Sterling rises broadly today as UK opposition lawmakers are moving to seek Brexit delay. Swiss Franc weakens broadly at the same time, partly due to the same reason. The forex markets are otherwise mixed, staying in tight range as consolidations continue. Yen is having a slight upper hand with Canadian Dollar. But the picture can easily change.

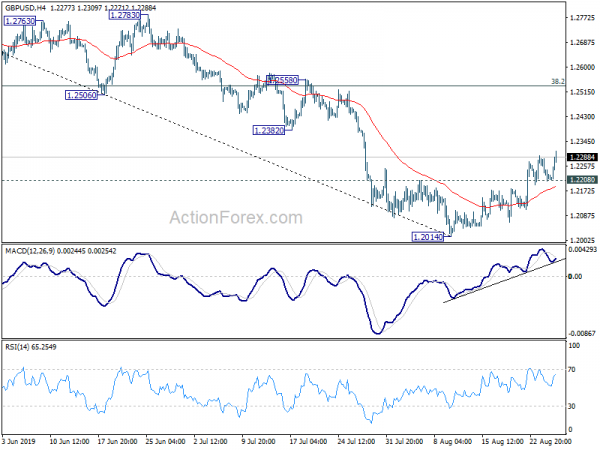

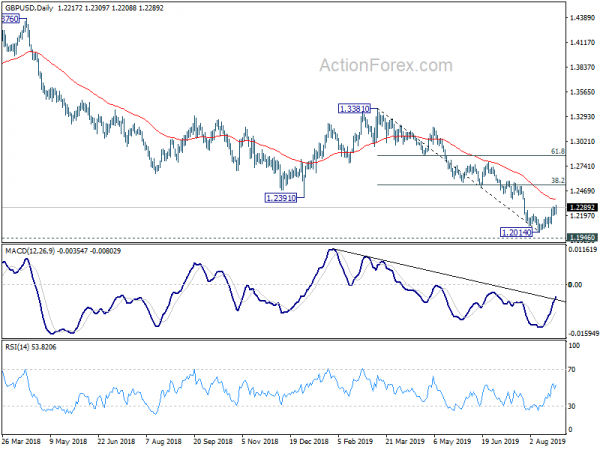

Technically, GBP/USD resumes recent rebound from 1.2014 and further rise should be seen to 55 day EMA (now at 1.2372). EUR/GBP extends corrective fall from 0.9324. But it’s now inside important near term support zone 0.8891/9051, which we expect strong support there. GBP/JPY is eyeing 130.69 minor resistance and break will extend recent corrective recovery from 126.54.

In US, DOW opens higher again and is currently up 100 pts. In Europe, FTSE is up 0.05%. DAX is up 0.95%. CAC is up 0.72%. German 10-year yield is down -0.012 at -0.676. Earlier in Asia, Nikkei rose 0.96%. Hong Kong HSI dropped -0.06%. China Shanghai SSE rose 1.35%. Singapore Strait Times rose 0.07%. Japan 10-year JGB yield rose 0.0084 to -0.266.

Sterling jumps as UK lawmakers agreed to seek Brexit delay by legislation

Sterling jumps on news that opposition parties agreed to try to pass a law to see another Brexit delay to prevent a no-deal Brexit on October 31. MP Anna Soubry tweeted : “Excellent meeting between all the opposition party leaders this morning. We agree we will work together to stop a no deal #Brexit by legislation”. Green Party MP Caroline Lucas also told BBC that MPs agreed “that the legislative way forward is the most secure way to try to extend Article 50, to get rid of that 31st October deadline towards which the prime minister is careering with ever greater recklessness”.

Separately, The European Commission said that President Jean-Claude Juncker will hold a telephone call with UK Prime Minister Boris Johnson on Brexit today. That comes as UK Brexit negotiator is going to Brussels tomorrow for a renewed push for Brexit negotiations. The commission’s spokesperson Mina Andreeva reiterated that “we stand ready to engage constructively with the UK on any concrete proposals that are compatible with the Withdrawal Agreement.”On the other hand, Johnson’s spokesperson Alison Donnelly said he believed there was enough time to agree on backstop alternative. And UK wants to discuss the options.

ECB de Guindos: Market expectations cannot replace policy judgement

ECB Vice President Luis de Guindos said that policy makers need to take market expectations with a “punch of salt”. He emphasized that “Our monetary policy is data dependent, not market dependent: indications from market expectations cannot replace our policy judgment”. He also added, “another way of robustifying our analysis is to look for expectations beyond those expressed in financial market prices.”

German Q2 GDP finalized at -0.1% qoq, slowed by foreign trade

Germany Q2 GDP was finalized at -0.1% qoq, 0.4% yoy. Statistisches Bundesamt noted that foreign trade slowed down growth. On the other hand, consumption expenditure and capital formation supported economic activity. It said that after seasonal and calendar adjustment, price-adjusted exports were down -1.3% from the preceding quarter, markedly more than imports (-0.3%). Positive contributions came from domestic demand. Household final consumption expenditure increased by 0.1% qoq. Government final consumption expenditure rose by 0.5% qoq.

RBA Debelle: Exchange rate plays important role of external shock absorber

RBA Deputy Governor Guy Debelle warned that US-China trade war poses a “significant risk” to Australia and the rest of the world. He also defended the existing rules-based global trading system. He said, “despite some flaws, that system has delivered sizeable benefits for global growth and welfare”, and “Australia has clearly been a major beneficiary of that system.”

Nevertheless, Debelle also noted that Australia is “less vulnerable” to external shocks now. He said “if you look at the balance sheet of the country as a whole, Australia has a net foreign currency asset position”. “Hence when the exchange rate depreciates, the value of net foreign liabilities actually declines rather than increase. To reiterate, this allows the exchange rate to play the important role of shock absorber to external shocks”, he added.

RBNZ Orr: Global investment on hold for political uncertainty in many, many regions

In an interview by Australian Financial Review, RBNZ Governor Adrian Orr said the “single biggest” factor for -50bps rate cut was domestic. Inflation expectations were starting to decline and “we didn’t want to be behind the curve”. He added, “we want to keep inflation expectations positive – near the mid-point of the band.” But Orr also noted that “global interest rates had swung dramatically between our monetary policy statements.” And the large swing in forward interest rates suggested “a significant story behind that.”

Orr also noted “investments has really been on hold for a while” globally, “given political uncertainty across many, many regions”. ” US-China escalating trade challenge, and that’s real now… Likewise, other countries: the Italians without government, Brexit, Hong Kong… So that manifests itself from being a political uncertainty, to capital no longer being invested. So this is one of the rolling challenges that’s happening.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2189; (P) 1.2237; (R1) 1.2267; More….

GBP/USD’s corrective recovery from 1.2014 extends to as high as 1.2309 so far. Further rise is expected as long as 1.2208 minor support holds, to 55 day EMA (now at 1.2370) and above. But upside should be limited by 38.2% retracement of 1.3381 to 1.2014 at 1.2536. On the downside, break of 1.2208 minor support will turn bias back to the downside for 1.2014 and then 1.1946 low.

In the bigger picture, down trend from 1.4376 (2018 high) is extending towards 1.1946 low. We’d be cautious on bottoming there. But decisive break will resume down trend from 2.1161 (2007 high) to 61.8% projection of 1.7190 to 1.1946 from 1.4376 at 1.1135. In any case, medium term outlook will stay bearish as long as 1.3381 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Y/Y Jul | 0.50% | 0.60% | 0.70% | |

| 06:00 | EUR | German GDP Q/Q Q2 F | -0.10% | -0.10% | -0.10% | |

| 08:30 | GBP | BBA Mortgage Approvals Jul | 43342 | 42854 | 42653 | 42775 |

| 13:00 | USD | House Price Index M/M Jun | 0.20% | 0.20% | 0.10% | 0.20% |

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Jun | 2.10% | 2.40% | 2.40% | |

| 14:00 | USD | Consumer Confidence Index Aug | 129 | 135.7 |