Canadian Dollar steals the show in early US session after astonishingly strong employment data. It’s followed by Yen, which had some jitters regarding new rumors about BoJ Governor nomination. European majors, on the other hand, are the weaker ones for today, in order of Euro, Swiss Franc and Sterling for now. Aussie and Kiwi are mixed, awaiting some guidance from risk markets.

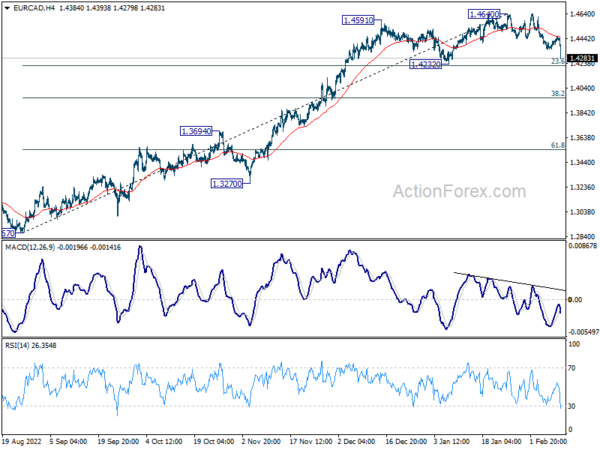

Technically, EUR/CAD resumed the decline from 1.4640. Prior rejection by 4 hour 55 EMA is a near term bearish signal. Next focus is 1.4232 support. Firm break there should confirm that a correction to whole rally from 1.2867 has started, and target 38.2% retracement of 1.2867 to 1.4640 at 1.3963. If that happens, it will more likely be accompanied by extended correction in EUR/USD, than breaking of 1.3224 key support in USD/CAD.

In Europe, at the time of writing, FTSE is down -0.64%. DAX is down -1.34%. CAC is down -1.17%. Germany 10-year yield is up 0.039 at 2.340. Earlier in Asia, Nikkei rose 0.31%. Hong Kong HSI dropped -2.01%. China Shanghai SSE dropped -0.30%. Singapore Strait Times rose 0.04%. Japan 10-year JGB yield is down -0.0069 at 0.491.

Canada employment grew 150k in Jan, unemployment rate unchanged at 5%

Canada employment grew strongly by 150k, or 0.8% mom, in January, well above expectation of 15k. Full-time work increased 121k.

Unemployment rate was unchanged at 5.0%, matched expectations, just shy of the record-low 4.9% in June and July last year. Participation rate rose 0.3% to 65.7%.

Total hours worked rose 0.8% mom, 5.6% yoy. Average hourly wages rose 4.5% yoy.

ECB Vujcic: Likely to see more rate action beyond March

ECB Governing Council member Boris Vujcic, Croatian central bank Governor, said, “we are likely to see more rate action beyond March.” But policymakers are going to wait for data to come in, ” then decide in May, June, July what we’re going to do.”

While the markets are pricing in a 3.4-3.5% terminal rate, Vujcic said, “It’s the market’s job to try to figure out what the terminal rate is, but it’s not something we have to do at this point in time… I would leave the issue of the terminal rate for later.”

Vujcic believed that headline inflation has peaked. He added, “already in November I argued that my worry was not a further increase in inflation, but the persistence.”

UK GDP contracted -0.5% mom in Dec, flat in Q4

UK GDP contracted notably by -0.5% mom in December, even worse than expectation of -0.3% mom. Services declined by -0.8% mom. Production rose 0.3% mom. Construction was flat for the month.

In Q4, GDP showed 0.0% qoq growth, matched expectations. Services sector was flat on the quarter. Production dropped -0.2% qoq while construction grew 0.3% qoq.

For 2022 as a whole, GDP grew 4.0%, following a 7.6% expansion in 2021.

Also released, industrial production came in at 0.3% mom -4.0% yoy in December, versus expectation of -0.2% mom, -5.3% yoy. Manufacturing was at 0.0% mom, -5.7% yoy, versus expectation of -0.2% mom, -6.1% yoy. Goods trade deficit widened from GBP -14.7B to GBP -19.3B, above expectation of GBP -17.2B.

Yen up and down on BoJ governor candidate news

Yen jumped earlier today on reports that Prime Minister Fumio Kishida is going to make a surprised nomination of academic Kazuo Ueda as the next BoJ Governor. Some interpreted that as a signal of a change in BoJ’s course for finally exiting ultra loose monetary policy.

However, Yen was then shot down after Ueda told Nippon TV BoJ’ current policy is “appropriate”, noting the need to continue with monetary easing. Ueda also noted, “it’s important to make decisions logically and explain clearly

Ueda, a former member of the BOJ’s policy board and an academic at Kyoritsu Women’s University. On the other hand, earlier rumor of appointing Deputy Governor Masayoshi Amamiya was seen as a sign of continuing currency policies.

The government is expected to present the nomination on February 13 and there would be hearings at the lower house on February 24.

Japan PPI slowed to 9.5% yoy in Jan, CGPI staying at record high

Japan PPI slowed from 10.5% yoy to 9.5% yoy in January, below expectation of 11.2% yoy. Sitting at 119.8 and unchanged from prior month, corporate goods price index matched the record high made in December.

On Yen basis, export price index slowed further to 9.0% yoy, comparing to the peak of 20.1% yoy made in September. Import price index also slowed to 17.8% yoy, comparing to the peak of 49.2% made in July. For the month, export price index declined for the third month, by -1.9% mom. Import price index dropped for the fourth month, by -3.9% mom.

RBA SoMP: No GDP contraction, trimmed mean inflation to stay higher and longer

In the Statement on Monetary Policy, RBA reiterated that “further increases in interest rates will be needed to ensure that the current period of high inflation is only temporary.”

“In assessing how much further interest rates need to increase, the Board will be paying close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market.”

The economy is not forecast to contract within the projection horizon. Meanwhile, trimmed mean inflation is projected to stay higher and longer till mid 2024.

Year-average GDP growth forecast to be (from 3.75% in 2022):

- 2.25% in 2023 (unchanged from prior forecast).

- 1.50% in 2024 (unchanged).

- 1.75% in 2024/25 year (new).

Headline CPI (7.8% in December 2022) is projected to slow to:

- 6.75% in June 2023 (unchanged).

- 4.75% in December 2023 (unchanged).

- 3.50% in June 2024 (down from 4.25%).

- 3.25% in December 2024 (unchanged).

- 3.00% in June 2025 (new).

Trimmed mean CPI (6.9% in December 22) is projected to slow to:

- 6.25% in June 2023 (up from 5.50%).

- 4.25% in December 2024 (up from 3.75%).

- 3.25% in June 2024 (down from 3.50%).

- 3.00% in December 2024 (down from 3.25%).

- 3.00% in June 2025 (new).

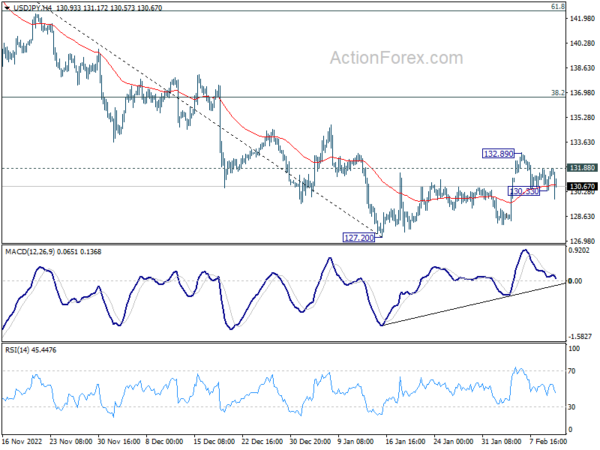

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 130.63; (P) 131.23; (R1) 132.12; More…

USD/JPY spiked through 130.33 minor support but quickly recovered. For now, deeper fall is in favor as long as 131.88 minor resistance holds. Corrective rebound from 127.20 could have completed with three waves up to 132.89. Retest of 127.20 would be seen next and decisive break there will resume larger down trend from 151.93. On the upside, above 131.88 will likely resume the rebound through 132.89 to 38.2% retracement of 151.93 to 127.20 at 136.64.

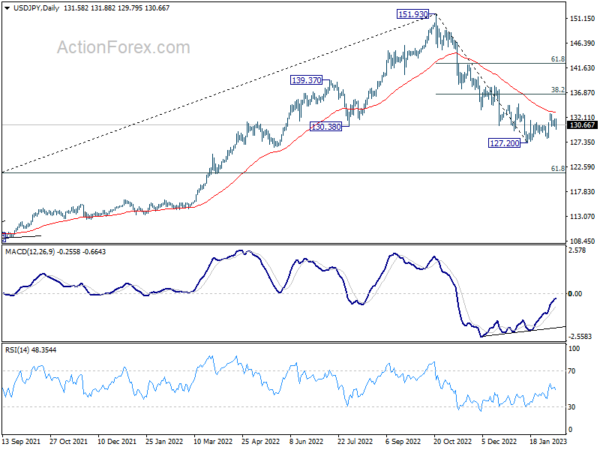

In the bigger picture, prior of 55 week EMA (now at 131.39) raises the chance of medium term bearish reversal, but that’s not confirmed yet. Strong rebound from current level, followed by sustained break of 38.2% retracement of 151.93 to 127.20 at 136.64 will argue that price actions from 151.93 is merely a corrective pattern. However, rejection by 136.64 will solidify medium term bearishness for 61.8% retracement of 102.58 to 151.93 at 121.43 and 38.2% retracement of 75.56 to 151.93 at 122.75.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Jan | 9.50% | 11.20% | 10.20% | 10.50% |

| 00:30 | AUD | RBA Monetary Policy Statement | ||||

| 01:30 | CNY | CPI Y/Y Jan | 2.10% | 2.30% | 1.80% | |

| 01:30 | CNY | PPI Y/Y Jan | -0.80% | -0.50% | -0.70% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Jan P | -9.70% | 1.00% | ||

| 07:00 | GBP | GDP M/M Dec | -0.50% | -0.30% | 0.10% | |

| 07:00 | GBP | GDP Q/Q Q4 P | 0.00% | 0.00% | -0.30% | -0.20% |

| 07:00 | GBP | Industrial Production M/M Dec | 0.30% | -0.20% | -0.20% | 0.10% |

| 07:00 | GBP | Industrial Production Y/Y Dec | -4.00% | -5.30% | -5.10% | -4.30% |

| 07:00 | GBP | Manufacturing Production M/M Dec | 0.00% | -0.20% | -0.50% | -0.60% |

| 07:00 | GBP | Manufacturing Production Y/Y Dec | -5.70% | -6.10% | -5.90% | -5.60% |

| 07:00 | GBP | Goods Trade Balance (GBP) Dec | -19.3B | -17.2B | -15.6B | -14.7B |

| 09:00 | EUR | Italy Industrial Output M/M Dec | 1.60% | 0.10% | -0.30% | -0.10% |

| 12:00 | GBP | NIESR GDP Estimate (3M) Jan | -0.10% | 0.10% | ||

| 13:30 | CAD | Net Change in Employment Jan | 150.0K | 15.0K | 104K | |

| 13:30 | CAD | Unemployment Rate Jan | 5.00% | 5.00% | 5.00% | |

| 15:00 | USD | Michigan Consumer Sentiment Index Feb P | 65 | 64.9 |