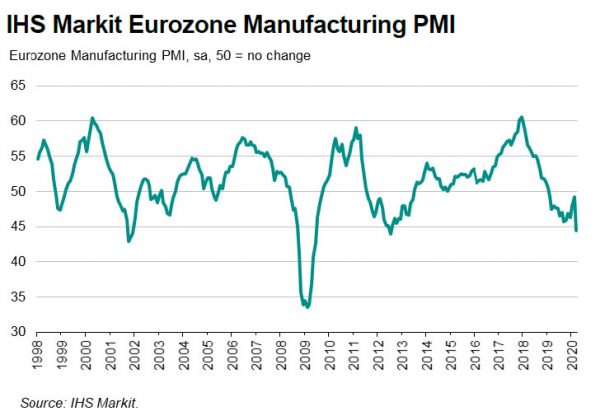

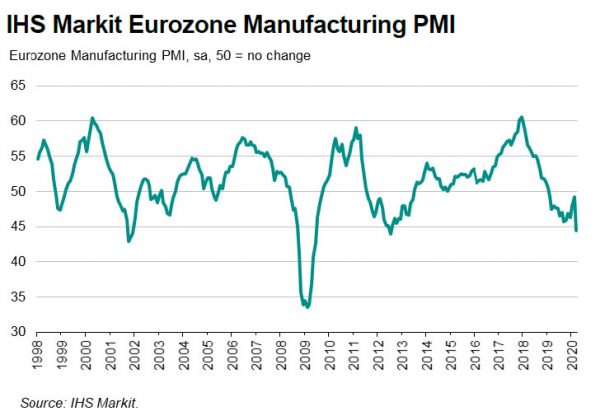

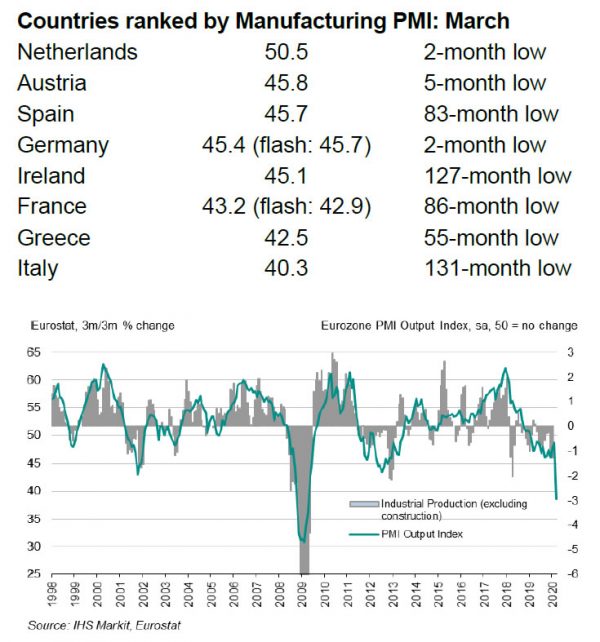

Eurozone PMI Manufacturing was finalized at 44.5 in March, down from February’s 29.2. Markit noted that coronavirus related shutdowns drove output and orders lower. There was record deterioration in supplier delivery performance.

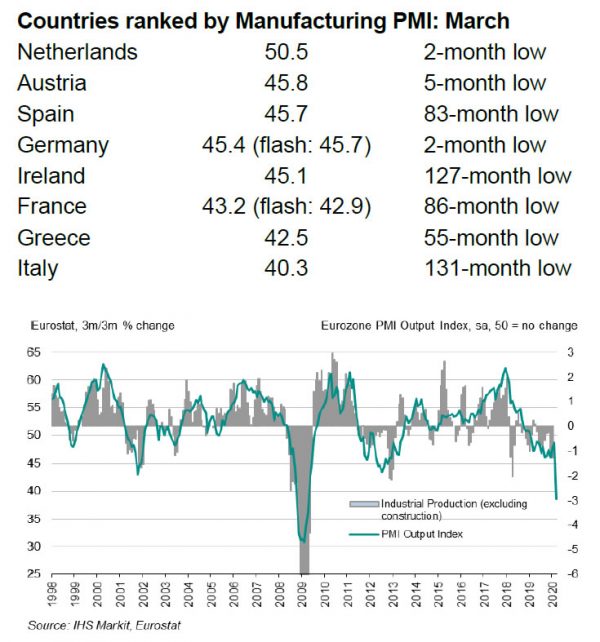

Among the member states, Italy hit 131-month low at 40.3. Greece hit 55-month low at 42.5. France hit 86-month low at 43.2. Ireland hit 127-month low at 45.1. Germany hit 2-month low at 45.1. Spain hit 83-month low at 45.7. Austria hit 5-month low at 45.8. Only the Netherlands stayed in expansion, at 2-month low of 50.5.

Chris Williamson, Chief Business Economist at IHS Markit said:

Chris Williamson, Chief Business Economist at IHS Markit said:

“Even the slide in the PMI to a seven-and-a-half-year low masks the severity of the slump in manufacturing as it includes a measure of supply chain delays, which boosted the index. Supply delays are normally seen as a sign of rising demand, but at the moment near-record delays are an indication of global supply chains being decimated by factory closures around the world.

“We need to look at the survey’s output and new orders gauges to get a better understanding of the scale of the likely hit to the economy that will come from the manufacturing sector’s collapse, and these indices hint at production falling at the sharpest rate since 2009, dropping an annualised rate approaching double digits.

“The concern is that we are still some way off peak decline for manufacturing. Besides the hit to output from many factories simply closing their doors, the coming weeks will likely see both business and consumer spending on goods decline markedly as measures to contain the coronavirus result in dramatically reduced orders at those factories still operating. Company closures, lockdowns and rising unemployment are likely to have an unprecedented impact on expenditure around the world, crushing demand for a wide array of products. Exceptions will be food manufacturing and pharmaceuticals, but elsewhere large swathes of manufacturing could see downturns of the likes not seen before”

Full release here.

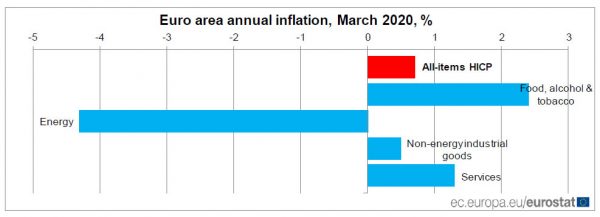

Eurozone PPI at -0.6% mom, -1.3% yoy in Feb

Eurozone PPI came in at -0.6% mom, -1.3% yoy in February, versus expectation of -0.1% mom, -0.6% yoy. Looking at some details, energy decreased -2.3% mom, intermediate goods dropped -0.2% mom. Capital goods rose 0.1% mom. Durable and non-durable consumer goods rose 0.2% mom.

EU PPI came in at 0.6% mom, -1.0% yoy. The largest decreases in industrial producer prices were recorded in Denmark (-2.2% mom), Spain and Portugal (both -1.3% mom), while the highest increases were observed in Slovakia (2.2% mom), Ireland and Cyprus (both 0.2% mom).

Full release here.