The global financial markets turned a bit mixed today even though risk aversion remains the underlying theme. European stocks are generally lower while US stocks recovers, turning into consolidations. Comments from China suggests that retaliation is still underway despite delay of part of the new US tariffs. Germany 10-year yield hits another record low of -0.681. In the currency markets, however, Yen and Swiss Franc are the weakest ones as consolidation extend. Euro is the third weakest as dragged down by treasury yields. Sterling is the strongest one for today, helped by retail sales. Dollar is mixed as it’s partly helped by generally positive economic data.

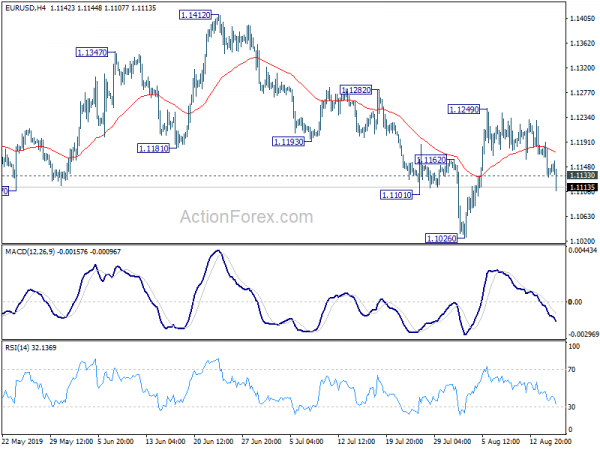

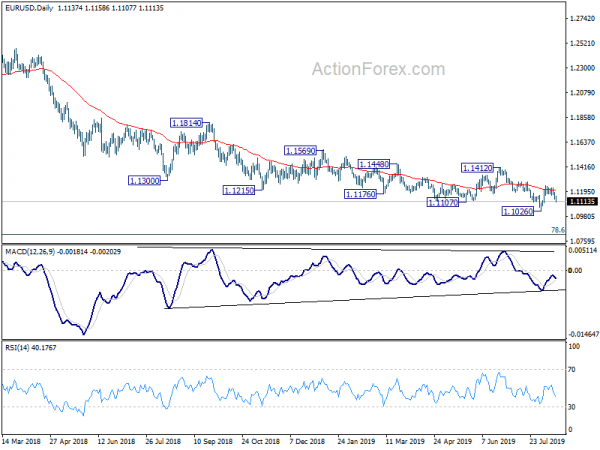

Technically, EUR/USD’s break of 1.1133 support suggests that rebound from 1.1026 has completed. Deeper fall would be seen back to retest this low. Break will resume larger down trend from 1.2555. EUR/GBP’s break of 0.9198 also indicates short term topping at 0.9324 and deeper pull back would be seen back to 0.8891/9051 support zone. USD/CHF and USD/JPY could be two focuses for the rest of the session. Break of 0.9797 and 107.09 resistance levels in both pair would in indicate short term bottoming in the pairs and bring stronger rebound.

In US, currently, DOW is up 0.29%. 10-year yield is down -0.0025 at 1.578. In Europe, FTSE is down -1.10%. DAX is down -0.53%. CAC is down -0.18%. German 10-year yield is down -0.253 at -0.674. Earlier in Asia, Nikkei dropped -1.21%. Hong Kong HSI rose 0.76%. China Shanghai SSE rose 0.25%. Singapore Strait Times dropped -0.68%. Japan 10-year JGB yield dropped -0.0178 to -0.237.

China said US violates Osaka agreement with new tariffs

Chinese Finance Ministry warned that the new tariffs violate the consensus reached by leaders of the countries at G20 in Osaka. And it pledged that China will take necessary countermeasures.

Separately, Foreign Ministry spokesperson Hua Chunying said, “We hope the U.S. will meet China halfway, and implement the consensus of the two heads of the two countries in Osaka.” And, China hopes to find mutually acceptable solutions through dialogue and consultation on the basis of equality and mutual respect.

US retail sales rose 0.7% mom in July, ex-auto sales up 1.0% mom

US retail sales rose 0.7% mom in July, well above expectation of 0.3% mom. Ex-auto sales rose strongly by 1.0% mom, versus expectation of 0.4% mom. Industrial production dropped -0.2% mom versus expectation of 0.1% mom. Capacity utilization dropped to 77.5%, below expectation of 77.8%.

Initial jobless claims rose 9k to 220k in the week ending August 10, above expectation of 212k. Four-week moving average of initial claims rose 1k to 213.75. Continuing claims rose 39k to 1.726m in the week ending August 3. Four-week moving average of continuing claims rose 9.25k to 1.697m.

Empire State Manufacturing index rose to 4.8, up from 4.3 and beat expectation of 1.9. Looking at some details, The employment and average workweek indexes were both slightly below zero, pointing to sluggishness in labor market conditions. Input prices increased as a slightly slower pace while selling price increases were little changed.

Philadelphia Fed Business Outlook dropped to 16.8, down from 21.8 but beat expectation of 10.0. The survey’s broad indicators remained positive, although their movements were mixed this month: The general activity, shipments, and employment indicators decreased from their readings last month, but the indicator for new orders increased.

UK retail sales rose 0.2%, non-store retailing the largest positive contributor

UK retail sales including auto and fuel rose 0.2% mom 3.3% in July, above expectation of -0.2% mom, 2.5% yoy. Retail sales ex-auto and fuel rose 0.2% mom 2.9% yoy, above expectation of -0.2% mom, 2.3% yoy.

Looking at the details, non-store retailing was the largest positive contributor on the month, with the amount spent and quantity bought contributing 0.6 and 0.7 percentage points respectively. In contrast, non-food stores were the largest negative contributor in July 2019, with the amount spent and quantity bought both at negative 0.6 percentage points.

Also released, Swiss PPI dropped -1.0% mom, -1.7% yoy in July versus expectation of -0.2% mom, -1.7% yoy.

RBA Debelle: Technology dispute could have larger impacts than tariffs

RBA Deputy Governor Guy Debelle said in a speech today that the direct effects of US-China tariffs “has not been all that large”. However, the larger impact has been the uncertainty generated by the dispute. The uncertainty takes “two forms”. Firstly, there was uncertainty about the “size and incidence” of tariffs. Secondly, it’s unsure how “technology dispute” will be resolved.

Debelle also warned that “it is plausible that the effect of the technology dispute will be larger than that of the tariffs” And, “the technology dispute raises the possibility that any business involved in the technology production chain will have to choose between East and West rather than selling into a global market.”

Also, he said current trade dispute would have a “large and long-lasting impact” on the “system of rules-based trade”. And, “The China–US dispute casts serious doubt on that. We can also see that manifest in the US–Europe trade issues, as well as those between South Korea and Japan.” Also, “trade is being used as the bargaining tool of choice, including for issues that don’t have much to do with trade.”

Australia added 41.1k jobs, but unemployment rate stuck at 5.2%

Australia employment grew 41.1k in July, well above expectation of 14.2k. Full-time jobs rose 34.5k while part time jobs rose 6.7k. Unemployment rate was steady at 5.2%, matched expectations. Participation rate rose 0.1% to 66.1%.

In seasonally adjusted terms, the largest increases in employment were in Queensland (up 19.9), New South Wales (up 13.0k), and Victoria (up 3.6k). The largest decrease was in Western Australia (down -4.2k). Unemployment rate increased in South Australia (up 0.9 pts to 6.9%) and Western Australia (up 0.2 pts to 5.9%), Decreases were recorded in Tasmania (down -0.8 pts to 6.0%), New South Wales (down -0.2 pts to 4.4%) and Queensland (down -0.1 pts to 6.4%), with Victoria recording no change.

The better than expected job growth should keep RBA on sideline in September. However, unemployment continues to be stuck at 5.2%. There is no sign of falling towards RBA’s natural rate of 4.5%. The central bank will still need more easing ahead to push down unemployment rate so as to push up inflation to target.

Also from Australian, consumer inflation expectation rose to 3.5$ in August, up from 3.2%.

Looking ahead

UK retail sales is the major focus in European session. Swiss will release PPI. Later in the day, a long list of US economic data will be released. Retail sales will catch most attention. But Empire state manufacturing, Philly Fed survey, industrial production and jobless could also be market moving. Non-farm productivity, NAHB housing index and business inventories will also be featured.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1116; (P) 1.1154; (R1) 1.1176; More…

EUR/USD’s break of 1.1133 minor support argues that rebound from 1.1026 has completed at 1.1249 already, after failing to sustain above 55 day EMA. Intraday bias is turned back to the downside for 1.1026 low. Firm break there will extend the downtrend from 1.2555. In case of another rise, we’d expect strong resistance from 1.1282 to limit upside.

In the bigger picture, current development suggests that down trend from 1.2555 (2018) is in progress and extending. Prior rejection of 55 week EMA also maintained bearishness. Further fall should be seen to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Decisive break there will target 1.0339 (2017 low). On the upside, break of 1.1412 resistance is needed to indicate medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | Consumer Inflation Expectation Aug | 3.50% | 3.20% | ||

| 01:30 | AUD | Employment Change Jul | 41.1K | 14.2K | 0.5K | |

| 01:30 | AUD | Unemployment Rate Jul | 5.20% | 5.20% | 5.20% | |

| 04:30 | JPY | Industrial Production M/M Jun F | -3.30% | -3.60% | -3.60% | |

| 06:30 | CHF | Producer & Import Prices M/M Jul | -0.10% | -0.20% | -0.50% | |

| 06:30 | CHF | Producer & Import Prices Y/Y Jul | -1.70% | -1.70% | -1.40% | |

| 08:30 | GBP | Retail Sales Inc Auto Fuel M/M Jul | 0.20% | -0.20% | 1.00% | 0.90% |

| 08:30 | GBP | Retail Sales Inc Auto Fuel Y/Y Jul | 3.30% | 2.50% | 3.80% | |

| 08:30 | GBP | Retail Sales Ex Auto Fuel M/M Jul | 0.20% | -0.20% | 0.90% | 0.80% |

| 08:30 | GBP | Retail Sales Ex Auto Fuel Y/Y Jul | 2.90% | 2.30% | 3.60% | |

| 12:30 | CAD | ADP Employment July | 73.7K | 30.4K | ||

| 12:30 | USD | Nonfarm Productivity Q2 P | 2.30% | 1.40% | 3.40% | |

| 12:30 | USD | Unit Labor Costs Q2 P | 2.40% | 1.80% | -1.60% | |

| 12:30 | USD | Empire State Manufacturing Aug | 4.8 | 1.9 | 4.3 | |

| 12:30 | USD | Philadelphia Fed Business Outlook Aug | 16.8 | 10 | 21.8 | |

| 12:30 | USD | Retail Sales Advance M/M Jul | 0.70% | 0.30% | 0.40% | 0.30% |

| 12:30 | USD | Retail Sales Ex Auto M/M Jul | 1.00% | 0.40% | 0.40% | 0.30% |

| 12:30 | USD | Initial Jobless Claims (AUG 10) | 220K | 212K | 209K | 211K |

| 13:15 | USD | Industrial Production M/M Jul | -0.20% | 0.10% | 0.00% | |

| 13:15 | USD | Capacity Utilization Jul | 77.50% | 77.80% | 77.90% | |

| 14:00 | USD | NAHB Housing Market Index Aug | 66 | 66 | 65 | |

| 14:00 | USD | Business Inventories Jun | 0.00% | 0.10% | 0.30% | |

| 14:30 | USD | Natural Gas Storage | 55B |