Dollar is recovering slightly today as focus turns to FOMC rate decision and, more importantly, new economic projections. While the greenback was sold off overnight following consumer inflation data, traders are still holding the larger bets for now. As for the week, Euro and Sterling are the strongest ones so far, followed by Yen. Commodity currencies are actually lagging behind even though though they’re up against the greenback too.

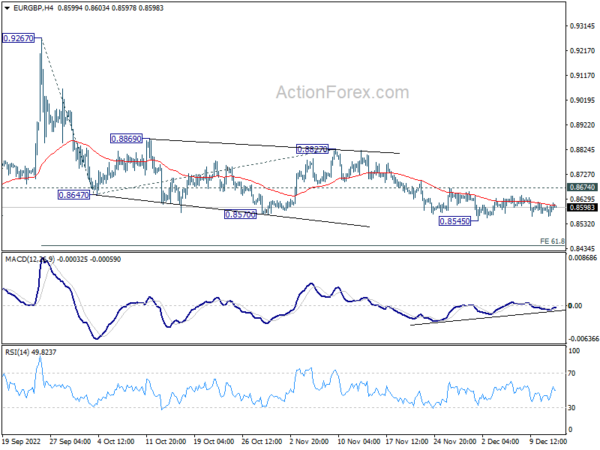

Technically, EUR/GBP could be a focus in European session. So far it’s still bounded in range above 0.8545 support. Further decline is in favor with 0.8674 resistance intact. Break of 0.8545 will resume the decline from 0.9267 to 61.8% projection of 0.9267 to 0.8647 from 0.8827 at 0.8444. Yet, the bigger move might only come after BoE and ECB on Thursday.

In Asia, Nikkei rose 0.72%. Hong Kong HSI is up 0.68%. China Shanghai SSE is down -0.14%. Singapore Strait Times is up 0.45%. Japan 10-year JGB yield is up 0.0007 at 0.256. Overnight, DOW rose 0.30%. S&P 500 rose 0.73%. NASDAQ rose 1.01%.

Japan Tankan manufacturing mood deteriorated, but non-manufacturing upbeat

Japan Tankan Large Manufacturing Index dropped from 8 to 7 in Q4, above expectation of 6. Sentiment has been deteriorating for the fourth straight quarter, and hit the lowest level since Q1 2021. Large Manufacturing Outlook dropped from 9 to 6, matched expectations.

On the other hand, Large Non-Manufacturing Index rose from 14 to 19, above expectation of 17. That’s the highest level since Q4 2019. Large Non-Manufacturing Outlook was unchanged at 11, below expectation of 16.

Large all industry capex dropped from 21.5% to 19.2%, above expectation of 18.4%.

Regarding inflation, 1-year ahead general prices expectations for all industries rose from 2.6% to 2.7%. 3-year ahead expectations rose from 2.1% to 2.2%. 5-year ahead expectations was unchanged at 2.0%.

RBNZ Hawkesby: We’ve seen very little impact of higher interest rates so far

RBNZ Deputy Governor Christian Hawkesby said in a speech that “we still think we have more work to do” to bring down inflation.

“We’ve seen very little impact of higher interest rates so far, outside of falling house prices and a cooling of the construction pipeline,” he added.

“As inflation expectations have been rising, we also think that neutral interest rates have drifted higher, meaning that the OCR needs to be higher than otherwise before monetary policy is really restricting the demand side of the economy,” he said.

Hawkesby pointed to November projections that the OCR would peak around 5.50%. But he noted, “25 years as an economist has taught me that the only certainty is that our forecasts won’t be exactly right. There are always shocks and unexpected developments that will evolve the story.”

FOMC preview: All about dot plots and 5%

Fed is widely expected to slow down the pace of rate hike today, and raise federal funds rate by 50bps to 4.25-4.50%. The main focus is on the new economic projections in particular the dot plots. Questions are where the terminal rate of the current cycle would be, and how long would rate stay there.

Yesterday’s CPI report showed further evidence that inflation is cooling, rather than plateauing, and in a quicker manner than expected. Currently markets are expecting Fed to make two more 25bps rate hikes in Q1. That would eventually bring interest rate to 4.75-5.00% range, keep it below the 5% psychological level.

Here are some previews:

- FOMC Meeting Preview: 50bps Hike Likely, But Will the 2023 Dots Rise above 5%?

- Fed Decision and US Inflation Stats to Decide Dollar’s Fate

- Fed Preview – Tightening Pressure Persists into 2023

Yesterday’s post-CPI reactions in the markets were clearly indecisive. S&P 500 spiked higher to 4100.96 but that pared back much of the gains to close just 0.73% higher at 4019.65. Today’s reactions could be bearish if Fed’s dot plots indicate that interest way will peak above 5%. Break of 3906.54 support will trigger near term bearish reversal in SPX. Nevertheless, another rally through yesterday’s high should push SPX further towards 4325.58 resistance and end the year on a high note.

Elsewhere

UK will release CPI data today while Swiss will release PPI. Eurozone industrial production will also be featured. Later in the day, Canada manufacturing sales and US import prices will also be published.

AUD/USD Daily Report

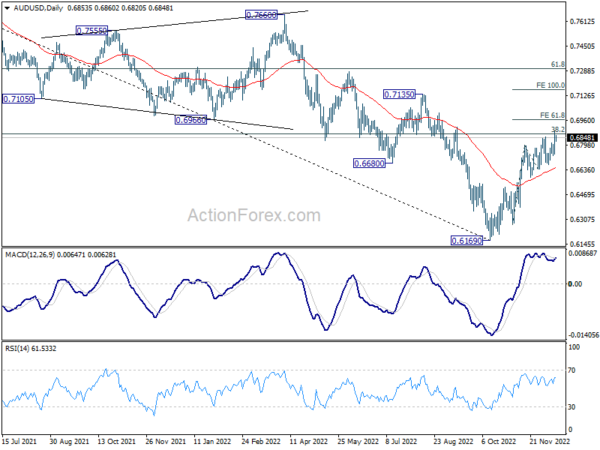

Daily Pivots: (S1) 0.6766; (P) 0.6830; (R1) 0.6919; More…

Intraday bias in AUD/USD stays on the upside at this point. Current rally should target 61.8% projection of 0.6271 to 0.6796 from 0.6641 at 0.6965. Firm break there will target 100% projection at 0.7166 next. For now, outlook will stay bullish as long as 0.6728 support holds, in case of retreat.

In the bigger picture, it’s still unsure if price actions from 0.6169 medium term bottom are developing into a corrective pattern or trend rejection. Rejection by 38.2% retracement of 0.8006 to 0.6169 at 0.6871 will maintain medium term bearishness for another fall through 0.6169 at a later stage. However, firm break of 0.6871, and sustained trading above 55 week EMA (now at 0.6912) will raise the chance of the start of a bullish up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account (NZD) Q3 | -10.21B | -10.20B | -5.22B | -5.42B |

| 23:50 | JPY | Tankan Large Manufacturing Index Q4 | 7 | 6 | 8 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q4 | 6 | 6 | 9 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q4 | 19 | 17 | 14 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q4 | 11 | 16 | 11 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q4 | 19.20% | 18.40% | 21.50% | |

| 23:50 | JPY | Machinery Orders M/M Oct | 5.40% | -1.00% | -4.60% | |

| 04:30 | JPY | Industrial Production M/M Oct F | -3.20% | -2.60% | -2.60% | |

| 07:00 | GBP | CPI M/M Nov | 1.20% | 2.00% | ||

| 07:00 | GBP | CPI Y/Y Nov | 11.50% | 11.10% | ||

| 07:00 | GBP | Core CPI Y/Y Nov | 6.60% | 6.50% | ||

| 07:00 | GBP | RPI M/M Nov | 1.50% | 2.50% | ||

| 07:00 | GBP | RPI Y/Y Nov | 14.30% | 14.20% | ||

| 07:30 | CHF | Producer and Import Prices M/M Nov | 0.40% | 0.00% | ||

| 07:30 | CHF | Producer and Import Prices Y/Y Nov | 4.80% | 4.90% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Oct | 0.00% | 0.90% | ||

| 13:30 | CAD | Manufacturing Sales M/M Oct | -0.20% | 0.00% | ||

| 13:30 | USD | Import Price Index M/M Nov | 0.20% | -0.20% | ||

| 15:30 | USD | Crude Oil Inventories | -3.4M | -5.2M | ||

| 19:00 | USD | Fed Interest Rate Decision | 4.50% | 4.00% | ||

| 19:30 | USD | FOMC Press Conference |