Yen falls broadly today after BoJ’s to maintain monetary policy unchanged. The sell-off can be attributed to the dismay of investors who had hoped for indications of a shift towards stimulus exit next year. BoJ’s steadfastness in its easing bias, without any hint of a policy adjustment, has contributed to Yen’s softening. Although this doesn’t signify an outright bearish reversal for Yen, it does set a tone of mild vulnerability for the currency as the year draws to a close, with mild downside risks ahead.

In contrast, New Zealand Dollar and the Australian Dollar are firming up mildly. Kiwi’s uplift is primarily driven by modest improvement in New Zealand’s business confidence data, suggesting a more optimistic economic outlook in the region. Australian Dollar is finding support from RBA’s latest meeting minutes which struck a balanced tone, but left the door ajar for possible future rate hikes.

Elsewhere, Dollar and Euro are lagging behind, following Yen in terms of performance. Swiss Franc and Sterling, on the other hand are emerging as stronger contenders. Canadian Dollar is presenting a mixed picture as investors and analysts await the release of Canada’s CPI, which is expected to provide further clarity on the country’s inflation trajectory and, by extension, potential monetary policy directions.

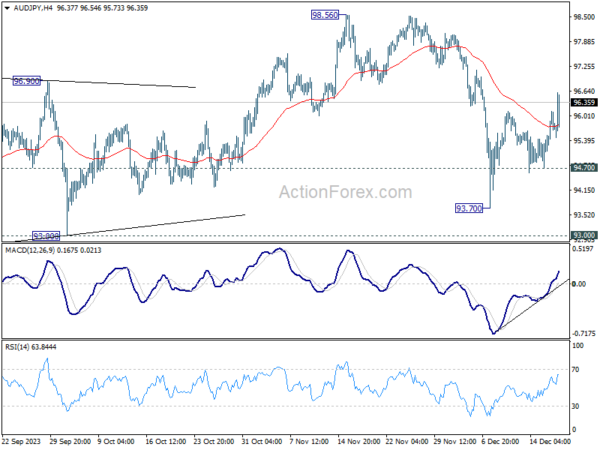

Technically, AUD/JPY’s rebound from 93.70 resumed by breaking through 96.13 minor resistance. Further rise is now in favor as long as 94.70 support holds. Upside could be capped by 98.56 resistance, at least on the first attempt. Corrective pattern from 98.56 could extend with another falling leg before completion. Meanwhile, break of 94.70 will bring retest of 93.70 instead.

In Asia, Nikkei closed up 1.41%. Hong Kong HSI is down -1.08%. China Shanghai SSE is down -0.47%. Singapore Strait Times is up 0.23%. Japan 10-year JGB yield fell -0.0286 to 0.641. Overnight, DOW closed up 0.00%. S&P 500 rose 0.45%. NASDAQ rose 0.62. 10-year yield rose 0.026 to 3.954.

BoJ holds steady despite speculation for tweaks

BoJ decided to maintain its monetary policy unchanged, a move that has come as a disappointment to some observers who anticipated minor policy changes or at least some alterations in the statement.

Under the Yield Curve Control framework, short-term policy interest rate remains at -0.1%. BoJ has also maintains its target for the 10-year JGB yield at approximately 0%, allowing for a cap of 1% for yield fluctuations. This decision was reached unanimously.

In addition, BoJ reiterated its commitment to an easing bias, stating it “will not hesitate to take additional easing measures if necessary.”

Regarding Japan’s economic outlook, BoJ expects a moderate ongoing recovery in the near term. However, it acknowledges downward pressures, primarily due to a slowdown in the recovery pace of overseas economies. Looking ahead, the central bank projects that as a positive cycle from income to spending strengthens, Japan’s economy will continue to grow at a rate above its potential growth rate.

In terms of inflation, BoJ anticipates CPI core to remain above 2% through fiscal 2024. Underlying inflation is expected to “increase gradually toward achieving the price stability target.”

RBA considered hike and hold, Dec minutes show

Minutes of RBA’s December 5 meeting revealed that both a 25bps hike and maintaining the status quo were considered. Ultimately, they opted to keep the interest rate unchanged at 4.35%. The rationale behind this decision was the perceived value in “waiting for further data to assess how the balance of risks was evolving and how best to balance these risks when setting policy.”

The board members concurred that the need for additional monetary tightening to ensure inflation returns to the target within a reasonable timeframe would be contingent on how incoming data influences the economic outlook and the assessment of risks.

The RBA emphasized its commitment to closely monitoring various economic indicators in its future policy decisions. This includes developments in the global economy, trends in domestic demand, and the outlook for inflation and the labor market.

NZ ANZ business confidence improved to 33.2, with mixed inflation signals

New Zealand’s ANZ Business Confidence climbed from 30.8 to 33.2 in December. Looking into the specifics, own activity outlook improved from 26.3 to 29.3, indicating positive sentiment about future business conditions. However, investment intentions dropped from 4.5 to 2.7, suggesting some hesitancy in capital expenditures. Employment intentions rose from 5.4 to 7.0, reflecting moderately stronger inclination towards hiring.

In terms of pricing, there was a noticeable increase, with pricing intentions moving from 46.8 to 50.2. This rise implies that more businesses are planning to increase their prices, which could contribute to inflationary pressures. Similarly, cost expectations saw an upward movement from 73.9 to 76.2, indicating rising costs for businesses. On the other hand, inflation expectations showed a decline from 4.79% to 4.61%.

ANZ commented on the mixed nature of the inflation indicators, as they do not present an encouraging outlook for inflation. With more data expected before RBNZ’s February decision, this survey’s results might not be among the most favorable. While recent GDP data showed RBNZ’s measures gaining more traction than previously understood, the extent of economic downturn required to bring inflation down to the 2% target remains an unresolved question.

New Zealand’s trade deficit narrows to NZD -1.2B, led by decreased trade with china

New Zealand’s goods trade deficit narrowed from NZD 1.7B to NZD 1.2B in November, aligning largely with market expectations. Exports fell by NZD 337m, representing -5.3% yoy decline, settling at NZD 6.0B. Meanwhile, imports saw a more substantial reduction of NZD 1.3B, -15% yoy decrease, totaling NZD 7.2B.

A key factor in these changes is reduced trade volume with China, which led contraction in both imports and exports. Exports to China decreased by NZD 183m, -9.7% yoy fall. Imports from China also saw a substantial reduction of NZD 347m, marking -17% yoy decrease.

Other key trading partners also showed varied trends. Exports to Australia and EU declined by NZD 35m (-4.5% yoy) and NZD 27m (-9.1% yoy), respectively. Conversely, exports to US increased by NZD 110m, a significant 18% yoy rise. Exports to Japan experienced a sharp decline of NZD 99m, -27% yoy drop.

In the realm of imports, alongside China, EU, Australia, US, and South Korea all registered declines. Imports from the EU decreased by NZD 164m (-14% yoy), from Australia by NZD 219m (-23% yoy), from the US by NZD 68m (-11% yoy), and from South Korea by NZD 231m (-32% yoy).

Fed’s Daly views 2024 as right for rate cuts, timetable uncertain

San Francisco Fed Bank President Mary Daly, in a Wall Street Journal interview yesterday, suggested that it might be appropriate for policymakers to start considering rate cuts in 2024, especially considering the easing of inflation this year. However, she also cautioned that it is premature to speculate on the exact timing of these rate reductions.

Daly emphasized the delicate balancing act Fed faces: the need to achieve price stability while minimizing job losses. Fed’s goal is to bring inflation down to its 2% target, but Daly highlighted the importance of doing so gently, “with as few disruptions to the labor market as possible.”

Another key point from Daly’s interview concerns the real borrowing costs for households and businesses. With inflation showing a downward trend, maintaining the current rate could inadvertently increase these costs. Daly conveyed her wariness that “we could overtighten quite easily, and so that’s what I’m mindful of”.

Aligning with the broader perspective of Fed policymakers, Daly’s views resonate with the median projections released last week. These projections suggest a majority of the 19 Fed policymakers anticipate a 75 basis-point reduction from the current target range of 5.25%-5.50% for the policy rate, aiming to bring inflation down to about 2.4% by the year’s end.

BoC’s Macklem see rate cuts in 2024, but with focus on core inflation trend

BoC Governor Tiff Macklem, in an interview with Bloomberg overnight, indicated that interest rate cuts are being considered “sometime in 2024,” but he emphasized that this decision hinges critically on the sustained easing of core inflation.

Macklem underlined the importance of core inflation as a key focus for BoC. He stated, “We’re very focused on core inflation.” Specifically, he pointed out the necessity for “a number of months with sustained downward momentum in core inflation” before the central bank can confidently move forward with interest rate cuts.

Nevertheles, Macklem expressed a growing confidence in the effectiveness of the current monetary policy, acknowledging that “increasingly, the conditions are in place to get us back to two-per-cent inflation.”

However, he was clear in conveying that this goal has not been fully achieved yet, stating, “but that is not yet assured, we’re not there yet.”

Looking ahead

Swiss trade balance and Eurozone CPI final will be relased in Euroepan session. Later in the day, Canada CPI, IPPI and RMPI will be featured while US will publish housing starts and building permits.

USD/JPY Daily Outlook

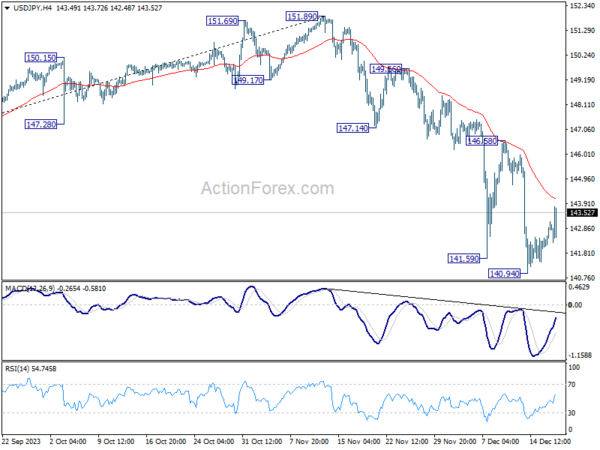

Daily Pivots: (S1) 142.15; (P) 142.66; (R1) 143.30; More…

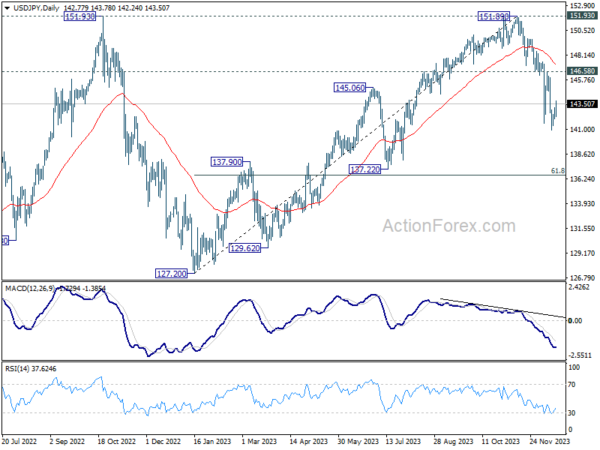

While USD/JPY’s recovery from 140.94 extends higher today, outlook is unchanged. Upside of recovery should be limited well below 146.58 resistance to bring another decline. On the downside, break of 140.94 will resume the fall from 151.89 to next fibonacci level at 136.63.

In the bigger picture, fall from 151.89 is seen as the third leg of the corrective pattern from 151.93 (2022 high). Deeper decline would be seen to 61.8% retracement of 127.20 to 151.89 at 136.63, sustained break there will pave the way to 127.20 support (2022 low). This will now remain the favored as long as 146.58 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Nov | -1234M | -1200M | -1709M | -1730M |

| 00:00 | NZD | ANZ Business Confidence Dec | 33.2 | 30.8 | ||

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 02:49 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 07:00 | CHF | Trade Balance (CHF) Nov | 3.50B | 4.60B | ||

| 10:00 | EUR | Eurozone CPI Y/Y Nov F | 2.40% | 2.40% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Nov F | 3.60% | 3.60% | ||

| 13:30 | USD | Housing Starts Nov | 1.360M | 1.372M | ||

| 13:30 | USD | Building Permits Nov | 1.470M | 1.498M | ||

| 13:30 | CAD | Industrial Product Price M/M Nov | -0.70% | -1.00% | ||

| 13:30 | CAD | Raw Material Price Index Nov | -3.50% | -2.50% | ||

| 13:30 | CAD | CPI M/M Nov | -0.10% | 0.10% | ||

| 13:30 | CAD | CPI Y/Y Nov | 2.90% | 3.10% | ||

| 13:30 | CAD | CPI Median Y/Y Nov | 3.30% | 3.60% | ||

| 13:30 | CAD | CPI Trimmed Y/Y Nov | 3.40% | 3.50% | ||

| 13:30 | CAD | CPI Common Y/Y Nov | 4.00% | 4.20% |