Australian construction sector continued in August with three of the four industry segments recording falls in activity and employment across the industry dropping in the month…. Builders and constructors link much of the fall in activity to rises in interest rates in recent months….. Softer demand was also reflected in the steep fall in the selling price index even though input prices and wage increases remain elevated.”

China Caixin PMI services dropped to 55 in Aug, PMI composite down to 53

China Caixin PMI Services dropped slightly from 55.5 to 55.0 in August, above expectation of 54.2. Caixin added that business activity growth held close to July’s 15-month high. total new orders rose despite stronger fall in new export business. Optimism around outlook was highest since November.

Wang Zhe, Senior Economist at Caixin Insight Group said: “In August, the Caixin China General Composite PMI dropped to 53 from 54 the previous month. The reading, while marking the second straight monthly drop, remained in expansionary territory. Both supply and demand continued to expand, albeit at a slower pace, with services outperforming manufacturing. Employment remained weak and input costs experienced the slowest increase in 27 months. Market confidence remained stable.”

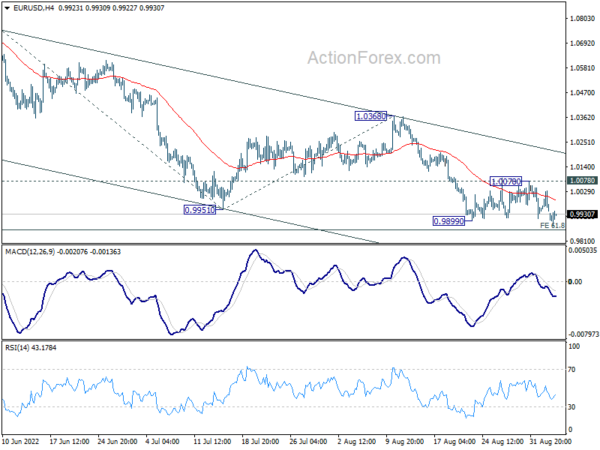

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 0.9925; (P) 0.9979; (R1) 1.0016; More…

Intraday bias in EUR/USD remains on the downside for 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860. Firm break there should prompt downside acceleration to 100% projection at 0.9546. On the upside, break of 1.0078 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

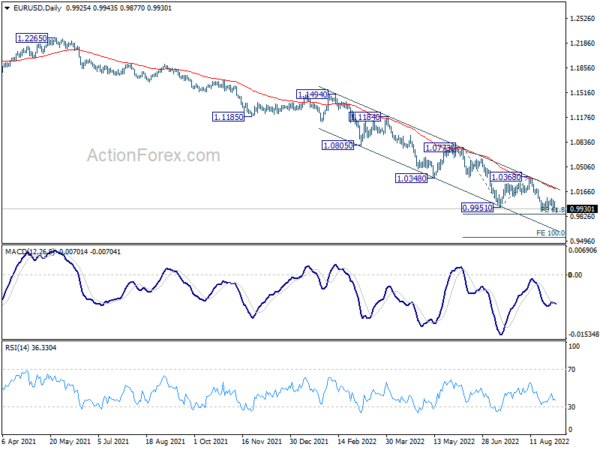

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0368 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Aug | 47.9 | 45.3 | ||

| 01:00 | AUD | TD Securities Inflation M/M Aug | -0.50% | 1.20% | ||

| 01:30 | AUD | Company Gross Operating Profits Q/Q Q2 | 7.60% | 4.00% | 10.20% | 9.80% |

| 01:45 | CNY | Caixin Services PMI Aug | 55 | 54.2 | 55.5 | |

| 07:00 | CHF | GDP Q/Q Q2 | 0.30% | 0.40% | 0.50% | |

| 07:45 | EUR | Italy Services PMI Aug | 50.5 | 48.3 | 48.4 | |

| 07:50 | EUR | France Services PMI Aug F | 51.2 | 51 | 51 | |

| 07:55 | EUR | Germany Services PMI Aug F | 47.7 | 48.2 | 48.2 | |

| 08:00 | EUR | Eurozone Services PMI Aug F | 49.8 | 50.2 | 50.2 | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Sep | -31.8 | -27.5 | -25.2 | |

| 08:30 | GBP | Services PMI Aug F | 50.9 | 52.5 | 52.5 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Jul | 0.30% | 0.60% | -1.20% | -1.00% |