Asian markets traded higher earlier today after Trump announced to extend trade truce with China beyond March 1. But there is no sustainable buying, except in China. Australian Dollar is lifted by positive sentiments. But New Zealand Dollar is even stronger after better than expected retail sales. On the other hand, Canadian Dollar is the weakest one for now but it’s just paring some of last week’s oil price triggered gains. Dollar is the second weakest.

Technically, there clear sign of reversal in Dollar yet. With 1.1275 minor support intact in EUR/USD, further rise is mildly in favor. Similarly, GBP/USD is holding above 1.2938 minor support, USD/CHF is held below 1.0060 minor resistance, USD/CAD is kept well below 1.3242. On the other hand, despite initial strength today, AUD/USD kept well below 0.7026 resistance and a break of 0.7054 is still in favor later. EUR/GBP could be a pair worth watching today as break of 0.8666 will extend decline from 0.8850 to 0.8617/20 key support zone.

In other markets, Nikkei is up 0.68% at the time of writing. Hong Kong HSI is up 0.01%. China Shanghai SSE is up 2.33%. Singapore Strait Times is down -0.39%. Japan 10-year JGB yield is up 0.002 at -0.0038, staying negative.

Trump delay new tariffs on China, planning Mar-a-Lago summit

Trump tweeted on Sunday that there was “substantial progress” made in US-China trade talks on “important structural issues including intellectual property protection, technology transfer, agriculture, services, currency, and many other issues”. Hence he will be delaying the scheduled March 1 tariff increase. In other words, trade truce now extends beyond the date.

Trump added that assuming there is additional progresses, he is planning a summit with Chinese President Xi Jinping at Mar-a-Lago resort in Florida to conclude the agreement.

Later, Trump also said there could be “very big news over the next week or two” if all goes in well. He added that “China has been terrific. We want to make a deal that’s great for both countries and that’s really what we’re going to be doing.”

China’s Xinhua also said the US and China have made “substantial progress” on specific issues in the latest round of trade talks.

UK delays Brexit vote to Mar 12, EU mulls 21-month extensions

UK Prime Minister Theresa May announced that a Brexit “meaningful vote” would not take place this week. Instead, the vote on the withdrawal agreement is rescheduled to March 12, just 17 days before the March 29 Brexit date. Though, the Parliament will still hold a series of Brexit votes on Wednesday. Also, May insisted that “we still have it within our grasp to leave the European Union with a deal on the 29th of March and that’s what I’m going to be working at”.

On the other hand, Bloomberg reported that EU is mulling an Article 50 extension for as long as 21 months beyond March 29. The idea of a short three-month delay has been floating for some time. But it’s seen by EU as insufficient to break the deadlock. A three-month extension is only meaningful if for completing legal processes if UK Parliament approves the agreement.

Japan Hamada: BoJ can drops the 2% inflation target

Koichi Hamada, an advisor to Japanese Prime Minister Shinzo Abe said the BoJ could abandon the 2% inflation target. He told Reuters that “prices don’t need to rise much. From the perspective of people’s livelihood, what’s more desirable is for prices to fall, not rise.”

And, the inflation target is only “a tool for achieving full employment”. Hamada added “it can be abandoned. It isn’t absolutely crucial”, and the “appropriate target level of inflation can be decided by the central bank”.

On current monetary policy, Hamada said “the world economy faces substantial turbulence, the BOJ can wait”. There is no need for loosen up policy too as “Demand is exceeding supply now. As long as this trend continues, we don’t need to worry too much.”

Busy week with high profile events

The last week of February is guaranteed to be an interesting one with all the high-profile events scheduled. Now that the trade truce between US and China are extended focus will firstly turn to USTR Robert Lighthizer’s testimony at House Ways and Means Committee on Wednesday. More details of the negotiations could be revealed.

Staying with the US, Trump will meet North Korean leader Kim Jong-un on February 27-28 in Vietnam. A one-on-one meeting is expected at some point in during the period. Fed Chair Jerome Powell will have his semi-annual Congressional testimony on Tuesday and Wednesday.

In the UK, Brexit meaningful vote is now delayed to March 12. Other Brexit votes will still take place on Wednesday. The Parliament could should vote for amendments to take over control of Brexit process. Staying with the UK, BoE Governor Mark Carney will also have his inflation report hearing in the Parliament on Tuesday.

On the data front, US will release trade balance, consumer confidence, Q4 GDP, PCE inflation and ISM manufacturing. Eurozone will release CPI flash; UK will release PMI manufacturing. Canada will release CPI and GDP. China will release manufacturing PMIs. All the data could be market moving.

Here are some highlights for the week:

- Monday: New Zealand retail sales, Japan corporate services prices

- Tuesday: German Gfk consumer sentiment; UK BBA mortgage approvals, BoE inflation report hearings; US housing starts and building permits, house price index, consumer confidence, Fed chair Powell testimony

- Wednesday: New Zealand trade balance, Eurozone M3; Canada CPI; US trade balance, wholesale inventories, factory orders, pending home sales, Fed chair Powell testimony

- Thursday: Japan industrial production, retail sales housing starts; Australia private capital expenditure; New Zealand ANZ business confidence; China PMIs; Swiss GDP, KOF; German import prices, CPI; Canada current account, IPPI, RMPI; US GDP, jobless claims; Chicago PMI

- Friday: Japan Tokyo CPI, unemployment rate, capital spending, consumer confidence; China Caixin PMI manufacturing; Swiss retail sales, PMI manufacturing; Eurozone PMI manufacturing final, CPI flash; UK PMI manufacturing, M4 money supply, mortgage approvals; Canada GDP; US personal income and spending; ISM manufacturing

AUD/USD Daily Outlook

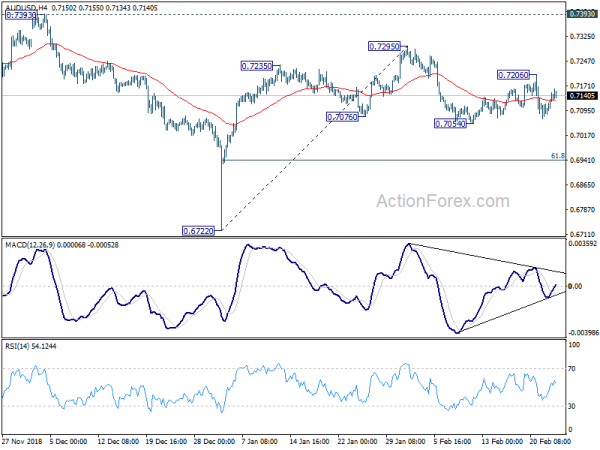

Daily Pivots: (S1) 0.7090; (P) 0.7121; (R1) 0.7158; More…

Intraday bias in AUD/USD remains neutral at this point. On the downside, decisive break of 0.7054 will complete a head and shoulder reversal pattern (ls: 0.7235, h: 0.7295, rs: 0.7206). That should confirm completion of rebound from 0.6722. Further decline should then be seen to 61.8% retracement of 0.6722 to 0.7295 at 0.6941 next. On the upside, though, break of 0.7206 will turn focus back to 0.7295 resistance instead.

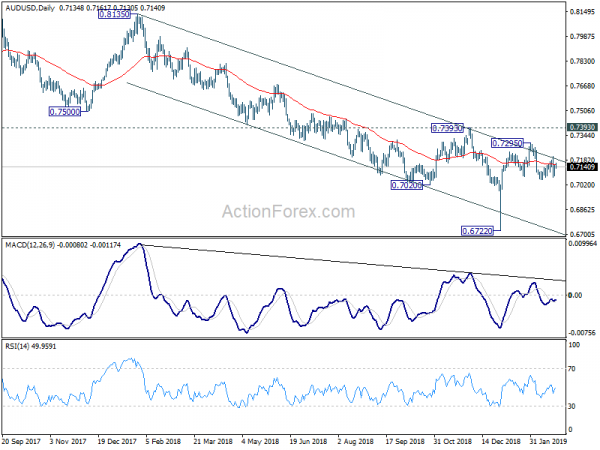

In the bigger picture, as long as 0.7393 resistance holds, we’d treat fall from 0.8135 as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Retail Sales Ex Inflation Q/Q Q4 | 1.70% | 0.50% | 0.00% | 0.30% |

| 21:45 | NZD | Retail Sales Core Q/Q Q4 | 2.00% | 0.80% | 0.40% | 0.70% |

| 23:50 | JPY | Corporate Service Price Y/Y Jan | 1.10% | 1.10% | 1.10% | |

| 15:00 | USD | Wholesale Inventories M/M Dec P | 0.30% | 0.30% |