Dollar might finally be committing to a rally after stronger than expected retail sales data. Consumer markets appeared to remain robust despite persistently high inflation. Talks of a higher terminal rate for Fed is also growing. On the other hand, Sterling was knocked down earlier today after lower than expected CPI reading, in particular against Euro and Swiss Franc, which were the second and third strongest for the day. Yen is not performing too well considering widening yield gap with US and Europe, but selloff someone slowed against others.

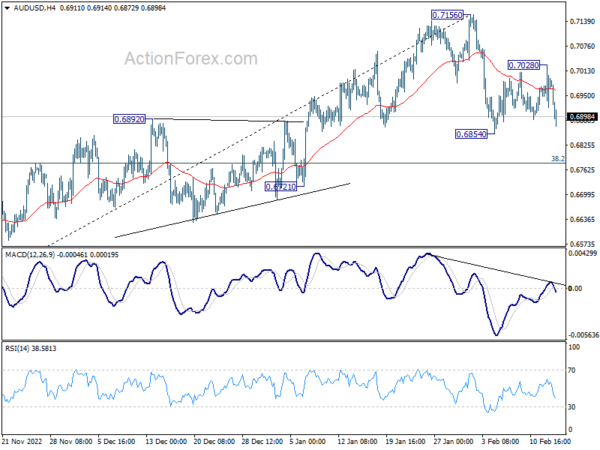

Technically, AUD/USD would be a focus leading up to tomorrow’s Australia job data. Current development suggests that correction from 0.7156 is ready to resume. Break of 0.6854 will target 38.2% retracement of 0.6169 to 0.7156 at 0.6779. Strong support could be seen from 0.6721 to bring rebound. However, it might start to feel a bit vulnerable should tomorrow’s data disappoints.

In Europe, at the time of writing, FTSE is up 0.09%. DAX is up 0.52%. CAC is up 0.99%. Germany 10-year yield is down -0.001 at 2.439. Earlier in Asia, Nikkei dropped -0.37%. Hong Kong HSI dropped -1.43%. China Shanghai SSE dropped -0.39%. Singapore Strait Times dropped -1.13%. Japan 10-year JGB yield rose 0.0027 to 0.507.

US retail sales up 3.0% mom in Jan, ex-auto sales rose 2.3% mom

US retail sales rose 3.0% mom to USD 697B in January, above expectation of 1.7% mom. Ex-auto sales rose 2.3% mom to USD 565B, above expectation of 0.9% mom. Ex-gasoline sales rose 3.2% mom to USD 637B. Ex-auto, gasoline sales rose 2.6% mom to USD 506B.

Total sales for the November through January period were up 6.1% yoy from the same period a year ago.

Eurozone industrial production down -1.1% mom in Dec, EU down -0.4% mom

Eurozone industrial production declined -1.1% mom in December, worse than expectation of -0.8% mom. Production of intermediate goods fell by -2.8%, durable consumer goods by -1.4%, non-durable consumer goods by -1.0% and capital goods by -0.4%, while production of energy grew by 1.3%.

EU industrial production dropped -0.4% mom. Among Member States for which data are available, the largest monthly decreases were registered in Ireland (-8.5%), Luxembourg (-5.2%) and Lithuania (-4.0%). The highest increases were observed in Denmark (+13.5%), Portugal (+4.1%) and Hungary (+3.8%).

Eurozone goods exports rose 9.0% yoy in Dec, imports rose 8.7% yoy

Eurozone goods exports rose 9.0% yoy to EUR 238.7B in December. Goods imports rose 8.7% yoy to EUR 247.5B. Trade deficit came in at EUR -8.8B. Intra-Eurozone trade rose 9.4% yoy to EUR 212.8B.

In seasonally adjusted term, exports dropped -4.6% mom to EUR 239.7B. Imports dropped -2.9% to EUR 257.9B. Trade deficit widened from November’s EUR -14.4B to EUR -18.1B, larger than expectation of EUR -16.0B. Intra-Eurozone trade dropped from EUR 233.5B to EUR 230.9B.

ECB de Cos: Recent inflation data are somewhat encouraging

ECB Governing Council member Pablo Hernandez de Cos said, “recent data on euro area inflation and some of its key determinants are somewhat encouraging, but the overall situation still requires caution”.

But he added that the evidence so far was very preliminary. Careful monitoring is required in some areas, including residual pass-through of inflation shocks, and the symmetry of pass-through of energy price declines to core inflation and wages, as well ass the effects of Chinese reopening.

“All these will have to be assessed as part of the full projections exercise under way in the run-up to our March meeting,” De Cos said.

UK CPI slowed more than expected to 10.1% yoy in Jan

UK CPI slowed from 10.5% yoy to 10.1% yoy in January, below expectation of 10.3% yoy. CPI core slowed from 6.3% yoy to 5.8% yoy, below expectation of 6.2% yoy.

The largest downward contribution to annual inflation came from transport (particularly passenger transport and motor fuels), and restaurants and hotels, with rising prices in alcoholic beverages and tobacco making the largest partially offsetting upward contribution to the change.

Also released, RPI came in at 0.0% mom, 13.4% yoy, versus expectation of 0.1% mom, 13.2% yoy. PPI input was at -0.1% mom, 14.1% yoy, versus expectation of 0.2% mom, 14.7% yoy. PPI output was at 0.5% mom, 13.5% yoy, versus expectation of 0.1% mom, 14.4% yoy. PPI core output was at 0.6% mom, 11.1% yoy, versus expectation of 0.7% mom, 11.9% yoy.

RBA Lowe: I don’t think we’re at the peak of interest rate yet

RBA Governor Philip Lowe said in a Senate hearing, “I don’t think we’re at the peak (on interest rate) yet, but how far we have to go up I don’t know.” He noted that inflation, which is currently sitting at 7.8%, was still “wage too high”. Unemployment would need to rise before there were any major changes to inflation.

“I understand why some people focus on the risks on the one side, but we’ve got to be attentive to the risk from higher inflation,” Lowe warned. “It’s corrosive for the economy. And all the evidence is if inflation stays high for too long, expectations adjust and that leads to higher interest rates and more unemployment..”

“The risks are two sided, and we’re trying to navigate our way through a narrow path.”

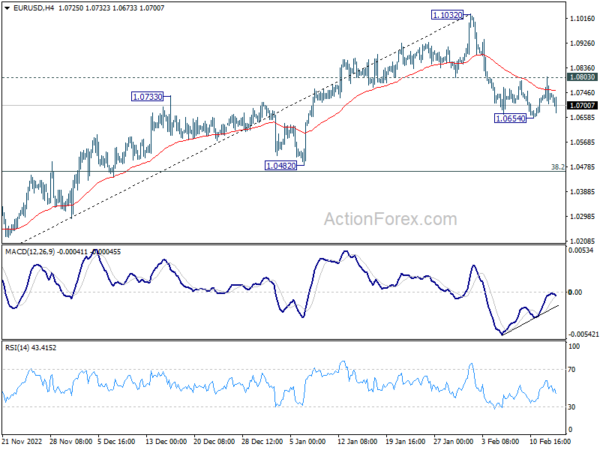

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0694; (P) 1.0749; (R1) 1.0791; More…

Focus is back on 1.0654 temporary low in EUR/USD with today’s fall. Firm break there will resume the corrective fall from 1.1032 to 38.2% retracement of 0.9534 to 1.1032 at 1.0463. Strong support should be seen around there to bring rebound, at least on first attempt. On the upside, firm break of 1.0803 minor resistance will turn bias back to the upside for retesting 1.1032 high instead.

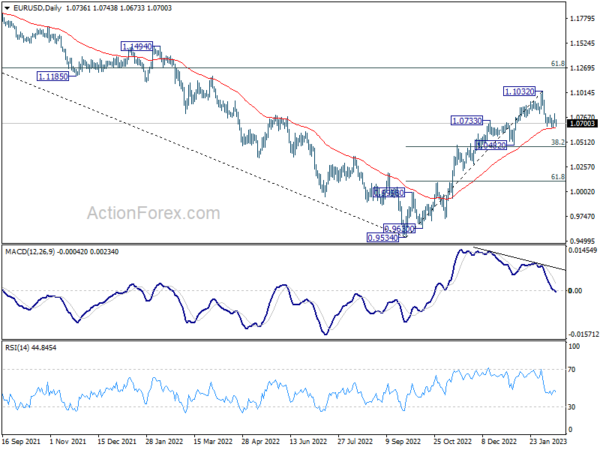

In the bigger picture, the rally from 0.9534 low (2022 low) is a medium term up trend rather than a correction. Further rise is in favor to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 next. This will remain the favored case as long as 1.0482 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Tertiary Industry Index M/M Dec | -0.40% | 0.00% | -0.20% | 0.10% |

| 07:00 | GBP | CPI M/M Jan | -0.60% | -0.40% | 0.40% | |

| 07:00 | GBP | CPI Y/Y Jan | 10.10% | 10.30% | 10.50% | |

| 07:00 | GBP | Core CPI Y/Y Jan | 5.80% | 6.20% | 6.30% | |

| 07:00 | GBP | RPI M/M Jan | 0.00% | 0.10% | 0.60% | |

| 07:00 | GBP | RPI Y/Y Jan | 13.40% | 13.20% | 13.40% | |

| 07:00 | GBP | PPI Input M/M Jan | -0.10% | 0.20% | -1.10% | |

| 07:00 | GBP | PPI Input Y/Y Jan | 14.10% | 14.70% | 16.50% | 16.20% |

| 07:00 | GBP | PPI Output M/M Jan | 0.50% | 0.10% | -0.80% | |

| 07:00 | GBP | PPI Output Y/Y Jan | 13.50% | 14.40% | 14.70% | 14.60% |

| 07:00 | GBP | PPI Core Output M/M Jan | 0.60% | 0.70% | 0.10% | 0.00% |

| 07:00 | GBP | PPI Core Output Y/Y Jan | 11.10% | 11.90% | 12.40% | 12.00% |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Dec | -18.1B | -16.0B | -15.2B | -14.4B |

| 10:00 | EUR | Eurozone Industrial Production M/M Dec | -1.10% | -0.80% | 1.00% | 1.40% |

| 13:15 | CAD | Housing Starts Jan | 215K | 252K | 249K | |

| 13:30 | CAD | Manufacturing Sales M/M Dec | -1.50% | -1.60% | 0.00% | |

| 13:30 | CAD | Wholesale Sales M/M Dec | -0.80% | -1.50% | 0.50% | |

| 13:30 | USD | Empire State Manufacturing Index Feb | -5.8 | -15.6 | -32.9 | |

| 13:30 | USD | Retail Sales M/M Jan | 3.00% | 1.70% | -1.10% | |

| 13:30 | USD | Retail Sales ex Autos M/M Jan | 2.30% | 0.90% | -1.10% | -0.90% |

| 14:15 | USD | Industrial Production M/M Jan | 0.40% | -0.70% | ||

| 14:15 | USD | Capacity Utilization Jan | 79.00% | 78.80% | ||

| 15:00 | USD | NAHB Housing Market Index Feb | 37 | 35 | ||

| 15:00 | USD | Business Inventories Dec | 0.40% | 0.40% | ||

| 15:30 | USD | Crude Oil Inventories | 1.5M | 2.4M |