Canadian Dollar is firming slightly up in early US session, bolstered by stronger-than-expected Canadian job growth data. Despite the weakness in oil prices following disappointment over OPEC’s production cut decisions, Loonie is displaying resilience. However, in the weekly performance chart, while Canadian Dollar is outshining Australian Dollar, it still lags behind the New Zealand Dollar (Kiwi).

In contrast, Euro is on track to be the week’s weakest performer, with fresh selling pressure emerging. There is a potential for extending the selloff in the near term, particularly as EUR/GBP and EUR/AUD break through key near-term support levels. A critical point of focus in the currency markets is whether EUR/USD will manage to defend 1.0851 support level.

Turning to Dollar, it remains the second worst performer of the week. The market is anticipating Fed Chair Jerome Powell’s final speech before Fed’s blackout period. But it is unlikely that he will deliver any significant new information. From this point forward, the Dollar’s trajectory is expected to be heavily data-dependent, leading up to FOMC rate decision on December 23. Key data releases that will likely influence Dollar’s movement include today’s ISM manufacturing data, next week’s ISM services and non-farm payroll reports, and CPI data in the following week.

In Europe, at the time of writing, FTSE is up 0.64%. DAX is up 0.71%. CAC is up 0.25%. Germany 10-year yield is down -0.0115 at 2.437. Earlier in Asia, Nikkei fell -0.17%. Hong Kong HSI fell -1.25%. China Shanghai SSE rose 0.06%. Singapore Strait Times rose 0.56%. Japan 10-year JGB yield rose 0.0256 to 0.700.

Canada’s employment rises 24.9k in Nov, unemployment rate ticks up to 5.8%

Canada’s employment grew 24.9k in November, better than expectation of 14.2k.

Unemployment rate rose from 5.7% to 5.8%, matched expectations, and continuing an upward trend observed since April.

Total hours worked fell -0.7% mom and were up 1.3% on a year-over-year basis.

On a year-over-year basis, average hourly wages rose 4.8%, similar to the increase recorded in October.

UK PMI manufacturing finalized at 47.2, recovery remains elusive

UK PMI Manufacturing was finalized at 47.2 in November, up notably from October’s 44.8. This marks the third consecutive month of rising PMI figures and the highest level since May.

Despite these gains, it is important to note that the PMI has remained below the neutral 50 mark for 16 consecutive months, indicating a prolonged period of contraction in the manufacturing sector.

Rob Dobson, Director at S&P Global Market Intelligence, commented, “Although the downturn in production eased sharply in November, the latest PMI report brings little festive cheer when the finer details are considered.”

Dobson pointed out that despite improvement in production, the sector faces ongoing challenges. These include sharp declines in new order inflows and exports, along with clients destocking, which collectively suggest that a robust and sustained revival in meaningful growth is not yet on the horizon.

Dobson also noted, “Manufacturers are preparing for tough times ahead, with their continued caution leading to cutbacks in staffing, inventories, and purchasing.”

Eurozone PMI manufacturing finalized at 44.2, continuing contraction, but slower

Eurozone’s PMI Manufacturing was finalized at 44.2 in November, up from October’s 43.1, reaching a six-month high. The report highlights reduction in the rate of decline for new orders, stocks, and purchasing activity, yet underscores a concerning trend of increasing employment cuts.

Breaking down the performance across Eurozone member states, Greece emerged as the only country in expansion, with PMI of 50.9. Ireland remained stable at 50.0. In contrast, other major economies like Spain (46.3), the Netherlands (44.9), Italy (44.4), France (42.9), Germany (42.6), and Austria (42.2) all registered figures indicative of ongoing contraction in their manufacturing sectors.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said, “November has not been the prettiest.” He noted the continuous decline in output and the trend of workforce reductions extending for six months. While acknowledging slight improvements in various sub-indices, de la Rubia pointed out that these are insufficient to signal a robust upward trend, describing them as “timid” and lacking the necessary dynamism.

De la Rubia also highlighted the divergent conditions within the top four Eurozone economies, with Germany uniquely showing a softening in output decline. In contrast, the situation appears to be worsening in other major economies.

He emphasized, “A crucial barometer for the recovery’s onset will likely be a more synchronized upward movement in the economies PMI indexes, leading to a self-reinforcing reciprocal push among countries.”

Swiss GDP rises 0.3% qoq in Q3, services provides support

Swiss GDP grew 0.3% qoq in Q3, above expectation of 0.1% qoq. SECO said: “The international environment remains challenging, with value added in industry stagnating accordingly. However, the service sector was once again able to provide a support.”

China’s Caixin PMI manufacturing rises to 50.7, back to growth amidst challenges

China’s Caixin PMI Manufacturing index climbed from 49.5 to 50.7 in November, surpassing the expected 49.3. According to Caixin’s release, this improvement is attributed to sustained rise in total new work, which helped push production back into growth territory. Additionally, there was softer reduction in employment and uptick in business confidence, reaching a four-month high.

Wang Zhe, Senior Economist at Caixin Insight Group, noted, “Overall, the manufacturing sector improved in November.” He cited several factors contributing to this improvement: expansion in supply and demand, stable prices, improved logistics, increased purchasing quantities, and a more optimistic outlook among manufacturers. However, he also pointed out some ongoing challenges, such as sluggish external demand, weak employment, and cautious inventory management by manufacturers.

Wang also commented on the broader macroeconomic context, stating, “The macro economy has been recovering.” He observed improvements in household consumption, industrial production, and market expectations. Despite these positive signs, he cautioned that both domestic and foreign demand remain insufficient, employment pressures are high, and the economic recovery is still searching for a solid footing.

Japan’s PMI manufacturing finalized at 48.3, contraction continues yet optimistic

November saw Japan’s Manufacturing PMI finalized at 48.3, a slight decline from October’s 48.7. This figure, reported by S&P Global, indicates a continued contraction in the manufacturing sector, with more pronounced decreases in output and new order inflows. The PMI reaching its lowest since February signals a challenging phase for the sector, primarily due to weakened demand both domestically and internationally.

Usamah Bhatti of S&P Global Market Intelligence commented on the sector’s performance, noting, “The headline PMI slipped deeper into contraction territory, largely due to quicker deteriorations in output and new order inflows.” He identified weak customer demand across both domestic and international markets as key factors behind this downturn.

On the inflation front, although inflationary pressures remained high, there was a noticeable easing. Input cost inflation slowed down to a three-month low, and selling price inflation reduced to its softest since July 2021. This easing in inflation suggests some relief in cost pressures for manufacturers.

Despite the current contraction, Japanese manufacturers are holding onto a sense of optimism for the future. Bhatti emphasized this positive outlook, stating, “Manufacturers remained optimistic that muted demand and production conditions would lift over the coming year.” This confidence is underpinned by expectations of a boost in demand, spurred by new product launches, particularly in the semiconductor sector.

RBNZ’s Hawkesby highlights inflation pressure from record migration

RBNZ Deputy Governor Christian Hawkesby provided insights into the central bank’s current monetary policy and the economic outlook in an interview today. He discussed timing of rate cuts, and impact of rising immigration.

RBNZ’s revised forecast does not foresee rate cuts until mid-2025. Explaining the rationale behind the delayed rate cuts, Hawkesby emphasized the need for RBNZ to ensure that inflation expectations are securely re-anchored. He also pointed out that the New Zealand economy had experienced overheating and now requires a period of cooling, marked by a negative output gap.

The interview also highlighted the impact of recent demographic shifts on the The RBNZ had initially perceived rising immigration as a mitigating factor for inflation risk, considering its potential to alleviate labor shortages and reduce wage pressure. However, Hawkesby revealed that the immigration surge has been more significant than anticipated, now contributing to increased demand in the economy.

Hawkesby remarked, “Net migration has peaked at higher levels, so that’s news in itself, important news.” He further explained that the “demand-side impacts” of this trend are becoming more evident. He added, “The fact you have got to house a bigger population and the impact that that has, particularly on rental inflation and things like that.”

New Zealand’s population witnessed a substantial increase of 2.7% in the year through September, the largest in over three decades, with net annual immigration reaching a record high of 118,835.

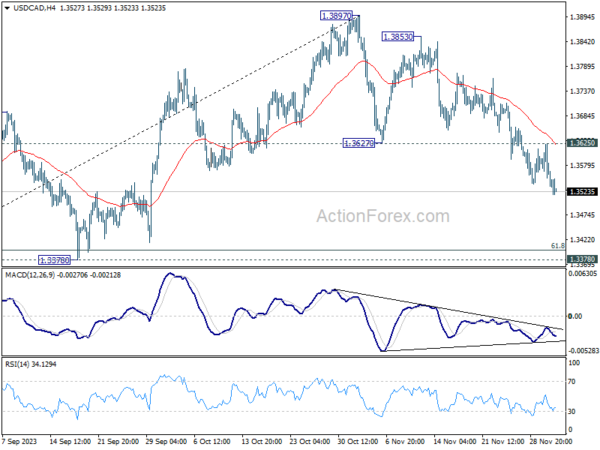

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3532; (P) 1.3579; (R1) 1.3606; More…

Intraday bias in USD/CAD remains on the downside at this point. Current fall from 1.3897 is in progress, and should target 1.3378 support next. On the upside, though, above 1.3625 minor resistance will turn intraday bias neutral again first.

In the bigger picture, corrective pattern from 1.3976 (2022 high) should have completed with three waves down to 1.3091. Decisive break of 1.3976 high will confirm resumption of up trend from 1.2005 (2021 low). Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3091 at 1.4064. This will remain the favored case as long as 1.3378 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Oct | 2.50% | 2.60% | 2.60% | |

| 23:50 | JPY | Capital Spending Q3 | 3.40% | 3.40% | 4.50% | |

| 00:30 | JPY | Manufacturing PMI Nov F | 48.3 | 48.1 | 48.1 | |

| 01:45 | CNY | Caixin Manufacturing PMI Nov | 50.7 | 49.3 | 49.5 | |

| 08:00 | CHF | GDP Q/Q Q3 | 0.30% | 0.10% | 0.00% | -0.10% |

| 08:30 | CHF | Manufacturing PMI Nov | 42.1 | 42 | 40.6 | |

| 08:45 | EUR | Italy Manufacturing PMI Nov | 44.4 | 45.5 | 44.9 | |

| 08:50 | EUR | France Manufacturing PMI Nov F | 42.9 | 42.6 | 42.6 | |

| 08:55 | EUR | Germany Manufacturing PMI Nov F | 42.6 | 42.3 | 42.3 | |

| 09:00 | EUR | Manufacturing PMI Nov F | 44.2 | 43.8 | 43.8 | |

| 09:30 | GBP | Manufacturing PMI Nov F | 47.2 | 46.7 | 46.7 | |

| 13:30 | CAD | Net Change in Employment Nov | 24.9K | 14.2K | 17.5K | |

| 13:30 | CAD | Unemployment Rate Nov | 5.80% | 5.80% | 5.70% | |

| 14:30 | CAD | Manufacturing PMI Nov | 48.6 | |||

| 14:45 | USD | Manufacturing PMI Nov F | 49.4 | 49.4 | ||

| 15:00 | USD | ISM Manufacturing PMI Nov | 47.7 | 46.7 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Nov | 46.2 | 45.1 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Nov | 46.8 | |||

| 15:00 | USD | Construction Spending M/M Oct | 0.40% | 0.40% |