The competition between Dollar and Euro for the title of the week’s weakest performer remains intense. Current talking point is particularly on ECB, where economists are increasingly predicting an early rate cut following this week’s pivotal inflation data. Goldman Sachs, aligning with this growing consensus, has updated its forecast today, now anticipating ECB to initiate a rate cut in Q2 of 2024, a quarter earlier than its previous projection. The market is now keenly observing whether this anticipation will trigger further selloff in Euro before weekly close, especially in crosses to push through additional support levels.

On the other side, Dollar’s performance could hinge on upcoming ISM manufacturing data, which is a crucial indicator of the manufacturing sector’s health, employment conditions, and inflationary pressures. While Dollar has found some support at critical near-term technical levels, it requires additional positive drivers to sustain or extend its current rebound. The likelihood of a sustained rebound largely depends on market expectations regarding the timing of potential rate cuts by Fed. If the market perceives a delay in rate cuts, it could provide the necessary bullish stimulus for the greenback.

Technically, Dollar Index is showing signs that it might have established a short-term bottom at 102.46, particularly after breaching breaching 61.8% retracement of 99.57 to 107.34 at 102.53 briefly. For confirmation of this scenario, however, Dollar Index would need to surpass 104.21 resistance. Such a move could trigger a stronger rise, aiming for 55 D EMA (now at 104.74). The ISM manufacturing data could be the catalyst Dollar needs to challenge these levels. If not, the market may shift its focus to next week’s non-farm payroll data for further direction.

In Asia, at the time of writing, Nikkei is down -0.12%. Hong Kong HSI is down -0.30%. China Shanghai SSE is down -0.10%. Singapore Strait Times is up 0.36%. Japan 10-year JGB yield is up 0.038 at 0.712. Overnight, DOW rose 1.47%. S&P 500 rose 0.38%. NASDAQ fell -0.23%. 10-year yield rose 0.081 to 4.352.

China’s Caixin PMI manufacturing rises to 50.7, back to growth amidst challenges

China’s Caixin PMI Manufacturing index climbed from 49.5 to 50.7 in November, surpassing the expected 49.3. According to Caixin’s release, this improvement is attributed to sustained rise in total new work, which helped push production back into growth territory. Additionally, there was softer reduction in employment and uptick in business confidence, reaching a four-month high.

Wang Zhe, Senior Economist at Caixin Insight Group, noted, “Overall, the manufacturing sector improved in November.” He cited several factors contributing to this improvement: expansion in supply and demand, stable prices, improved logistics, increased purchasing quantities, and a more optimistic outlook among manufacturers. However, he also pointed out some ongoing challenges, such as sluggish external demand, weak employment, and cautious inventory management by manufacturers.

Wang also commented on the broader macroeconomic context, stating, “The macro economy has been recovering.” He observed improvements in household consumption, industrial production, and market expectations. Despite these positive signs, he cautioned that both domestic and foreign demand remain insufficient, employment pressures are high, and the economic recovery is still searching for a solid footing.

Japan’s PMI manufacturing finalized at 48.3, contraction continues yet optimistic

November saw Japan’s Manufacturing PMI finalized at 48.3, a slight decline from October’s 48.7. This figure, reported by S&P Global, indicates a continued contraction in the manufacturing sector, with more pronounced decreases in output and new order inflows. The PMI reaching its lowest since February signals a challenging phase for the sector, primarily due to weakened demand both domestically and internationally.

Usamah Bhatti of S&P Global Market Intelligence commented on the sector’s performance, noting, “The headline PMI slipped deeper into contraction territory, largely due to quicker deteriorations in output and new order inflows.” He identified weak customer demand across both domestic and international markets as key factors behind this downturn.

On the inflation front, although inflationary pressures remained high, there was a noticeable easing. Input cost inflation slowed down to a three-month low, and selling price inflation reduced to its softest since July 2021. This easing in inflation suggests some relief in cost pressures for manufacturers.

Despite the current contraction, Japanese manufacturers are holding onto a sense of optimism for the future. Bhatti emphasized this positive outlook, stating, “Manufacturers remained optimistic that muted demand and production conditions would lift over the coming year.” This confidence is underpinned by expectations of a boost in demand, spurred by new product launches, particularly in the semiconductor sector.

RBNZ’s Hawkesby highlights inflation pressure from record migration

RBNZ Deputy Governor Christian Hawkesby provided insights into the central bank’s current monetary policy and the economic outlook in an interview today. He discussed timing of rate cuts, and impact of rising immigration.

RBNZ’s revised forecast does not foresee rate cuts until mid-2025. Explaining the rationale behind the delayed rate cuts, Hawkesby emphasized the need for RBNZ to ensure that inflation expectations are securely re-anchored. He also pointed out that the New Zealand economy had experienced overheating and now requires a period of cooling, marked by a negative output gap.

The interview also highlighted the impact of recent demographic shifts on the The RBNZ had initially perceived rising immigration as a mitigating factor for inflation risk, considering its potential to alleviate labor shortages and reduce wage pressure. However, Hawkesby revealed that the immigration surge has been more significant than anticipated, now contributing to increased demand in the economy.

Hawkesby remarked, “Net migration has peaked at higher levels, so that’s news in itself, important news.” He further explained that the “demand-side impacts” of this trend are becoming more evident. He added, “The fact you have got to house a bigger population and the impact that that has, particularly on rental inflation and things like that.”

New Zealand’s population witnessed a substantial increase of 2.7% in the year through September, the largest in over three decades, with net annual immigration reaching a record high of 118,835.

Looing ahead

Swiss GDP and PMI manufacturing will be released in Euroepan session, along with Eurozone and UK PMI manufacturing final. Later in the day, Canada’s employment daata and US ISM manufacturing will be the main focuses.

EUR/AUD Daily Outlook

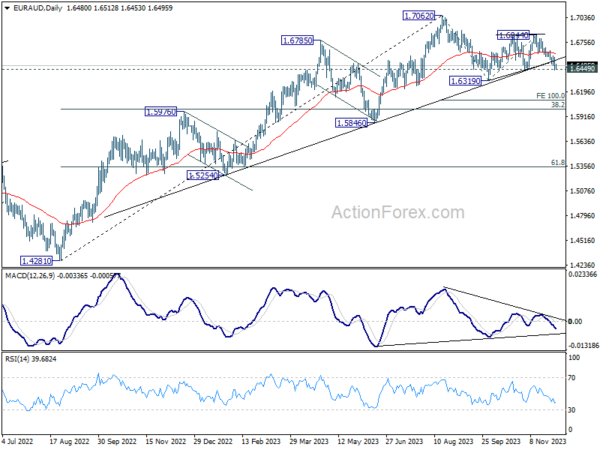

Daily Pivots: (S1) 1.6425; (P) 1.6506; (R1) 1.6567; More…

EUR/AUD’s fall from 1.6844 is still in progress and intraday bias stays on the downside, with focus on 1.6449 support. Decisive break there will argue that corrective pattern from 1.6319 has completed at 1.6844. More importantly, decline from 1.17062 is ready to resume through 1.6319 next. On the upside, above 1.6601 minor resistance will turn intraday bias neutral first.

In the bigger picture, the break of medium term trend line support now suggests that a medium term top was already formed at 1.7062. Fall from there is seen as correcting the whole up trend from 1.4281 (2022 low). Firm break of 1.6449 support will solidify this bearish case and target 38.2% retracement of 1.4281 to 1.7062 at 1.6000.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Oct | 2.50% | 2.60% | 2.60% | |

| 23:50 | JPY | Capital Spending Q3 | 3.40% | 3.40% | 4.50% | |

| 00:30 | JPY | Manufacturing PMI Nov F | 48.3 | 48.1 | 48.1 | |

| 01:45 | CNY | Caixin Manufacturing PMI Nov | 50.7 | 49.3 | 49.5 | |

| 08:00 | CHF | GDP Q/Q Q3 | 0.10% | 0.00% | ||

| 08:30 | CHF | Manufacturing PMI Nov | 42 | 40.6 | ||

| 08:45 | EUR | Italy Manufacturing PMI Nov | 45.5 | 44.9 | ||

| 08:50 | EUR | France Manufacturing PMI Nov F | 42.6 | 42.6 | ||

| 08:55 | EUR | Germany Manufacturing PMI Nov F | 42.3 | 42.3 | ||

| 09:00 | EUR | Italy GDP Q/Q Q3 | 0% | 0% | ||

| 09:00 | EUR | Manufacturing PMI Nov F | 43.8 | 43.8 | ||

| 09:30 | GBP | Manufacturing PMI Nov F | 46.7 | 46.7 | ||

| 13:30 | CAD | Net Change in Employment Nov | 14.2K | 17.5K | ||

| 13:30 | CAD | Unemployment Rate Nov | 5.80% | 5.70% | ||

| 14:30 | CAD | Manufacturing PMI Nov | 48.6 | |||

| 14:45 | USD | Manufacturing PMI Nov F | 49.4 | 49.4 | ||

| 15:00 | USD | ISM Manufacturing PMI Nov | 47.7 | 46.7 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Nov | 46.2 | 45.1 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Nov | 46.8 | |||

| 15:00 | USD | Construction Spending M/M Oct | 0.40% | 0.40% |