Dollar rises broadly today, in the first trading day of August. The greenback is bolstered by mild risk aversion and rallying US yields. Meanwhile, traders are also probably starting to position ahead of the heavy weight data this week. However, the greenback is stuck below last week’s high against Euro so far. Firm break there this resistance is needed to solidify upside momentum of Dollar.

Australian Dollar’s decline gained pace in a slightly delayed reaction to RBA’s decision to hold interest rates earlier today. As market analysts dissect and digest the statement, some are beginning to predict a prolonged pause from the Australian central bank, leading to an acceleration in Aussie’s sell-off. New Zealand Dollar and Canadian Dollar are the next weakest currencies for the moment, with the Japanese Yen also underperforming, except against the Dollar.

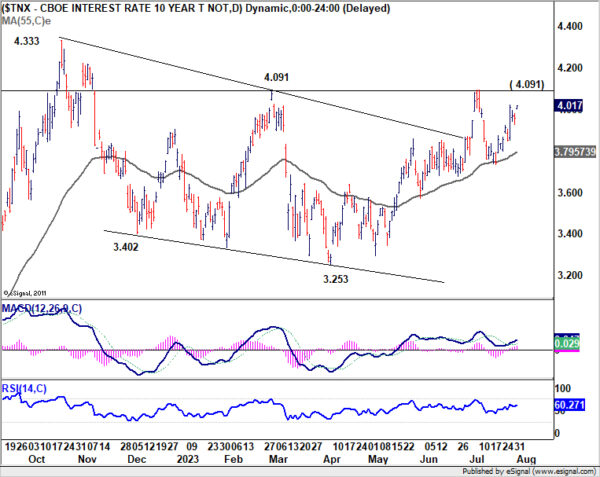

Technically, while US 10-year yield reclaims 4% handle today, it’s still kept below last week’s high. More importantly, 4.091 resistance is the key level to overcome for the near term. TNX would just engage in sideway trading in a narrowing range until this resistance is broken decisively. However, firm break of 4.091 would set the stage for further rally to retest 4.333 high, possibly in rather quick manner, and give much support to extend Dollar’s near term rise. Let’s see if this week’s data from the US would trigger the move.

In Europe, at the time of writing, FTSE is down -0.32%. DAX is down -0.92%. CAC is down -0.92%. Germany 10-year yield is up 0.048 at 2.540. Earlier in Asia, Nikkei rose 0.92%. Hong Kong HSI dropped -0.34%. China Shanghai SSE dropped -0.00%. Singapore Strait Times dropped -0.01%. Japan 10-year JGB yield dropped -0.0090 to 0.594.

Eurozone unemployment rate unchanged at 6.4%, EU at 5.9%

In June, unemployment rates in both Eurozone the EU remained stable at 6.4% and 5.9% respectively, according to Eurostat data.

Eurostat estimated that as of June 2023, around 12.802m individuals in the EU were unemployed, 10.814m of whom are from Eurozone.

Despite the unchanged monthly figures, the unemployment rate has seen a year-on-year decrease. Compared with June 2022, unemployment decreased by -387k in the EU and by -441k in Eurozone.

Eurozone PMI manufacturing finalized at 42.7, manufacturing recession is here to…

Eurozone PMI Manufacturing was finalized at 42.7 in July, down from June’s 43.4, marking a 38-month low. PMI Manufacturing Output correspondingly dipped to 42.7 from 44.2, signaling another 38-month low.

Among member states, Greece’s PMI Manufacturing showed a promising uptick to 53.5, a 14-month high, whereas Germany and Austria both posted a dismal 38-month low at 38.8. France also hit 38-month low at 45.1. Other states exhibited mixed results, with Spain hitting a 7-month low at 47.8, and Italy experiencing a modest 2-month high at 44.5.

Commenting on these figures, Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, stated: “It looks like the manufacturing recession is here to stay in the eurozone. Stronger declines in output, new orders and purchase volumes at the start of the third quarter back up our view that the economy as a whole is in for a bumpy ride in the second half of the year.”

de la Rubia also noted ECB’s reaction to deflation of output prices, which have quickened their decline, falling at the fastest pace in nearly 14 years. However, he cautioned that “the worries about services inflation remain high on the agenda.”

UK PMI manufacturing finalized at 45.3, deepening downturn

UK PMI Manufacturing was finalized at 45.3 in July. This level, matching the joint-weakest performance since May 2020, signals an ongoing deterioration in operating conditions, with PMI remaining below the pivotal 50.0 threshold for the twelfth consecutive month.

“July saw a deepening of the UK’s manufacturing downturn,” noted Rob Dobson, Director at S&P Global Market Intelligence. He attributed the slump to a combination of factors including overstocked clients, escalating export losses, rising interest rates, and the ongoing cost-of-living crisis.

Dobson also highlighted falling domestic and export demand and rapidly declining backlogs of work as precursors to potential cutbacks in production, employment, and purchasing in the near future. While falling prices offer some relief from inflation, he warned that they could signify more trouble ahead for manufacturers’ profits and subsequent investment.

RBA on hold, keeps tightening bias

RBA kept its cash rate target at 4.10%, retaining a hawkish bias. The bank noted, “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe.” However, RBA underscored that any future decision will be data-dependent and based on an “evolving assessment of risks.”

Explaining the decision to hold rates, RBA stated that “higher interest rates are working to establish a more sustainable balance between supply and demand in the economy and will continue to do so.” Amidst “uncertainty” surrounding the economic outlook, maintaining the current rate provides “further time” to assess the impact of previous hikes.

While the central bank anticipates recent data to be “consistent” with an inflation return to its 2-3% target over the forecast horizon, it warned of “significant uncertainties”.

RBA expressed concerns about the surprising persistence of services price inflation overseas, which could potentially reflect in Australia. Additionally, it mentioned uncertainties about “how firms’ pricing decisions and wages will respond to the slowing in the economy at a time when the labour market remains tight.” Also, it stated that “the outlook for household consumption is also an ongoing source of uncertainty.”

Japan PMI manufacturing finalized at 49.6, but business optimism elevated

Japan PMI Manufacturing was finalized at 49.6 in July, down from June’s 49.8. That also marked the second month of concurrent decline in output and new orders. Usamah Bhatti at S&P Global Market Intelligence highlighted the significant role of “quicker deterioration in new order inflows” and also “sustained” decline in production.

Despite these struggles, inflationary pressures showed signs of abating as the rate of input cost inflation was the slowest since February 2021. However, selling price inflation was “unchanged” and “sharp overall” as Japanese manufacturers passed on a portion of higher cost burdens to clients.

The industry displayed robust optimism about the future, with the second-highest positive sentiment recorded in the last 18 months, driven by expectations of a boost in domestic and international demand owing to new product launches and the ongoing mitigation of COVID-19 and inflation-related influences.

China Caixin PMI manufacturing down to 49.2, first contraction in three months

China’s Caixin PMI Manufacturing index slipped from 50.5 to 49.2 in July, marking the first contraction in three months and falling below the expected 50.3. According to Caixin, there was a marginal contraction in output, and total sales plummeted due to a more pronounced decline in new export orders. Additionally, both input costs and output charges saw a decrease.

Senior Economist at Caixin Insight Group, Wang Zhe, highlighted the deteriorating situation, stating, “Overall, manufacturing conditions contracted in July, with supply, demand, exports, and employment all deteriorating. Prices continued to decline, inventories rose without companies adjusting them, and logistics times increased.” He noted that manufacturers’ optimism remained, but it had weakened.

Wang further explained, “China’s economic recovery in the first quarter exceeded expectations, but the momentum weakened in the second. Although the data for industrial production and investment in June showed some signs of recovery, macroeconomic growth remained sluggish, and considerable downward pressure on the economy persisted.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2818; (P) 1.2845; (R1) 1.2863; More…

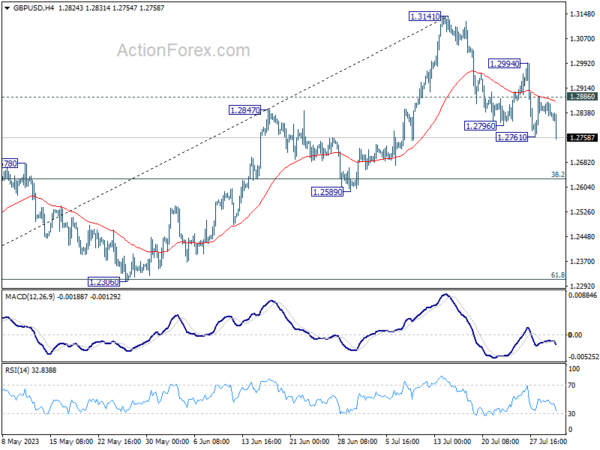

GBP/USD’s breach of 1.2761 temporary low indicates resumption of fall from 1.3141. Intraday bias is back on the downside for 38.2% retracement of 1.1801 to 1.3141 at 1.2629, as a correction to rise from 1.1801. On the upside, above 1.2886 minor resistance will turn bias back to the upside for stronger rebound.

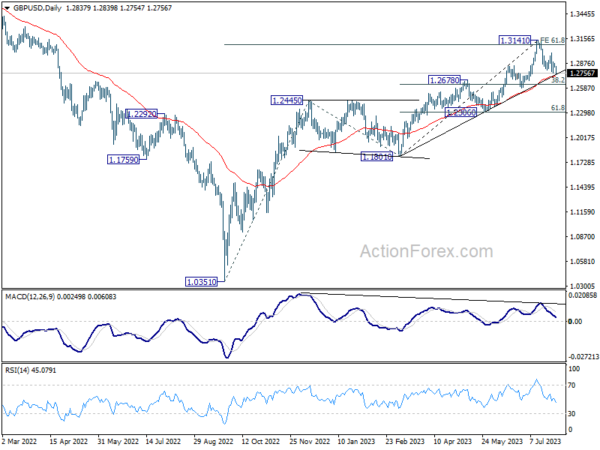

In the bigger picture, as long as 1.2678 resistance turned support holds, rise from 1.0351 (2022 low) is expected to continue. Next target is 100% projection of 1.0351 to 1.2445 from 1.1801 at 1.3895. However, sustained break of 1.2678 will argue that it’s at least correcting this rally, with risk of bearish reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Jun | 3.50% | -2.20% | -2.30% | |

| 23:01 | GBP | BRC Shop Price Index Y/Y Jun | 7.60% | 8.40% | ||

| 23:30 | JPY | Unemployment Rate Jun | 2.50% | 2.60% | 2.60% | |

| 00:30 | JPY | Manufacturing PMI Jul F | 49.6 | 49.4 | 49.4 | |

| 01:30 | AUD | Building Permits M/M Jun | -7.70% | -7.90% | 20.60% | |

| 01:45 | CNY | Caixin Manufacturing PMI Jul | 49.2 | 50.3 | 50.5 | |

| 04:30 | AUD | RBA Interest Rate Decision | 4.10% | 4.35% | 4.10% | |

| 07:45 | EUR | Italy Manufacturing PMI Jul | 44.5 | 43.9 | 43.8 | |

| 07:50 | EUR | France Manufacturing PMI Jul F | 45.1 | 44.5 | 44.5 | |

| 07:55 | EUR | Germany Unemployment Change Jun | -4K | 15K | 28K | |

| 07:55 | EUR | Germany Unemployment Rate Jun | 5.60% | 5.70% | 5.70% | |

| 07:55 | EUR | Germany Manufacturing PMI Jul F | 38.8 | 38.8 | 38.8 | |

| 08:00 | EUR | Italy Unemployment Rate Jun | 7.40% | 7.70% | 7.60% | |

| 08:00 | EUR | Eurozone Manufacturing PMI Jul F | 42.7 | 42.7 | 42.7 | |

| 08:30 | GBP | Manufacturing PMI Jul F | 45.3 | 45 | 45 | |

| 09:00 | EUR | Eurozone Unemployment Rate Jun | 6.40% | 6.50% | 6.50% | 6.40% |

| 13:30 | CAD | Manufacturing PMI Jul | 48.9 | 48.8 | ||

| 13:45 | USD | Manufacturing PMI Jul F | 49 | 49 | ||

| 14:00 | USD | ISM Manufacturing PMI Jul | 46.5 | 46 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Jul | 42.3 | 48.1 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Jul | 41.8 | |||

| 14:00 | USD | Construction Spending M/M Jun | 0.60% | 0.90% |