New Zealand Dollar rises broadly after RBNZ delivered the historical 75bps rate hike as widely expected. Yet, it’s staying in near term range against the greenback. For now, Euro is following Kiwi as second strongest for the day, then Swiss Fran and Sterling. Canadian Dollar is the weakest, followed by Yen and Aussie. Apparently, Aussie is additionally dragged by selloff against Kiwi. Dollar is mixed and awaits more economic data as well as FOMC minutes, before US holiday tomorrow.

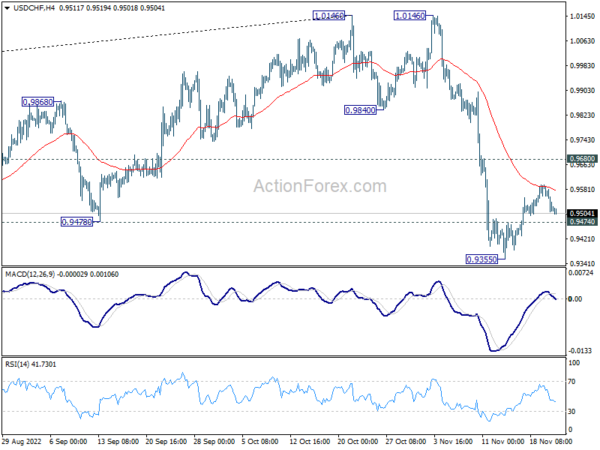

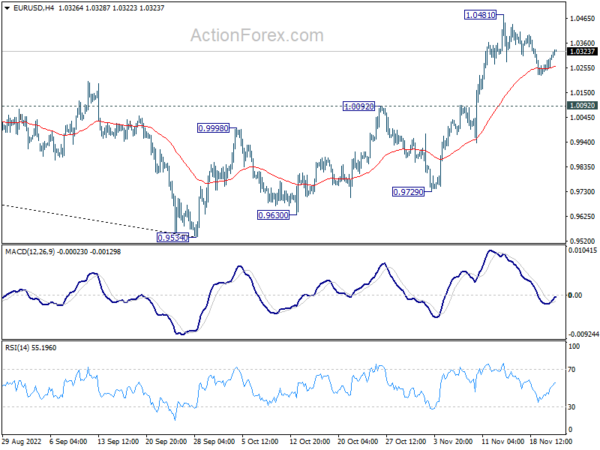

Technically, Dollar is back under some pressure, in particular against Euro and Swiss Franc. 1.0092 support in EUR/USD and 0.9680 minor resistance in USD/CHF stay intact, and keep bearish bias in Dollar. EUR/USD and USD/CHF could revisit recent levels at 1.0481 and 0.9355 respectively during the rest of the week if selloff in Dollar intensifies.

In Asia, Japan was on holiday. Hong Kong HSI is up 1.05%. China Shanghai SSE is up 0.33%. Singapore Strait Times is down -0.06%. Overnight, DOW rose 1.18%. S&P 500 rose 1.36%. NASDAQ rose 1.36%. 10-year yield dropped -0.067 to 3.758.

RBNZ hikes 75bps to 4.25%, tightening not finished

RBNZ raises the Official Cash Rate by a record 75bps to 4.25% as widely expected. The central bank maintained that “monetary conditions needed to continue to tighten further, so as to be confident there is sufficient restraint on spending to bring inflation back within its 1-3 percent per annum target range.”

During the meeting, increases of 50, 75 and 100bps were considered. But members agreed that “a larger increase in the OCR was appropriate, given the resilience of domestic spending, and the higher and more persistent actual and expected inflation outcomes.”

But on the “balances of risks”, a 75bps hike was “appropriate at this meeting”. Members highlights that “the cumulative tightening of monetary conditions delivered to date continues to pass through to the economy via the lagged transmission to effective retail interest rates.”

In the new forecasts, annual inflation is projected to rise further to 7.5% in Q4 and Q1, then stay above 5% throughout 2023. Inflation would then slowly drop back to 2.9% in Q3, 2024. Quarterly GDP is projected to contract from Q2 2023 to Q1 2024, turn flat in Q2 and Q3 2024, before returning to slight growth. OCR will continue to rise and peak at 5.5% in Q3 2023, before turning down in second half of 2024.

Australia PMI composite dropped to 47.7, deteriorating demand and worsening price pressures

Australia PMI Manufacturing dropped from 52.7 to 51.5 in November, a 29-month low. PMI Services dropped from 49.3 to 47.2, a 10-month low. PMI Composite also dropped from 49.8 to 47.7, a 10-month low.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence said:

“The latest S&P Global Flash Australia Composite PMI data revealed that the private sector economy further contracted midway into the fourth quarter, faced with deteriorating demand conditions. In particular, the service sector continued to be affected by higher interest rates and capacity constraints, leading to a sharper fall in business activity.

“That said, with price inflation further climbing in November, the pressure remains on the central bank to keep tightening monetary policy to rein in prices. This is also amid indications of solid employment growth from the PMI data.

“The mix of deteriorating demand and worsening price pressures does not bode well for the near-term outlook, and this has also been reinforced by the decline in private sector confidence in November.”

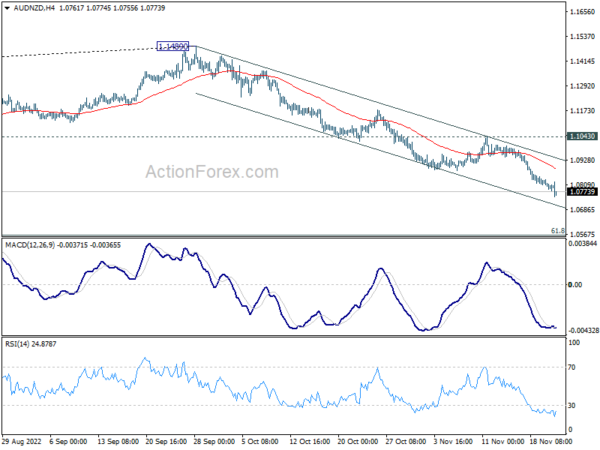

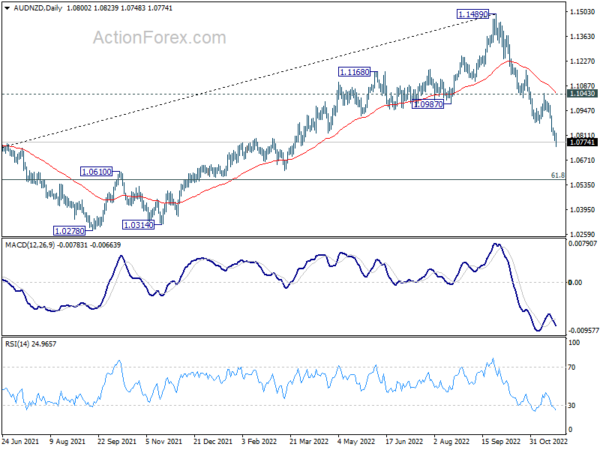

AUD/NZD extending decline after RBNZ

AUD/NZD is extending the decline from 1.1489 after RBNZ’s rate hike today. For the near term, outlook will stay bearish as long as 1.1043 resistance holds, even in case of recovery.

In the bigger picture, whole up trend from 0.9992 (2020 low) should have completed with three waves up to 1.1489. Current down side momentum argues that fall from 1.1489 is an impulsive move. But at this point, it’s viewed as a leg inside the long term sideway pattern that started in 2015. Even in such case, AUD/NZD would try to hit 61.8% retracement of 0.9992 to 1.1489 at 1.0560 before forming a bottoming.

Looking ahead

Eurozone and UK PMIs are the main focuses in European session. Later in the day, US will release jobless claims, durable goods orders, PMIs, and new home sales. Fed will also publish FOMC minutes.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0259; (P) 1.0283; (R1) 1.0328; More…

EUR/USD recovered after drawing support from 4 hour 55 EMA, but stays well below 1.0481. Intraday bias remains neutral an more consolidative trading could be seen. But after all, as long as 1.0092 resistance turned support holds, further rally is still expected. On the upside, break of 1.0481 will resume the rise from 0.9534 and target 1.0609 fibonacci level. However, sustained break of 1.0092 will turn bias to the downside for 55 day EMA (now at 1.0052) and below.

In the bigger picture, a medium term bottom was in place at 0.9534, on bullish convergence condition in daily MACD. Even as a corrective rise, rally from 0.9534 should target 38.2% retracement of 1.2348 (2021 high) to 0.9534 at 1.0609. Sustained trading above 55 week EMA (now at 1.0566) will raise the chance of trend reversal and target 61.8% retracement at 1.1273. This will now remain the favored case as long as 1.0092 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | Manufacturing PMI Nov P | 51.5 | 52.7 | ||

| 22:00 | AUD | Services PMI Nov P | 47.2 | 49.3 | ||

| 01:00 | NZD | RBNZ Rate Decision | 4.25% | 4.25% | 3.50% | |

| 08:15 | EUR | France Manufacturing PMI Nov P | 47 | 47.2 | ||

| 08:15 | EUR | France Services PMI Nov P | 50.6 | 51.7 | ||

| 08:30 | EUR | Germany Manufacturing PMI Nov P | 45.2 | 45.1 | ||

| 08:30 | EUR | Germany Services PMI Nov P | 46.4 | 46.5 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Nov P | 46.5 | 46.4 | ||

| 09:00 | EUR | Eurozone Services PMI Nov P | 48.4 | 48.6 | ||

| 09:30 | GBP | Manufacturing PMI Nov P | 45.6 | 46.2 | ||

| 09:30 | GBP | Services PMI Nov P | 48 | 48.8 | ||

| 13:30 | USD | Initial Jobless Claims (Nov 18) | 224K | 222K | ||

| 13:30 | USD | Durable Goods Orders Oct | 0.40% | 0.40% | ||

| 13:30 | USD | Durable Goods Orders ex Transportation Oct | 0.10% | -0.50% | ||

| 14:45 | USD | Manufacturing PMI Nov P | 49.8 | 50.4 | ||

| 14:45 | USD | Services PMI Nov P | 47.7 | 47.8 | ||

| 15:00 | USD | Michigan Consumer Sentiment Nov F | 54.7 | 54.7 | ||

| 15:00 | USD | New Home Sales Oct | 575K | 603K | ||

| 15:30 | USD | Crude Oil Inventories | -2.6M | -5.4M | ||

| 17:00 | USD | Natural Gas Storage | 86B | 64B | ||

| 19:00 | USD | FOMC Meeting Minutes |