Euro is experiencing some selling pressure today, brought on by discouraging investor confidence data, with other European currencies also showing signs of distress. Meanwhile, US Dollar is making strides, superseding commodity currencies as it rides the wave of last week’s late rally.

Australian Dollar is trading within a narrow range against Canadian Dollar and New Zealand Dollar, as markets anticipate the outcome of tomorrow’s RBA rate decision. On the other hand, the Japanese Yen presents a mixed picture as it continues in its near-term consolidation phase.

Technically, the strong rally in AUD/NZD in the last two weeks argues that corrective pattern from 1.1085 has completed with three waves down to 1.0556. Immediate focus is now on 1.0928 resistance in the coming session. Decisive break there will confirm this case and would probably prompt further rise through 1.1085, to resume the whole rebound from 1.0469. Nevertheless, break of 1.0769 minor support will revive some near term bearishness for deeper fall back to 1.0556.

RBA previews:

In Europe, at the time of writing, FTSE is up 0.49%. DAX is up 0.16%. CAC is down -0.16%. Germany 10-year yield is up 0.0067 at 2.383. Earlier in Asia, Nikkei rose 2.20%. Hong Kong HSI rose 0.84%. China Shanghai SSE rose 0.07%. Singapore Strait Times rose 0.72%. Japan 10-year JGB yield closed flat at 0.434.

Eurozone Sentix fell to -17, Germany the biggest problem child

Eurozone Sentix Investor Confidence dropped from -13.1 to -17 in June, well below expectation of -9.2. Current Situation index dropped from -7.0 to -15.8. But Expectations index ticked up from -19.0 to -18.3.

Sentix said, “Eurozone economy continues to send weak signals at the beginning of June”, and “the clear slump in the assessment of the economic situation is particularly striking”.

Meanwhile, inflation expectations rose to -6, comparing to -44.25 a year ago. “Thus, positive inflation surprises are on the horizon,” Sentix said.

Sentix also noted: :The biggest problem child in the Eurozone remains Germany, which plummets dramatically in the sentix economic indices. The situation collapses to -22 points, expectations fall again slightly to -20.3 points. The overall index plunges to -21.1 points. All lows since Nov/Dec 2022.”

Eurozone PPI at -3.2% mom, 1.0% yoy in Apr

Eurozone PPI came in at -3.2% mom, 1.0% yoy in April, versus expectation of -2.7% mom, 0.8% yoy. For the month, industrial producer prices decreased by 10.1% mom in the energy sector and by -0.6% mom for intermediate goods, while prices increased by 0.2% mom for durable consumer goods, by 0.3% mom for non-durable consumer goods and by 0.4% mom for capital goods. Prices in total industry excluding energy decreased by -0.1% mom.

EU PPI was at -2.9% mom, 2.3% yoy. The largest monthly decreases in industrial producer prices were recorded in Belgium (-9.1%), Italy (-6.5%) and Ireland (-6.3%), while increases were observed in Germany (+0.3%), Denmark (+0.2%) as well as Greece, Cyprus, Malta and Slovenia (all +0.1%).

Eurozone PMI composite finalized at 52.8, manufacturing downside to be reflected in services slowdown

Eurozone PMI Services was finalized at 55.1 in May, down from April’s 56.2. PMI Composite was finalized at 52.8, down notably from April’s 54.1. HCOB noted that services activity growth stayed strong, but factory output fell at the quickest pace in six months.

Looking at some countries, Spain PMI Composite (55.2), Italy (52.0) and France (51.2) were at 4-month low. Germany was at 53.9, a 2-month low.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said: “Relatively resilient services activity growth should ensure that the eurozone regains some footing and shows a positive rate of expansion in the second quarter after GDP stagnated in the October – March period.

“However, the downturn in manufacturing is a drag on economic growth and is likely to be reflected in a further slowdown in the services sector in the coming months. We do not anticipate an overall economic recession, though.”

UK PMI services finalized at 55.2, strong growth so far in Q2

UK PMI Services was finalized at 55.2 in May, down slightly from April’s 55.9. S&P Global said there were robust rises in output and incoming new work. Staffing numbers increased for the fifth month running. Wage pressures pushed up cost inflation to a new three-month high. PMI Composite was finalized at 54.0, down from prior month’s 54.9.

Tim Moore, Economics Director at S&P Global Market Intelligence: “Service sector businesses have experienced strong growth so far in the second quarter of 2023… Rising export sales were also reported… Job creation was maintained… Intense wage pressures continued across the service economy… Average prices charged by service sector companies nonetheless increased at the second-weakest pace since August 2021.”

Swiss CPI slowed to 2.2% yoy in May, slightly above expectations

Swiss CPI rose 0.3% mom in May, slightly below expectation of 0.4% mom. Core CPI (excluding fresh and seasonal products, energy and fuel) rose 0.2% mom. Domestic products prices rose 0.3% mom. Imported products prices rose 0.1% mom.

Comparing with May 2022, CPI slowed from 2.6% yoy to 2.2% yoy, above expectation of 2.1% yoy. Core CPI was unchanged at 2.2% yoy. Domestic products prices slowed from 2.6% yoy to 2.4% yoy. Imported products prices fell notably from 2.4% yoy to 1.4% yoy.

Japan PMI services finalized at record 55.9, overall growth accelerated in Q2

Japan PMI Services was finalized at 55.9 in May, up from April’s 55.4, setting another fresh series record. PMI Composite was finalized at 54.3, up from April’s 52.9, the second strongest reading since record began in 2007, after October 2013.

Usamah Bhatti, Economist at S&P Global Market Intelligence, said: “The record expansion in activity among service providers, coupled with a renewed increase in manufacturing production contributed to a stronger increase in overall private sector activity.

“The rate of expansion was solid and the second-strongest in the history of the series (behind October 2013). The upturn was led by the dominant services sector, although there was a renewed sense of optimism for private sector activity given the expansions in manufacturing output and new orders.

“Latest data also provides the indication economic growth has accelerated in the second quarter of the year, following the 1.3% year-on- year increase in growth in the first quarter of 2023, according to the latest official statistics.”

China Caixin PMI services rose to 57.1, overall economy lacks internal drive

China Caixin PMI Services rose from 56.4 to 57.1 in May, above expectation of 55.2. The rate of expansion was the second-steepest seen over the past two-and-a-half years. PMI Composite rose from 53.6 to 55.6, highest since end of 2020.

Wang Zhe, Senior Economist at Caixin Insight Group said: “In general, it remains a prominent feature of the Chinese economy that the services sector is stronger than manufacturing. In May, the Caixin China services PMI showed that services activity was picking up overall, but employment expansion and market optimism weakened. In the manufacturing sector, employment deteriorated, prices plunged, and manufacturers also became less optimistic toward the outlook, according to the Caixin China manufacturing PMI.

“This divergence highlights that economic growth is lacking internal drive and market entities lack sufficient confidence, underscoring the importance of expanding and restoring demand. Currently, stabilizing employment, increasing income and bolstering expectations through proactive fiscal policy should be prioritized given a dire job market and mounting deflationary pressure.”

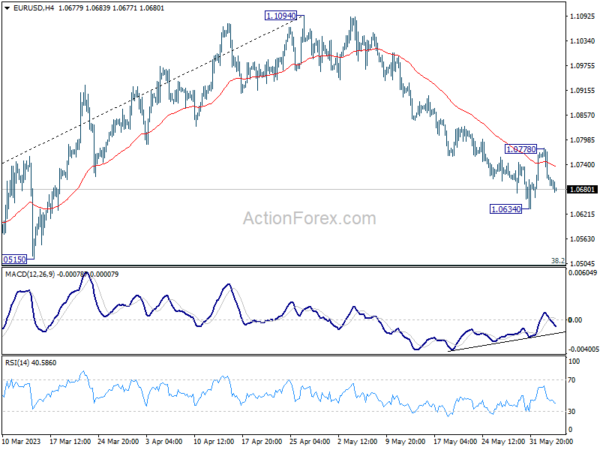

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0682; (P) 1.0731; (R1) 1.0756; More…

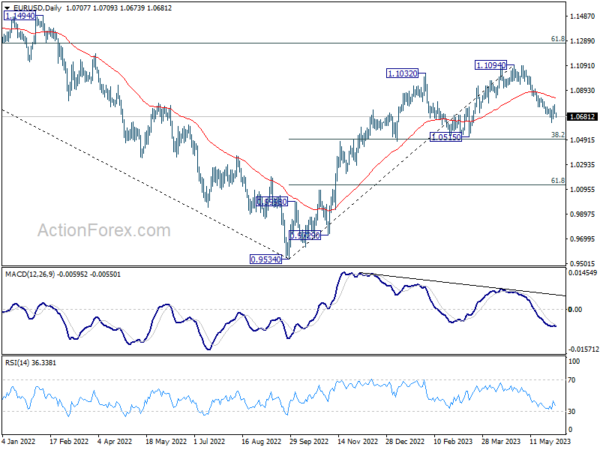

EUR/USD dips notably today but stays above 1.0634 support. Intraday bias remains neutral first. On the downside, break of 1.0634 will resume the corrective decline from 1.1094. Deeper fall should then be seen to 1.0515 cluster support, 38.2% retracement of 0.9534 to 1.1094 at 1.0498. On the upside, however, above 1.0778 will resume the rebound from 1.0634 to 55 D EMA (now at 1.0829).

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | TD Securities Inflation M/M May | 0.90% | 0.20% | ||

| 01:30 | AUD | Company Gross Operating Profits Q/Q Q1 | 0.50% | 2.10% | 10.60% | 12.70% |

| 01:45 | CNY | Caixin Services PMI May | 57.1 | 55.2 | 56.4 | |

| 06:00 | EUR | Germany Trade Balance (EUR) Apr | 18.4B | 16.1B | 16.7B | 14.9B |

| 06:30 | CHF | CPI M/M May | 0.30% | 0.40% | 0.00% | |

| 06:30 | CHF | CPI Y/Y May | 2.20% | 2.10% | 2.60% | |

| 07:45 | EUR | Italy Services PMI May | 54 | 53.7 | 57.6 | |

| 07:50 | EUR | France Services PMI May F | 52.5 | 52.8 | 52.8 | |

| 07:55 | EUR | Germany Services PMI May F | 57.2 | 57.8 | 57.8 | |

| 08:00 | EUR | Eurozone Services PMI May F | 55.1 | 55.9 | 55.9 | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jun | -17 | -9.2 | -13.1 | |

| 08:30 | GBP | Services PMI May F | 55.2 | 55.1 | 55.1 | |

| 09:00 | EUR | Eurozone PPI M/M Apr | -3.20% | -2.70% | -1.60% | |

| 09:00 | EUR | Eurozone PPI Y/Y Apr | 1.00% | 0.80% | 5.90% | |

| 13:45 | USD | Services PMI May F | 55.1 | 55.1 | ||

| 14:00 | USD | ISM Services PMI May | 52.6 | 51.9 | ||

| 14:00 | USD | Factory Orders M/M Apr | 0.80% | 0.90% |