European and world leaders’ summits preceding and concluding the upcoming week will be the most closely watched events as the market tone will be tied to how much progress is made with Brexit arrangements and in easing Sino-US trade tensions. The Federal Reserve will also be attracting plenty of attention as several policymakers, including Chairman Powell, are scheduled to speak. In terms of economic indicators, Australian quarterly business expenditure, Canadian Q3 GDP and US PCE inflation will be the highlights.

Hopes high for Brexit deal at Brexit summit

European Union leaders will meet on Sunday, November 25 for a special summit to sign-off the Withdrawal Agreement between Britain and the EU as well as on the declaration on the framework for the future relationship. Sterling jumped above the $1.29 on Thursday after the UK and EU negotiators managed to reach an agreement on the text outlining the future relationship. Excluding last-minute hiccups such as Spain objecting on the terms for Gibraltar, the withdrawal deal and future declaration are set to get the seal of approval by EU member states.

However, pound bulls are unlikely to return to the market in droves just yet, as, even if a deal is finalized, all eyes will be on the UK Parliament, which many expect will vote down the agreements when MPs get to have their say sometime in December.

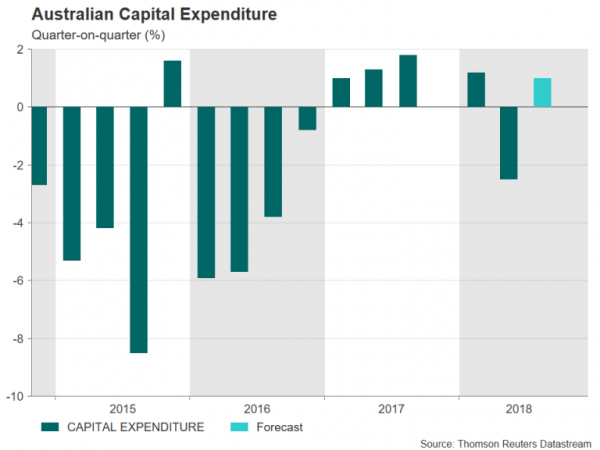

Aussie eyes Q3 capex for GDP clues

The Australian dollar is on track to end three straight weeks of gains as it pulls back from 2½-week highs on receding risk appetite in the markets. The focus next week though will return to the domestic economy as third quarter figures on business spending are out on Thursday, followed by private sector lending for October on Friday. Capital expenditure is forecast to have increased by 1.0% quarter-on-quarter in Q3, rebounding from the prior quarter’s 2.5% decline. A strong reading would be positive for the aussie as it would point to encouraging GDP numbers due the following week.

In addition to Australian data, aussie traders will be looking at Chinese PMI figures on Friday. China’s official manufacturing PMI slowed to just above the 50-expansion level in October as local exporters came under pressure from the higher tariffs imposed by the United States. Further deterioration in the manufacturing activity gauge would fuel concerns of a slowdown in China and hurt the aussie, which is often traded as a liquid proxy for the Chinese economy.

Battered loonie seeks Canadian GDP boost

Like their Australian counterpart, the kiwi and the loonie – the other major commodity-linked currencies – came under pressure versus the greenback during the past week as the risk-off sentiment weighed on commodity prices. While the New Zealand dollar’s decline was more attributed to profit-taking, having rallied 6% between the October trough and the November top, the Canadian dollar’s losses were driven by the oil sell-off. Both currencies are set for further volatility next week as key indicators are released in New Zealand and Canada.

Retail sales numbers from New Zealand for the June-September period are up first on Monday. They will be followed by October trade figures on Tuesday and the ANZ business outlook index on Thursday. The ANZ’s confidence gauge had slumped to a 10-year low in August before recovering to -37.1 in October. A further improvement in November could help the kiwi resume its rebound.

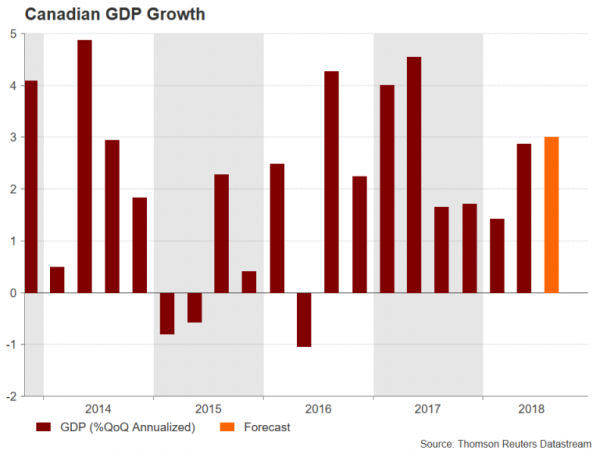

The loonie also stands to gain from next week’s data if they strengthen expectations of another rate rise by the Bank of Canada in early 2019 following October’s quarter-point hike to 1.75%. The biggest clue will likely come from third quarter GDP estimates due on Friday. Canada’s economy is projected to have expanded by an annualized rate of 3.0% during the third quarter, which would be a slight improvement on the prior 2.9%.

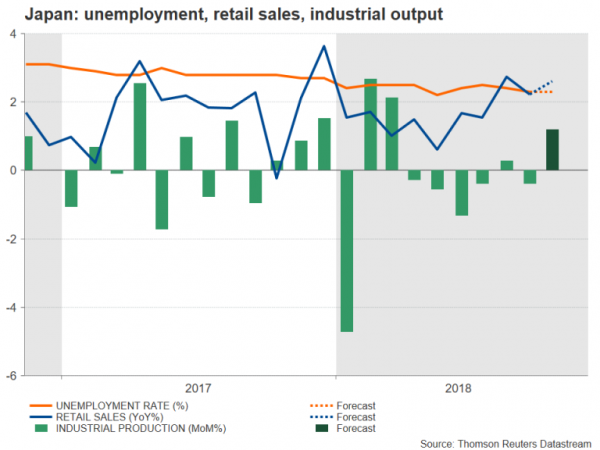

Yen likely to be unfazed by slew of Japanese data

The Japanese economic calendar will be a busy one in the upcoming week but safe-haven flows relating to global trade tensions and political uncertainty in Europe will probably remain the yen’s biggest drivers. Attention at the start of the week will fall on the Nikkei/Markit flash manufacturing PMI for November on Monday. Retail sales for October will follow on Thursday. Lastly on Friday, data on the labour market and industrial production will be watched. Japan’s jobless rate is forecast to stay unchanged at 2.3% in October, near multi-decade lows, while the preliminary reading on industrial output for October is forecast to show a 1.2% month-on-month bounce from September’s 0.4% dip.

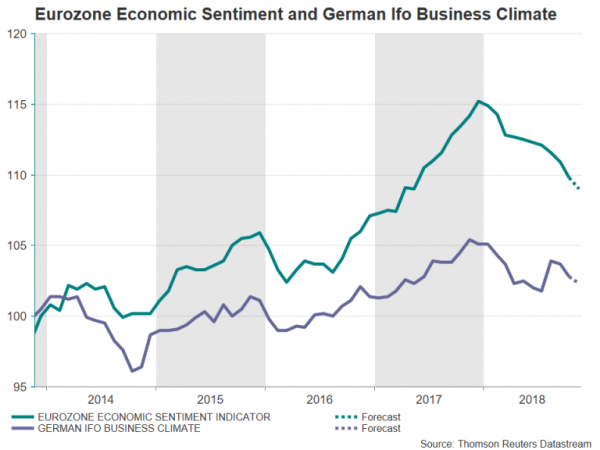

Draghi’s parliamentary hearing and Eurozone inflation eyed

ECB President Mario Draghi will testify before the European Parliament’s Economic and Monetary Affairs Committee on Monday, which comes hot on the heels of the ECB’s meeting minutes published this week. Draghi is unlikely to provide any new views on the monetary policy outlook. However, any repetition of earlier remarks that the projected rate path could be adjusted if the growth and inflation outlook worsen could still drag on the euro.

In terms of data, Germany’s Ifo survey will provide a glimpse at German business sentiment. But those hoping for a turnaround will probably be disappointed as the Ifo’s business climate index is expected to drop from 102.8 to 102.3 in November. On Thursday, traders will get the chance to assess business confidence in the wider euro area. The economic sentiment indicator is forecast to fall from 109.8 to 109.0 in November. The flash PMIs published this week also showed a deceleration in German and Eurozone manufacturing and services activity during the month.

Finally, on Friday, the flash inflation numbers for November are due, along with the bloc’s unemployment rate for October. The Eurozone’s headline CPI rate is expected to decrease by 0.1 percentage points to 2.1% year-on-year in November, while the core rate that excludes all volatile items is anticipated to stay unchanged at 1.1%.

PCE inflation, Fed and Trump-Xi meeting to be dollar’s focal points

There will be no shortage of sources of direction for the US dollar next week, with traders at risk of being overwhelmed by important data releases, Fed speakers, the FOMC meeting minutes and highly anticipated trade talks between Chinese and US leaders.

Starting with US economic pointers, the housing sector, which is under scrutiny lately due to signs of a slowdown, will move to the fore early in the week with the S&P CoreLogic Case-Shiller 20-City Composite Home Price index out on Tuesday. Other housing data during the week will include new home sales (Wednesday) and pending home sales (Thursday), both for October. Also scheduled for Tuesday is the Conference Board’s consumer confidence index, which is predicted to ease in November from October’s 18-year high. On Wednesday, the second estimate of GDP growth in the third quarter is due. Economic growth is expected to be unrevised from the initial reading of 3.5%.

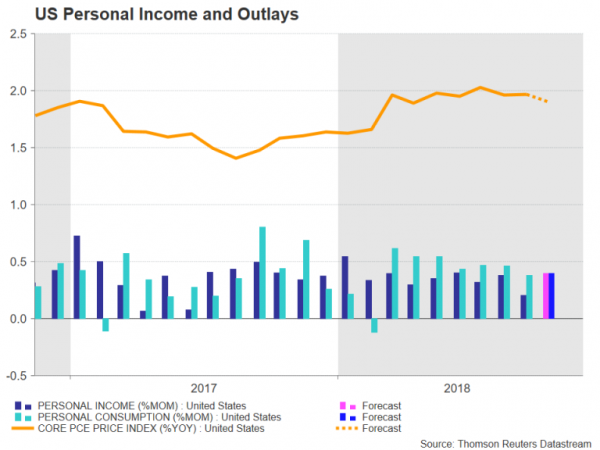

More key releases will follow on Thursday with the personal income and outlays report. Both personal income and consumption are forecast to have risen by 0.4% m/m in October, maintaining the steady and solid growth enjoyed throughout the year. Meanwhile, the Fed’s favourite price barometer, the core personal consumption expenditures (PCE) price index, is expected to have moderated a little to 1.9% y/y in October.

The GDP and PCE prints may fail to see the usual reaction in the markets as the focus is increasingly turning on 2019 in relation to Fed policy. The Fed itself will have the opportunity to message to the markets its latest assessment of the US economy through its meeting minutes and via public appearances. The minutes of the October/November policy meeting will be published on Thursday and will probably hint at a rate hike in December. But potentially of more significance to traders will be what FOMC members comment on regarding the pace of rate hikes in 2019, and more specifically, whether Fed Chairman, Jerome Powell will signal a rethink of the central bank’s gradual tightening approach when he speaks on Wednesday.

Drawing the week to a close will be the meeting between President Trump and President Xi at the sidelines of the G20 summit on November 30 – December 1. Sentiment towards the two sides reaching an eventual deal on better trade relations has improved substantially lately amid renewed efforts by the two countries to bridge their differences over trade policy. However, it’s unclear how many concessions the Chinese are willing to make at this point and how concerned Trump is with the sell-off on Wall Street to push the two leaders to strike some sort of a truce.

Any progress at the G20 summit would be positive for risk appetite but possibly negative for the dollar, which has benefited the most from the heightened trade risks.