Risk sentiment appeared to have turned negative after this week’s strong inflation data as well as hawkish comments from central bankers, not limited to Fed. Dollar is set to end as the best performer on expectations of higher terminal interest rate and risk aversion. But Euro is not too far away considering that ECB is not yet that close on a pause. Yen will likely end as the worst with additional pressure from rising US and European benchmark yields. Commodity currencies are also set to end lower.

Technically, if 10-year yield could break through 3.905 resistance and close the week above there, that would be a rather bullish sign. Such development should confirm that corrective pattern from 4.333 has completed at 3.373. While it might still be a bit early to call for up trend resumption, TNX should at least have a go at above 4% level in the very near term.

In Europe, at the time of writing, FTSE is down -0.23%. DAX is down -0.67%. CAC is down -0.45%. Germany 10-year yield is up 0.0138 at 2.496. Earlier in Asia, Nikkei dropped -0.66%. Hong Kong HSI dropped -1.28%. China Shanghai SSE dropped -0.77%. Singapore Strait Times rose 0.52%. Japan 10-year JGB yield dropped -0.0038 to 0.503.

ECB Schnabel: We may have to act more forcefully

ECB Executive Board member Isabel Schnabel said in a Bloomberg interview, “we are still far away from claiming victory”, adding that “we may have to act more forcefully.” She also noted that a broad disinflation process has not even started.” Meanwhile, “wage growth has picked up substantially” and could be “more persistent.

Schnabel also indicated that market pricing of a terminal rate of 3.50% may be too optimistic. “Markets are priced for perfection,” she said. “They assume inflation is going to come down very quickly toward 2% and it is going to stay there, while the economy will do just fine. That would be a very good outcome, but there is a risk that inflation proves to be more persistent than is currently priced by financial markets.”

A 50 basis-point hike next month is “necessary under virtually all plausible scenarios,” she said. “There is no inconsistency between our principle of data-dependency and these intentions because it’s very unlikely that the incoming data is going to put this intention into question.”

ECB Villeroy: Interest rate would probably peak in summer

ECB Governing Council member Francois Villeroy de Galhau said that interest rate would probably peak in the summer, which technically ends in September. Meanwhile, a rate cut this year is out of question.

But he also emphasized there is no “automatic moves” at each meeting. the central criteria is a “shift in the inflation path”, especially underlying inflation.

He also noted that interest rate will be kept at the peak level as long as necessary to bring inflation back to 2% target.

UK retail sales volume rose 0.5% mom in Jan, value up 0.6% mom

UK retail sales volume rose 0.5% mom in January, much better than expectation of -0.2% mom decline. Ex-fuel sale volume rose 0.4% mom, above expectation of 0.0% mom.

Compare with a year ago, retail sales volume dropped -5.1% yoy, versus expectation of of -5.5% yoy. Ex-fuel sales volume dropped -5.3% yoy, matched expectations.

In value term, retail sales rose 0.6% mom, 4.1% yoy. Ex-fuel sales rose 0.5% mom, 3.7% yoy.

RBA Lowe: We need to make clear to the community we were not done yet

In the second parliamentary grilling today, RBA Governor Philip Lowe said, “based on the currently available information, the board expect that further increases will be needed over the months ahead to ensure that inflation returns to target.”

“Given there is a significant demand element to inflation, we need to respond to that with further monetary policy and we need to make that clear to the community that we were not done yet,” Lowe said.

“The RBA and many other central banks are managing two risks,” he said. “One is the risk of not doing enough, which would result in high inflation persisting and then later proving very costly to get down. The other is the risk that we move too fast, or too far.”

USD/CHF Mid-Day Outlook

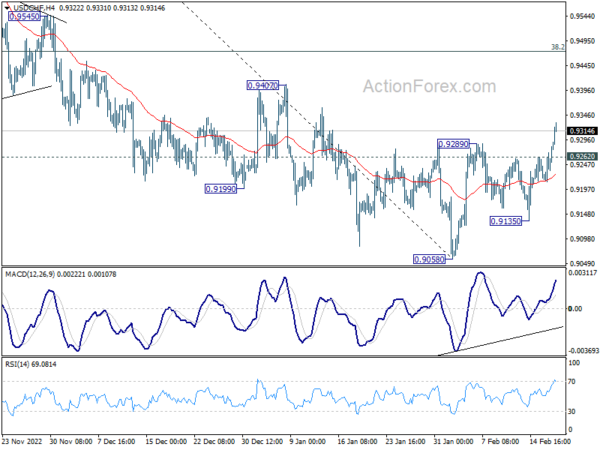

Daily Pivots: (S1) 0.9223; (P) 0.9248; (R1) 0.9281; More…

Intraday bias in USD/CHF remains on the upside for the moment. Rally from 0.9058 short term bottom should target 0.9407 resistance, or possibly further to 38.2% retracement of 1.0146 to 0.9058 at 0.9474. On the downside, below 0.9262 minor support will turn intraday bias neutral first.

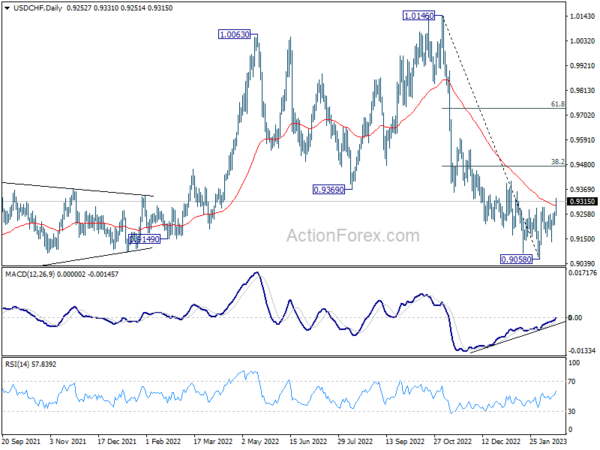

In the bigger picture, decline from 1.0146 is seen as part of a long term sideway pattern. As long as 38.2% retracement of 1.0146 to 0.9058 at 0.9474 holds, another fall is in favor through 0.9058. However, sustained trading above 0.9474 will indicate that the medium term trend has reversed, and open up further rally to 1.0146 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | GBP | Retail Sales M/M Jan | 0.50% | -0.20% | -1.00% | -1.20% |

| 07:00 | GBP | Retail Sales Y/Y Jan | -5.10% | -5.50% | -5.80% | -6.10% |

| 07:00 | GBP | Retail Sales ex-Fuel M/M Jan | 0.40% | 0.00% | -1.10% | -1.40% |

| 07:00 | GBP | Retail Sales ex-Fuel Y/Y Jan | -5.30% | -5.30% | -6.10% | -6.50% |

| 07:00 | EUR | Germany PPI M/M Jan | -1.00% | -1.60% | -0.40% | |

| 07:00 | EUR | Germany PPI Y/Y Jan | 17.80% | 16.40% | 21.60% | |

| 09:00 | EUR | Eurozone Current Account (EUR) Dec | 15.9B | 5.1B | 13.6B | 12.8B |

| 13:30 | CAD | Industrial Product Price M/M Jan | 0.40% | -0.10% | -1.10% | |

| 13:30 | CAD | Raw Material Price Index Jan | -0.10% | -0.20% | -3.10% | |

| 13:30 | USD | Import Price Index M/M Jan | -0.20% | -0.10% | 0.40% |