European majors are trading generally higher today as Eurozone will take the center of stage. There are worries of deeper and longer than expected slowdown in the Eurozone economy. PMIs from Germany, France and Eurozone will provide some hints on economic performance at the start of the year. ECB rate decision will for sure be the focus too. In particular, the tone of the post-meeting press conference will likely turn more cautious, if not dovish. Hence, while Euro is recovering, there is risk of renewed selling ahead, which might also drag down the Swiss Franc and, to a lesser extent, Sterling.

On the other hand, commodity currencies are generally lower despite lack of risk aversion in the markets. Australian Dollar turns south after mixed job data, strong in the headline by questionable in the details. New Zealand Dollar is paring some CPI prompted gains. Meanwhile, Canadian Dollar weakens as oil recovery lost momentum.

Technically, AUD/USD’s break of 0.7116 minor support today suggests that the rebound from flash crash low at 0.6722 has completed at 0.7235 already. More downside is now in favor in AUD/USD to retest 0.6722 low. Sterling’s rallies against Dollar, Euro and Yen are in progress, still with firm intraday momentum. EUR/USD is in recovery while USD/CHF is in retreat. But there is no change in near term outlook. That is, more upside is in favor in Dollar against Euro and Franc.

In other markets, Nikkei closed down -0.11% today. At the time of writing, Hong Kong HSI is up 0.28%, China Shanghai SSE is up 0.47%. Singapore Strait Times is up 0.37%. Japan 10 year JGB yield is up 0.0031 at 0.0009, staying positive. Overnight, DOW rose 0.70%. S&P 500 rose 0.22%. NASDQ rose 0.08%. 10-year yield rose 0.025 to 2.744.

ECB to turn cautious but no change in forward guidance yet

ECB rate decision and press conference is a main focus for today. No change is expected in monetary policy. And the main refinancing rate will be held at 0.00%. As recent economic data pointed to further weakness in the Eurozone economy, ECB president Mario Draghi might turn a bit more cautious or even dovish in the press conference.

Market has already pushed back their expectations on the first rate hike to mid-2020. But, ECB is still unlikely to make any change to the forward guidance. That is, ECB will reiterate that interest rates will stay at present level at least through summer of 2019. ECB probably would wait for more incoming data before making such a change.

Here are some suggested previews on ECB:

- ECB Preview – ECB to Turn More Dovish as Economic Data Surprise to Downside

- ECB Meeting and Eurozone PMIs Eyed as Euro/Dollar Flirts with Trendline

- ECB Preview: Dovish Draghi Expected, So Could EUR/USD Rise?

- No NY’s Resolutions from ECB

- ECB Preview: We Assign 60% Chance of ECB Hike in December 2019

BoE Haldane: People to take finger of pause button, if some Brexit deal is done

BoE Chief Economist Andy Haldane said in a newspaper interview that “if the economy continues to tick along, as we expect, then we might expect some further limited and gradual rises”.

In particular, if some Brexit deal is done, “that would reduce uncertainty and, we think, cause people to take their finger of the pause button and do a bit more investment spending”.

And if the economy begins to “change direction, “we will be flexible in the face of that.”

EU Barnier: Opposing no-deal Brexit won’t stop no-deal Brexit

EU chief Brexit negotiator Michel Barnier said yesterday that no-deal Brexit is now the default, and “Preparing for a no-deal scenario is more important now than ever, even though I still hope that we can avoid this scenario.”

He also warned that “Opposing no-deal will not stop no-deal from happening at the end of March. To stop no-deal, another majority will have to emerge.” And he added, “This is the objective of the political consultations that Theresa May has started and we hope, sincerely, we hope that this process will be successful”.

Meanwhile, he also pointed out there are two possible ways to leave the EU. “Number one, an orderly withdrawal based on the agreement that we have built step by step with the UK over the last 18 months.” Or, “Number two, a disorderly withdrawal, leaving the EU without a deal, is a default scenario and there appears to be a majority in the House of Commons to oppose a no-deal.”

BoC Poloz: Timing of next rate hike depends on how the economy responds to the shocks

BoC Governor Stephen Poloz reiterated that more rate hikes are warranted for the central bank. But the timing would be “data dependent” and “it will depend on how the economy responds to the shocks we’ve described.” He referred to developments including Canada’s housing market, trade tensions and import of lower oil prices.

In particular, Poloz noted the past increase interest rates could lead to slumping activity. And the housing markets hasn’t “quite settled down”. He would like to see how the markets stabilize to know “where we stand”. That’s a sign taken then BoC could opt for a pause for a while.

But Poloz also defended past rate hikes of BoC and some other central banks. He noted “we are at a stage in the cycle where it always looks like monetary policy is doing the wrong thing”. And, given the economy is “near its steady state, interest rates also should be near their steady state.” But Poloz emphasized that the actual level of the so called steady state, or neutral rate, is an “open question”. BoC estimates it to be 2.5-3.5%.

WH Hassett said there will be a US-China trade deal by March 1

White House economic adviser Kevin Hassett said yesterday he’s confidence that US and China will reach a trade deal by March 1 deadline. He said in a CNN interview that “Yes, I am confident that it can happen, that the talks are moving forward”.

And, “There’s a lot of progress to be made but it’s a very strong situation right now. And I think the Chinese recognize that they’ve got a big potential gain for coming up with a deal because as you mentioned their growth has really fallen off the cliff.”

Also, Hassett talked down the risk of government shut down on credit rating. He said “I don’t think a downgrade is in play … I don’t think that there’s any risk at all, given how strong the economy is, that we will be downgraded.”

Japan PMI manufacturing dropped to 50, exports drop steepest in over 2.5 years

Japan PMI manufacturing dropped to 50.0 in December, down from 52.6. That also marked the end of the longest expansionary run for over a decade. In particular, exports decline at strongest pace in two-and-a-half years. And, production scaled back for first time since July 2016, while confidence lowest in over six years.

Joe Hayes, Economist at IHS Markit, noted “Preliminary PMI data for January bodes ill for Japan’s manufacturing sector, indicating the end of a near two-and-a-half-year growth run as the index dropped to 50.0. The underlying picture will raise concern given renewed reductions were seen in new orders and output. Further signs that the downturn in the global trade cycle could yet worsen were also signalled, with new export orders falling at the sharpest rate since July 2016. The widely-anticipated rebound in Q4 should not distract from the bigger picture. Domestic economic weakness compounded with slowing global growth coincided with the lowest level of business confidence for over six years.”

Australia job growth driven by part time jobs, participation rate fell

Australia job market grew 21.6k in December, above expectation of 18.1k. Full-time jobs, however, dropped -3k. Part-time jobs rose 24.6k. Unemployment rate dropped -0.1% to 5.0%, better than expectation of 5.0%. That equals the lowest level in more than 6 years, as touched back in September and October. However, participation rate dropped by -0.1% to 65.6%. While the set of data was solid, it isn’t too encouraging and paints no sign of tightening in the Australian job market.

Looking ahead

In addition to ECB rate decision and press conference, Eurozone will release PMIs. US will also release PMIs and leading indicator.

EUR/USD Daily Outlook

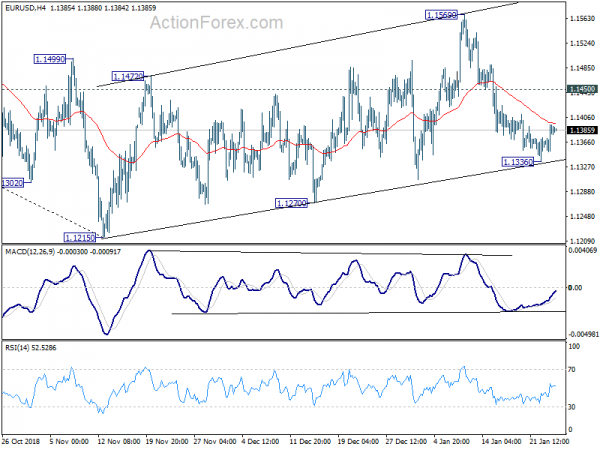

Daily Pivots: (S1) 1.1356; (P) 1.1375; (R1) 1.1400; More…..

EUR/USD’s recovery today suggests temporary bottoming at 1.1336. As such recovery is weak so far, we’d treat is as a correction. Intraday bias is turned neutral first. At this point, we’re still slightly favoring that corrective rise from 1.1215 should have completed at 1.1569. On the downside, break of 1.1336 will resume the fall from 1.1569 to retest 1.1215 low. However, break of 1.1450 resistance will argue that the corrective pattern from 1.1215 is extending with another rise. And, intraday bias will be turned to the upside for 1.1569 and above.

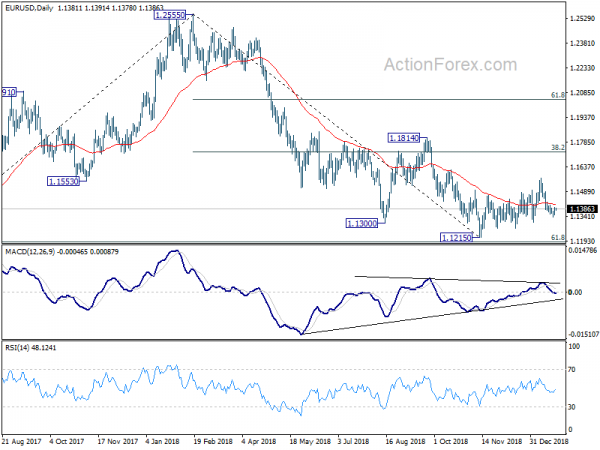

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | Employment Change Dec | 21.6K | 18.1K | 37.0K | |

| 0:30 | AUD | Unemployment Rate Dec | 5.00% | 5.10% | 5.10% | |

| 0:30 | AUD | Part Time Employment Change Dec | 24.6k | 43.4k | ||

| 0:30 | JPY | PMI Manufacturing Jan P | 50 | 52.6 | ||

| 8:15 | EUR | France Manufacturing PMI Jan P | 50 | 49.7 | ||

| 8:15 | EUR | France Services PMI Jan P | 50.5 | 49 | ||

| 8:30 | EUR | Germany Manufacturing PMI Jan P | 51.4 | 51.5 | ||

| 8:30 | EUR | Germany Services PMI Jan P | 52.2 | 51.8 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Jan P | 51.3 | 51.4 | ||

| 9:00 | EUR | Eurozone Services PMI Jan P | 51.5 | 51.2 | ||

| 12:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 13:30 | USD | Initial Jobless Claims (JAN 19) | 215K | 213K | ||

| 14:45 | USD | US Manufacturing PMI Jan P | 53.5 | 53.8 | ||

| 14:45 | USD | US Services PMI Jan P | 54.1 | 54.4 | ||

| 15:00 | USD | Leading Index Dec | -0.10% | 0.20% | ||

| 15:30 | USD | Natural Gas Storage | -81B | |||

| 16:00 | USD | Crude Oil Inventories | -2.7M |