- ECB decision and Eurozone PMIs will chart euro’s course today

- Pound soars to 10-week highs versus dollar as no-deal Brexit risk fades

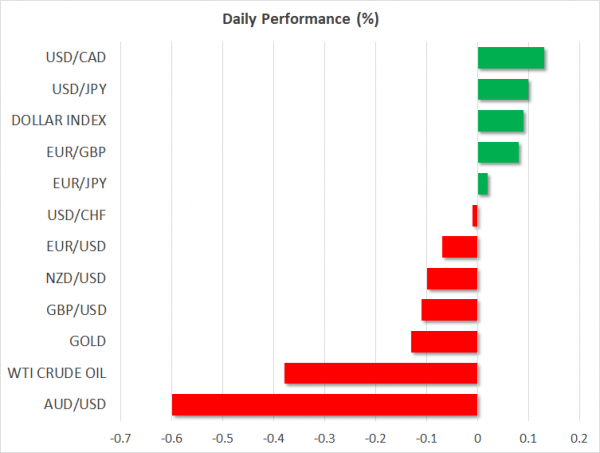

- Aussie tumbles on mounting speculation for RBA rate cut

- Stocks inch higher on strong earnings, dollar rebound stalls

ECB meeting & Eurozone PMIs could make-or-break euro/dollar today

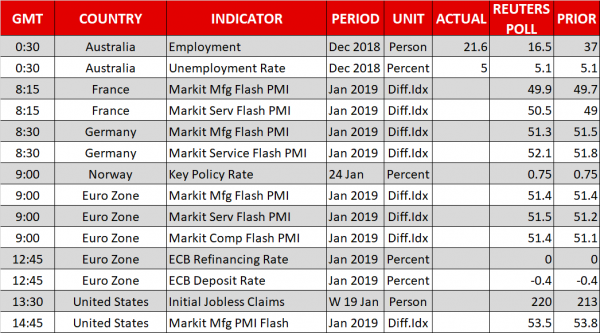

It will be a crucial session for European assets and the euro itself today. The European Central Bank (ECB) will announce its policy decision at 1245 GMT, which will be followed by a press conference from President Draghi at 1330 GMT. A few hours ahead of the event, the Eurozone’s preliminary manufacturing and services PMIs for January will be released.

No action is expected, so all eyes will be on whether the ECB will downgrade its language around growth, in light of weakening economic data. It teased as much at the previous meeting and considering that the data pulse has weakened even further since then, a dovish recalibration in the assessment of growth risks seems sensible. While the euro could come under some initial pressure if this is indeed the case, any downside is unlikely to be massive as the move is broadly expected.

Instead, the more important variable for the euro’s overall path may be Draghi’s tone, and whether or not investors get the sense that a rate hike this year is becoming less and less likely. Separately, any major surprise in the bloc’s PMIs could prove equally – if not more – important for the euro than anything the ECB says. Euro/dollar is hovering just above an uptrend line drawn from the November lows, and today’s events may be the catalyst for either a clear rebound off that area or a break below it, thereby keeping the short-term technical bias positive or turning it neutral, respectively.

Sterling claims new heights as no-deal Brexit risk seen fading

The British currency was by far the best performer in the G10 FX space on Wednesday, surging to clear the $1.30 handle against the dollar. The move followed news that the Labour party will support an amendment that aims to prevent a no-deal Brexit. While that was hardly surprising, since half of Labour MPs support another referendum and the entire party wants to stop a no-deal exit, investors still took the opportunity to buy the pound.

Although uncertainty is still elevated as there is no clear “next step” in the Brexit process, there seems to be a paradigm shift underway, with markets turning increasingly positive on the UK currency as they judge that the worst-case scenario will likely be avoided.

Aussie crumbles as RBA rate-cut speculation picks up

Elsewhere, the aussie is the worst performing major currency today, despite Australia releasing another set of strong employment data overnight. The currency reversed course after a major Australian bank announced it will raise its mortgage rates. Australian households are heavily indebted, so such hikes could constrain consumers further, curbing economic growth. In short, investors interpreted the news as increasing the probability that the RBA could cut its own policy rate soon, to offset the negative impact.

Stocks inch higher, dollar pulls back

Market sentiment remained fragile overall on Wednesday, with US markets trading mostly sideways before rallying towards the end of the session to close modestly higher. The Dow Jones (+0.80%) outperformed, aided by strong earnings from IBM (+8.5%) and Procter and Gamble (+4.9%). The earnings season continues today with Intel, which will report its results after Wall Street’s closing bell.

Meanwhile, the dollar struggled after White House advisor Hassett raised the possibility that economic growth in Q1 may be zero if the government shutdown continues. The move underscores that the longer the shutdown lasts, the more detrimental it becomes to the economy and markets. Today, the Markit manufacturing PMI for January could attract attention.