The markets are steadily mixed in Asian session today. Sentiment is stabilized somewhat on news that US President Joe Biden and Russian President Vladimir Putin have agreed in principle to a summit over Ukraine, as brokered by French President Emmanuel Macron. Nevertheless, risks of imminent war remain. For now, Aussie and Kiwi are the slightly firmer ones while Dollar and Yen are soft. But the picture could easily change on geopolitical developments. PMI data from Eurozone and UK will likely take a back seat.

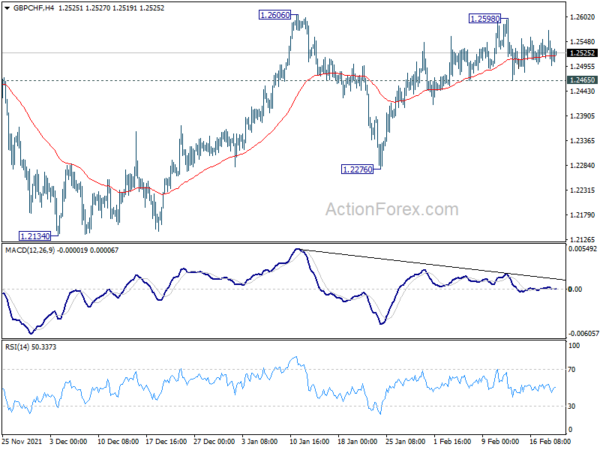

Technically, we’ll keep an eye on GBP/CHF to gauge overall risk sentiment. It’s so far resiliently hold above 1.2465 minor support, and further rise is still mildly in favor through 1.2598/2606 resistance. However, firm break of 1.2465 will indicate that rise from 1.2276 has completed, probably the pattern from 1.2134 too. Deeper decline would be seen back to 1.2276 support, and possibly further through 1.2134 if risk aversion intensifies.

In Asia, at the time of writing, Nikkei is down -0.86%. Hong Kong HSI is down -0.71%. China Shanghai SSE is down -0.36%. Singapore Strait Times is up 0.18%. Japan 10-year JGB yield is down -0.0061 at 0.214.

Australia PMI composite jumped to 55.9, economy bounced back quickly

Australia PMI Manufacturing rose from 55.1 to 57.6 in February. PMI Services jumped from 46.6 to 56.4, an 8-month high. PMI Composite rose from 46.7 to 55.9, also an 8-month high.

Jingyi Pan, Economics Associate Director at IHS Markit, said:

“The Australian economy bounced back quickly in February, according to the IHS Markit Flash Australia Composite PMI, after contracting sharply at the start of 2022, hit by the COVID-19 Omicron wave.

“Demand and output both returned to growth, boding well for hiring activity in February. That said, shortages of input materials and labour persisted as issues for private sector firms. This led to input prices continuing to increase sharply while selling price inflation hit a record according to the latest PMI survey. While this perhaps comes as no surprise in the initial recovery phase from the latest COVID-19 wave, the lingering impact on overall inflation and wages will have to be closely followed.

“Business confidence amongst private sector firms improved once again in February after briefly dipping in January, reflecting the short-lived nature of the latest COVID-19 wave, which was a positive sign.”

Japan PMI manufacturing dropped to 52.9 in Feb, services dropped to 42.7

Japan PMI Manufacturing dripped from 55.4 to 52.9 in February, below expectation of 55.0. PMI Services dropped sharply from 47.6 to 42.7, worst reading since May 2020. PMI Composite dropped from 49.9 to 44.6.

Usamah Bhatti, Economist at IHS Markit, said:

“Activity at Japanese private sector businesses contracted sharply during February as the Omicron variant of COVID-19 led to record case numbers and renewed restrictions in Japan. The decline was the second in successive months though was the sharpest recorded for 20 months and came amid the steepest downturn in the services sector since the first wave of the pandemic in May 2020. Moreover, manufacturers signalled a reduction in output for the first time in five months, though the rate of contraction was considerably softer than that seen in the dominant services sector, and was only mild overall.

“Private sector firms also noted a decrease in aggregate new business for the first time since September, largely driven by domestic reductions while new export orders broadly stagnated. Firms continued to report that rising input prices and material shortages, notably in fuel and metals continued to dampen private sector activity. In fact, February saw the strongest rise in average cost burdens since August 2008.

“Companies were optimistic that activity would improve in the year ahead, though the continued resurgence of COVID-19 had clouded the outlook and drove optimism to a six-month low.”

RBNZ to hike by 25bps or 50bps?

RBNZ is widely expected to raise interest rate by another 25bps to 1.00% this week. Though, there are some speculations of a 50bps hike. Focuses will also be on RBNZ’s guidance on the rate path ahead, as well as any plan to start offloading the NZD 54B of government bonds purchased between March 2020 and July 2021.

In the UK, Monetary Policy Report hearings in the parliament will be the main focus. Governor Andrew Bailey will be scrutinized on inflation outlook, as CPI hit three decade high of 5.5% in January. Given that four MPC members actually voted for a 50bps hike at last meeting, markets are also eager to know how the hawk/dove balance is evolving.

On the data front, PMIs from Australia, Japan, Eurozone, UK and US will be featured. US consumer confidence, durable goods orders and PCE inflation could be another market mover. Germany Ifo business climate, New Zealand retail sales are also among those to be watched. Here are some highlights for the week:

- Monday: Australia PMIs; Japan PMI manufacturing; Eurozone PMIs; UK PMIs.

- Tuesday: Japan corporate services prices; UK Public sector net borrowing; Germany Ifo business climate; UK house price index, PMIs, consumer confidence.

- Wednesday: Australia wage price index, construction work done; RBNZ rate decision; Germany Gfk consumer climate; Swiss Credit Suisse economic expectations; Eurozone CPI final.

- Thursday: New Zealand trade balance; Australia private capital expenditure; US GDP, jobless claims, new home sales.

- Friday: New Zealand retail sales; Japan Tokyo CPI; Germany Gfk consumer confidence; Germany GDP final, import prices; France GDP, consumer spending; Eurozone M3 money supply; US personal income and spending, durable goods orders, pending home sales.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7153; (P) 0.7190; (R1) 0.7216; More…

Intraday bias in AUD/USD remains neutral at this point. Further rise would remain in favor as long as 0.7050 support holds. Above 0.7247 will target 0.7313 resistance. Decisive break there argue that correction from 0.8006 has completed at 0.6966, after hitting 0.6991 key support. Outlook will be turned bullish for 0.7555 resistance next. On the downside, however, break of 0.7050 support will bring retest of 0.6966 low instead.

In the bigger picture, focus remains on 0.6991 key structural support. Sustained break there will argue that the whole up trend from 0.5506 might be finished at 0.8006, after rejection by 0.8135 long term resistance. Deeper decline would then be seen back to 61.8% retracement of 0.5506 to 0.8006 at 0.6461. Meanwhile, strong rebound from 0.6991 will retain medium term bullishness. That is, whole up trend from 0.5506 is still in progress.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | CBA Manufacturing PMI Feb P | 57.6 | 55.1 | ||

| 22:00 | AUD | CBA Services PMI Feb P | 56.4 | 46.6 | ||

| 00:30 | JPY | Manufacturing PMI Feb P | 52.9 | 55 | 55.4 | |

| 07:00 | EUR | Germany PPI M/M Jan | 1.50% | 5.00% | ||

| 07:00 | EUR | Germany PPI Y/Y Jan | 24.20% | |||

| 08:15 | EUR | France Manufacturing PMI Feb P | 55.5 | 55.5 | ||

| 08:15 | EUR | France Services PMI Feb P | 53.5 | 53.1 | ||

| 08:30 | EUR | Germany Manufacturing PMI Feb P | 59.4 | 59.8 | ||

| 08:30 | EUR | Germany Services PMI Feb P | 53.2 | 52.2 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Feb P | 58.7 | 58.7 | ||

| 09:00 | EUR | Eurozone Services PMI Feb P | 51.7 | 51.1 | ||

| 09:30 | GBP | Manufacturing PMI Feb P | 57.5 | 57.3 | ||

| 09:30 | GBP | Services PMI Feb P | 55.2 | 54.1 |