Dollar has been relatively today and risks of escalation in trade war diminished. Deeper selling is seen after inflation data showed larger than expected fall in core CPI in August. Though, the greenback is currently underperformed by Yen due to easing risk aversion. In addition to trade optimism, Turkish central bank also delivered the anticipated rate hike, which helps lift the Lira by more than 2%. Talking about central banks, both BoE and ECB stand pat today and their decisions are widely expected.

On the other hand, Australian Dollar continues to be the biggest winner today, as additionally supported by strong job data. Euro followed as the second strongest.

Technically, we could Dollar and Yen extending this week’s decline further in US session. In particular, EUR/USD will likely take on 1.1733 resistance while USD/CHF will take on 0.9640 support. EUR/JPY breaks 129.97 minor resistance and should now be heading to 130.86 and above. USD/JPY, however, is staying in range and show no intention of a breakout.

Dollar falls as core CPI slowed more than expected, ignore strong job data

Dollar suffers renewed sell after core consumer came in lower than expected. Headline CPI rose 0.2% mom, 2.7% yoy versus expectation of 0.1% mom, 2.7% yoy. That slowed from prior month’s 0.2% mom, 2.9% yoy. Core CPI rose 0.1% mom, 2.2%, missed expectation of 0.2% mom, 2.4% yoy. Also it missed expectation of 0.2% mom, 2.4% yoy.

Job data was solid though. Initial jobless claims dropped -1k to 204k in the week ended September 8. That’s the new lowest since December 6 1969. Four-week moving average of initial claims dropped -2k to 208k, lowest since December 6, 1969. Continuing claims dropped -15k to 1.696m, lowest since December 1, 1973. Four week moving average of continuing claims dropped -8.25k to 1.71125m., lowest since November 24, 1973.

ECB stands pat, half asset purchase starting October, lowers growth forecast

ECB kept main refinancing rate unchanged at 0.00% as widely expected. The marginal lending facility and the deposit facility are kept at 0.25% and -0.40% respectively. ECB also maintained forward guidance that “the Governing Council expects the key ECB interest rates to remain at their present levels at least through the summer of 2019”. Also, starting October, monthly asset purchase will be halved to EUR 15B, and end after December. ECB also said it intends to reinvest the principal payments “for an extended period of time”.

In the new staff projections, ECB lowered 2018 and 2019 growth forecasts but kept 2020 growth forecast unchanged. For 2018, growth is projected to be 2.0%, down from 2.1%. For 2019, growth is projected to be 1.8%, down from prior 1.9%. For 2020, growth is projected to be 1.7%, unchanged. Inflation forecasts were kept unchanged, at 1.7% in 2018, 2019 and 2020.

From Germany, CPI was finalized at 0.1% mom, 2.0% yoy in August. From Swiss, PPI rose 0.0% mom, 3.4% yoy in August.

BoE kept bank rate unchanged at 0.75%, August projections broadly on track

BoE kept bank rate unchanged at 0.75% as widely expected. Asset purchase target was also unchanged at GBP 435B. Both were made by unanimous decision. The central bank maintained tightening bias and said “an ongoing tightening of monetary policy over the forecast period would be appropriate to return inflation sustainably to the 2% target at a conventional horizon.” But it also reiterated that the projections were conditioned on the expectation of a smooth Brexit.

BoE noted that economic projections as presented in the August Inflation Report “appear to be broadly on track”. Downside risk to global economy increased “to some degree”. Growth has softened and financial conditions tightened in emerging markets, “in some cases markedly”. Further protectionist measures by the US and China could a larger negative impact than expected. Domestically, economic outlook could be influenced by Brexit process and responses from households, business and markets. BOE noted that there were indications of “greater uncertainty” regarding Brexit.

Turkish Lira surges as CBRT hikes policy rate from 17.75% to 24%

What a volatile day for the Turkish Lira. It originally plunged on President Tayyip Erdogan’s comments against interest rate. But then CBRT announce to raise policy rate (one week repo auction rate) from 17.75% to 24%. USDTRY drops more than -3% after the release and is now set to take on 6.000 handle. Last month’s low at 5.7000 suddenly looks within reach.

CBRT said in the statement that “recent developments regarding the inflation outlook point to significant risks to price stability.” Further, “deterioration in the pricing behavior continues to pose upside risks on the inflation outlook”. Thus, “, the Committee has decided to implement a strong monetary tightening to support price stability.” Also, “other factors affecting inflation will be closely monitored and, if needed, further monetary tightening will be delivered.”

China received trade talk invitation, working on details

Chinese Foreign Ministry spokesman Geng Shuang said at a regular press briefing that it received the invitation from the US for restarting trade talks. And the countries are now in discussion about the details. Geng said that “China has always held that an escalation of the trade conflict is not in anyone’s interests. In fact, from last month’s preliminary talks in Washington, the two sides’ trade talk teams have maintained various forms of contact, and held discussions on the concerns of each side.”

Ministry of Commerce spokesman Gao Feng also said the two side are discussing details for future talks. And, he added that trade escalation is not in interest of either country. But he also emphasized that trade deficit with US is due to its low saving and control on export to China. He hoped that US will not find excuses for trade protectionism and urged it to comply with WTO rules.

AmCham survey showed US-China trade war already negatively impacting US companies

A joint survey by AmCham China and AmCham Shanghai showed that over nearly two-thirds of survey respondents experienced negative impact from US-China tariff war. Moreover, for additional US tariffs, 74.3% expected negative impact and 47.2% expected “strong negative impact. For additional China tariffs, 67.6% expected negative impact and 38.2% expected “strong negative impacts”. Increased cost of manufacturing (47.1) and decreased demand for products (41.8%) were the to most significant downside of the tariffs.

William Zarit, Chairman of AmCham China said “the White House has threatened to fire the next barrage of tariffs at $200 billion more Chinese goods, expecting with this onslaught, or subsequent ones, China will wave a white flag. But that scenario risks underestimating China’s capability to continue meeting fire with fire.”

Eric Zheng, Chairman of AmCham Shanghai warned that “tariffs are already negatively impacting U.S. companies and the imposition of a proposed $200 billion tranche will bring a lot more pain”. And “if almost a half of American companies anticipate a strong negative impact from the next round of U.S. tariffs, then the U.S. administration will be hurting the companies it should be helping.”

The survey was conducted between August 29 and September 5, 2018. Over 430 companies responded.

Overwhelmingly negative impact of US-China tariffs on European companies in China

European Union Chamber of Commerce in China, also carried out a survey regarding US-China tariff war. Results showed that 53.9% responding said US tariffs on China affected their company. 42.9% said China tariff on US products affected their company. There is, roughly 11% difference. The Chamber said that “the high rate of negative views on either side of the trade war is emblematic of the degree of interconnectivity in the global economy.” But at the same time 72.5% said they’re taking no action to cope with the trade war, but just monitoring the situation.

Mats Harborn, president of the European Union Chamber of Commerce in China said “the effects of the US-China trade war on European firms in China are significant and overwhelmingly negative.” The Chamber shared the concerns regarding China’s trade and in vestment practices. However, Harborn warned that “continuing along the path of tariff escalation is extremely dangerous”. He added “it threatens to dismantle the entire global, rules-based system at a time when we should be working together to modernise it.”

Strong 44k job growth in Australia, unemployment rate unchanged at 5.3%

Australia job market grew 44k in August, well pass expectation of 18.4k. Full time employment grew strongly by 33.7k. Part time jobs added 10.2k. Unemployment was unchanged at 5.3%, matched expectation. Labor force participation rate rose to 65.7%, up from 65.6%.

Overall, the set of data affirmed RBA’s view that spare capacity is gradually being taken out, which is a prelude to meaningful wage growth. However, wages have actually need to show the increase before RBA is convinced that eventually there is enough upward pressure on inflation. Talk of rate hike is premature based on just today’s data.

Japan core machine orders jumped 11.0% yoy in July

In Japan, private machinery orders, excluding volatile ones, rose 11.0% yoy in July, well above expectation of 5.8% yoy. Total machinery orders rose 18.8% yoy. The strong growth suggests that companies were keen to invest despite the threat of trade protectionism. And rising capex will likely add to economic growth. So far, trade war worries haven’t materialized in economic data yet.

Also released, domestic CGPI rose 3.0% yoy in August, below expectation of 3.1% yoy.

GBP/USD Mid-Day Outlook

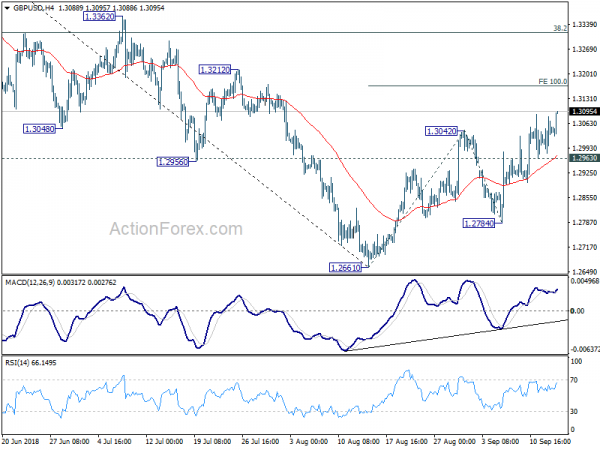

Daily Pivots: (S1) 1.2994; (P) 1.3033; (R1) 1.3085; More…

GBP/USD’s rebound picks up momentum ahead and hits as high as 1.3092 so far. Intraday bias remains on the upside for 100% projection of 1.2661 to 1.3042 from 1.2784 at 1.3165, and possibly above. However, as this is seen as a corrective move, upside should be e limited by 1.3316 key fibonacci level to bring near term reversal. On the downside, break of 1.2963 minor support will now argue that rebound from 1.2661 has completed. In such case, intraday bias will be turned back to the downside for 1.2784 and then 1.2661.

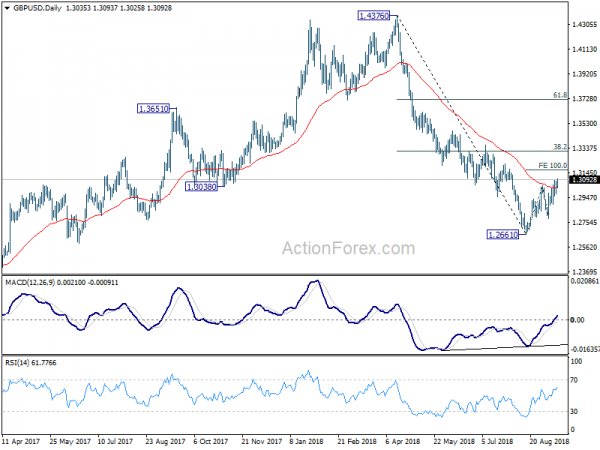

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4099). The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS House Price Balance Aug | 2% | 2% | 4% | |

| 23:50 | JPY | Domestic CGPI Y/Y Aug | 3.00% | 3.10% | 3.10% | 3.00% |

| 23:50 | JPY | Machine Orders M/M Jul | 11.00% | 5.80% | -8.80% | |

| 01:00 | AUD | Consumer Inflation Expectation Sep | 4.00% | 4.00% | ||

| 01:30 | AUD | Employment Change Aug | 44.0K | 18.4K | -3.9K | -4.3K |

| 01:30 | AUD | Unemployment Rate Aug | 5.30% | 5.30% | 5.30% | |

| 06:00 | EUR | German CPI M/M Aug F | 0.10% | 0.10% | 0.10% | |

| 06:00 | EUR | German CPI Y/Y Aug F | 2.00% | 2.00% | 2.00% | |

| 07:15 | CHF | Producer & Import Prices M/M Aug | 0.00% | 0.10% | 0.10% | |

| 07:15 | CHF | Producer & Import Prices Y/Y Aug | 3.40% | 3.40% | 3.60% | |

| 11:00 | GBP | BoE Bank Rate | 0.75% | 0.75% | 0.75% | |

| 11:00 | GBP | BoE Asset Purchase Target Sep | 435B | 435B | 435B | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | 0.00% | |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | CAD | New Housing Price Index M/M Jul | 0.10% | 0.10% | 0.10% | |

| 12:30 | USD | CPI M/M Aug | 0.20% | 0.10% | 0.20% | |

| 12:30 | USD | CPI Y/Y Aug | 2.70% | 2.70% | 2.90% | |

| 12:30 | USD | CPI Core M/M Aug | 0.10% | 0.20% | 0.20% | |

| 12:30 | USD | CPI Core Y/Y Aug | 2.20% | 2.40% | 2.40% | |

| 12:30 | USD | Initial Jobless Claims (SEP 8) | 204K | 210K | 203K | 205K |

| 14:30 | USD | Natural Gas Storage | 65B | 63B | ||

| 18:00 | USD | Monthly Budget Statement Aug | -183.0B | -76.9B |